Overview

The article delivers critical insights regarding the expected rise in Medicare Part B premiums for 2025, projected to reach $185.00. This adjustment represents a notable 5.9% increase, significantly impacting beneficiaries, especially those reliant on fixed incomes. Key factors driving this increase include:

- Adjustments in medical education costs

- Modifications in Social Security benefits

Consequently, this underscores the necessity for retirees to engage in meticulous financial planning to navigate the challenges posed by escalating healthcare expenses.

Introduction

As Medicare beneficiaries prepare for the financial implications of the anticipated premium increases in 2025, a complex landscape of healthcare costs unfolds. With the standard monthly premium for Medicare Part B projected to rise significantly, understanding the factors driving these changes becomes essential. Stakeholders—including healthcare providers and beneficiaries—must navigate this evolving terrain, which encompasses adjustments to deductibles, the impact of Social Security cost-of-living adjustments, and the nuances of income-related surcharges.

By leveraging comprehensive data insights, such as those provided by CareSet, individuals can better equip themselves to manage their healthcare expenses and make informed decisions that enhance their access to necessary medical services.

This article delves into the critical aspects of the 2025 Medicare landscape, offering a thorough analysis of the expected changes and strategic approaches to mitigate their impact.

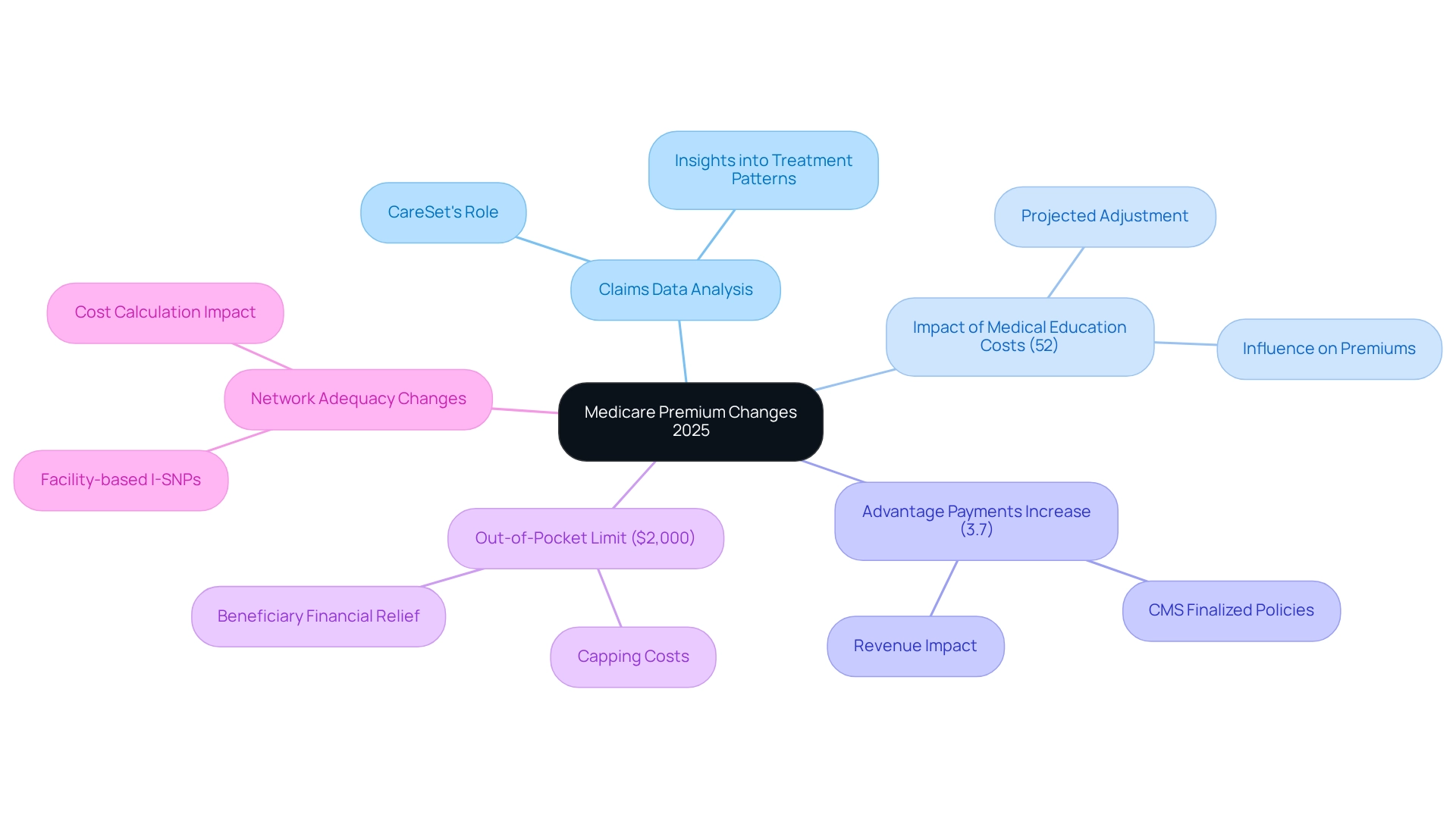

CareSet: Comprehensive Medicare Data Analysis for Understanding Premium Changes

CareSet excels in extracting and interpreting complex healthcare claims data, equipping stakeholders with in-depth insights into treatment patterns and provider networks. This expertise is essential for examining the elements influencing the 2025 Medicare Part B premium increase. By leveraging extensive claims data from over 62 million beneficiaries and 6 million providers, CareSet enables a nuanced examination of trends and patient demographics that influence these changes.

For instance, the anticipated technical adjustment to growth rates related to medical education costs is projected at 52% for calendar year 2025, which will significantly impact the 2025 Medicare Part B premium increase. Furthermore, the Centers for Medicare and Medicaid Services (CMS) recently announced finalized policies for Advantage payments, indicating an average revenue increase of 3.7% for 2025. These adjustments, together with the limit on out-of-pocket expenses at $2,000, signify a wider initiative to ease beneficiaries’ financial pressures and improve the framework of healthcare programs. Significantly, a new network adequacy exception request for facility-based I-SNPs has also been introduced, which may further impact cost calculations.

Expert insights highlight the significance of precise Medicare data analysis in comprehending these cost changes. George Gagliardi, a certified financial planner, notes, “But for those already receiving or about to get Social Security checks, I don’t think that there is anything to worry about.” This viewpoint emphasizes the consistency of Social Security benefits for retirees despite fluctuating costs. Analysts stress that thorough data analysis is essential for stakeholders to manage the intricacies of the healthcare system, especially as the average worker retirement benefit is projected to increase to $1,976 per month in 2025. CareSet’s commitment to delivering high-quality insights without relying on flawed projections positions it as a leader in this field, empowering clients to make informed decisions that ultimately enhance patient outcomes.

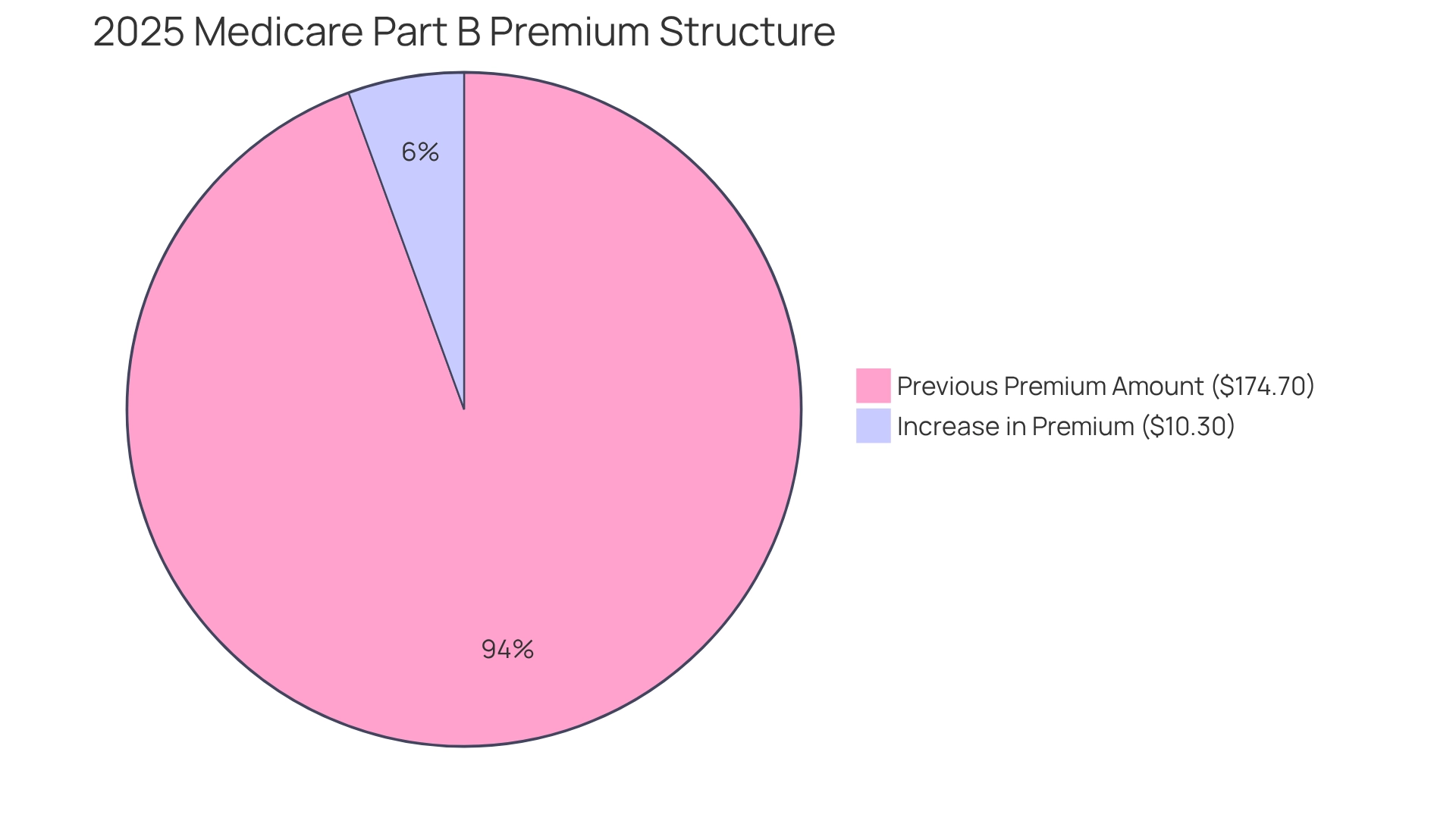

2025 Medicare Part B Premium Increase: Expected Percentage Rise

The 2025 Medicare Part B premium increase will raise the standard monthly charge to $185.00, which is an increase of $10.30 from the previous year’s fee of $174.70. This adjustment translates to an approximate 5.9% increase, which is part of the 2025 Medicare Part B premium increase, significantly impacting beneficiaries, particularly those on fixed incomes. Such premium changes can profoundly affect budgeting and healthcare access for many seniors, underscoring the importance of understanding these financial shifts within the broader context of patient care and market strategies. CareSet’s comprehensive healthcare data insights empower pharmaceutical market access managers to better comprehend these trends and develop strategies to mitigate their impact on patients.

According to the Centers for Medicare and Medicaid Services (CMS), the 2025 Medicare Part B premium increase is part of broader adjustments that also encompass changes to deductibles and coinsurance amounts. As Bill Cass, Director of Wealth Planning, noted, “Putting your tax refund to work” is crucial for managing these rising costs. Beneficiaries should also be aware that open enrollment for 2025 ends on December 7, making it essential for them to review their options and plan accordingly. By utilizing CareSet’s data insights, stakeholders can recognize patient needs and enhance their strategies in response to these economic changes, ensuring improved patient care and access.

Impact of Social Security COLA on 2025 Medicare Part B Premiums

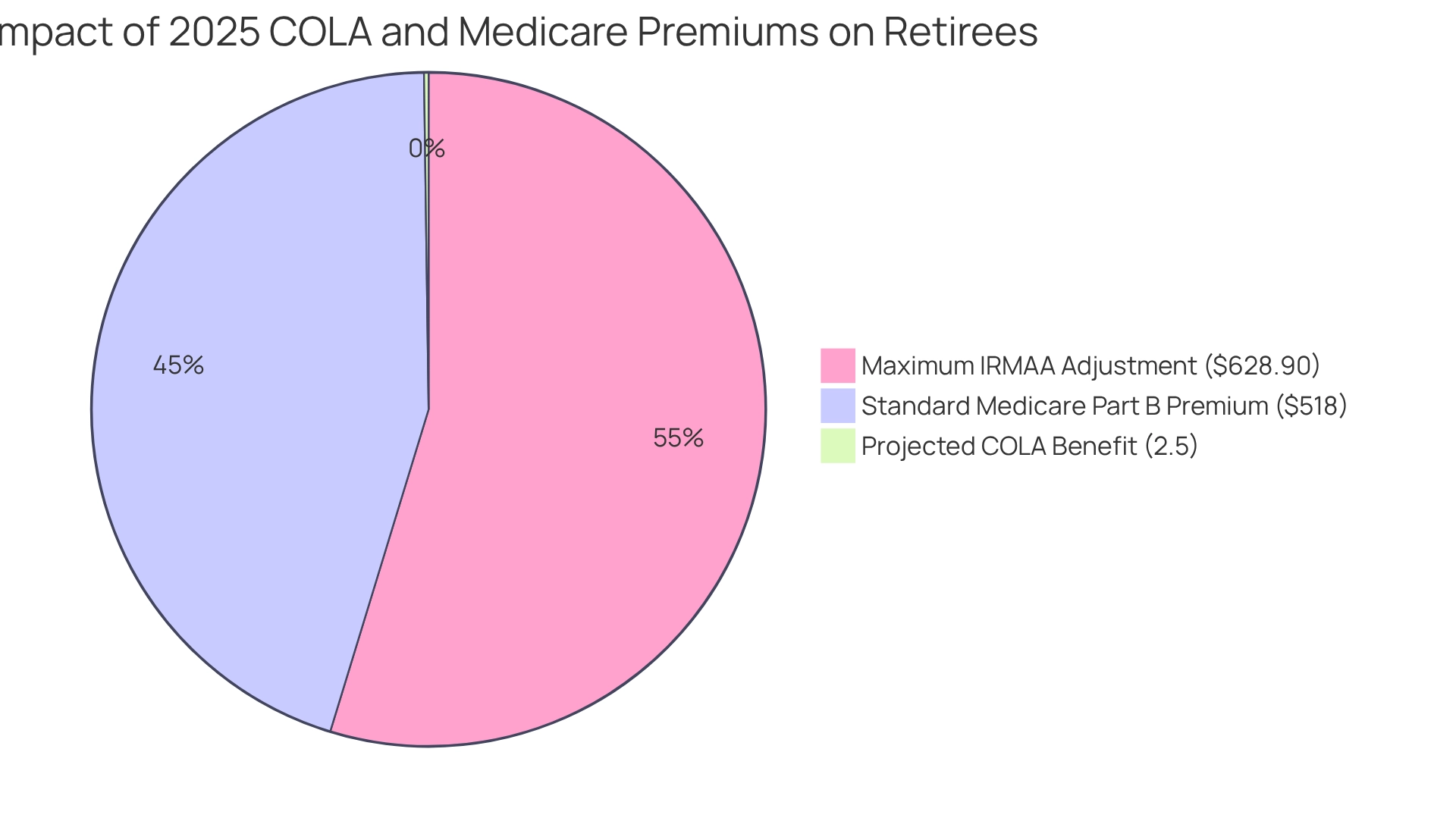

In 2025, the Social Security Cost-of-Living Adjustment (COLA) is projected to be approximately 2.5%. While this adjustment may offer some relief against rising living expenses, the 2025 Medicare Part B premium increase could significantly diminish its benefits for many retirees. Specifically, the monthly premium for individuals not qualifying for premium-free Part A is expected to rise to $518. When combined with the anticipated COLA, this may result in tighter budgets and increased economic pressure for recipients. This relationship is crucial, as changes in Social Security payments directly influence the economic landscape for individuals relying on Medicare.

For instance, the income-related monthly adjustment amounts (IRMAA) for high-earning recipients in 2025 will range from $13.70 to $85.80, complicating the financial situation for those affected. Approximately 8% of Part B beneficiaries are subject to IRMAA, with costs for individuals earning above $106,000 potentially escalating to $628.90 monthly. This highlights the considerable economic strain on higher-income seniors, who may struggle to manage these rising expenses.

Real-world examples illustrate the difficulties retirees face in handling healthcare costs amid these adjustments. Many seniors navigate a complex economic environment where even modest increases in Social Security benefits can be offset by surging healthcare expenses. Economists note that the economic impact of COLA adjustments on healthcare recipients can be substantial, often leading to tough decisions regarding medical care and other essential costs. As Johnson pointed out, “Even so, there were still significant double-digit price spikes under every recent presidential administration — George W. Bush, Obama, Trump, and Joe Biden,” underscoring the historical context of these increases.

In conclusion, while the 2025 Social Security COLA may provide some financial relief, the 2025 Medicare Part B premium increase presents significant challenges for retirees. This underscores the importance of careful budgeting and financial planning in the face of escalating healthcare expenses.

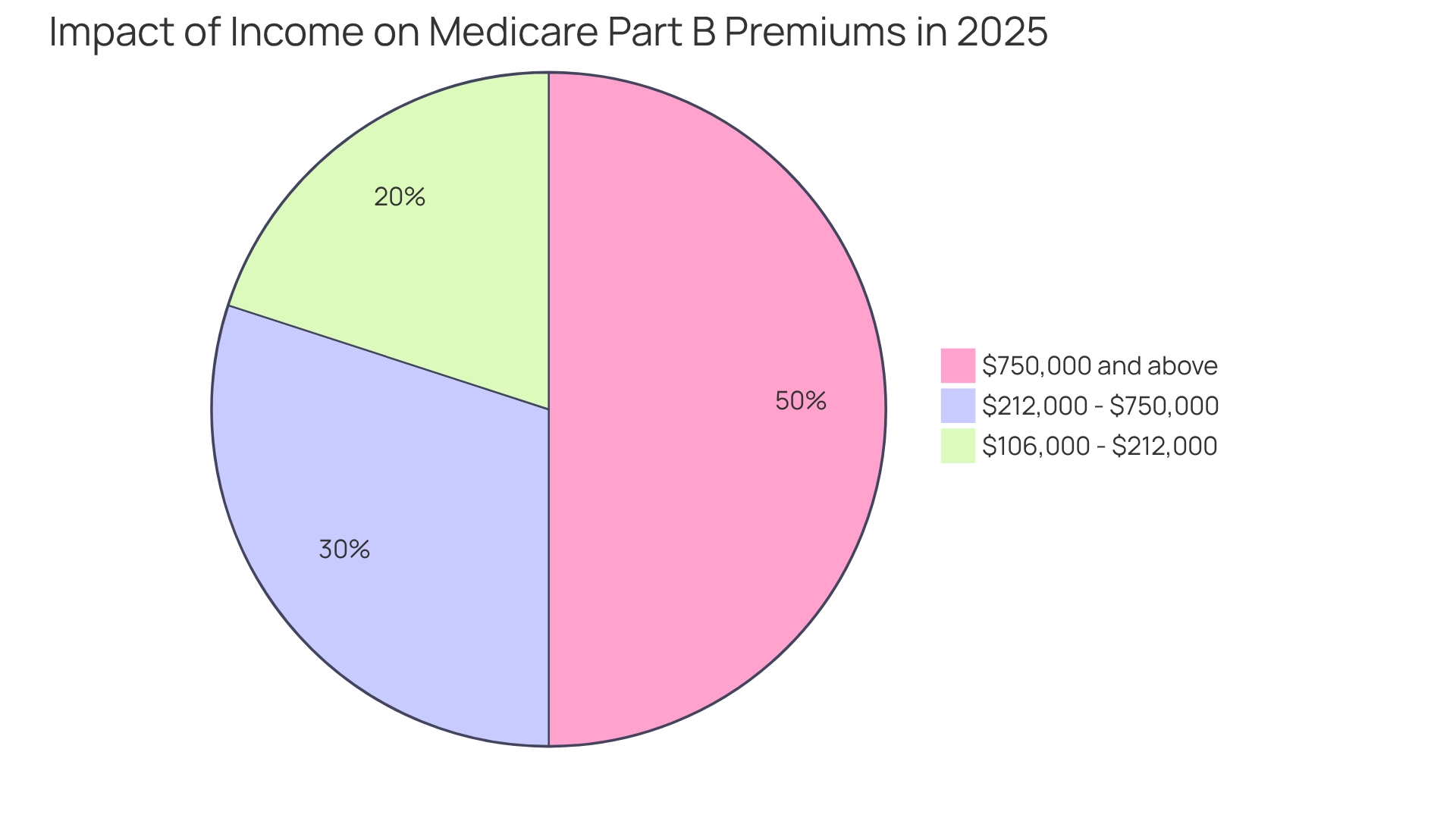

Income-Related Adjustments: Premiums for Higher-Income Medicare Enrollees

In 2025, higher-income Medicare participants will encounter additional charges due to the 2025 Medicare Part B premium increase based on their modified adjusted gross income (MAGI). Individuals earning over $106,000 and couples with incomes exceeding $212,000 will face extra costs due to the 2025 Medicare Part B premium increase, leading to total expenses that can vary significantly, ranging from $259.00 to $628.90, depending on their income categories. This adjustment illustrates a systematic approach to ensure that those with greater economic resources contribute more towards their healthcare coverage, especially considering the 2025 Medicare Part B premium increase.

For instance, married couples with a MAGI of $750,000 or more will incur a standard charge plus an additional fee of $443.90, highlighting the financial implications for high earners. Proactive income management strategies can potentially mitigate these expenses, allowing individuals to lower their future healthcare costs and alleviate the financial burden associated with the Income-Related Monthly Adjustment Amount (IRMAA). By effectively managing their income, higher-income participants can strategically position themselves to lessen the impact of these costs.

Experts emphasize the importance of understanding MAGI’s role in determining the 2025 Medicare Part B premium increase and other healthcare expenses. Tax professionals stress that efficient income planning can significantly influence contribution levels, making it essential for higher-income participants to remain cognizant of their financial situations, particularly in light of the 2025 Medicare Part B premium increase. As retirement author Donna LeValley notes, grasping these economic dynamics is vital for effectively managing healthcare expenses.

Case studies demonstrate how strategic adjustments in income can lead to substantial savings on healthcare premiums. By refining their economic profiles, enrollees can navigate the complexities of healthcare expenses more adeptly, ensuring they are not disproportionately affected by the surcharges. This proactive strategy not only addresses immediate financial concerns but also promotes long-term financial well-being in the realm of healthcare expenses.

Additionally, for inquiries regarding prescription drug coverage, individuals should contact the Centers for Medicare & Medicaid Services (CMS), underscoring the importance of diligent management of related matters.

2025 Medicare Part B Deductibles: What to Expect

The 2025 Medicare Part B premium increase will result in the yearly deductible rising to $257, compared to $240 in 2024. This change signifies an increasing financial strain for recipients, who will need to cover more personal expenses before the government program begins to pay for medical services. Historical trends reveal that such increases are not uncommon; over the past decade, Medicare Part B deductibles have steadily climbed, reflecting broader healthcare cost pressures.

Healthcare economists have observed that rising deductibles can significantly impact recipients, particularly those with fixed incomes. Many recipients have shared their experiences managing higher deductibles, often postponing essential medical care or seeking alternative funding sources to cover their expenses.

As stakeholders in the healthcare sector, understanding these trends is crucial. CareSet’s comprehensive healthcare data insights empower stakeholders to analyze patient treatment pathways and provider interventions, ensuring that strategies are informed by the experiences of over 62 million beneficiaries and 6 million providers. This data-focused approach can enhance patient care and support business success in navigating the complexities of healthcare.

A recent case study highlighted the legislative changes impacting Part B of the program, which have resulted in the 2025 Medicare Part B premium increase and adjustments to eligibility criteria. These changes aim to ensure the program remains sustainable and responsive to the needs of those it serves. As M. Kent Clemens stated, ‘The amounts and rates related to the 2025 Medicare Part B premium increase announced in this document are effective January 1, 2025.’ As the deductible increases, the implications for beneficiaries become more pronounced, with many facing difficult choices regarding their healthcare access.

Furthermore, it is significant that the balance owed for the Part B account is anticipated to be zero by the conclusion of 2025, introducing another layer of complexity to the financial environment of the program. The rise to $257 in 2025, attributed to the 2025 Medicare Part B premium increase, is part of a larger trend that underscores the importance of understanding the evolving healthcare landscape. Stakeholders must remain vigilant in monitoring these changes to effectively support individuals navigating the intricacies of their healthcare costs.

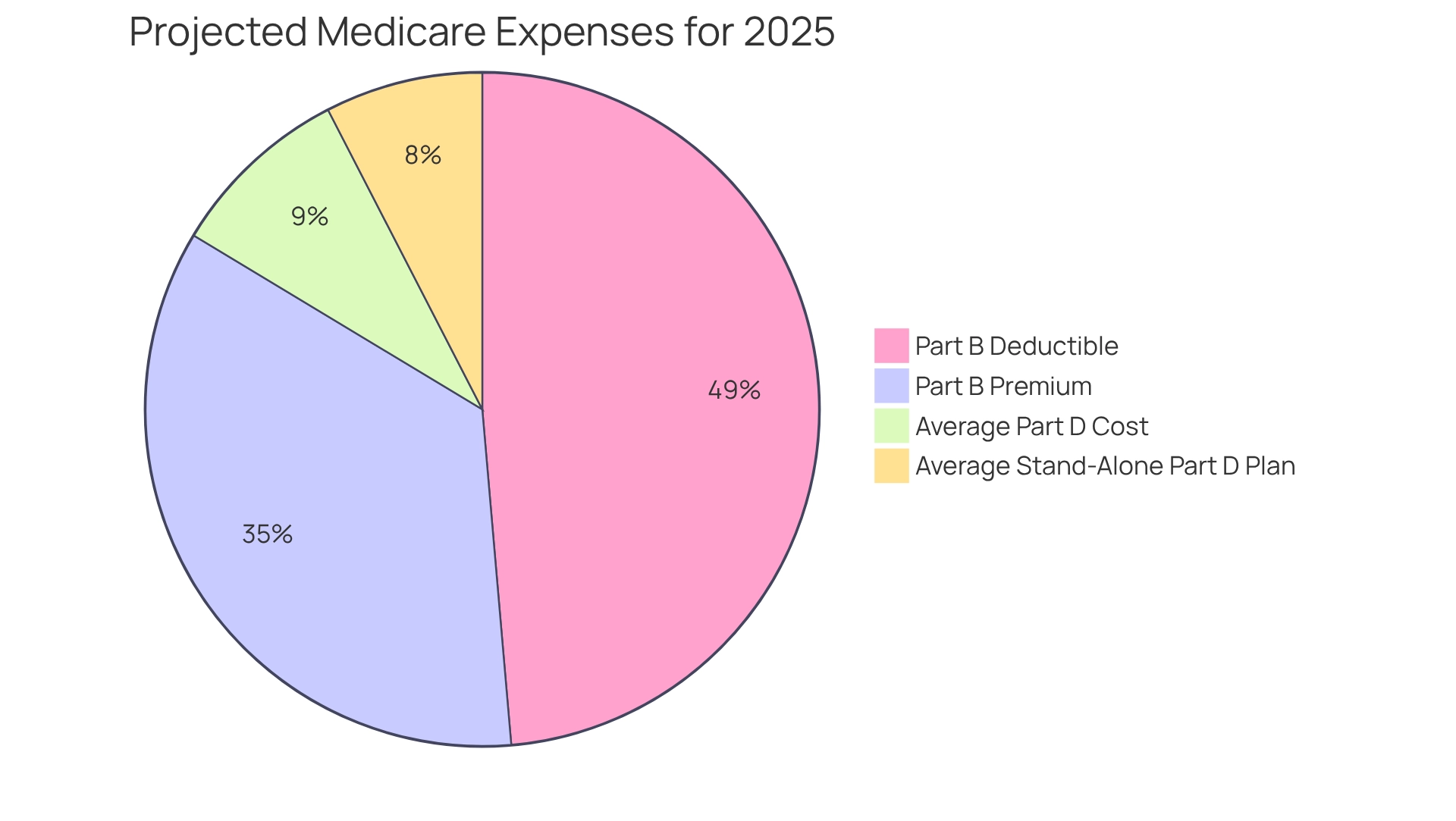

Overall Medicare Costs in 2025: A Comprehensive Overview

In 2025, healthcare expenses are projected to surge considerably, highlighted by the 2025 Medicare Part B premium increase, with the standard Part B fee escalating to $185 and the deductible increasing to $257. This signifies a significant shift in the economic landscape for recipients, who will also face elevated expenses for Part D costs, anticipated to average around $46.50. Notably, the average monthly cost for stand-alone Medicare Part D plans is expected to decrease from $41.63 in 2024 to $40 in 2025. These modifications reflect broader trends in healthcare expenditure and inflation, underscoring the necessity for recipients to engage in careful financial planning.

The anticipated rise in Part D charges illustrates ongoing strains within the healthcare system, with high-income recipients potentially facing even greater expenses based on their earnings. As healthcare analysts observe, these increasing premiums could significantly impact recipients, particularly those on fixed incomes, who may struggle to cope with these heightened costs.

Real-world examples underscore the challenges faced by numerous recipients as they navigate these escalating expenses. For instance, the introduction of a $2,000 out-of-pocket cap on prescription drugs under Part D is expected to provide relief to nearly 3.2 million Americans, assisting them in managing their healthcare expenses more effectively. This substantial shift is anticipated to alleviate some economic pressures, especially for individuals who frequently rely on prescription medications. Overall, the expected increases in healthcare expenses, particularly due to the 2025 Medicare Part B premium increase, necessitate a proactive strategy from recipients, emphasizing the importance of understanding these trends and preparing for the financial implications they entail.

For partners in the healthcare sector, including pharmaceutical firms leveraging CareSet’s extensive data solutions—which encompass over $900 billion in claims annually and 14+ years of claims information—these economic shifts highlight the need for strategic growth initiatives that respond to the evolving landscape of healthcare expenses and their impact on patient care. With insights derived from over 62 million recipients and 6 million providers, CareSet empowers stakeholders to navigate these changes effectively, ensuring patient needs are met while optimizing business strategies.

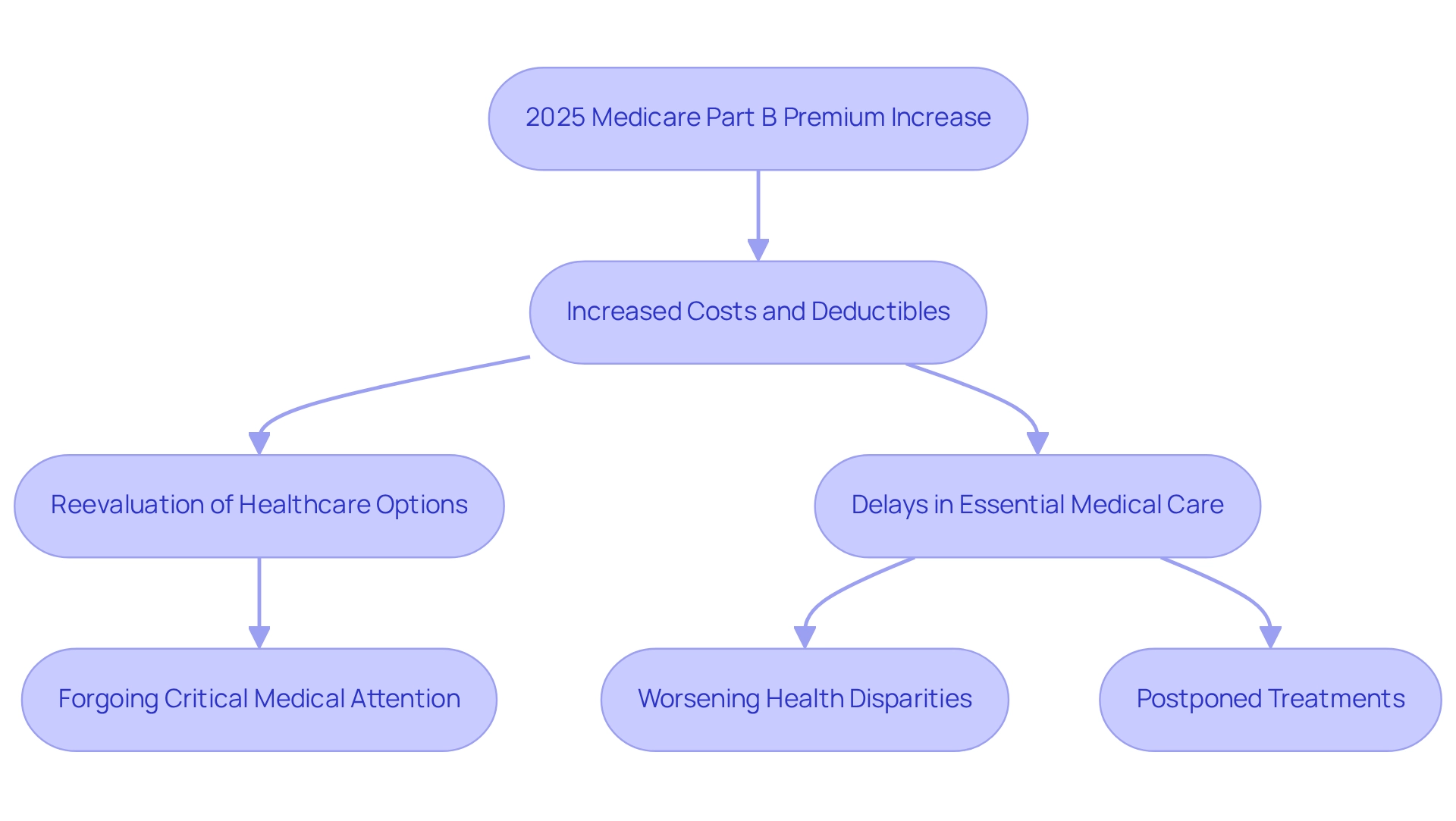

Implications of the 2025 Premium Increase on Healthcare Access

The anticipated increase in costs and deductibles due to the 2025 Medicare Part B premium increase is poised to prompt many recipients to reassess their healthcare options. This reevaluation may lead to delays in essential medical care due to budget constraints. Such postponements have the potential to worsen existing health disparities, particularly impacting individuals on fixed incomes who may already find it challenging to afford necessary services.

Healthcare advocates have expressed concern that rising costs could significantly influence recipients’ healthcare decisions, forcing them to prioritize expenses over necessary care. Real-world examples illustrate that some recipients have postponed treatments or routine check-ups, apprehensive about the financial implications of higher fees. The Centers for Medicare & Medicaid Services has noted that ‘Medicare enrollees who are already receiving Social Security benefits can expect the 2025 Medicare Part B premium increase to be automatically deducted from their Social Security payments in January,’ highlighting the direct financial repercussions for recipients. As beneficiaries evaluate their options, the likelihood of forgoing critical medical attention escalates, potentially leading to more severe health complications in the future.

This scenario underscores the urgent need for comprehensive healthcare analysis services, such as those offered by CareSet, which integrates over 100 external data sources to empower stakeholders in navigating these challenges effectively and making informed decisions that enhance patient care. CareSet’s insights can aid stakeholders in understanding the broader economic landscape influencing healthcare access and identifying strategies to mitigate the impact of rising costs. Furthermore, the recent increase in the Part A fee, which has risen to $518.00 for individuals with fewer than 30 quarters of coverage, further illustrates the growing healthcare expenses that beneficiaries must confront. This context accentuates the necessity of grasping the wider financial environment affecting healthcare access.

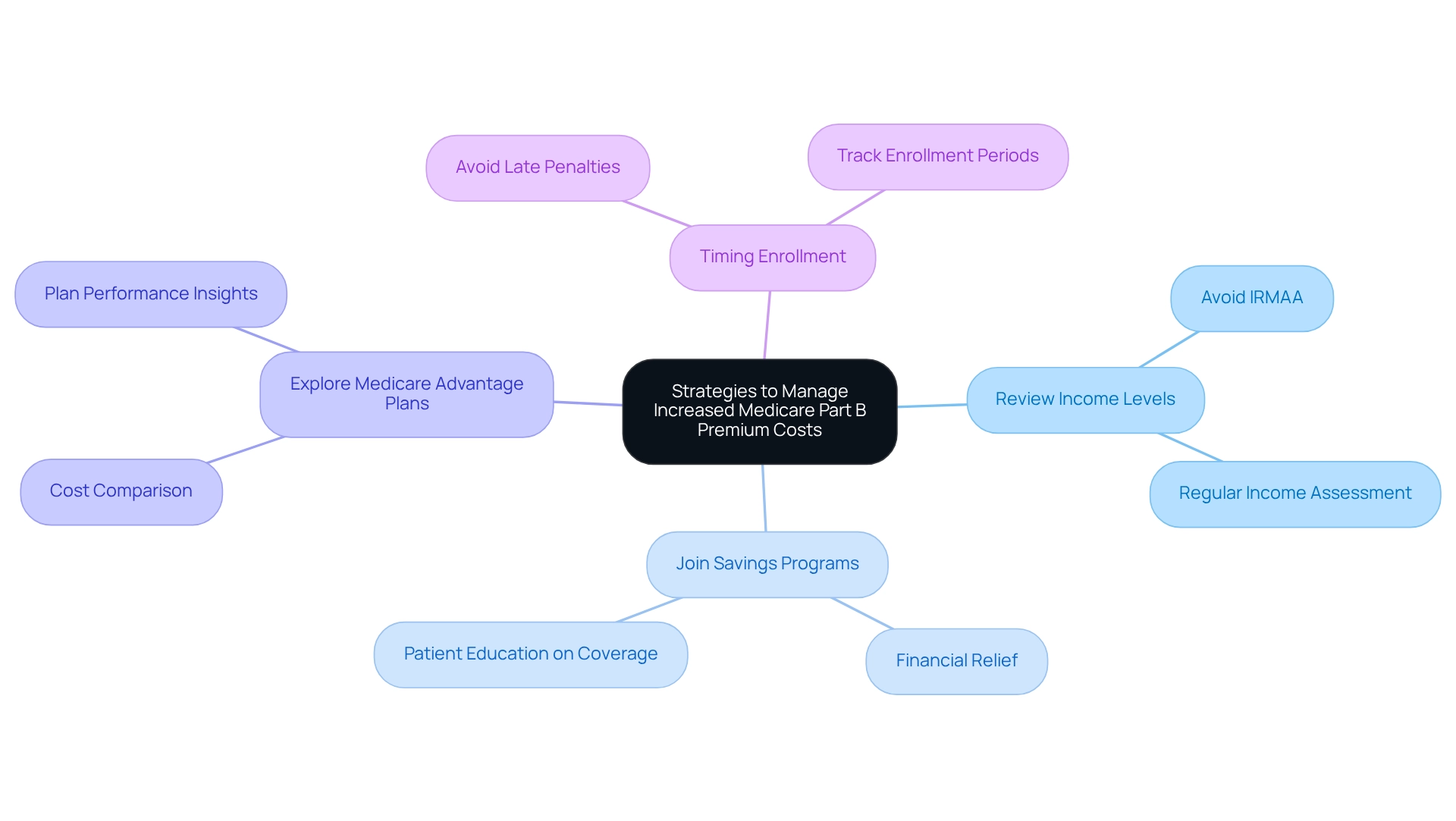

Strategies to Manage Increased Medicare Part B Premium Costs

Beneficiaries can strategically manage the rising costs of Medicare Part B premiums through several effective approaches, particularly by leveraging insights from CareSet’s comprehensive Medicare data solutions. First, reviewing income levels is crucial to avoid Income-Related Monthly Adjustment Amount (IRMAA) surcharges, which can significantly increase out-of-pocket expenses. By understanding their income brackets, recipients can make informed decisions about their healthcare coverage. Financial advisors recommend that beneficiaries regularly assess their income to ensure they remain within the thresholds that avoid these surcharges.

Joining Savings Programs for healthcare represents another effective strategy. These programs can help reduce premium costs for eligible individuals, providing financial relief amidst increasing healthcare expenses. Statistics indicate that fifty-two percent of survey participants were unaware that the government health program covers COVID tests, vaccines, and treatments, emphasizing the necessity for enhanced patient education about available resources. CareSet’s data insights can empower beneficiaries by providing tailored information about these programs and their eligibility criteria.

Exploring various Medicare Advantage plans is also advisable, as some may offer lower premiums compared to traditional Medicare. Beneficiaries should compare the benefits and costs of different plans to find the best fit for their healthcare needs and financial situations. CareSet’s extensive data on plan performance can assist recipients in making informed choices.

Additionally, timing enrollment is essential to avoid late penalties, which can further exacerbate premium costs. By staying informed about enrollment periods and deadlines, participants can ensure they maximize their coverage options without incurring unnecessary fees. CareSet’s insights can assist recipients in tracking these critical dates effectively.

Real-world examples illustrate the effectiveness of these strategies. For instance, beneficiaries who actively engaged with financial advisors and utilized CareSet’s data insights reported considerable savings by modifying their income reporting and enrolling in suitable savings programs. This proactive approach not only alleviates financial burdens but also enhances access to necessary healthcare services. As Juliette Cubanski, assistant director of the program on health insurance policy at KFF, observed, “We’re witnessing some alterations not only regarding costs, but also concerning cost-sharing, deductibles, and elements of coverage that could influence both what individuals spend, as well as their capacity to obtain the medications they require.”

In summary, by examining income levels, signing up for Savings Programs, exploring Advantage plans, and timing their enrollment wisely, individuals can navigate the complexities of the 2025 Medicare Part B premium increase while maintaining their healthcare access. The case study titled ‘Educating Patients on Coverage Options Amid Premium Changes’ further illustrates the importance of effective patient education in managing these costs, showcasing how CareSet’s insights can lead to better decision-making and financial outcomes.

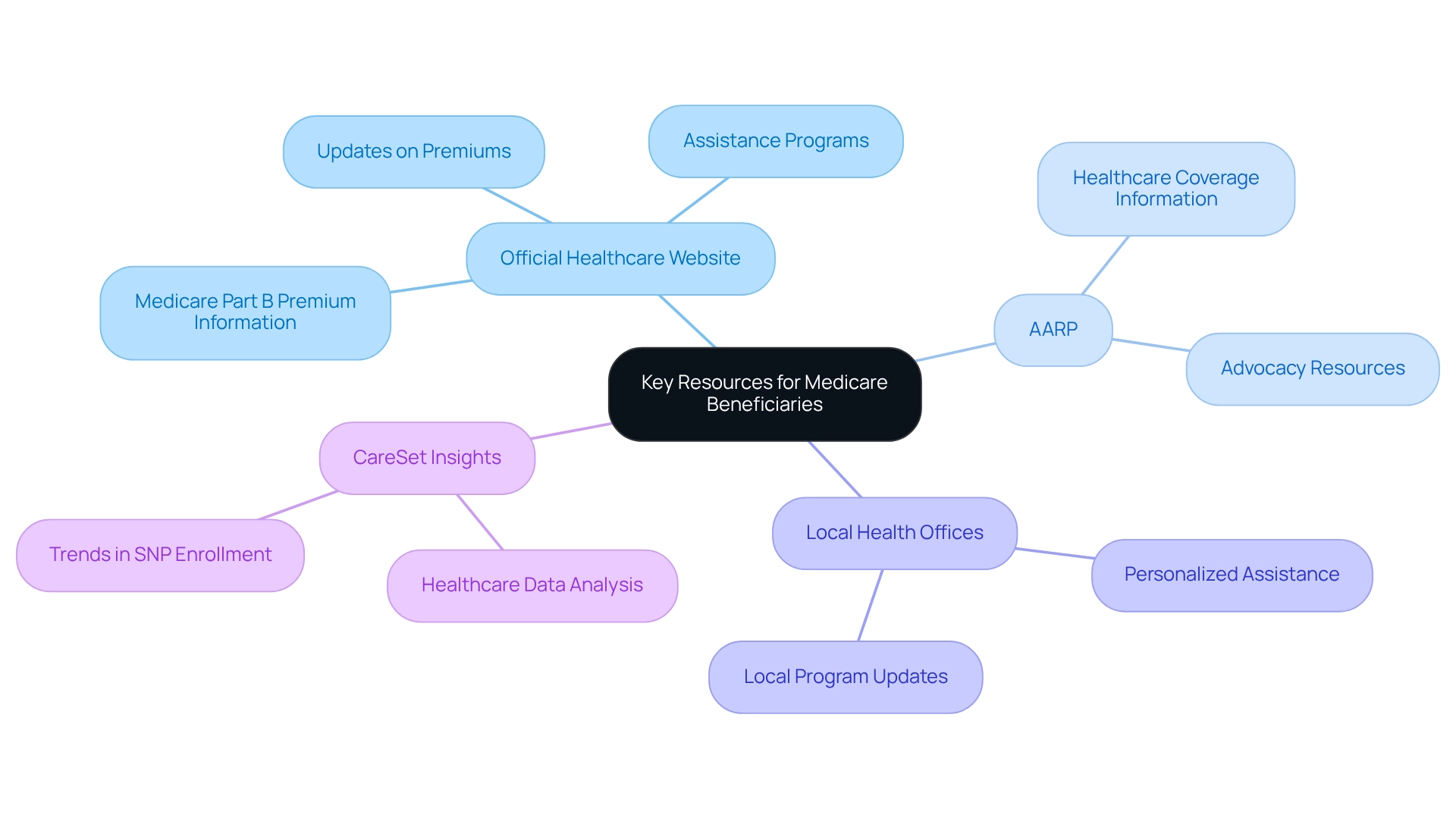

Staying Informed: Key Resources for Medicare Beneficiaries

To navigate the complexities of healthcare changes effectively, individuals should utilize key resources such as the official healthcare website, AARP, and local health offices. These platforms provide prompt updates on premiums, deductibles, and assistance programs, enabling recipients to make informed choices about their healthcare coverage. Additionally, CareSet’s comprehensive healthcare data insights can further enhance this understanding, providing valuable information that supports data-driven decision-making.

Enrollment in Advantage Special Needs Plans (SNPs) has surged, with over 6.6 million beneficiaries qualifying since 2019, highlighting the increasing demand for specialized care. This trend emphasizes the significance of using available resources to comprehend the changing environment of healthcare. Furthermore, CareSet’s data solutions can help healthcare businesses analyze these trends and tailor their strategies accordingly. Notably, Humana represents 18% of the Medicare Advantage market share, demonstrating the competitive landscape within health plans.

The official health insurance website provides crucial data on premium alterations, including information about the 2025 Medicare Part B premium increase that may affect recipients’ expenses. Advocacy organizations underscore the importance of remaining knowledgeable, as 89.4% of health insurance members are aged 65 and older—a group that frequently needs customized information to effectively manage their healthcare choices. As Kimberly Lankford, a noted authority in financial journalism, points out, “Staying updated on healthcare program changes is essential for recipients to enhance their healthcare options.” By actively engaging with these resources, including CareSet’s insights, recipients can improve their comprehension of the program and make knowledgeable choices regarding their healthcare.

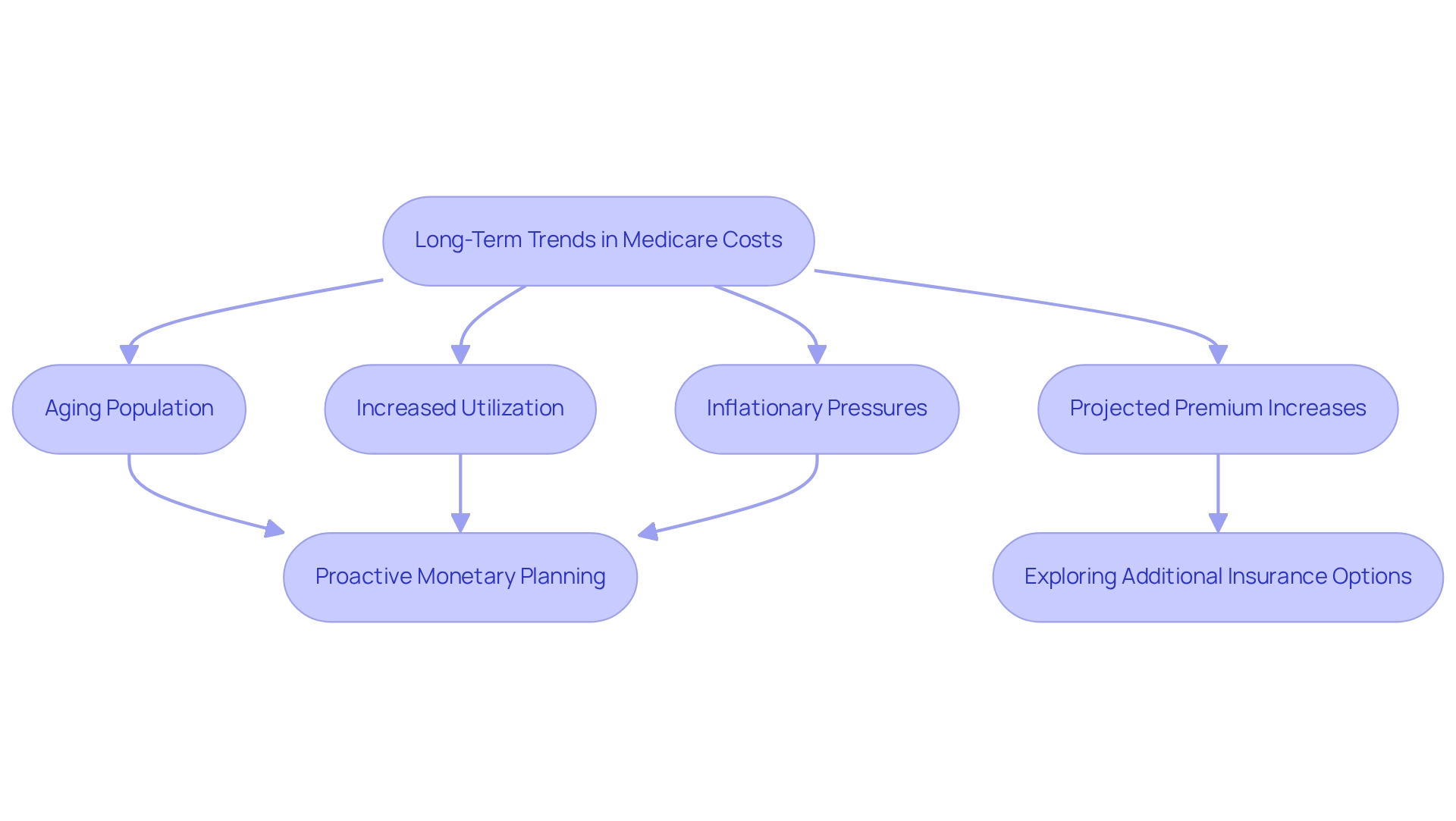

Long-Term Trends in Medicare Costs: What Lies Ahead

Looking ahead, healthcare expenses are projected to rise steadily, driven by an aging population, increased healthcare utilization, and persistent inflationary pressures. As recipients face potential increases in premiums, including the 2025 Medicare Part B premium increase, and out-of-pocket costs, proactive monetary planning becomes crucial. The case study on Long-Range Trust Fund Adequacy emphasizes how recipients are adjusting their budgets and exploring additional insurance options in response to these anticipated changes.

Experts predict that the economic strain of healthcare expenses will remain a central concern for policymakers, influencing upcoming reforms in the program. Julie A. Su, Acting Secretary of Labor, highlighted that the long-range actuarial balances for the OASI, DI, and HI Trust Funds reveal significant challenges, with balances projected at 0.14, -3.50, and -0.35 respectively. This underscores the urgency for recipients to stay informed about policy changes, particularly the 2025 Medicare Part B premium increase, and their potential impact on healthcare expenses.

Healthcare economists stress the importance of anticipating these trends, as the integration of over 100 external data sources by CareSet reveals critical insights into treatment patterns and cost trajectories. By understanding these long-term trends, recipients can make informed decisions that will help mitigate the financial impact of rising healthcare expenses in the coming years.

For pharmaceutical market access managers, recognizing these trends is vital for developing effective market access strategies that align with the evolving landscape of healthcare expenses. CareSet’s comprehensive Medicare data solutions empower healthcare stakeholders by offering insights from over 62 million beneficiaries and 6 million providers, enhancing their capacity to navigate the complexities of patient treatment pathways and optimize engagement with healthcare providers.

Conclusion

Navigating the anticipated increases in Medicare costs for 2025 requires a proactive approach from beneficiaries and stakeholders alike. The projected rise in the standard Medicare Part B premium to $185, along with an increase in deductibles, underscores the growing financial pressures that many seniors will face. Understanding these changes is essential, as they can significantly impact budgeting, healthcare access, and overall patient care.

Stakeholders can leverage data insights from organizations like CareSet to better comprehend the factors driving these premium adjustments and identify strategies to mitigate their effects. By analyzing comprehensive claims data, CareSet empowers beneficiaries and healthcare providers with the knowledge needed to make informed decisions regarding coverage options and financial planning.

Ultimately, it is crucial for Medicare beneficiaries to stay informed about their healthcare options, engage with available resources, and employ strategic financial management techniques. As the landscape of Medicare continues to evolve, understanding these trends and preparing for future cost implications will be key to maintaining access to necessary medical services. By taking these steps, beneficiaries can navigate the complexities of Medicare more effectively, ensuring their healthcare needs are met even amidst rising costs.