Overview

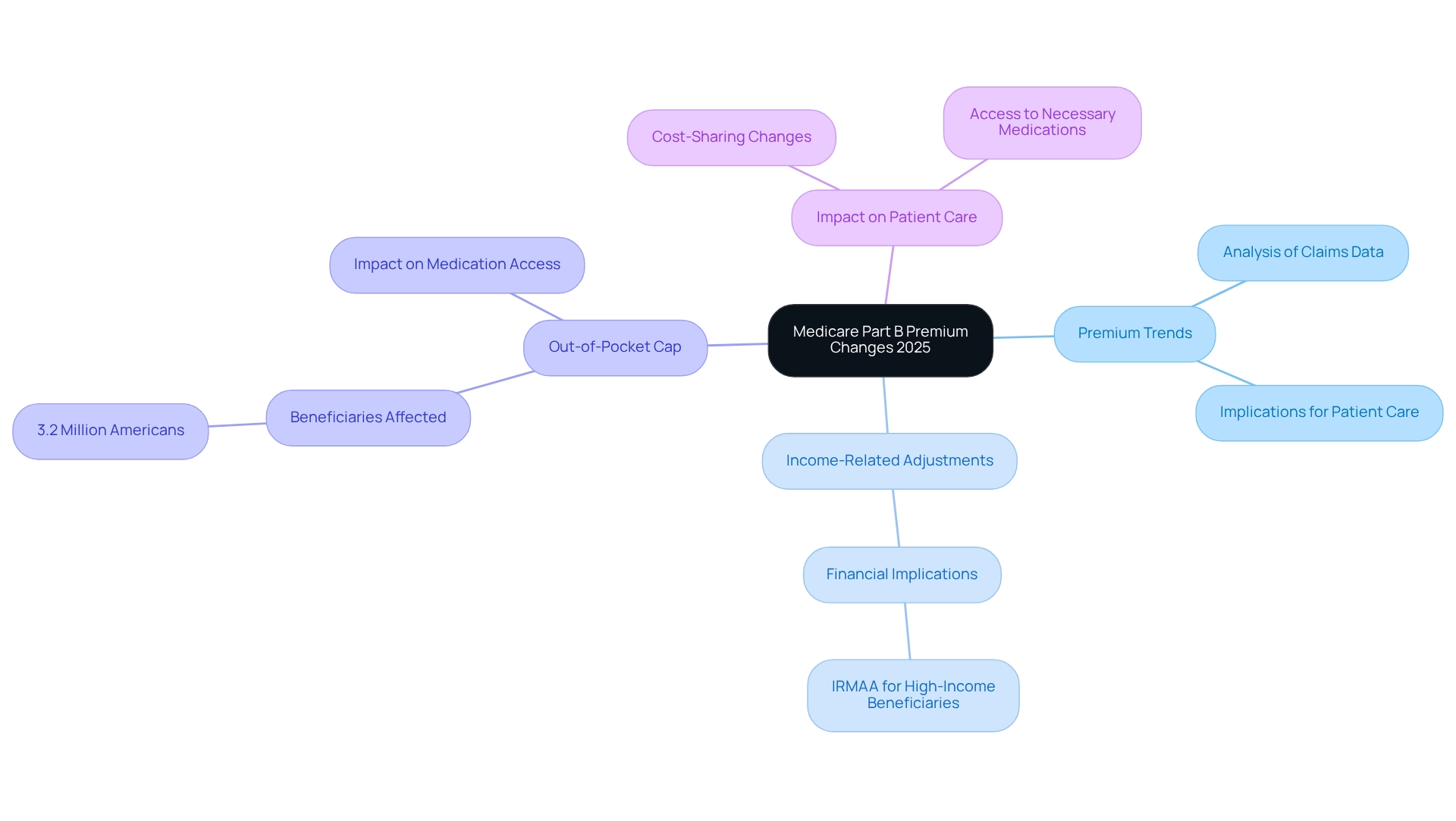

The article addresses the anticipated changes to Medicare Part B premiums for 2025, underscoring essential insights that beneficiaries must grasp regarding these adjustments. Notably, premiums are set to increase to $185.00, which carries significant implications tied to the Income-Related Monthly Adjustment Amount (IRMAA). These developments will undoubtedly impact patient care and access to medications, highlighting the necessity for strategic financial planning among beneficiaries and healthcare providers alike.

Introduction

As the landscape of Medicare evolves, beneficiaries are confronted with a wave of changes that could significantly impact their healthcare costs and access. With anticipated increases in Medicare Part B premiums, deductibles, and the Income-Related Monthly Adjustment Amount (IRMAA) for 2025, understanding these adjustments is crucial for both patients and healthcare providers.

The projected rise in costs reflects broader economic trends and necessitates strategic planning to navigate the complexities of coverage options. This article delves into the implications of these changes, offering insights and strategies that empower stakeholders to make informed decisions in an increasingly challenging environment.

CareSet: Comprehensive Medicare Data Analysis for 2025 Premium Changes

CareSet excels in extracting and interpreting complex healthcare claims data, equipping stakeholders with critical insights into the factors influencing 2025 Medicare Part B premiums. By leveraging an extensive analysis of over $1.1 trillion in annual claims data, CareSet uncovers significant trends and patterns that elucidate the implications of these premium changes on patient care and provider reimbursement strategies.

For 2025, the anticipated changes in 2025 Medicare Part B premiums are expected to reflect broader shifts in healthcare expenses and patient requirements. Notably, for the 2023 tax year, if a couple filing jointly exceeds a Modified Adjusted Gross Income (MAGI) of $212,000, they will incur an Income-Related Monthly Adjustment Amount (IRMAA), underscoring the financial implications for higher-income beneficiaries.

Expert opinions indicate that these premium changes will not only affect out-of-pocket costs but also influence access to necessary medications. As Juliette Cubanski, deputy director of the program on Medicare policy at KFF, notes, “We’re seeing some changes not just in terms of premiums, but in terms of cost-sharing, deductibles, and aspects of coverage that could affect both what people pay, but also their ability to access the medications that they need.”

Additionally, the introduction of a $2,000 out-of-pocket cap on prescription drugs is projected to benefit nearly 3.2 million Americans under the 2025 Medicare Part B premiums. This cap is expected to enhance patient care by reducing the financial burden on beneficiaries, thereby improving their access to essential medications. CareSet’s dedication to delivering prompt and pertinent insights aids clients in managing these changes, ultimately promoting long-term strategic growth and improving patient outcomes in the medical sector.

To discover how CareSet can empower your organization with practical insights and strategies, we encourage you to explore our extensive data solutions and case studies that showcase our influence on medical strategies.

2025 Medicare Part B Premium Increase: Key Figures and Implications

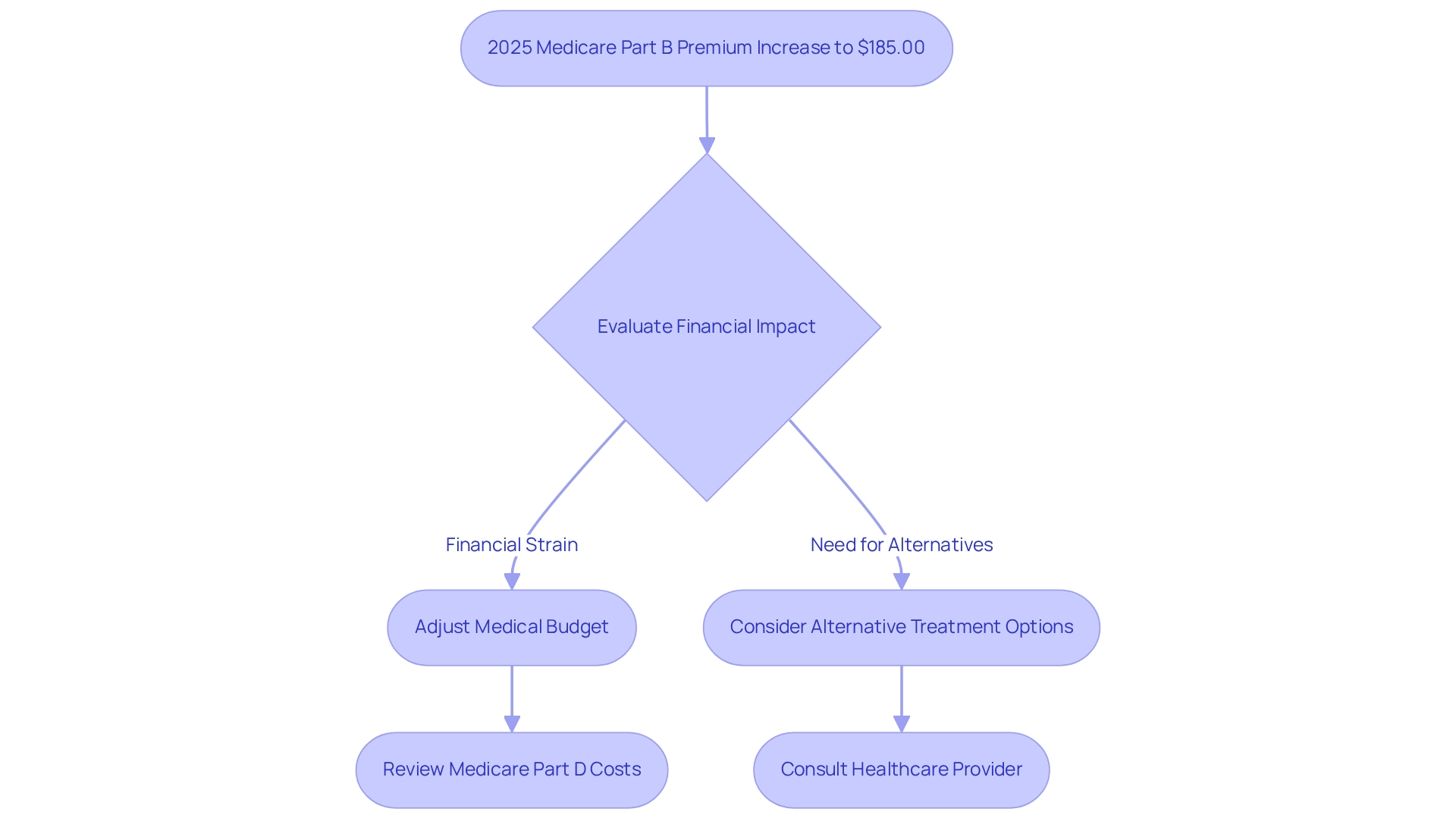

In 2025, the Medicare Part B premiums will increase to $185.00, which reflects a rise of $10.30 from the previous year’s premium of $174.70. This adjustment mirrors current medical expenditure trends and is projected to affect approximately 60 million beneficiaries. The financial implications of this increase necessitate meticulous planning for both patients and healthcare providers, as many individuals may encounter budgetary constraints due to escalating healthcare costs.

This premium increase is not merely a numerical adjustment; it signifies broader economic factors, including inflation and the escalating costs of medical services. Healthcare economists assert that such modifications can profoundly affect beneficiaries’ access to essential care, especially for those on fixed incomes. As premiums rise, patients may need to reassess their medical budgets, potentially leading to difficult choices regarding treatment options.

Moreover, the 2025 Medicare Part B premiums increase is part of a broader trend observed over the past decade, characterized by consistent cost growth driven by various factors, including heightened demand for medical services and advancements in medical technology. This trend underscores the importance of strategic financial planning for recipients and service providers alike as they navigate the complexities of health coverage and associated expenses.

In addition to the Part B premium increase, recipients must also consider the Medicare Part D Income-Related Monthly Adjustment Amount (IRMAA) for 2025, which ranges from $0.00 to $85.80 based on income and filing status. This additional expense can further strain the finances of those affected, making it critical for recipients to evaluate their total medical costs.

Hal Levy, a health specialist, emphasizes, “Our mission is to provide information that will help everyday people make better decisions about buying and maintaining their health coverage.” This sentiment resonates strongly in light of the recent premium increases, as recipients are compelled to make informed decisions about their medical options.

Furthermore, CareSet’s comprehensive approach to medical analytics, which integrates over 100 external data sources, offers valuable insights that can assist stakeholders in navigating the financial ramifications of these premium changes. For instance, pharmaceutical market access managers can utilize CareSet’s data to identify trends in consumer spending and adjust their market access strategies accordingly. Additionally, actionable insights from CareSet can empower stakeholders to develop patient engagement initiatives that address the challenges posed by rising premiums.

In summary, the 2025 Medicare Part B premiums increase not only highlights the ongoing shifts in healthcare expenses but also serves as a crucial reminder for recipients to evaluate their healthcare strategies in light of these changes. By leveraging CareSet’s data insights, stakeholders can better prepare for the financial implications of these adjustments and enhance their decision-making processes.

Income-Related Monthly Adjustment Amount (IRMAA) Changes for 2025

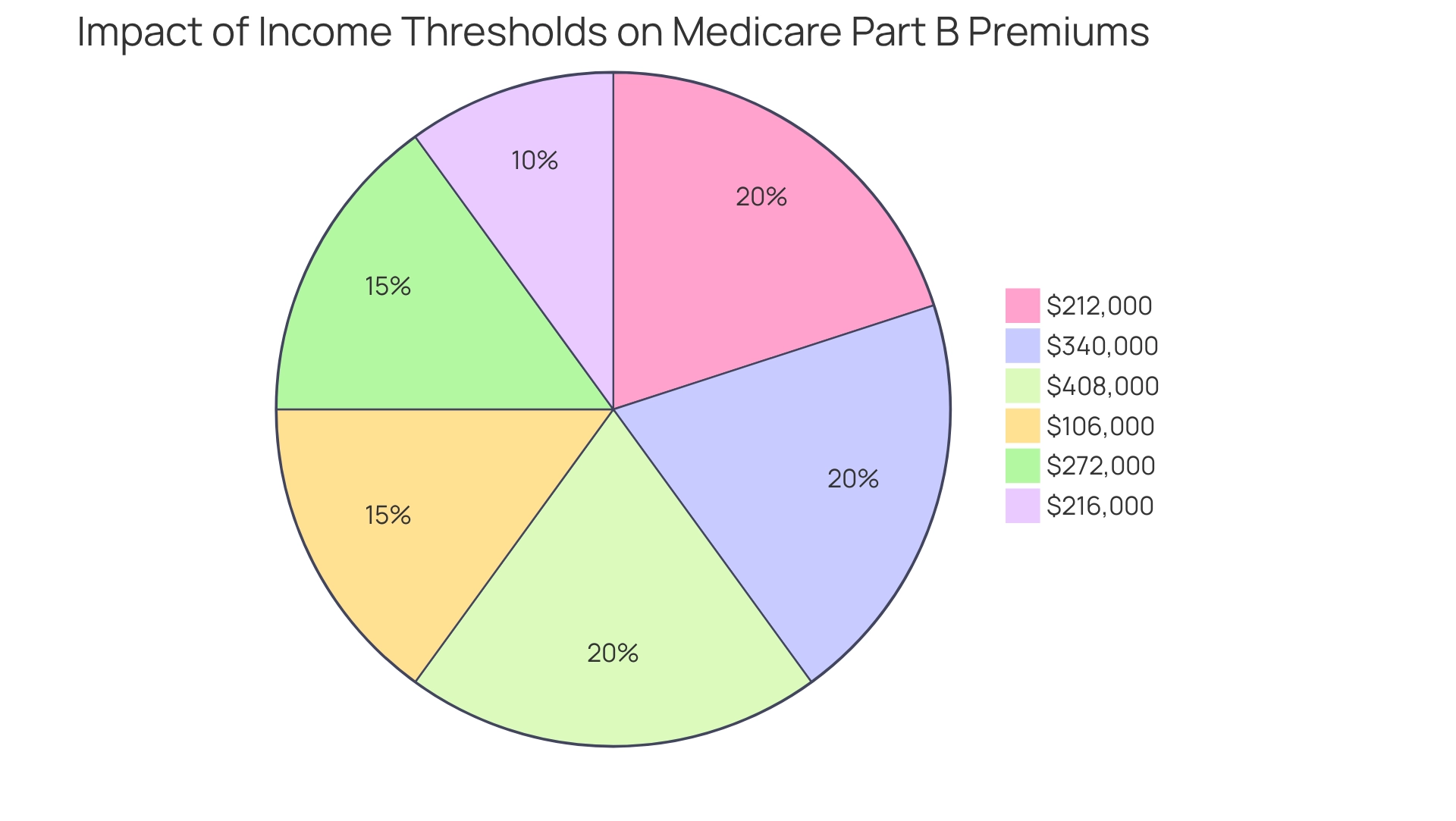

In 2025, the rise in the Income-Related Monthly Adjustment Amount (IRMAA) thresholds will impact beneficiaries with higher incomes, which will be reflected in the 2025 Medicare Part B premiums. Specifically, individuals with a modified adjusted gross income (MAGI) exceeding $106,000 and couples surpassing $212,000 will incur additional surcharges on their 2025 Medicare Part B premiums. This adjustment aims to ensure that those with greater financial resources contribute a more equitable share to healthcare funding.

The projected IRMAA brackets for 2026 are set at $216,000, $272,000, $340,000, and $408,000, reflecting various inflation scenarios. These changes emphasize the ongoing modifications to healthcare premiums, particularly the 2025 Medicare Part B premiums, which have traditionally been affected by income levels, as outlined in the historical context of premium adjustments. For example, recipients earning over $106,000 in 2023 encountered higher premiums based on earnings from two years earlier, underscoring the significance of comprehending how income variations can affect healthcare expenses.

Expert commentary from Jae W. Oh, Managing Principal of GH2 Benefits, LLC, highlights that while most people do not pay premiums for Part A, those who do might still face income-related surcharges. Comprehending these additional charges is essential for recipients, as it directly influences their financial strategies and readiness for healthcare expenses.

The modifications to IRMAA signify an increasing acknowledgment of the need to allocate healthcare expenses fairly among recipients according to their financial abilities. As these changes take effect, high-income recipients must navigate the complexities of their premiums, particularly if they experience life changes that affect their income, which can lead to adjustments in their IRMAA determinations. Grasping these dynamics is essential for efficient financial planning, particularly for individuals who might need to contest IRMAA decisions because of life changes impacting income.

Additionally, it is significant to mention that most costs associated with the program are financed by general revenues, which further clarifies the financial framework of the system and its importance to recipients. To prepare for possible IRMAA changes, recipients should routinely assess their income situation and seek advice from financial consultants, ensuring they are ready to handle their financial obligations related to healthcare.

2025 Medicare Part B Deductible: What Beneficiaries Should Expect

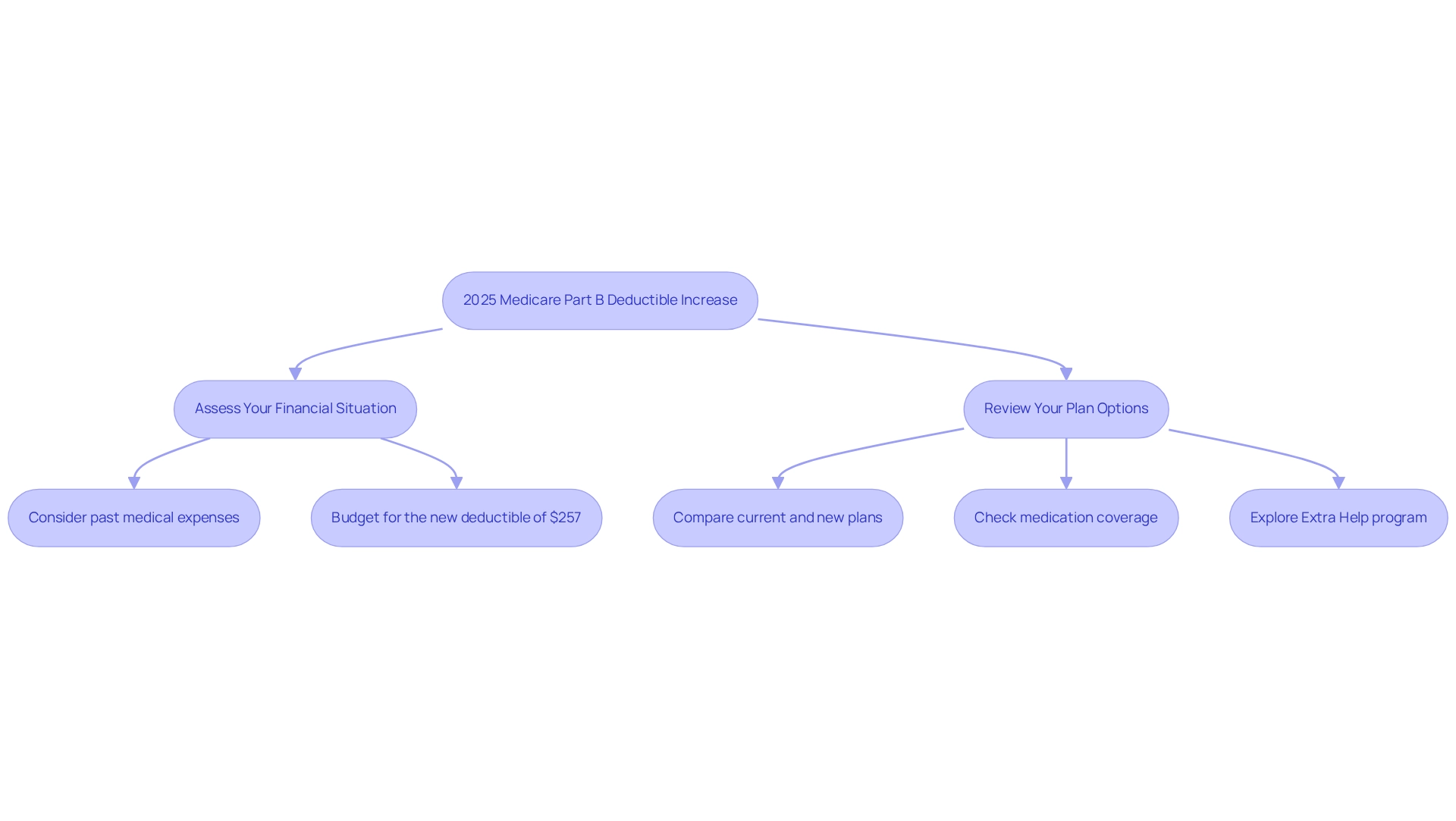

In 2025, the yearly deductible for Part B will rise to $257, which is part of the adjustments in the 2025 Medicare Part B premiums from $240 in 2024. This change signifies that beneficiaries must cover this amount out-of-pocket before the government starts reimbursing medical expenses. Such adjustments are vital for recipients as they strategize their medical budgets for the upcoming year.

Historical trends reveal that Medicare Part B deductibles have steadily increased over time, mirroring broader medical expense trends. For example, the deductible was $203 in 2021, showcasing a consistent upward trajectory. Financial analysts emphasize the importance of budgeting for these deductibles, advising recipients to consider their medical needs and potential costs.

As individuals prepare for open enrollment, they are encouraged to compare plans and ensure their medications are included, significantly impacting their overall medical expenses. Rachel Christian, an investing reporter, advises, “Take time during open enrollment to compare plans, confirm your medications are covered, and explore options like the Extra Help program to reduce your costs.”

Furthermore, the introduction of Medigap High Deductible Plans, with a deductible set at $2,870, complicates financial planning for many in relation to the 2025 Medicare Part B premiums. This increase in deductibles may lead individuals to reassess their supplemental coverage options, ultimately affecting their healthcare affordability and access.

National Health Education Week provides resources for recipients to make informed decisions, further supporting their financial planning efforts.

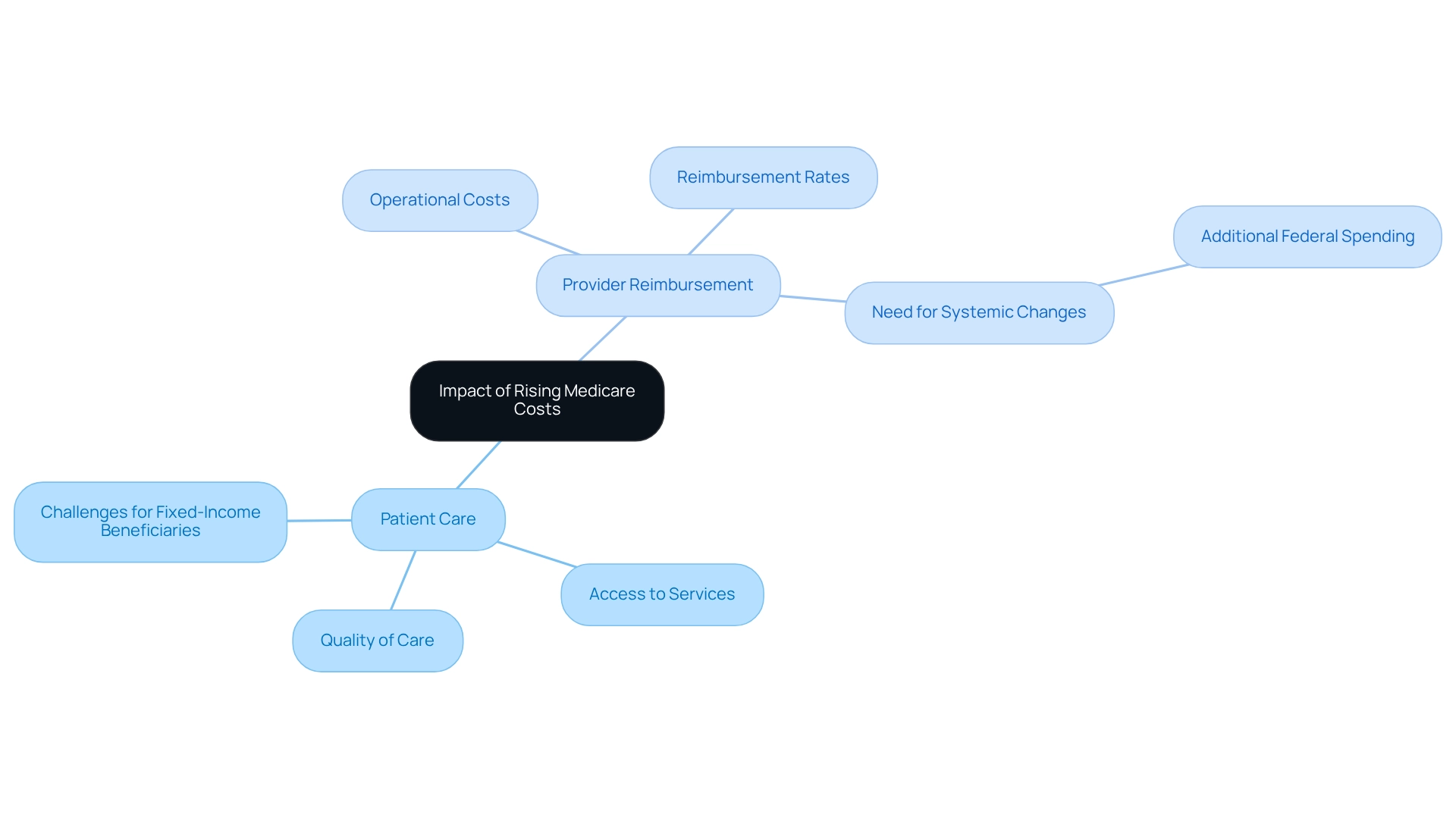

Impact of Rising Medicare Costs on Patient Care and Provider Reimbursement

The rising expenses associated with healthcare, particularly in premiums and deductibles, pose significant challenges for beneficiaries, especially those on fixed incomes. As these costs escalate, access to vital healthcare services may diminish, leading to adverse effects for vulnerable populations. This situation is equally alarming for providers; reimbursement rates frequently fall short of meeting the increasing operational costs, potentially undermining the quality of care provided.

Statistics reveal that in 2020, health spending as a share of GDP varied significantly across states, with West Virginia at 28.7% and Washington at a mere 11.7%. All differences analyzed in this study are significant at the 95% confidence level, underscoring the broader ramifications of escalating healthcare costs on patient access and care quality. Furthermore, projections indicate that by 2031, 61% of eligible beneficiaries are expected to enroll in Advantage plans, signaling a shift towards private health plans that may offer better reimbursement rates compared to traditional health coverage.

Expert insights indicate that the mounting financial pressures on Medicare can lead to substantial reimbursement challenges for healthcare providers. As operational costs rise, many providers struggle to maintain service quality, which can ultimately affect patient outcomes. For instance, case studies illustrate that some providers report a decline in patient care quality due to their inability to manage increasing operational expenses, highlighting that these dynamics are far from theoretical. CareSet’s comprehensive data solutions for medical programs can empower strategies by providing insights from over 62 million beneficiaries and 6 million providers, enabling stakeholders to analyze patient treatment pathways and enhance provider engagement.

Healthcare professionals have voiced concerns regarding reimbursement challenges stemming from rising expenses, emphasizing the need for systemic changes to ensure that care remains accessible and sustainable. As Anthony Damico, an independent consultant, remarked, “Adopting such changes, however, would require additional federal spending.” Addressing these challenges is crucial for stakeholders seeking to navigate the complexities of the evolving medical landscape and cultivate an environment where both patient care and provider sustainability can flourish.

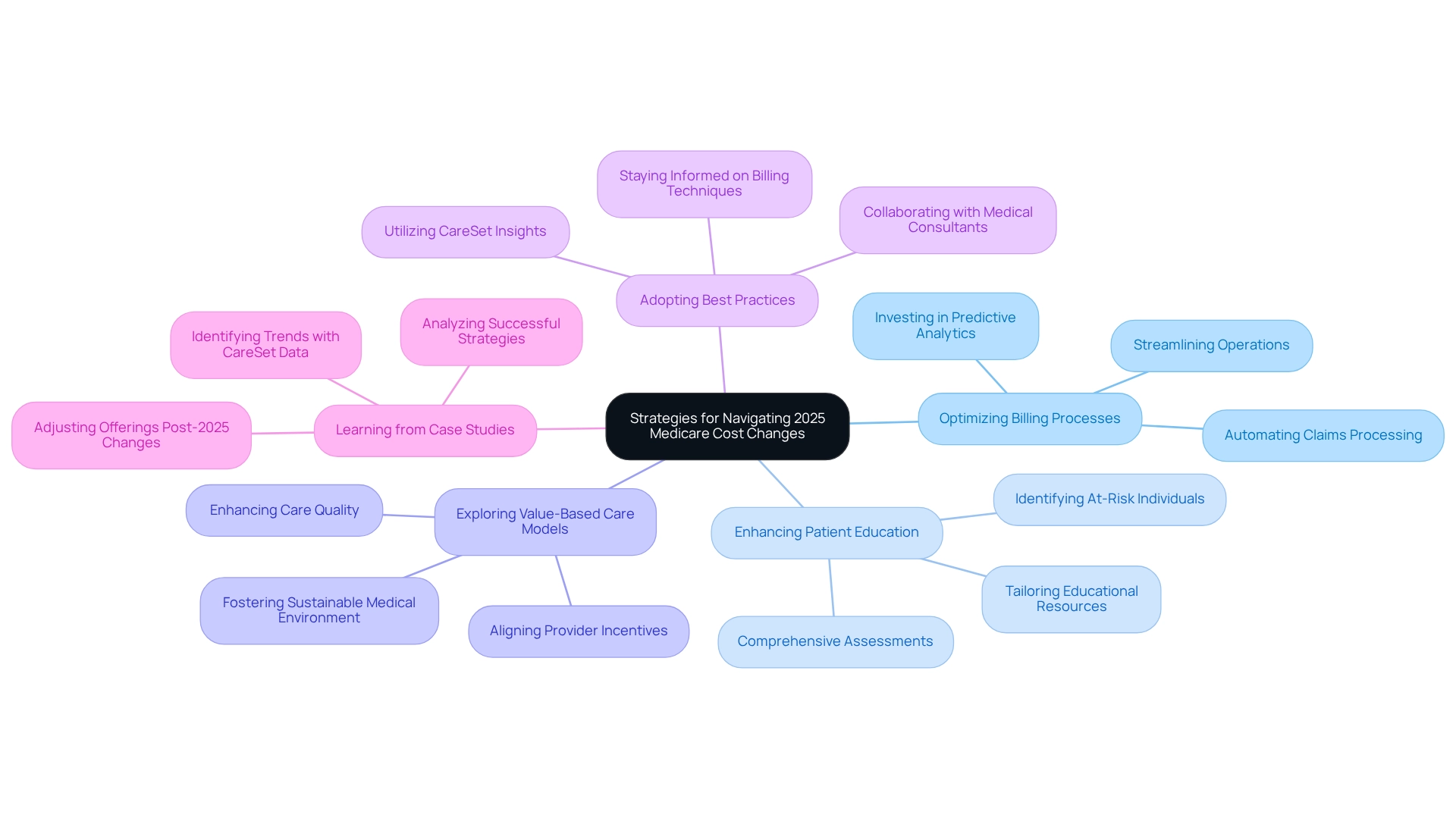

Strategies for Healthcare Providers to Navigate 2025 Medicare Cost Changes

Service providers can implement various effective strategies to navigate the anticipated cost changes in 2025, leveraging insights from CareSet’s extensive medical data. Key approaches include:

- Optimizing Billing Processes: Streamlining billing operations is paramount. Investing in predictive analytics and AI tools can significantly enhance clinical decision-making and automate claims processing, thereby reducing manual workload and minimizing errors. CareSet’s monthly Medicare updates offer valuable insights into drug utilization, enabling providers to refine their billing strategies based on the types of diseases diagnosed and the treatment pathways defined by NDC and HCPCS codes.

- Enhancing Patient Education: Educating patients about their coverage options is crucial. Comprehensive assessments can identify individuals at risk for conditions such as depression and anxiety, ensuring they receive timely support and care. As noted by Hardle, “Seniors also will receive more comprehensive assessments to early detect those at risk of depression, anxiety, and more.” CareSet’s data empowers providers to tailor educational resources effectively, ensuring that patients fully understand their treatment options.

- Exploring Value-Based Care Models: Transitioning to value-based care aligns provider incentives with patient outcomes, fostering a more sustainable medical environment. Insights from CareSet can guide providers in discerning which treatments are most effective and how to align their services with patient needs, ultimately enhancing care quality.

- Adopting Best Practices: Providers should remain informed about the latest billing optimization techniques and regulatory changes. Collaborating with medical consultants can yield customized strategies for efficient expense management. CareSet’s insights into provider networks and pharmaceutical utilization can inform these best practices, ensuring providers maintain a competitive edge.

- Learning from Case Studies: Analyzing successful billing optimization case studies can provide valuable insights into effective strategies. For instance, the reduction in special benefits in Advantage plans in 2025 underscores the necessity for providers to adjust their offerings and communication strategies in response to the 2025 Medicare Part B premiums. CareSet’s data solutions can help identify trends and inform strategic decisions, demonstrating that “CareSet identifies 15% more targets and 250% more patients than leading claims vendors.”

By proactively addressing these changes and utilizing CareSet’s extensive data insights, providers can enhance their financial health while continuing to deliver high-quality care. Consider arranging a consultation with a medical advisor to customize these strategies for your practice.

Educating Patients on Medicare Coverage Options Amid Premium Changes

As health insurance premiums continue to rise, it becomes increasingly vital for healthcare providers to educate patients about their coverage options. This education should encompass the distinctions between Advantage plans, Medigap, and Part D options, as well as how these choices can effectively manage out-of-pocket expenses. A significant 52% of survey participants were unaware that the government program covers essential services such as COVID tests, vaccines, and monoclonal antibody treatments, underscoring the need for clear communication. By providing accessible and straightforward information, healthcare providers empower patients to make informed decisions that align with their healthcare needs and financial circumstances.

The impact of premium changes on patient decision-making cannot be overstated. For instance, case studies reveal that regions with higher Advantage enrollment rates, such as Michigan at 62%, illustrate the effectiveness of localized education strategies tailored for specific populations. Additionally, California boasts the highest number of health care program enrollees at 6.5 million, highlighting the necessity for targeted educational efforts in diverse regions. CareSet’s monthly updates enhance provider engagement by delivering novel insights into drug utilization and treatment pathways, addressing critical questions such as which diseases providers diagnose and treat, and how patients navigate from diagnosis to treatment. As Claire Ernst, director of governmental affairs at the Medical Group Management Association, states, “The federal health insurance program is designed for individuals 65 years or older and those younger than 65 with certain health conditions.” This emphasizes the significance of comprehending coverage choices, particularly for common health issues among seniors, such as high blood pressure, high cholesterol, arthritis, cataracts, and diabetes.

As we approach 2025, it is essential to prioritize patient education about healthcare options, particularly in understanding the 2025 Medicare Part B premiums, ensuring that individuals comprehend their coverage and can navigate the complexities of the system. To improve patient outcomes, pharmaceutical market access managers should contemplate implementing localized educational initiatives that cater to the specific needs of their target populations, leveraging insights from CareSet’s extensive healthcare data solutions.

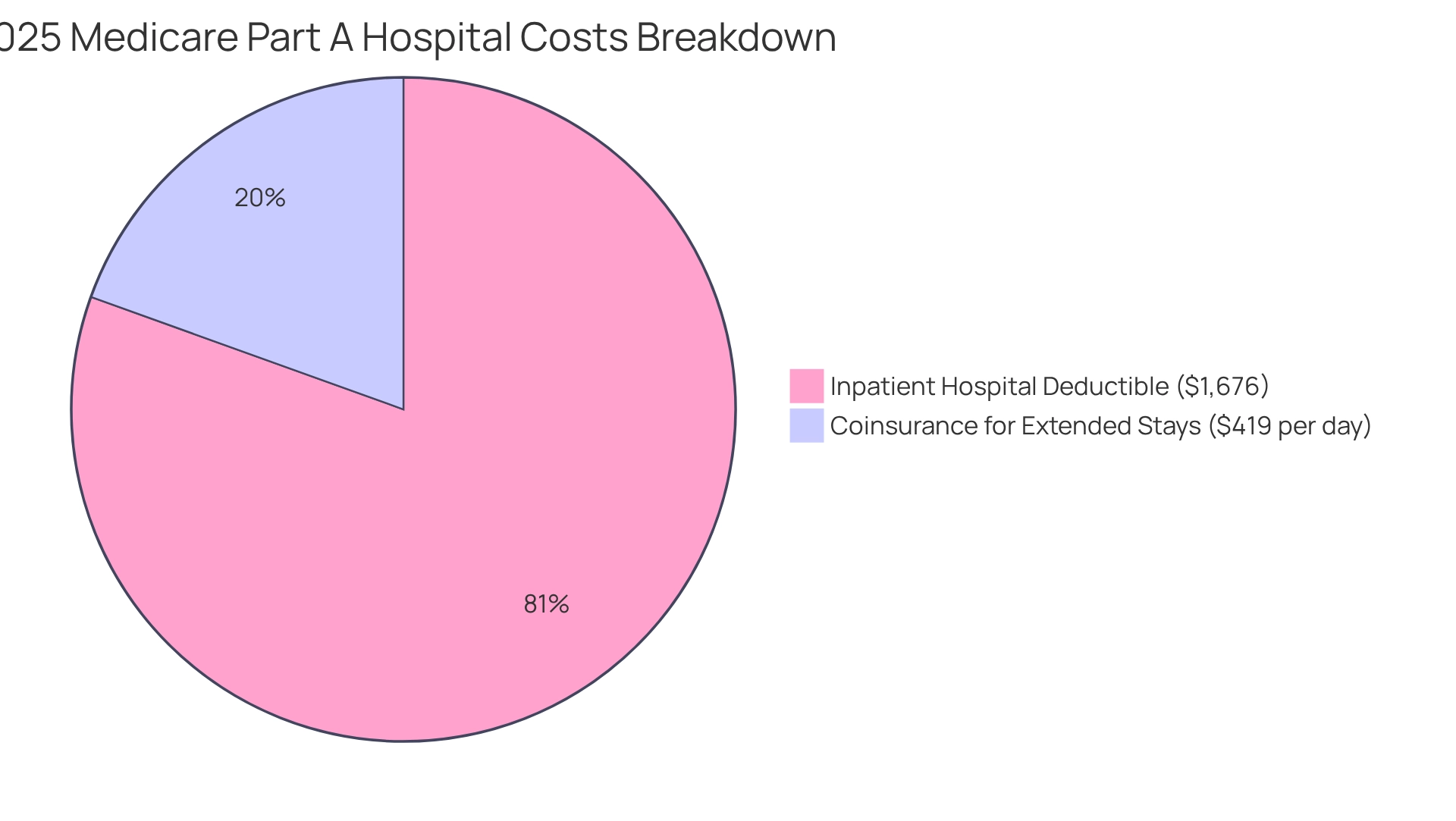

Medicare Part A Cost Adjustments: What to Know for 2025

In 2025, the Part A inpatient hospital deductible will rise to $1,676, an increase from $1,632 in 2024. Furthermore, the coinsurance for hospital stays extending beyond 60 days will increase to $419 per day. These modifications underscore the necessity for beneficiaries to grasp the full spectrum of expenses, as they can significantly impact financial obligations during hospital stays. With nearly 3.2 million Americans anticipated to benefit from the new out-of-pocket cap on Part D, comprehending these cost adjustments becomes even more crucial for effective financial planning and patient care management.

CareSet’s monthly updates on healthcare deliver innovative insights into drug utilization and treatment pathways, empowering stakeholders to navigate these changes adeptly. CareSet addresses vital business questions, such as:

- Which diseases providers diagnose and treat?

- How patients transition from diagnosis to treatment?

As highlighted by SueM863718, “You need the best health care when you’re seriously ill, not just for routine things… Why limit your care to a network?” This perspective emphasizes the importance of understanding healthcare options, particularly the potential drawbacks of relying solely on Advantage plans.

CareSet’s comprehensive approach not only meets immediate data needs but also promotes long-term strategic growth, enabling stakeholders to enhance patient care and optimize business success.

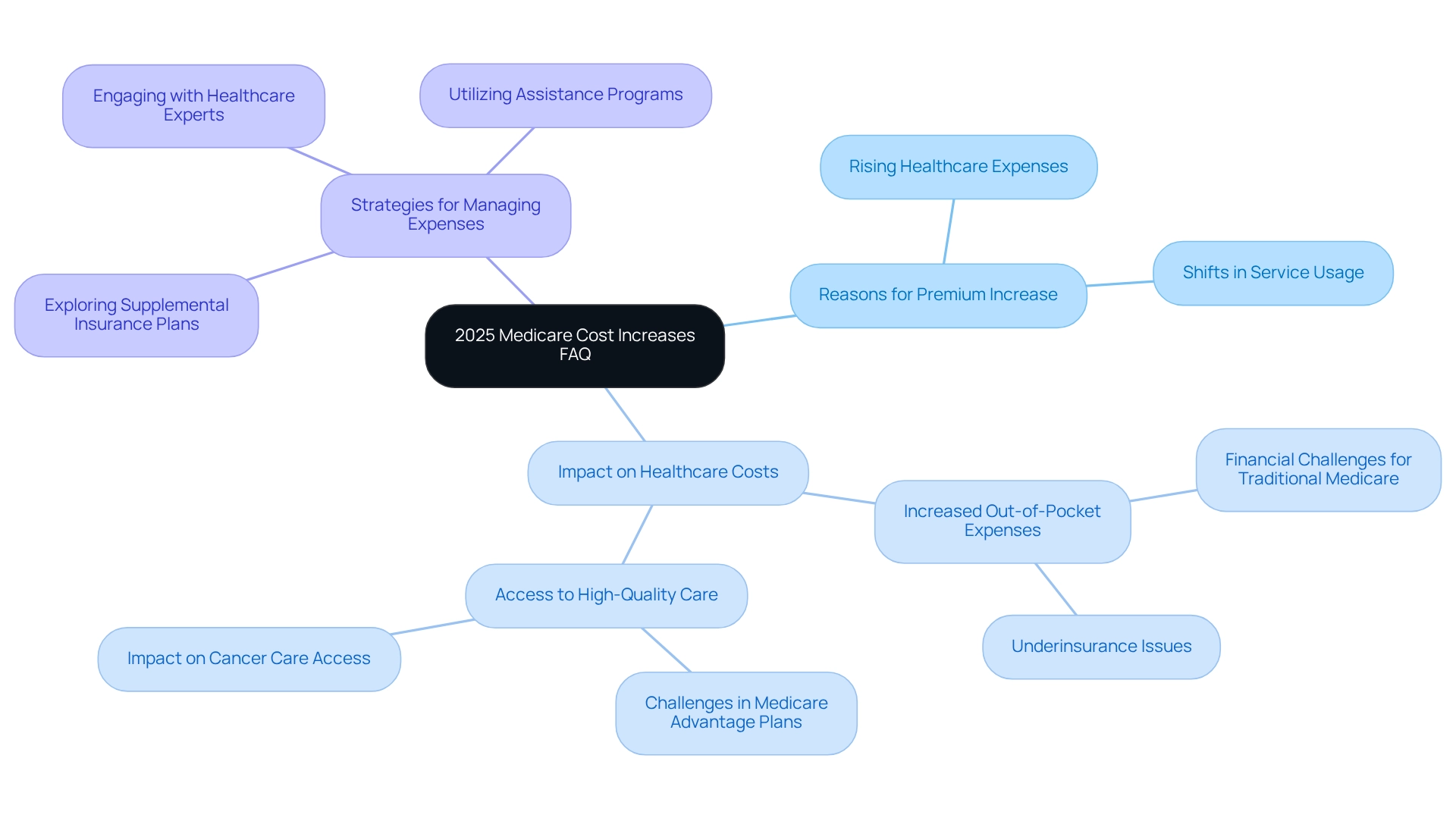

Frequently Asked Questions About 2025 Medicare Cost Increases

Recipients are understandably concerned about the impending healthcare price increases, prompting a series of common inquiries. Key questions include:

- What are the reasons behind the premium increase?

- How will these changes impact overall healthcare costs?

- What strategies can I employ to manage these expenses effectively?

Addressing these concerns is vital for equipping recipients with the information they need to navigate the evolving landscape of healthcare.

Statistics indicate that many beneficiaries express anxiety over potential changes, particularly regarding affordability and access to care. In 2025, the anticipated increase in Medicare Part B premiums is largely associated with rising healthcare expenses and shifts in service usage, specifically the 2025 Medicare Part B premiums. Notably, Medicare 2.0 aims to promote greater access to providers within Medicare Advantage (MA) plans, which is essential as many MA patients encounter difficulties in accessing high-quality care. Experts underscore that understanding these factors is crucial for recipients to grasp the broader implications of the changes.

Moreover, recipients frequently seek clarification on how these price hikes will affect their out-of-pocket expenses. For instance, a recent case study highlighted the financial challenges faced by individuals enrolled in traditional Medicare, many of whom contend with elevated out-of-pocket costs that may lead to underinsurance and restricted access to essential care. Proposed reforms aim to alleviate these financial burdens, ultimately enhancing access to vital services. As Richard J. Gilfillan observed, “Many MA plans deem even local cancer centers, let alone national centers of excellence, to be out of network; consistent with this finding, MA patients are less likely to receive care at high-quality cancer centers and are more likely to die after cancer surgery.” This emphasizes the importance of addressing access challenges in light of rising expenses.

To mitigate the impact of escalating costs, beneficiaries are encouraged to explore available options, such as supplemental insurance plans or assistance programs. Engaging with healthcare experts can provide tailored guidance and strategies to assist in managing costs effectively. CareSet also offers complimentary assistance for seniors and encourages potential clients to reach out for options. By addressing these frequently asked questions, recipients can feel more informed and prepared for the changes ahead, ensuring they make the best choices for their medical needs.

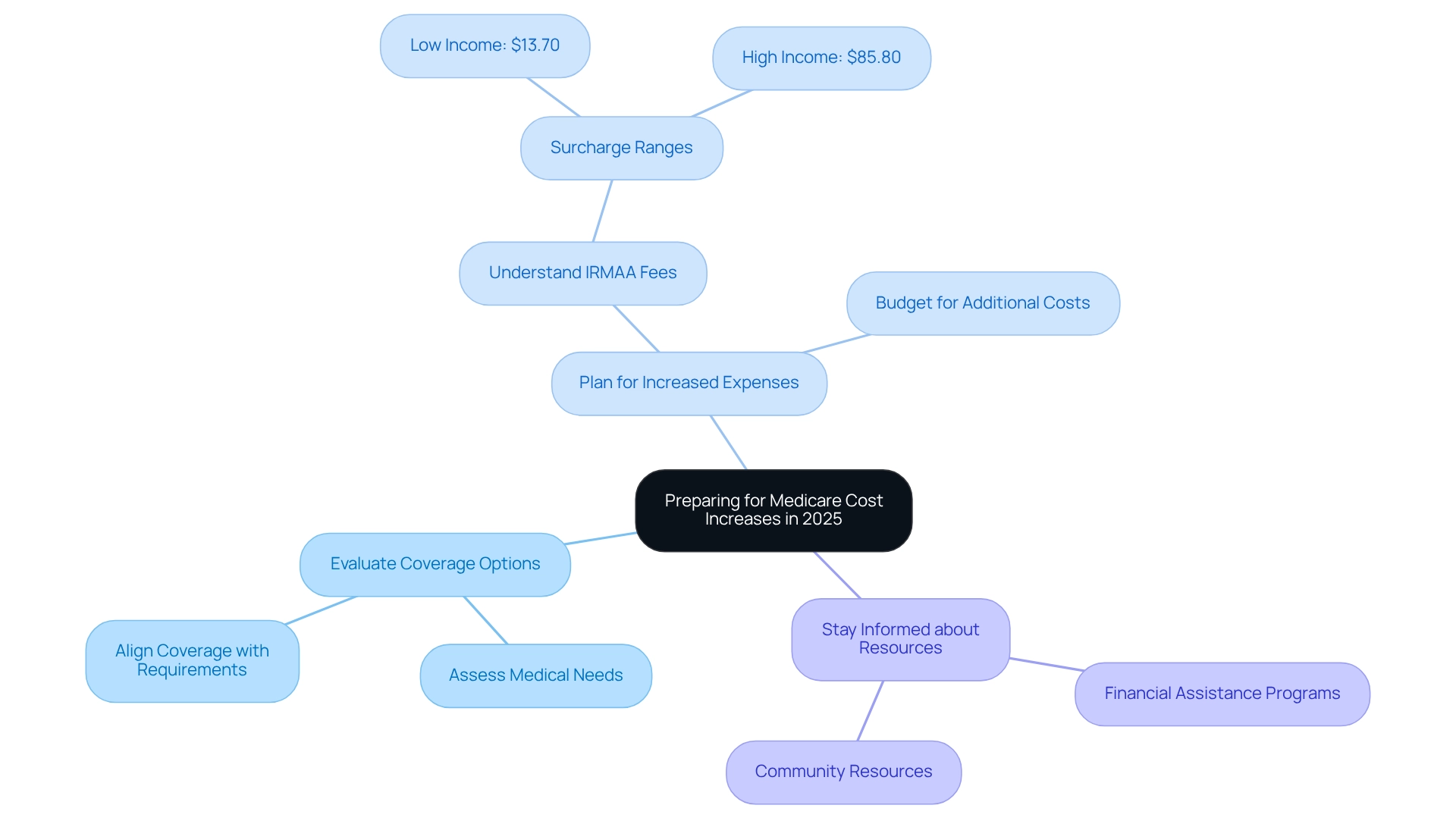

Preparing for Medicare Cost Increases in 2025: A Guide for Beneficiaries and Providers

To effectively prepare for the anticipated 2025 Medicare Part B premiums, recipients must conduct a thorough evaluation of their current plans while assessing their medical needs. A significant number of beneficiaries qualify for premium-free Part A, which can substantially impact their overall healthcare costs. Providers are instrumental in offering resources and guidance to help navigate these impending changes. Key strategies include:

- Evaluating coverage options to ensure they align with evolving healthcare requirements.

- Planning for increased expenses, particularly as higher earners may face additional fees for Part D coverage, which can range from $13.70 to $85.80 based on income. As the Centers for Medicaid Services emphasizes, ‘IRMAA is an additional fee included in your premium.’

- Staying informed about supplementary resources available to assist in managing costs, such as financial assistance programs or community resources.

By implementing these proactive measures, beneficiaries can more effectively navigate the complexities of the Medicare landscape, while providers can enhance their support. Moreover, CareSet’s comprehensive healthcare data insights empower healthcare partners to make informed decisions regarding drug utilization and treatment pathways, ultimately leading to improved patient outcomes and satisfaction.

Conclusion

The anticipated changes to Medicare in 2025 carry significant implications for beneficiaries and healthcare providers alike. With Medicare Part B premiums increasing to $185.00 and an annual deductible rising to $257, financial planning has never been more critical. These adjustments are not mere numbers; they signify broader economic trends and the escalating costs of healthcare services that directly influence patient care and accessibility.

Furthermore, modifications to the Income-Related Monthly Adjustment Amount (IRMAA) will impact higher-income beneficiaries, underscoring the necessity for individuals to reassess their Medicare strategies and budget accordingly. As the healthcare landscape continues to evolve, it is imperative for beneficiaries to remain informed about their coverage options and potential out-of-pocket costs, particularly regarding Medicare Advantage and supplemental insurance.

Healthcare providers also encounter challenges as rising costs can strain reimbursement rates and affect the quality of care delivered. Implementing effective strategies such as optimizing billing processes, enhancing patient education, and exploring value-based care models can facilitate navigation through these changes. By leveraging comprehensive data insights, providers can make informed decisions that support both their financial health and the quality of care they deliver.

Ultimately, proactive engagement with these changes is essential for all stakeholders involved in the Medicare system. Beneficiaries must educate themselves on their options, while providers must adapt to the shifting landscape to ensure sustainable care delivery. As the Medicare environment becomes increasingly complex, focusing on informed decision-making will be crucial for maintaining access to necessary healthcare services and improving patient outcomes.