Overview

The article addresses the modifications to the Medicare Income-Related Monthly Adjustment Amount (IRMAA) brackets for 2025, presenting essential strategies for managing associated costs. Understanding these adjustments is crucial, as they can profoundly affect healthcare premiums for higher-income individuals.

To navigate these changes effectively, the article outlines actionable strategies, including:

- Maximizing retirement contributions

- Utilizing Roth conversions

These strategies can significantly alleviate these financial burdens.

Introduction

Navigating the intricacies of Medicare can indeed be daunting, particularly in understanding the Income-Related Monthly Adjustment Amount (IRMAA). This crucial surcharge, impacting higher-income beneficiaries, has the potential to significantly affect healthcare costs, often resulting in unexpected financial strains.

As the landscape of Medicare evolves, especially with upcoming adjustments for 2025, it is essential for beneficiaries to comprehend how their income influences premiums and to explore strategies for managing these costs.

From understanding the IRMAA brackets to implementing financial strategies and knowing one’s rights in the appeals process, this article delves into the vital aspects of IRMAA. By empowering readers to take control of their Medicare expenses, we aim to secure a more stable financial future.

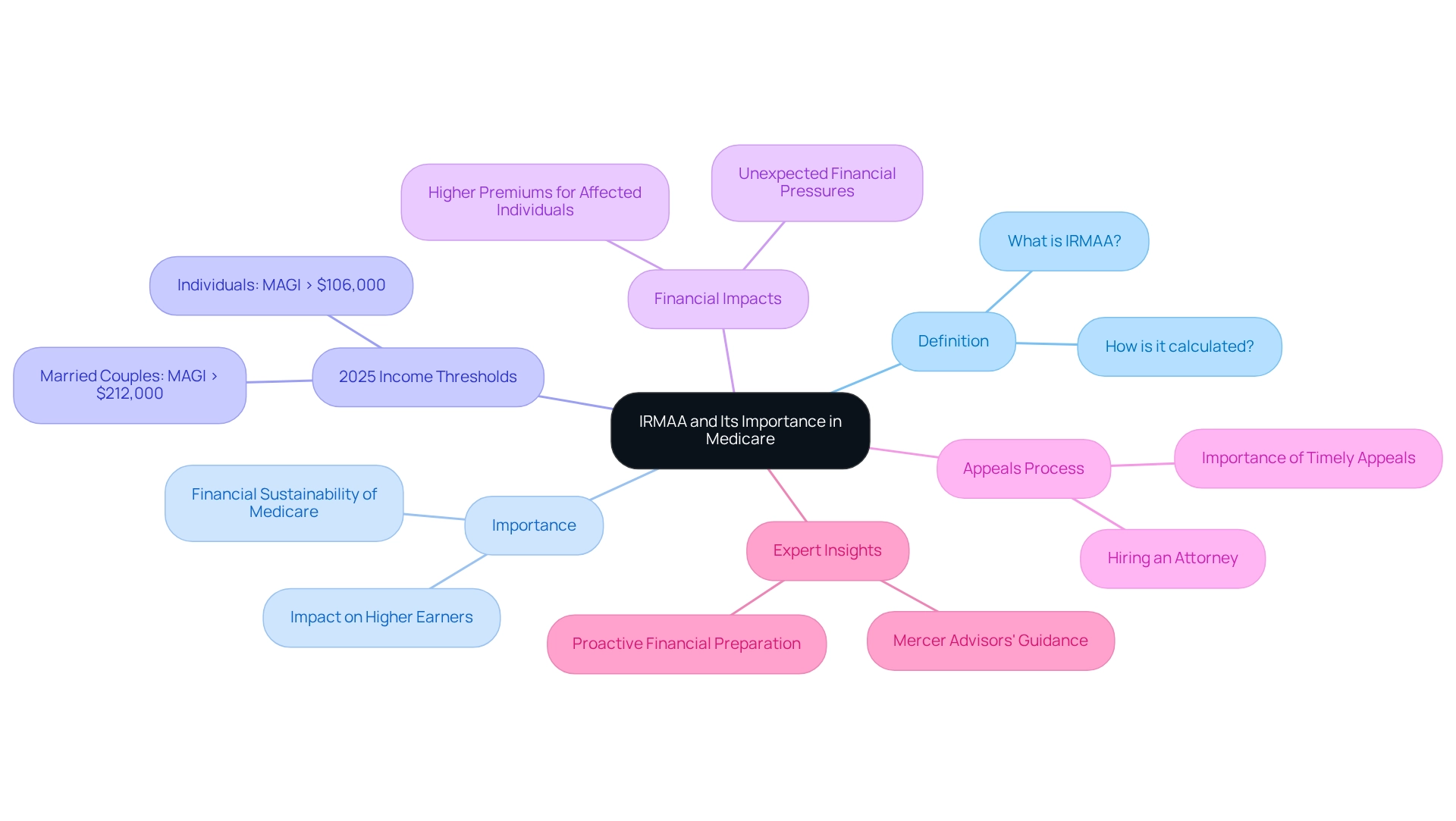

Define IRMAA and Its Importance in Medicare

The Income-Related Monthly Adjustment Amount (IRMAA) signifies an additional fee applied to specific individuals enrolled in health insurance, augmenting their regular Part B and Part D premiums. This surcharge is determined based on the recipient’s modified adjusted gross income (MAGI) from two years prior. For 2025, individuals with a MAGI exceeding $106,000 and married couples filing jointly with a MAGI above $212,000 will fall into the 2025 Medicare IRMAA brackets and incur these additional costs.

Understanding the income-related adjustment is crucial, as it ensures that higher-earning individuals contribute a fair share to the Medicare program, thereby aiding its financial sustainability. This modification is particularly significant for recipients who may be unaware of how their earnings impact healthcare costs, potentially leading to unexpected financial pressures.

Real-world examples illustrate the impact of IRMAA adjustments on recipients. For instance, those who experience a sudden drop in income may find themselves facing higher premiums based on outdated income assessments. This scenario underscores the importance of timely appeals and adjustments. In some cases, hiring a lawyer may be necessary for higher levels of appeal, providing individuals with essential guidance throughout this process. Furthermore, awareness of the 2025 Medicare IRMAA brackets and critical dates regarding the management of income-related adjustments, as detailed in the case study ‘Key Dates for IRMAA Management in 2025,’ can help recipients navigate these changes efficiently, preventing unforeseen financial challenges.

Current data suggests that a significant portion of individuals enrolled in healthcare programs will be affected by the 2025 Medicare IRMAA brackets, which highlights the necessity for proactive financial preparation. Experts emphasize that understanding the income-related monthly adjustment amount is vital for maintaining financial stability in retirement, as it directly influences out-of-pocket healthcare expenses. Healthcare economists indicate that the ramifications of the income-related monthly adjustment amount extend beyond individual recipients, impacting the overall financing and sustainability of the health insurance program. As Mercer Advisors notes, “With over 24,000 coverage options, Chapter’s specialists can assist you in selecting the best plan for your health and financial requirements.”

In summary, the income-related monthly adjustment amount plays a pivotal role in shaping the financial landscape for Medicare recipients, making it essential for stakeholders to remain informed about its updates and implications.

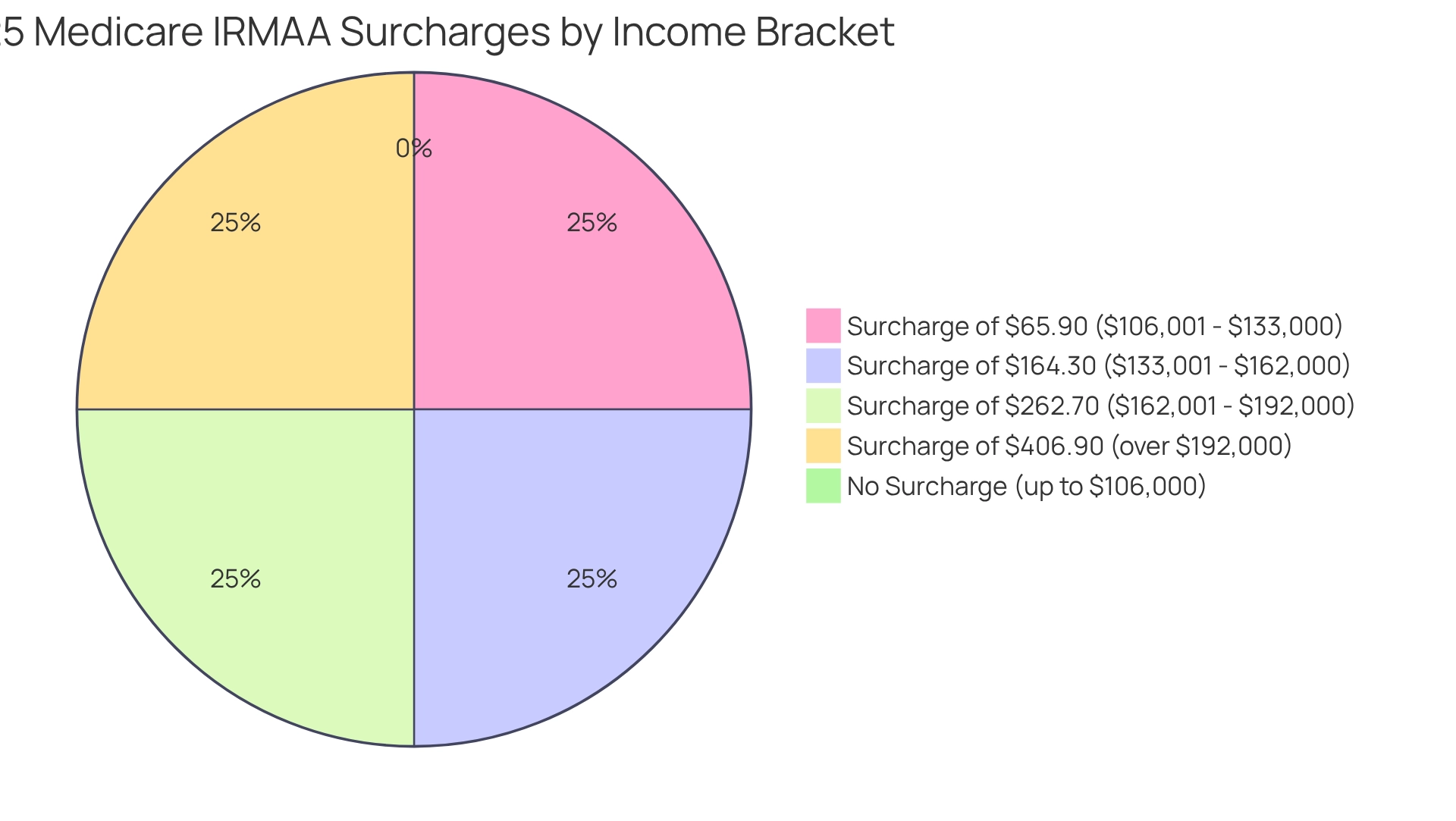

Explore the 2025 IRMAA Brackets and Premium Adjustments

For 2025, the adjusted 2025 Medicare IRMAA brackets indicate that individuals with MAGI up to $106,000 will face no IRMAA surcharge. Those with MAGI from $106,001 to $133,000 will incur an additional charge of $65.90 on top of the standard Part B premium of $185.00 according to the 2025 Medicare IRMAA brackets. For individuals with MAGI from $133,001 to $162,000, the surcharge increases to $164.30 according to the 2025 Medicare IRMAA brackets. Individuals with MAGI from $162,001 to $192,000 will incur an additional $262.70 according to the 2025 Medicare IRMAA brackets, while those exceeding $192,000 will face a surcharge of $406.90. For married couples, these thresholds are doubled, reflecting the rising costs of healthcare and necessitating higher contributions from wealthier recipients.

Understanding the 2025 Medicare IRMAA brackets is essential for recipients to efficiently manage their finances and mitigate unforeseen healthcare costs. As Christian Worstell, a senior writer on health insurance, emphasizes, “the more recipients understand their coverage, the better their overall health and wellness becomes as a result.” This statement underscores the importance of being aware of potential expenses associated with the income-related adjustment.

It is also crucial to recognize that individuals enrolled in Medicare Advantage are still responsible for the Part B premium as well as any applicable income-related monthly adjustment amounts. The additional premium is determined by the modified adjusted gross earnings reported on IRS tax returns from two years prior; for instance, the premiums corresponding to the 2025 Medicare IRMAA brackets are based on 2023 earnings. Individuals and couples exceeding the income thresholds will incur higher premiums, ensuring they remain informed about their potential expenses. Furthermore, projections indicate that a 2.5% inflation rate over the next five months could lead to estimated 2027 income brackets of $214,000, $270,000, $336,000, and $402,000, providing context for future planning and trends in Medicare expenses.

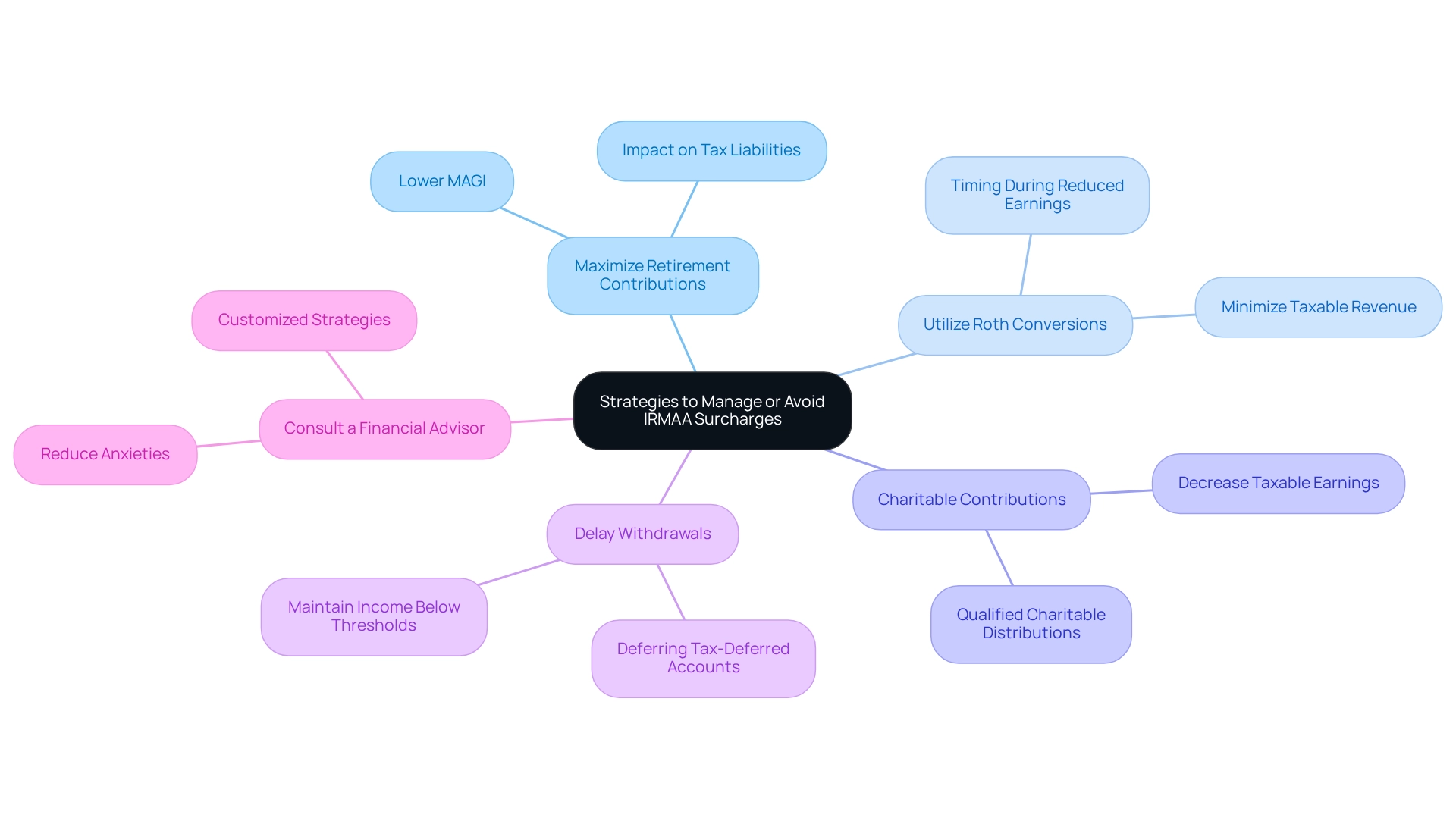

Implement Strategies to Manage or Avoid IRMAA Surcharges

To effectively manage or avoid IRMAA surcharges, beneficiaries should consider the following strategies:

-

Maximize Retirement Contributions: Increasing contributions to tax-deferred retirement accounts can lower your Modified Adjusted Gross Income (MAGI), potentially keeping you below the IRMAA threshold. Statistics indicate that maximizing retirement contributions can significantly impact MAGI, making this a crucial strategy.

-

Utilize Roth Conversions: Strategically timing Roth IRA conversions during years of reduced earnings can help manage taxable revenue levels, minimizing the impact on your MAGI.

-

Charitable Contributions: Making qualified charitable distributions can effectively decrease your taxable earnings, thereby lowering your MAGI.

-

Delay Withdrawals from Retirement Accounts: If possible, deferring withdrawals from tax-deferred accounts can assist in keeping your income beneath the thresholds for income-related adjustments.

-

Consult a Financial Advisor: Collaborating with a financial planner experienced in healthcare can offer customized strategies that fit your distinct financial circumstances. As Rasheed Ahmed, CFP®, states, “Above all, being knowledgeable can help reduce potential anxieties and vulnerability as you approach a new life chapter.”

Applying these strategies can greatly reduce the financial strain of IRMAA on your healthcare premiums, especially considering the 2025 Medicare IRMAA brackets, ensuring a more manageable retirement planning process. Additionally, understanding common deductions added back to AGI for MAGI calculation is essential, as it allows beneficiaries to accurately assess their financial situation. Staying informed about legislative changes regarding Medicare premiums is also crucial, as higher premiums may apply if an individual’s MAGI exceeds the 2025 Medicare IRMAA brackets.

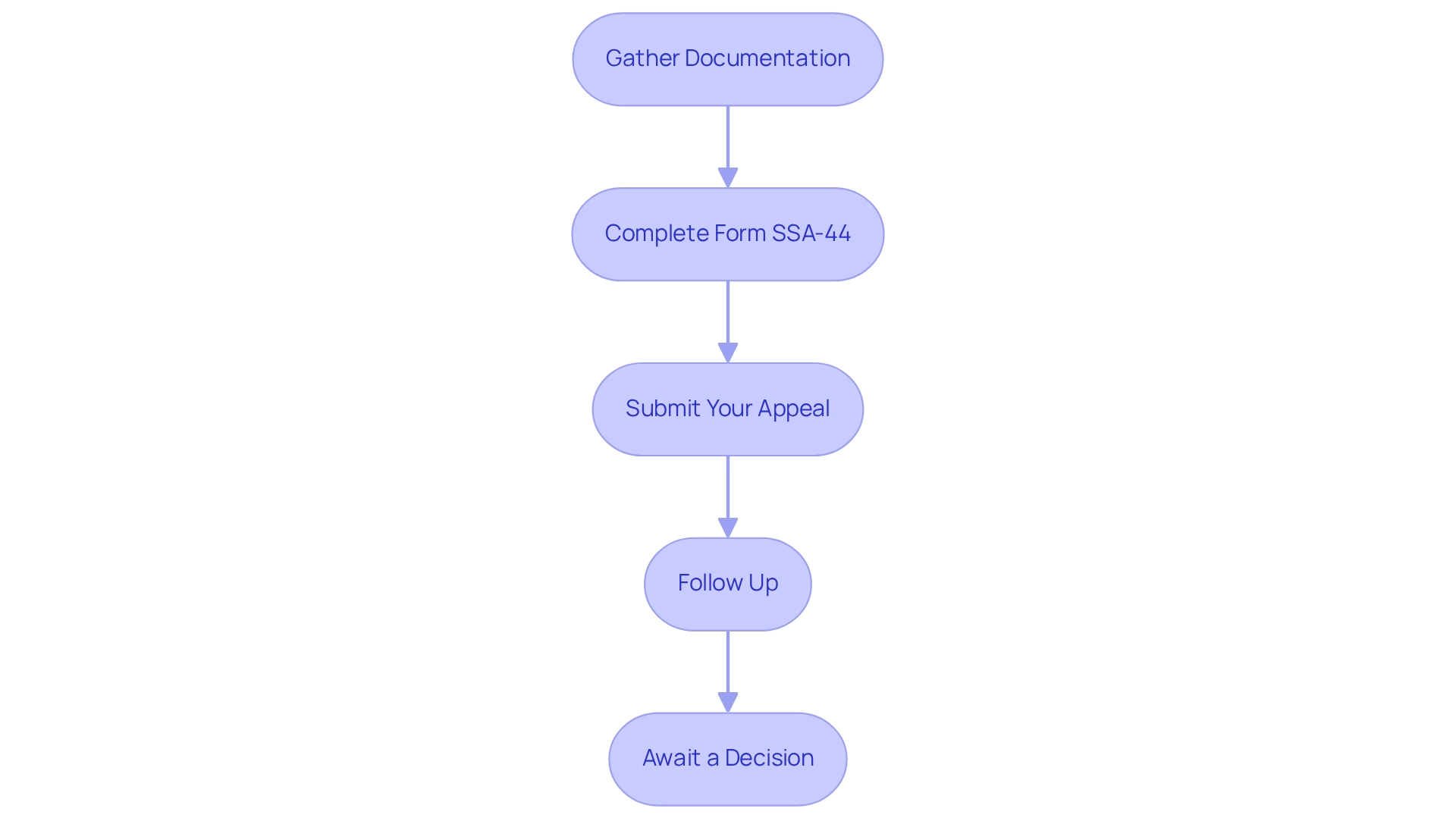

Understand the IRMAA Appeals Process and Your Rights

If you believe your income-related monthly adjustment amount determination is incorrect, you possess the right to contest it. Navigating the appeals process effectively can lead to significant benefits. Here’s how to proceed:

-

Gather Documentation: Begin by collecting relevant documents that support your case, such as tax returns or evidence of life-changing events that may have impacted your income. This documentation is essential for substantiating your appeal.

-

Complete Form SSA-44: Utilize this form to request a reconsideration of your income-related monthly adjustment amount. Ensure that all information is accurate and complete to avoid processing delays.

-

Submit Your Appeal: Dispatch the completed SSA-44 form to your local Social Security office. Alternatively, you may submit your appeal online or by phone, offering flexibility in how you choose to proceed.

-

Follow Up: After submitting your appeal, it is prudent to follow up to confirm receipt and processing status. This proactive measure can help ensure your appeal is not overlooked.

-

Await a Decision: The Social Security Administration will review your appeal and notify you of their decision. Should your appeal be denied, you have the right to request a hearing within 60 days. Understanding this process empowers recipients to advocate for themselves and potentially reduce their Medicare expenses related to the 2025 Medicare IRMAA brackets.

Statistics indicate that approximately 50% of appeals related to income-related adjustments are successful, particularly when recipients provide thorough documentation. Common reasons for appeals include fluctuations in earnings due to retirement or other life changes. Legal experts affirm that beneficiaries are entitled to challenge IRMAA determinations related to the 2025 Medicare IRMAA brackets, underscoring the importance of being informed about the appeals process. As Mark Annese states, “A successful appeal could result in reduced health care premiums if earnings alterations are substantial enough.” Furthermore, the case study titled “Understanding Premium Adjustments” illustrates how Social Security assesses income from two years prior to determine Part B and D premiums, emphasizing the critical nature of appealing when income changes occur. By adhering to these steps and leveraging available resources, individuals can adeptly manage the intricacies of appeals and strive for equitable Medicare premiums. Additionally, FAQs related to IRMAA appeals can provide further guidance for beneficiaries navigating this process.

Conclusion

Navigating the complexities of the Income-Related Monthly Adjustment Amount (IRMAA) is essential for Medicare beneficiaries, especially as adjustments for 2025 come into play. Understanding the significance of IRMAA and its implications for healthcare costs is crucial for managing financial stability in retirement. Beneficiaries with higher incomes face additional premiums based on their modified adjusted gross income (MAGI), necessitating careful planning and awareness of the IRMAA brackets to avoid unexpected financial burdens.

Effective strategies can help mitigate or even avoid these surcharges. The following methods can be employed to manage their MAGI and stay below the IRMAA thresholds:

- Maximizing retirement contributions

- Utilizing Roth conversions

- Making charitable contributions

Consulting with financial advisors knowledgeable about Medicare can provide personalized guidance tailored to individual circumstances, enhancing overall financial health.

Moreover, understanding the appeals process is vital for those who believe their IRMAA determination is incorrect. By gathering the necessary documentation and following the appropriate steps, beneficiaries can advocate for themselves and potentially lower their Medicare costs. With approximately half of IRMAA appeals being successful, it’s important to be informed and proactive.

In conclusion, staying informed about IRMAA and its implications empowers Medicare beneficiaries to take control of their healthcare expenses. By understanding the brackets, implementing effective financial strategies, and knowing their rights in the appeals process, individuals can navigate the intricacies of Medicare with confidence, ultimately securing a more stable and manageable financial future.