Overview

This article examines the implications of the 2025 Income-Related Monthly Adjustment Amount (IRMAA) brackets and premiums for high-income earners. Notably, individuals with a Modified Adjusted Gross Income (MAGI) exceeding $106,000 (or $212,000 for married couples) will encounter increased Medicare costs. This reality underscores the critical need for proactive financial planning and strategic income management to effectively navigate these changes. Real-world examples and expert insights will illustrate the financial impact on beneficiaries, emphasizing the importance of preparation in this evolving landscape.

Introduction

Navigating the complexities of Medicare presents a significant challenge, particularly for high-income earners confronting the Income-Related Monthly Adjustment Amount (IRMAA). As Medicare’s landscape continues to evolve, it is essential to grasp how income thresholds influence premiums for effective financial planning.

With substantial adjustments anticipated for 2025, beneficiaries must recognize the implications of their Modified Adjusted Gross Income (MAGI), which may result in unexpected surcharges.

This article explores the intricacies of IRMAA, providing insights into:

- Its calculation

- The appeals process

- Strategies for alleviating financial burdens

By equipping readers with actionable intelligence, it empowers them to make informed decisions, confidently navigating the complexities of Medicare.

CareSet: Comprehensive Medicare Data Analysis for IRMAA Insights

CareSet excels in extracting and interpreting complex Medicare claims data, providing stakeholders with essential insights into the Income-Related Monthly Adjustment Amount for 2025. By examining over $1.1 trillion in annual claims data, CareSet reveals crucial patterns that clarify the financial implications of the income-related monthly adjustment amount for high-income earners.

Individuals with modified adjusted gross income (MAGI) exceeding $200,000 for single filers or $400,000 for married couples can expect to incur additional charges on their Medicare costs. This comprehensive analysis empowers clients to navigate the intricacies of Medicare expenses, ensuring they are fully aware of potential surcharges and their impact on overall healthcare costs.

CareSet’s commitment to delivering complete and accurate Medicare insights, free from flawed projections, enables clients to make informed decisions in a complex healthcare landscape. Moreover, individuals facing adjustments have the opportunity to contest based on significant life events that may have reduced their earnings.

As David Fei, CFP®, points out, “If your earnings exceeded $106,000 (MAGI) on your 2023 taxes, then you can anticipate some additional charges on top of your original full Part B premium.” It is also essential to consider that withdrawals from inherited IRAs are regarded as taxable income and must be included in the MAGI for income-related monthly adjustment amount calculations.

By utilizing real-world examples and professional insights, CareSet offers practical intelligence that enhances strategic planning and patient engagement for high-income individuals encountering adjustments.

2025 IRMAA Brackets: Key Changes for High-Income Earners

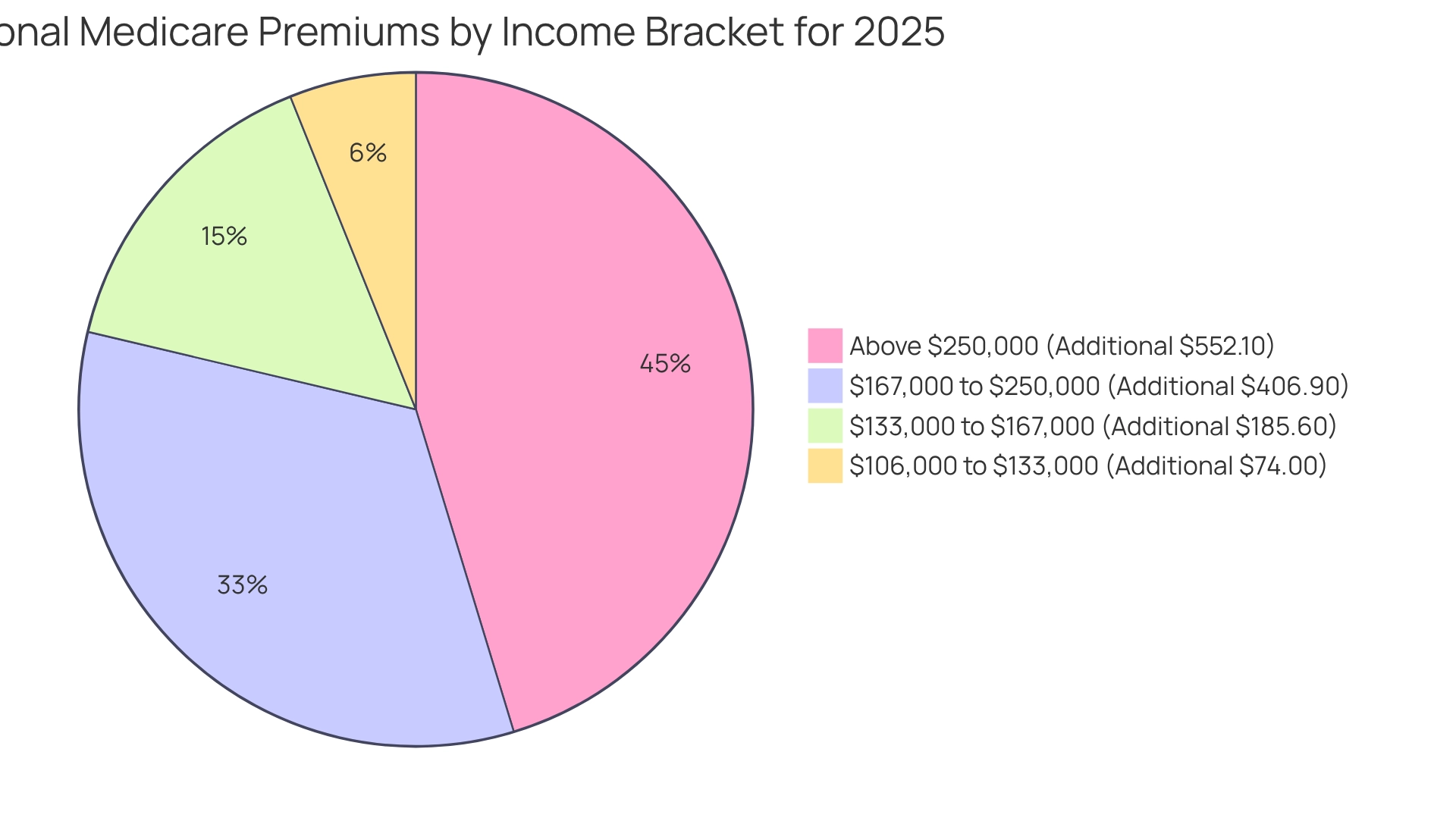

In 2025, the income-related monthly adjustment amounts have been updated to reflect revised income thresholds, which are part of the 2025 IRMAA brackets and premiums, imposing additional premiums on higher earners. Individuals with a Modified Adjusted Gross Income (MAGI) exceeding $106,000, as well as married couples filing jointly with a MAGI above $212,000, will face increased costs. If the 2023 amount is not accessible, the 2022 MAGI will be utilized to determine the additional premium. The new IRMAA brackets are as follows:

- $106,000 to $133,000: Additional $74.00

- $133,000 to $167,000: Additional $185.60

- $167,000 to $250,000: Additional $406.90

- Above $250,000: Additional $552.10

These adjustments underscore the growing financial burden on high-income earners, necessitating proactive financial planning. As David Fei, CFP®, ChFEBC℠, AIF® states, “If your income surpassed $106,000 (MAGI) on your 2023 taxes, then you can anticipate additional costs on top of your original full Part B fee.” Consider a couple whose MAGI was $212,500 in 2023, slightly exceeding the $212,000 limit for the surcharge. Consequently, they will face a surcharge in 2025 IRMAA brackets and premiums, leading to a total Medicare Part B premium of $259.00 per month, which includes a base premium of $185.00 plus a surcharge of $74.00, along with a Part D premium surcharge of $13.70. This real-life example illustrates the significance of comprehending and preparing for the financial effects of the new thresholds, as these adjustments can greatly influence overall healthcare expenses for high-income individuals and families. By recognizing these changes, stakeholders can better navigate the complexities of Medicare costs, aligning with CareSet’s commitment to providing actionable intelligence that fosters long-term strategic growth.

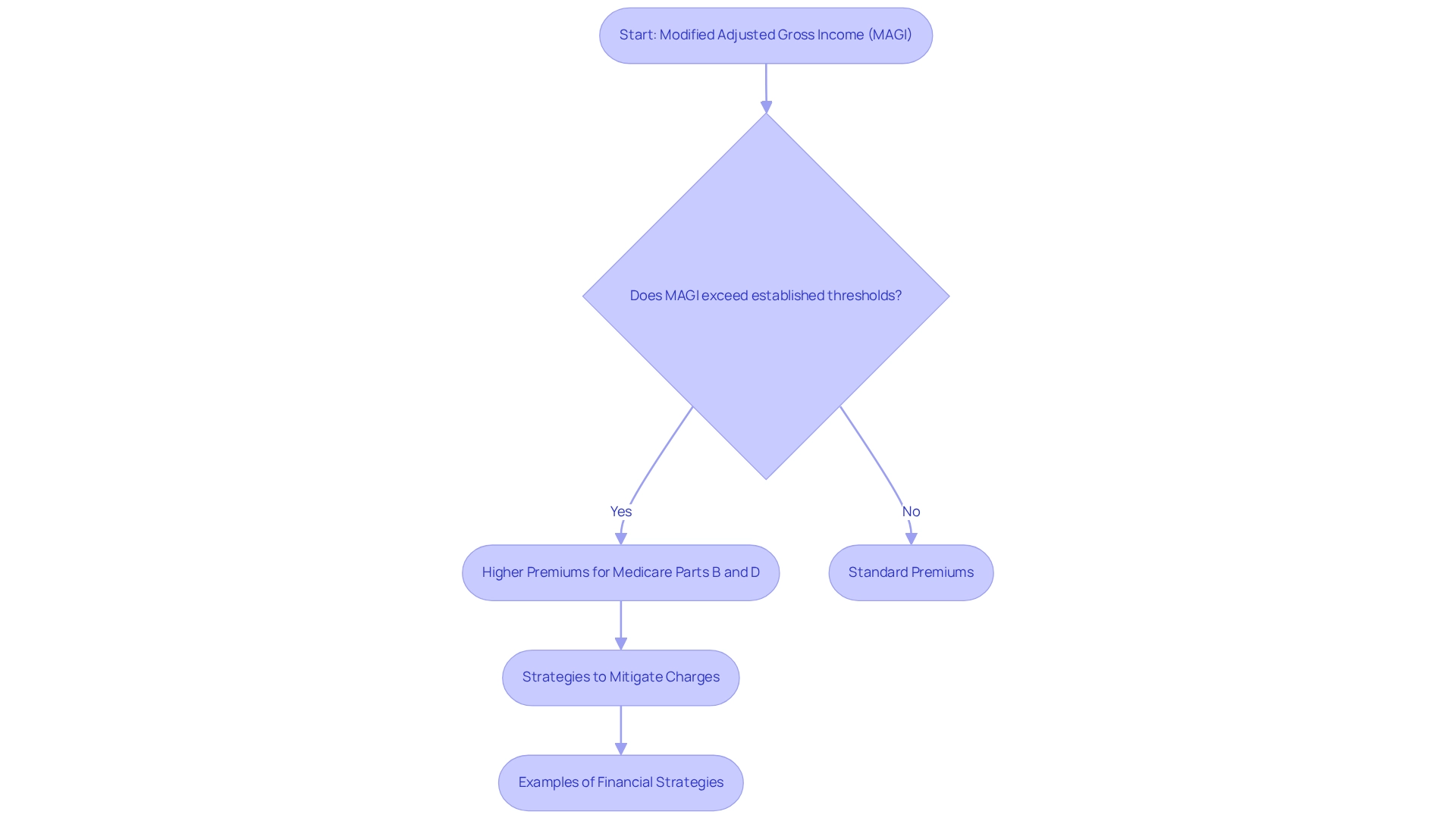

IRMAA Calculation: How Your Income Affects Medicare Premiums

The Income-Related Monthly Adjustment Amount (IRMAA) is calculated based on your Modified Adjusted Gross Income (MAGI) from two years prior. For example, your earnings from 2023 will determine the 2025 IRMAA brackets and premiums. This calculation involves summing your adjusted gross income (AGI) with any tax-exempt interest income. If your MAGI exceeds the established thresholds, you will incur higher premiums for Medicare Parts B and D.

Understanding this calculation is crucial for beneficiaries to effectively anticipate their costs and plan their finances. For 2024, individuals earning $500,001 and above will face a monthly fee of $594. This tiered system indicates that higher earners encounter significantly higher expenses, making it essential to plan for potential surcharge fees to enhance retirement financial quality. It is important to note that this fee is specifically for 2024, as the focus here is on the 2025 IRMAA brackets and premiums related to the income-related monthly adjustment amounts.

Clever financial strategies can mitigate charges and improve retirement revenue quality. Real-world examples illustrate how fluctuations in earnings can impact Medicare premiums. For instance, individuals who anticipate a decrease in income may benefit from the annual reassessment of the income-related adjustment, potentially resulting in lower fees. By comprehending the complexities of income-related monthly adjustment amounts calculations, beneficiaries can better manage their financial responsibilities and optimize their healthcare costs. As Mark Annese noted, “However, this isn’t just any old flat fee; it’s linked directly to inflation rates as well as federal budget considerations.” Understanding the tiered structure of Medicare premiums, as discussed in the case study titled “The Tiers That Bind – And Sometimes Sting,” can assist individuals in preparing for potential increases in their Medicare expenses.

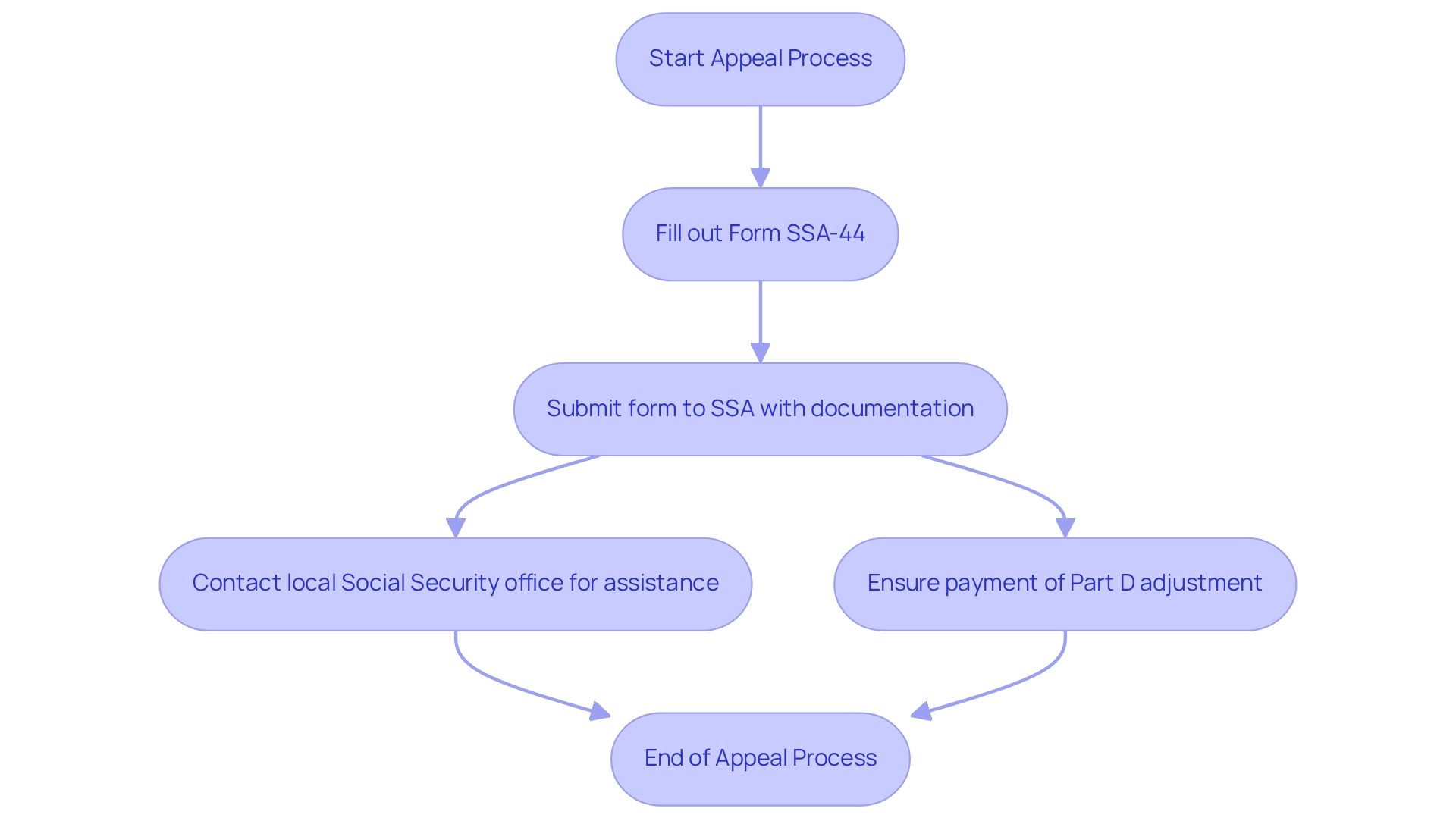

IRMAA Appeals Process: Steps to Challenge Your Premium Determination

If you believe your IRMAA determination is incorrect, you can initiate an appeal. Start by filling out Form SSA-44, which requests reconsideration due to a life-altering event or a notable reduction in earnings. This form must be submitted to the Social Security Administration (SSA) along with any supporting documentation. Common qualifying events include:

- Retirement

- Divorce

- Loss of income

To ensure your appeal is processed swiftly, it is crucial to submit within 60 days of receiving your notice.

It is important to note that beneficiaries must pay the full amount of the Part D adjustment to maintain coverage during the appeals process. Furthermore, individuals are encouraged to contact local Social Security offices for assistance in navigating the appeal procedure.

For instance, Mary K. Holmes shared her experience: “I contacted Aetna and we both stayed on the line, and Aetna contacted my doctor, and I got my new card within one day. She is amazing. Thank you!” This highlights the potential for quick resolutions when seeking assistance.

Incorporating these steps and resources can significantly improve your chances of a successful appeal.

Income Management Strategies: Avoiding IRMAA Surcharges

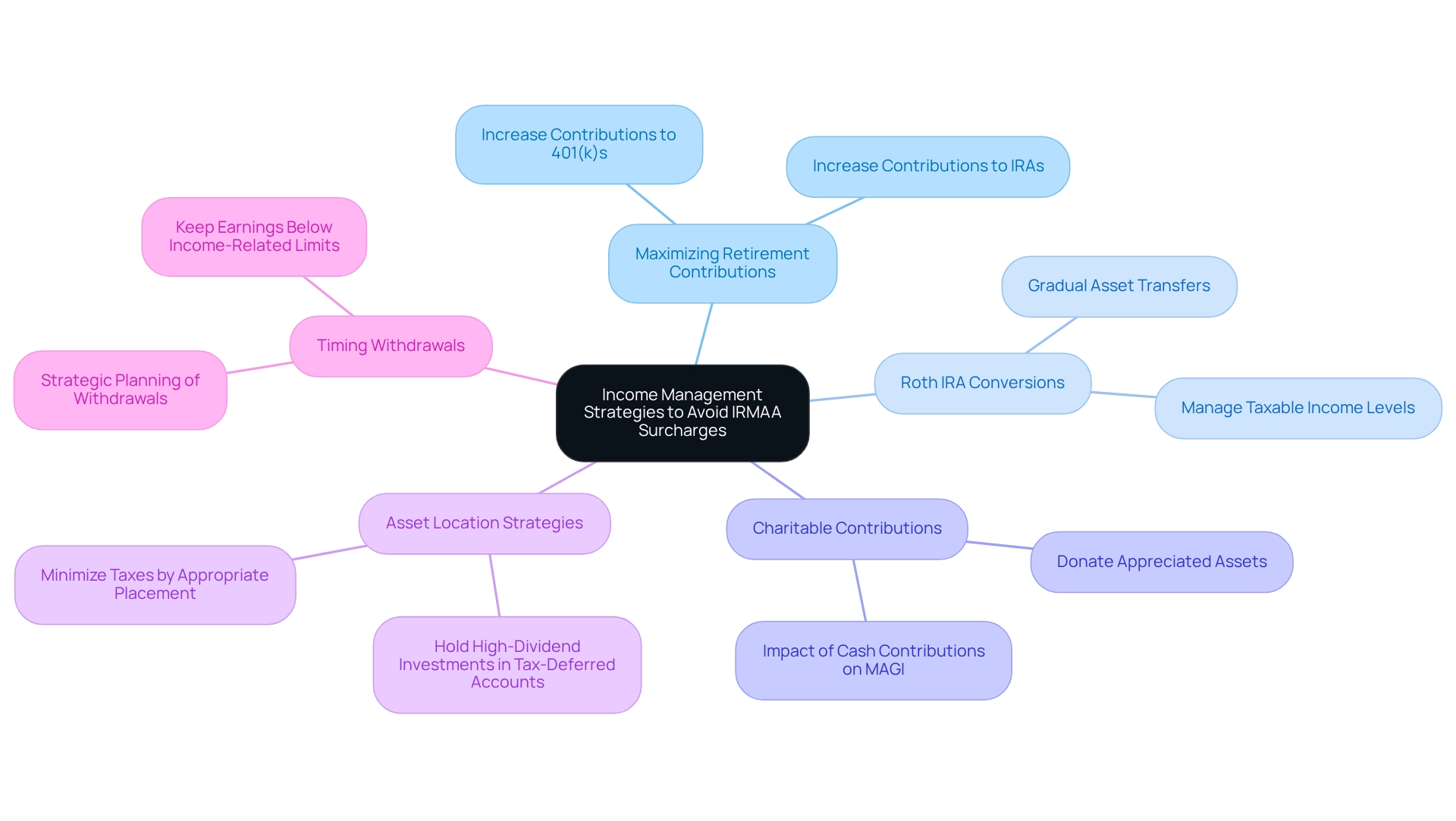

To effectively avoid IRMAA surcharges, consider implementing the following income management strategies:

- Maximizing Retirement Contributions: Increasing contributions to tax-deferred accounts such as 401(k)s or IRAs can significantly lower your taxable income, thereby reducing your Modified Adjusted Gross Income (MAGI).

- Roth IRA Conversions: Gradually transferring assets from traditional IRAs to Roth IRAs facilitates improved management of taxable income levels over time, assisting in remaining below certain thresholds.

- Charitable Contributions: Donating appreciated assets not only aids charitable causes but also decreases your MAGI, which may result in reduced premiums. However, it’s important to note that cash contributions can lower your current-year tax liability but will impact your MAGI for Medicare premium adjustments.

- Asset Location Strategies: Placing different types of investments in appropriate accounts can minimize taxes. For instance, holding high-dividend investments in tax-deferred accounts can help avoid increasing your tax bill.

- Timing Withdrawals: Strategically planning the timing of withdrawals from taxable accounts can help keep your earnings below the income-related adjustment limits, ensuring you avoid unnecessary surcharges.

These approaches, when implemented carefully, can offer significant advantages in managing your finances and mitigating the effect of adjustments on your Medicare costs. As one financial consultant remarked, ‘Effective income management is essential for high-income earners to maneuver through the intricacies of Medicare costs.’ Furthermore, case studies have demonstrated that individuals who apply these strategies often observe considerable decreases in their surcharges.

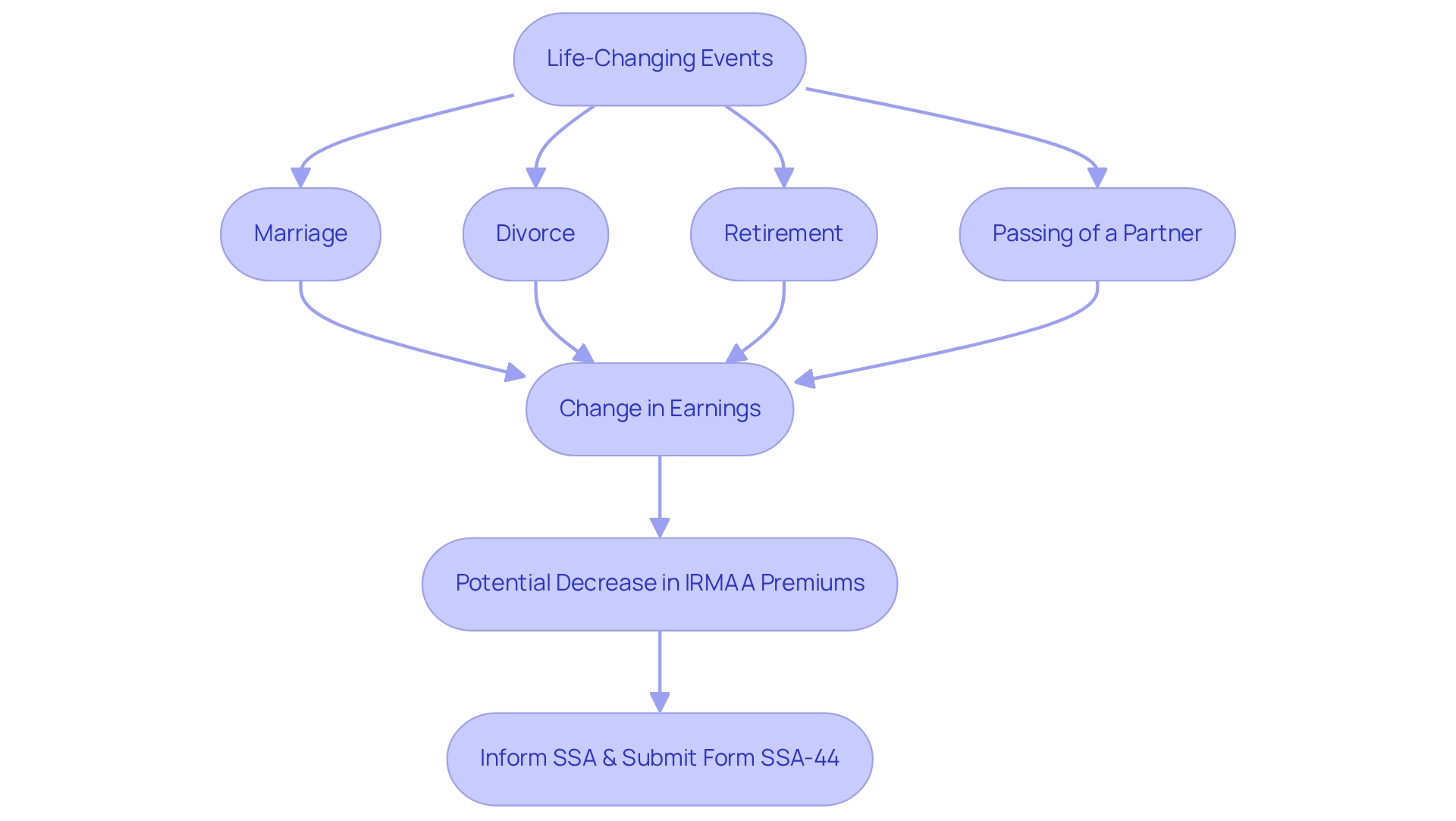

Life-Changing Events: Their Impact on IRMAA Premiums

Transformative occurrences can significantly influence the 2025 irmaa brackets and premiums. Major events such as marriage, divorce, retirement, or the passing of a partner often lead to changes in earnings, which may make you eligible for a decrease in your income-related monthly adjustment amount under the 2025 irmaa brackets and premiums. For instance, in 2023, the income-related monthly adjustment amount threshold was set at $97,000 for individuals and $194,000 for married couples filing jointly. If your income falls below these thresholds due to a life event, it is crucial to inform the Social Security Administration (SSA) and submit Form SSA-44 to request an adjustment based on your new economic situation.

A user shared their experience with the SSA-44 form, noting that their tier 2 income-related monthly adjustment amount was reduced to tier 1 based on 2024 MAGI. This highlights how beneficiaries can successfully navigate income-related adjustments. Such proactive measures can greatly alleviate the financial burden associated with increased costs. Real-life instances demonstrate that recipients who effectively manage these changes often see their costs adjusted positively, underscoring the importance of timely communication with the SSA about the 2025 irmaa brackets and premiums. Monetary specialists emphasize that understanding how marriage or retirement impacts income-related Medicare adjustments is vital for effective planning, as these events can result in significant savings on Medicare expenses. As David aptly noted, ‘Your premium does not cover the giveback,’ which underscores the economic implications of these charges. Given the complexities of Medicare and the additional income adjustment, possessing the right information and strategies is essential for adeptly managing these financial challenges.

CareSet’s commitment to data leadership ensures that clients receive comprehensive insights crucial for navigating the intricacies of the healthcare landscape. By leveraging these insights, individuals can make informed decisions that enhance their financial well-being.

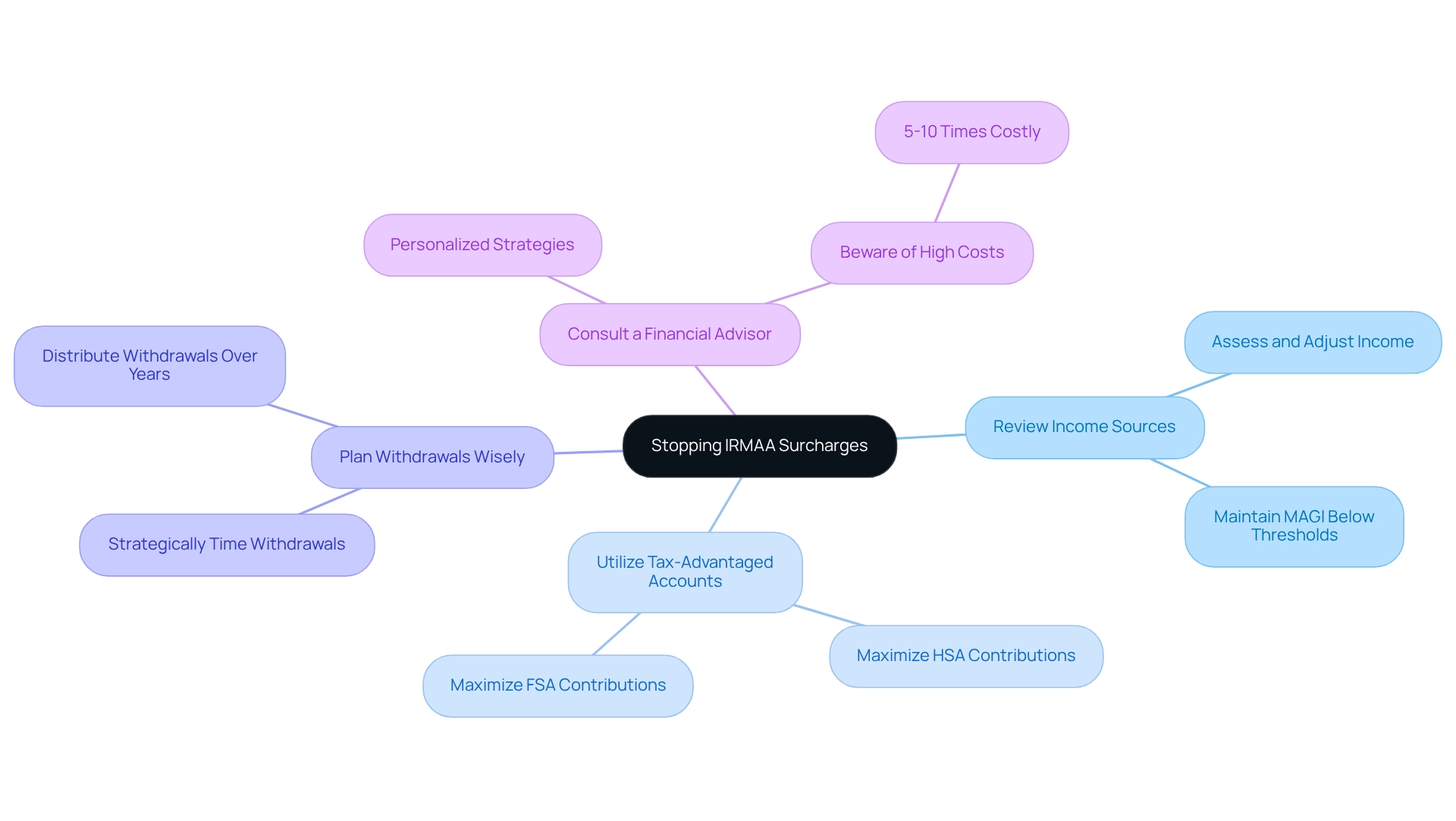

Stopping IRMAA Surcharges: Effective Strategies for Beneficiaries

To effectively stop or reduce the 2025 IRMAA brackets and premiums surcharges, beneficiaries can implement several key strategies.

-

Review Income Sources: Regularly assess and adjust your income sources to maintain your Modified Adjusted Gross Income (MAGI) below the IRMAA thresholds. This proactive approach can help avoid unexpected surcharges.

-

Utilize Tax-Advantaged Accounts: Maximize contributions to Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs). These accounts can significantly decrease your taxable earnings, thereby reducing your MAGI.

-

Plan Withdrawals Wisely: Strategically timing withdrawals from retirement accounts can help manage earnings levels effectively. For example, distributing withdrawals across several years may maintain your earnings below the IRMAA thresholds.

-

Consult a Financial Advisor: Engaging with a consultant can provide personalized strategies tailored to your specific monetary situation. Advisors can assist in navigating complex revenue sources and recommend modifications that align with your financial objectives. However, be mindful that paying an advisor a percentage of assets can cost 5-10 times too much if not managed properly.

Real-world examples illustrate the effectiveness of these strategies. Beneficiaries who underwent significant life changes, such as job loss or decreased earnings, successfully submitted Form SSA-44 to request a review of their surcharge determination, resulting in a reduction or removal of fees. This emphasizes the significance of comprehending and controlling revenue sources to efficiently alleviate the effects of the 2025 IRMAA brackets and premiums. As Harry Sit remarked, “I am still attempting to convert my traditional IRA’s to a Roth as much as I can without incurring a higher Medicare cost,” highlighting the importance of strategic income management.

Furthermore, with possible rises in Medicare Part B costs by up to $443.90 and Part D charges by up to $85.00 in the context of 2025 IRMAA brackets and premiums, it is essential for beneficiaries to respond quickly to prevent these fees.

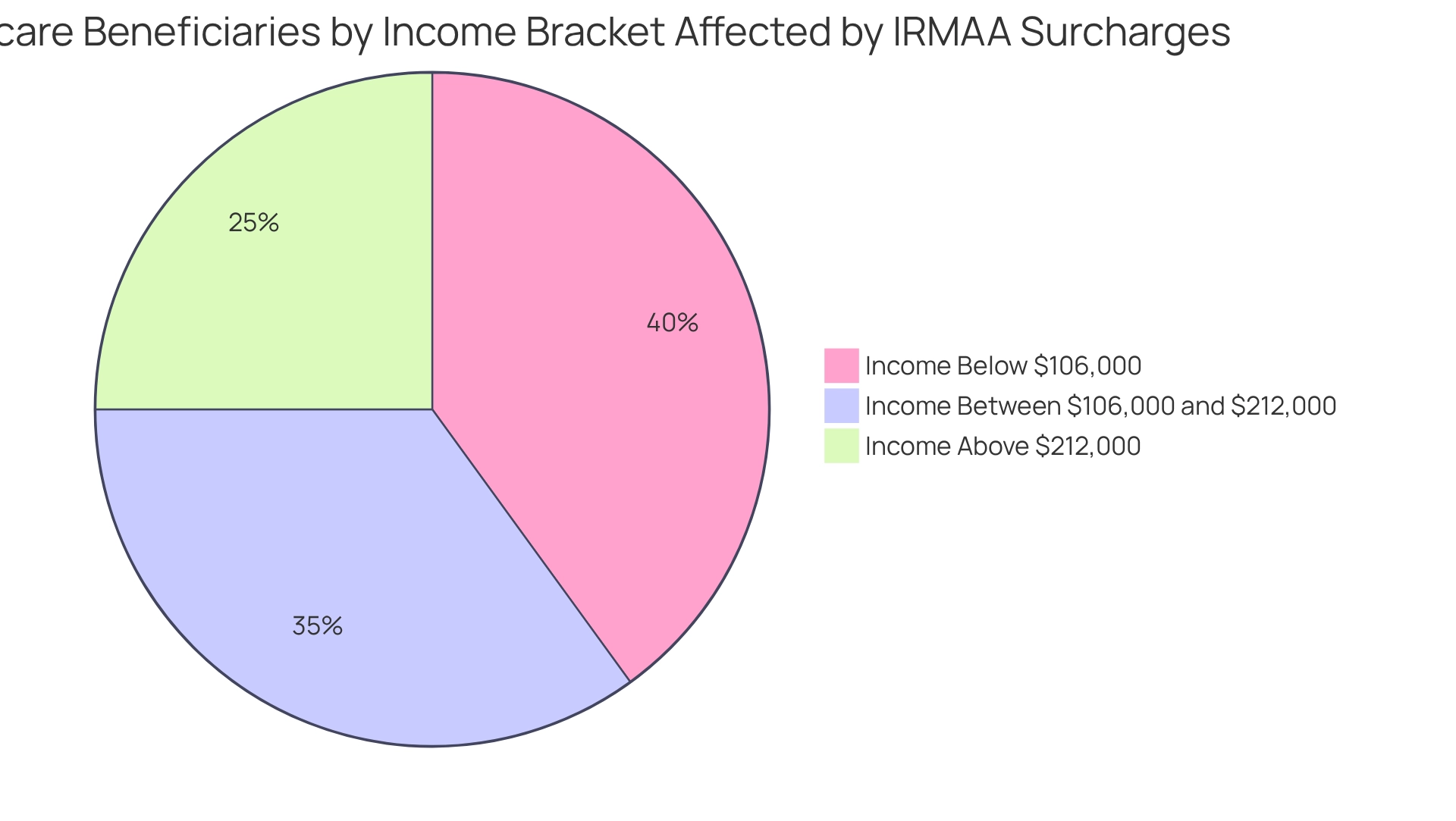

IRMAA Eligibility: Who Is Affected by the Surcharges?

IRMAA surcharges are imposed on Medicare beneficiaries whose Modified Adjusted Gross Income (MAGI) exceeds specific thresholds. For 2025, individuals with a MAGI over $106,000 and married couples filing jointly with a MAGI exceeding $212,000 will be subject to the 2025 IRMAA brackets and premiums. This adjustment can significantly impact healthcare budgets, making it essential for beneficiaries to assess their earnings levels annually. High-earning individuals often find themselves unexpectedly impacted by these surcharges, particularly if their earnings fluctuate or if they experience changes in their financial circumstances.

Real-life examples illustrate the challenges faced by high-income earners. For instance, a couple whose earnings rose due to a one-time bonus may unexpectedly discover they are liable for additional Medicare costs. Statistics reveal that a significant portion of Medicare recipients fall into these income categories, emphasizing the extensive effect of surcharges. It is also important to note that a zero-premium Medicare Advantage plan has no monthly premium for coverage, which can be a consideration for beneficiaries when planning their healthcare expenses.

Comprehending income-related monthly adjustment amount eligibility is essential for effective financial planning. Beneficiaries should be aware that the surcharges are based on income reported from tax returns filed two years prior, meaning that any discrepancies or outdated information can lead to unexpected costs. Experts indicate that adjustments in income-related monthly adjustment amount determination can occur if IRS data includes mistakes or if obsolete tax returns were utilized. The Social Security Administration informs beneficiaries of their income-related monthly adjustment amount status, and there is an appeals process for those whose financial situations have changed.

Experts highlight the significance of proactive planning to mitigate the impacts of the income-related monthly adjustment amount. As Donna LeValley, a retirement writer, suggests, ‘To prevent this risk, ensure you appropriately time a Roth conversion; you can then evade the income-related adjustments when you convert and take distributions.’ By staying informed about the 2025 IRMAA brackets and premiums, beneficiaries can better manage their healthcare costs and avoid unexpected charges. As the landscape of Medicare evolves, understanding these nuances will be vital for high-income earners navigating their healthcare options.

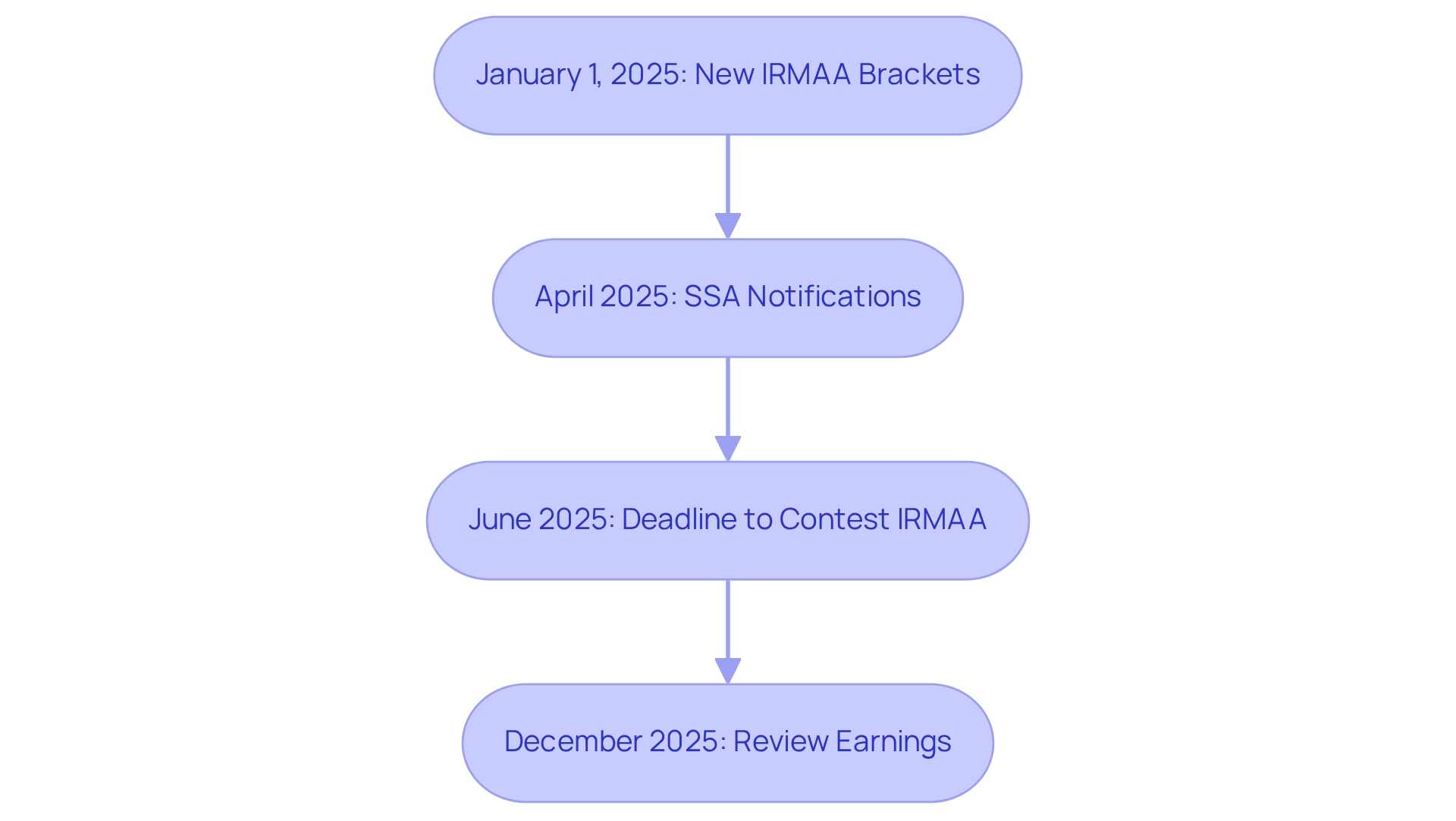

2025 IRMAA Timeline: Key Dates and Changes to Watch

Key dates to monitor in 2025 regarding the income-related monthly adjustment amount are crucial for beneficiaries to understand:

- January 1, 2025: The new 2025 irmaa brackets and premiums will come into effect, directly impacting premiums for high-income earners.

- April 2025: Beneficiaries will receive notifications from the Social Security Administration (SSA) detailing their income-related monthly adjustment amount status, which is calculated based on their 2023 income.

- June 2025: This date marks the deadline for submitting Form SSA-44 for individuals wishing to contest their income-related monthly adjustment amount determination due to significant life changes, such as job loss or considerable medical expenses. It is vital to recognize that multiple stages of the appeal process are available should an appeal be denied.

- December 2025: Beneficiaries should review their earnings and prepare for any necessary adjustments in the upcoming year to avoid unexpected surcharges.

To illustrate, consider the case of Bill and Barbara, a married couple whose Modified Adjusted Gross Income (MAGI) was $212,500 in 2023. This income marginally exceeded the $212,000 threshold, resulting in a surcharge according to the 2025 irmaa brackets and premiums. Consequently, their total Medicare Part B fee will amount to $259.00 each month, which includes a base charge of $185.00 alongside a surcharge of $74.00. Furthermore, their Medicare Part D premium will incur a surcharge of $13.70 per month. This example underscores the importance of comprehending surcharges, as they can significantly impact retirement planning. Notably, IRMAA surcharges are recalculated annually based on income from two years prior, highlighting the necessity for beneficiaries to remain vigilant about their financial situations and the implications of these changes. Understanding these key dates and the ramifications of surcharges is essential for effective retirement planning, ensuring beneficiaries are prepared for any financial adjustments.

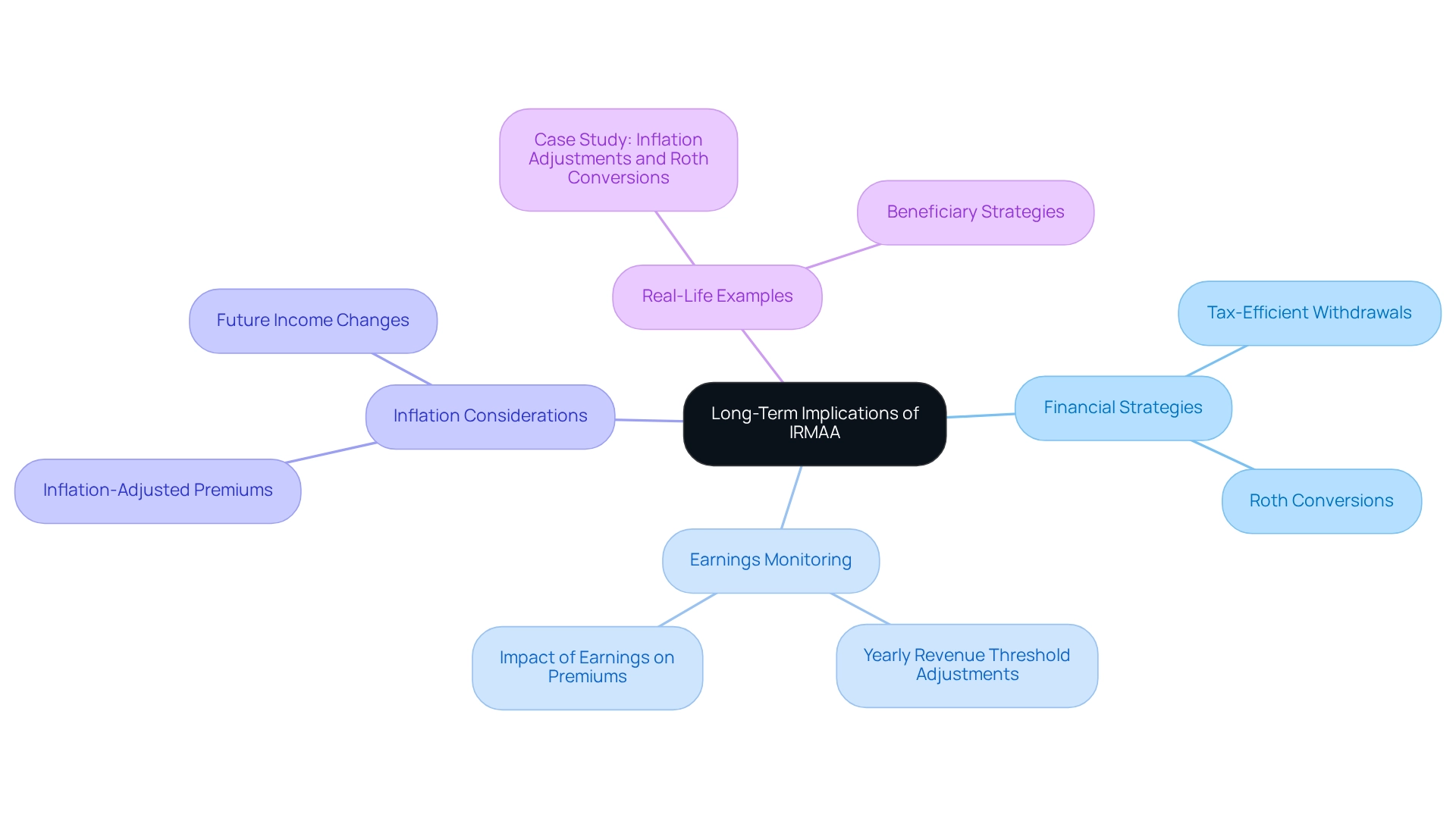

Long-Term Implications of IRMAA: Planning for Future Medicare Costs

The long-term implications of the Income-Related Monthly Adjustment Amount (IRMAA) can profoundly influence beneficiaries’ financial planning. With yearly adjustments to revenue thresholds, high-earning individuals must closely monitor their earnings to avoid unexpected surcharges. Effective planning for future Medicare expenses requires the implementation of strategies such as tax-efficient withdrawal methods and regular evaluations of earnings.

For instance, amounts related to the additional Medicare premium are adjusted for inflation and take into account earnings from two years earlier, significantly affecting future premiums. This necessitates that individuals factor in potential income changes due to inflation when making decisions about Roth conversions or other income-generating strategies. By proactively anticipating changes in the income-related monthly adjustment amount and adapting financial plans accordingly, beneficiaries can effectively mitigate the impact of rising healthcare costs, ensuring sustainable financial health throughout retirement.

As highlighted by a specialist, “Many individuals are oblivious to the effects it can exert on their monthly cash flow,” underscoring the importance of comprehending its consequences. Retirement advisors frequently recommend that clients maintain flexibility in their financial strategies to adapt to possible changes in the 2025 IRMAA brackets and premiums. Real-life instances demonstrate how beneficiaries have successfully managed these challenges by modifying their monetary strategies, ultimately safeguarding their retirement savings amid rising Medicare expenses. For example, the case study titled “Inflation Adjustments and Roth Conversions” emphasizes how individuals must consider potential future revenue changes resulting from inflation when strategizing their Roth conversions to prevent unforeseen premium hikes.

In conclusion, a strategic emphasis on overseeing future Medicare expenses, especially those related to the 2025 IRMAA brackets and premiums, is crucial for high-income earners seeking to ensure their economic stability in retirement. To enhance financial planning, beneficiaries should regularly review their income strategies and consider consulting with a financial adviser to tailor their approach to potential IRMAA changes.

Conclusion

Navigating the complexities of the Income-Related Monthly Adjustment Amount (IRMAA) is essential for high-income Medicare beneficiaries, particularly in light of the anticipated changes for 2025. Understanding how Modified Adjusted Gross Income (MAGI) impacts premiums enables individuals to prepare effectively for potential surcharges. The revised IRMAA brackets illustrate the increasing financial burden that high earners may encounter, highlighting the necessity of proactive financial planning to alleviate these costs.

Beneficiaries are urged to explore various strategies to manage their income levels efficiently. This includes:

- Maximizing retirement contributions

- Utilizing tax-advantaged accounts

- Strategically planning withdrawals

Furthermore, being aware of the appeals process for IRMAA determinations can offer relief for those facing life-changing events that alter their income. By staying informed and employing sound financial strategies, high-income earners can adeptly navigate the intricacies of Medicare and minimize the influence of IRMAA on their overall healthcare expenses.

Ultimately, understanding and planning for IRMAA transcends the mere avoidance of additional premiums; it is a critical aspect of ensuring financial stability in retirement. As Medicare continues to evolve, beneficiaries must remain vigilant in monitoring their income levels and adapting their strategies accordingly. By doing so, they can secure a more manageable and sustainable healthcare future, free from unexpected financial strains.