Overview

Health care payers, encompassing government organizations, commercial entities, and self-insured employers, are pivotal in funding and shaping the medical services landscape. Their influence extends to accessibility, coverage options, and reimbursement rates, making their decisions critical to the financial sustainability of providers and the quality of patient care. Data-driven insights underscore this significance, guiding stakeholders in enhancing service delivery and navigating the complexities inherent in health service provision. The ramifications of these decisions are profound, as they directly affect both the operational capabilities of providers and the experiences of patients seeking care.

Introduction

In the intricate world of healthcare, payers serve as the financial backbone, influencing every aspect of service delivery and patient access. Comprised of government entities, private insurers, and self-insured employers, these organizations shape the landscape of healthcare by determining coverage options and reimbursement rates.

As the dynamics shift, with government payers projected to finance nearly half of all healthcare services by 2025, the interplay between payers and providers becomes increasingly critical.

This article delves into the multifaceted roles of healthcare payers, exploring their impact on provider relationships, the complexities of risk adjustment, and the implications of market consolidation. By understanding these elements, stakeholders can better navigate the evolving healthcare system and enhance patient outcomes.

Define Healthcare Payers and Their Role in the System

Health care payers are organizations responsible for funding or reimbursing health services, and they are categorized into three primary groups:

- Government/public organizations, such as Medicare and Medicaid

- Commercial entities, including private insurance companies

- Self-insured employers

By 2025, health care payers are projected to include government payers funding approximately 50% of medical services, while commercial payers will cover about 35%, leaving the remaining 15% to self-insured employers.

Health care payers play a pivotal role in shaping medical accessibility, influencing coverage options, reimbursement rates, and the overall financial landscape for providers. Their policies and decisions significantly affect the financial sustainability of providers and health care payers, as well as the quality of service that patients receive. For instance, CareSet’s extensive Medicare data insights, which encompass information from over 62 million beneficiaries and 6 million providers, empower stakeholders in the medical field to make informed decisions that enhance service quality and business success. This data-driven approach is particularly advantageous for pharmaceutical and biotech companies looking to refine their market access strategies.

The role of health care payers extends beyond mere financial transactions; they are integral to the medical ecosystem. Their influence is evident in case studies, such as one involving an oncology treatment manufacturer, which illustrates how health care payers’ reimbursement policies affect individual access to therapies and the overall effectiveness of service delivery. Recent studies indicate that among older individuals, medical expenses for males were 2% higher than for females, suggesting that funders may need to consider gender-specific strategies to improve individual treatment and resource allocation.

Expert insights underscore that effective engagement with health care payers and other stakeholders is crucial for pharmaceutical companies aiming to enhance both market access and healthcare outcomes. Chris Schmaltz, Chief Value-Based Care Officer, emphasizes, “Managing value-based care operations and insurer contracting is crucial for fostering significant change in care management for individuals, providers, and medical systems.” As the healthcare landscape evolves, understanding the dynamics of health care payers will be essential for stakeholders aiming to navigate the complexities of health service provision and enhance patient outcomes. Furthermore, employing systems thinking can facilitate the standardization of clinical information for healthcare teams, thereby enhancing the effectiveness of reimbursement strategies.

Explore the Relationship Between Payers and Providers

The connection between funders and providers is intricate and multifaceted, characterized by negotiation and collaboration. Health care payers negotiate reimbursement rates with providers, which significantly influences the range of services offered and the quality of care delivered. Providers depend on insurers for timely payments, while insurers rely on providers to deliver efficient services within established financial constraints. This interdependence fosters collaboration, particularly through value-driven initiatives, where health care payers and providers align their efforts to enhance health outcomes. Nevertheless, conflicts may arise, particularly regarding reimbursement disputes and the administrative challenges that accompany these negotiations.

Statistics from 2025 reveal that the outcomes of payer-provider negotiations are increasingly shaped by the integration of over 100 external data sources, as exemplified by companies like CareSet. CareSet’s monthly Medicare updates yield innovative insights into drug utilization and treatment pathways, thereby enhancing provider engagement and empowering pharmaceutical strategies. This complexity underscores the critical role of data-driven insights in influencing these negotiations. Furthermore, without proactive policy measures, the crisis of government underpayment threatens patient access to care, highlighting the inherent challenges within provider relationships.

Recent proposed changes in funding relationships aim to foster innovation and improve patient access to at-home dialysis, reflecting the evolving nature of these interactions. Understanding this dynamic is essential for pharmaceutical firms seeking to align their strategies with payer expectations and navigate the complexities of the medical landscape effectively. By integrating expert insights and case studies on payer-provider relationships, including those from CareSet, stakeholders can deepen their understanding of how these negotiations impact medical services.

Understand Risk Adjustment and Its Implications for Payers

Risk adjustment stands as a pivotal statistical procedure that modifies payments to medical providers based on the health status and risk profiles of their patients. This mechanism ensures that providers receive equitable remuneration for the complexity of services they deliver, a factor that gains significance as the medical field shifts towards value-based service models. Effective risk adjustment is essential for payers to maintain financial stability, as it aids in forecasting medical expenses and efficiently allocating resources.

CareSet’s comprehensive Medicare data insights, drawn from over 62 million beneficiaries and 6 million providers, empower stakeholders in the medical field to enhance service quality and business success. By scrutinizing treatment pathways through Medicare claims data, including the application of ICD, NDC, and HCPCS codes, stakeholders can attain a deeper understanding of provider interventions and treatment approvals.

Patients typically navigate from diagnosis to treatment through a series of steps involving various healthcare environments, such as hospitals, outpatient clinics, and specialty facilities. Grasping these pathways is vital for stakeholders to pinpoint where interventions can be most effective. For example, a patient diagnosed with a chronic condition may first receive care in a primary care setting before being referred to a specialist for advanced treatment options.

The Centers for Medicare & Medicaid Services (CMS) is currently evaluating the impact of the COVID-19 pandemic on risk score normalization. This analysis holds critical importance for those financing, as it may lead to alterations in risk scores that directly affect financial stability and resource allocation. The introduction of new Social Determinants of Health (SDOH) Z codes for 2025, ranging from Z59.10 to Z59.819, addresses various aspects of inadequate housing. These codes will influence risk profiles and payment adjustments, adding complexity to the risk adjustment landscape.

The transition to CMS-HCC Version 28 is poised to reshape the operational framework for insurers. This updated model aspires to provide more accurate weights and risk scores based on recent data, which CMS anticipates will result in a decline in Medicare Advantage (MA) risk scores. Such transformations will have significant implications for MA organizations as they adapt to the integration of two models and the challenges that accompany it. The case study titled “CMS’s Approach to Risk Adjustment Changes” illustrates how these adjustments can impact beneficiary risk scores, underscoring the necessity for MA organizations to navigate these changes adeptly.

Current statistics reveal that risk adjustment models are becoming increasingly sophisticated, with an emphasis on enhancing the accuracy of risk scores. Expert opinions underscore the importance of these models for stakeholders, asserting that they are vital for managing financial risk and ensuring equitable access to care. Case studies highlight how effective risk adjustment can lead to improved provider compensation, ultimately fostering a more sustainable medical system.

As the medical landscape continues to evolve, it is imperative for payers to stay informed about the latest advancements in risk adjustment models. The 2025 Rate Announcement, which encompasses updates to Medicare Part D benefit parameters, reflects ongoing efforts to refine risk adjustment processes and bolster the financial viability of medical organizations. The finalized Part D risk adjustment model update from CMS emphasizes changes to plan liability for low-income individuals, further highlighting the critical role of accurate risk adjustment in ensuring equitable access to medical services.

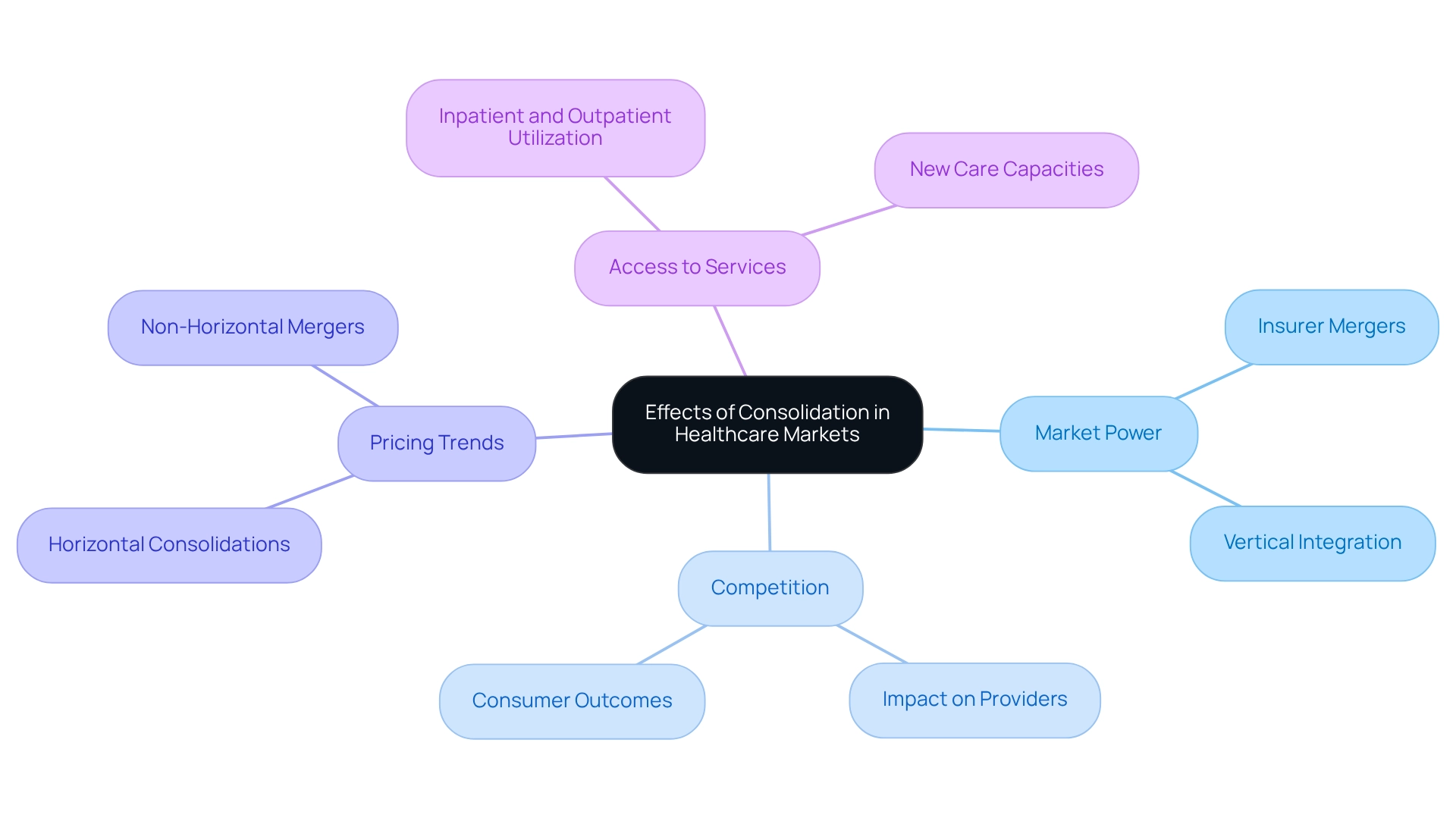

Analyze the Effects of Consolidation in Healthcare Markets

Consolidation in healthcare markets, particularly among providers, carries profound implications for the industry. As insurers merge, they often enhance their market power, which can lead to lower prices for consumers. However, this increased power may simultaneously reduce competition, resulting in higher costs for providers. Such dynamics significantly influence reimbursement rates and the availability of services, ultimately impacting access to treatment.

The trend of vertical integration, where insurers acquire providers, further complicates these relationships. This integration blurs the distinctions between health care payers and providers, which raises critical questions about the quality of service and patient choice. Studies have shown that both horizontal consolidations—mergers within the same market—and non-horizontal mergers—across different service categories—tend to increase prices for hospitals, physician groups, and insurance premiums, as highlighted in the case study titled “Economic Implications of Healthcare Mergers” presented by Leemore Dafny.

As we approach 2025, the effects of these consolidations are becoming increasingly evident. Statistics indicate that the number of hospitals has slightly increased from 6,021 in 1998 to 6,129 in 2021. This rise reflects ongoing transformations in the medical field, especially considering the increase in inpatient and outpatient usage propelled by postponed treatment during the pandemic. Recently developed capabilities in outpatient, professional, and ambulatory environments have been established to meet this demand, further illustrating the shifting dynamics.

Comprehending these trends is essential for pharmaceutical firms and other interested parties striving to navigate the changing medical environment effectively. CareSet’s extensive medical data insights can empower these stakeholders by offering essential information on the impacts of insurer mergers on competition, pricing strategies, and the overall quality of care delivered to patients. Insights from industry analysts highlight that the impact of health care payers’ mergers can lead to significant changes in market dynamics. As Natasha Murphy, Director of Health Policy, emphasizes, the Health Policy team advances health coverage, access, affordability, and quality in healthcare payment and delivery, underscoring the importance of these issues in the context of consolidation.

Conclusion

Healthcare payers play a pivotal role in shaping the healthcare landscape, influencing access, quality, and the financial stability of both providers and patients. With government payers projected to finance nearly half of all healthcare services by 2025, it is essential for stakeholders to understand the distinctions among payer types—government, commercial, and self-insured—to effectively navigate the complexities of coverage and reimbursement.

The relationship between payers and providers is characterized by negotiation and collaboration, where success hinges on effective communication. Value-based care initiatives underscore the necessity of aligning incentives to enhance patient outcomes. However, ongoing challenges, such as reimbursement disputes, must be managed diligently to foster productive partnerships.

Risk adjustment is vital for ensuring fair compensation that reflects patient complexity, particularly as the industry transitions toward value-based models. Staying informed about evolving risk adjustment methodologies is crucial for payers to maintain financial stability and ensure equitable access to care.

Moreover, consolidation within healthcare markets presents both opportunities and challenges. While it may enhance market power and reduce costs for consumers, it can also diminish competition and lead to increased prices for providers. Understanding these dynamics is essential for stakeholders, including pharmaceutical companies, as they navigate the evolving landscape.

In conclusion, the interplay between healthcare payers, providers, and market forces highlights the need for informed strategies and collaboration. By recognizing these complexities, stakeholders can make data-driven decisions that ultimately enhance the quality and accessibility of care for all.