Overview

The article emphasizes the importance of mastering the medical billing revenue cycle to achieve optimal results in healthcare financial management. It asserts that understanding and effectively managing key components of Revenue Cycle Management (RCM)—including charge capture, denial management, and payment posting—is crucial for enhancing operational efficiency and financial performance. This necessity is underscored by the ongoing trends towards automation and data analytics, which serve to improve processes and reduce claim denials. By focusing on these elements, healthcare organizations can position themselves for greater financial success.

Introduction

In the intricate realm of healthcare, the financial processes that underpin patient care are frequently overlooked, yet they are pivotal to an organization’s success. Revenue Cycle Management (RCM) stands as the backbone of this financial framework, steering healthcare providers through the complex journey from patient registration to payment collection. As the healthcare landscape undergoes transformation, grasping the nuances of RCM becomes increasingly essential—not solely for financial viability but also for operational efficiency.

This article examines the fundamental components of RCM, delineates the critical steps for effective management, and addresses the common challenges organizations encounter. Moreover, it investigates how harnessing data analytics can refine these processes, ultimately enhancing financial performance and patient satisfaction in a rapidly evolving environment.

Understand Revenue Cycle Management in Medical Billing

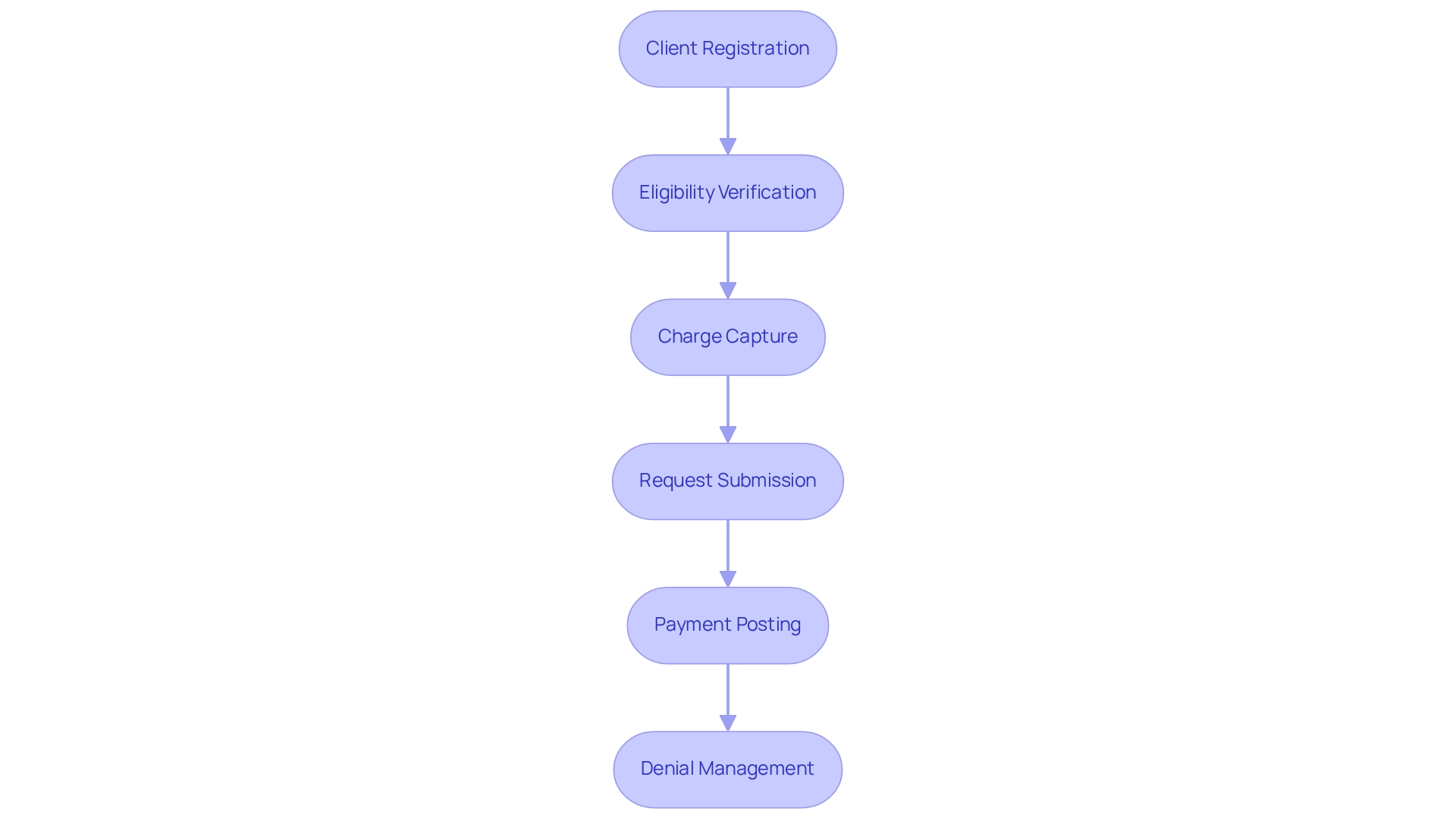

Revenue Cycle Management (RCM) encompasses the financial processes that healthcare organizations utilize to track care episodes, spanning from registration and appointment scheduling to the final payment of balances. A comprehensive understanding of the medical billing revenue cycle is vital for healthcare professionals, as it directly influences both financial performance and operational efficiency. The key components of RCM include:

- Client Registration: Collecting essential client information and insurance details to initiate the billing process.

- Eligibility Verification: Confirming the individual’s insurance coverage and benefits to prevent denial of requests.

- Charge Capture: Accurately documenting services rendered to ensure precise billing and reimbursement.

- Request Submission: Sending requests to insurance firms for reimbursement, a critical step in the financial cycle.

- Payment Posting: Recording payments received from both insurers and patients to maintain accurate financial records.

- Denial Management: A crucial aspect of the medical billing revenue cycle, focusing on proactively addressing and resolving denied claims to recover lost revenue and enhance cash flow.

Mastering these components is essential for healthcare organizations to sustain financial viability.

Recent trends indicate a growing adoption of automation tools aimed at streamlining these processes, significantly enhancing employee satisfaction by alleviating repetitive tasks that contribute to burnout among RCM staff. For example, automation can reduce the manual entry of data, allowing staff to concentrate on more strategic tasks. Furthermore, understanding the medical billing revenue cycle is imperative, particularly given that approximately 49.1% of total care physicians operated in physician offices in 2020, underscoring the necessity for effective billing practices in these settings. Additionally, the stability of RCM services is exemplified by R1 RCM, Inc.’s extended partnership with American Physician Partners until 2031, indicating an increasing reliance on effective RCM solutions. As the healthcare landscape evolves, remaining informed about the dynamics of the medical billing revenue cycle, including insights from the case study titled ‘Future Opportunities in Healthcare Revenue Cycle Management,’ will empower organizations to capitalize on emerging opportunities and optimize their financial performance.

Follow the Key Steps of the Revenue Cycle

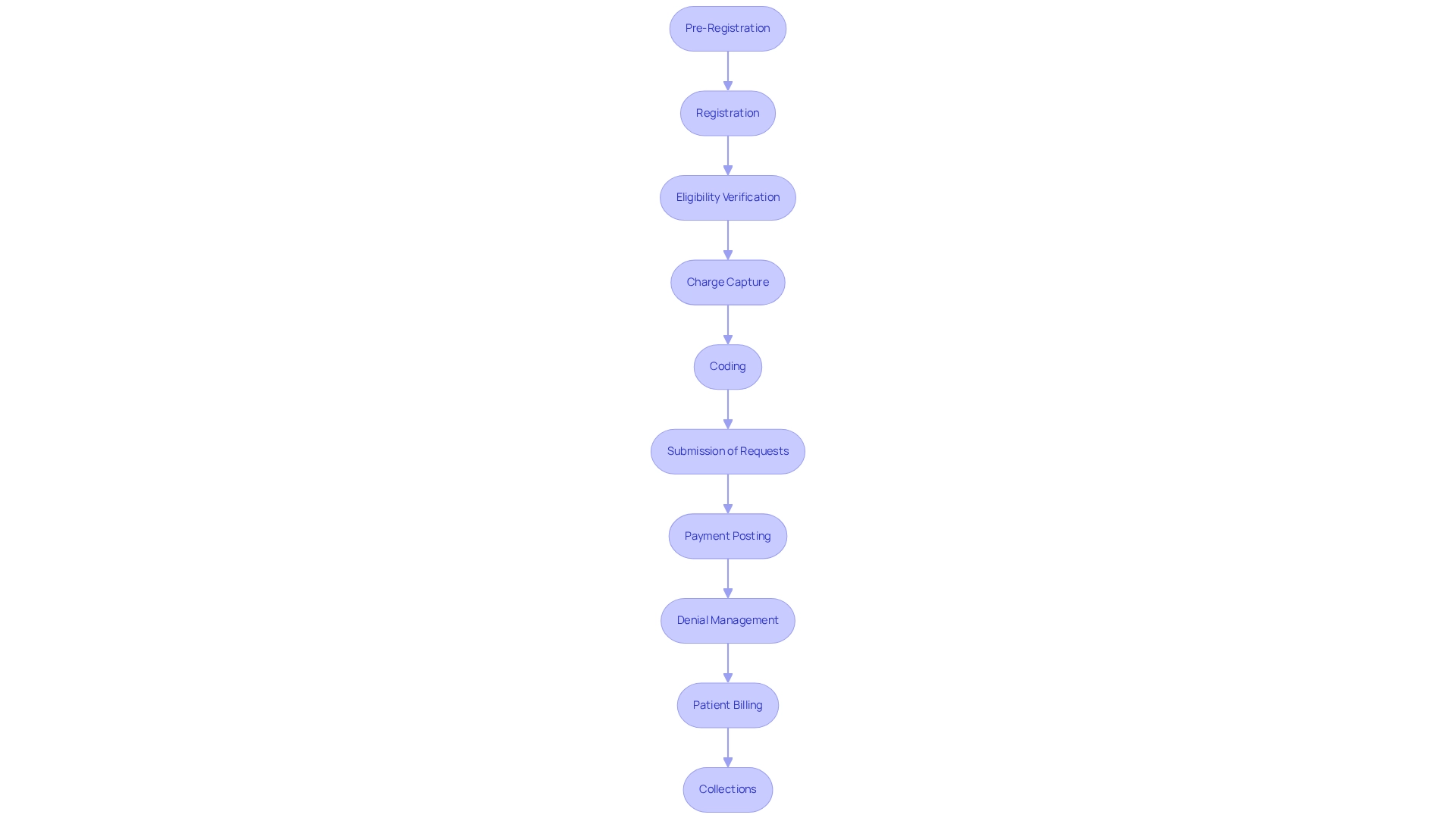

To effectively manage the revenue cycle, healthcare organizations must implement several critical steps:

-

Pre-Registration: Gathering individual information prior to appointments is essential for optimizing workflow and enhancing visitor flow. Statistics indicate that efficient pre-registration can significantly improve operational effectiveness; research demonstrates that organizations with robust pre-registration systems can reduce wait times for individuals by as much as 30%.

-

Registration: Upon arrival, confirming and updating patient details ensures accuracy in the billing process, setting the foundation for a smooth revenue cycle.

-

Eligibility Verification: Conducting thorough checks on insurance coverage and benefits is vital to prevent claim denials, which can hinder income generation.

-

Charge Capture: Accurately documenting all services rendered is crucial to ensure that no charges are overlooked, thereby maximizing revenue potential. Regular audits of charge capture processes can benchmark performance and identify areas for improvement.

-

Coding: Assigning the correct codes for diagnoses and procedures is essential for facilitating accurate billing and compliance with regulations, ensuring that healthcare organizations receive appropriate compensation.

-

Submission of Requests: Prompt submission of requests to insurance payers accelerates payment and sustains cash flow, which is critical for operational stability.

-

Payment Posting: Meticulously recording all payments and adjustments keeps financial records accurate and up-to-date, providing a clear picture of the organization’s financial health.

-

Denial Management: Proactively monitoring and addressing denied requests is necessary to recover lost revenue. Implementing structured denial management processes can significantly reduce the average time taken to resolve claim denials. A case study on best practices reveals that organizations that train staff and utilize technology to streamline denial management can cut resolution times by up to 50%. As Srivalli Harihara, Senior Manager of Coding Education, notes, “Properly appealing a denial may require some research by coding professionals and sometimes queries to the providers.”

-

Patient Billing: After insurance payments, sending statements to patients for any remaining balances ensures transparency in billing and fosters trust.

-

Collections: Establishing effective methods for gathering overdue payments enhances overall financial cycle management, ensuring that cash flow remains robust.

By adhering to these steps, healthcare organizations can optimize their processes within the medical billing revenue cycle, improve cash flow, and foster long-term strategic growth.

Identify and Resolve Common Revenue Cycle Challenges

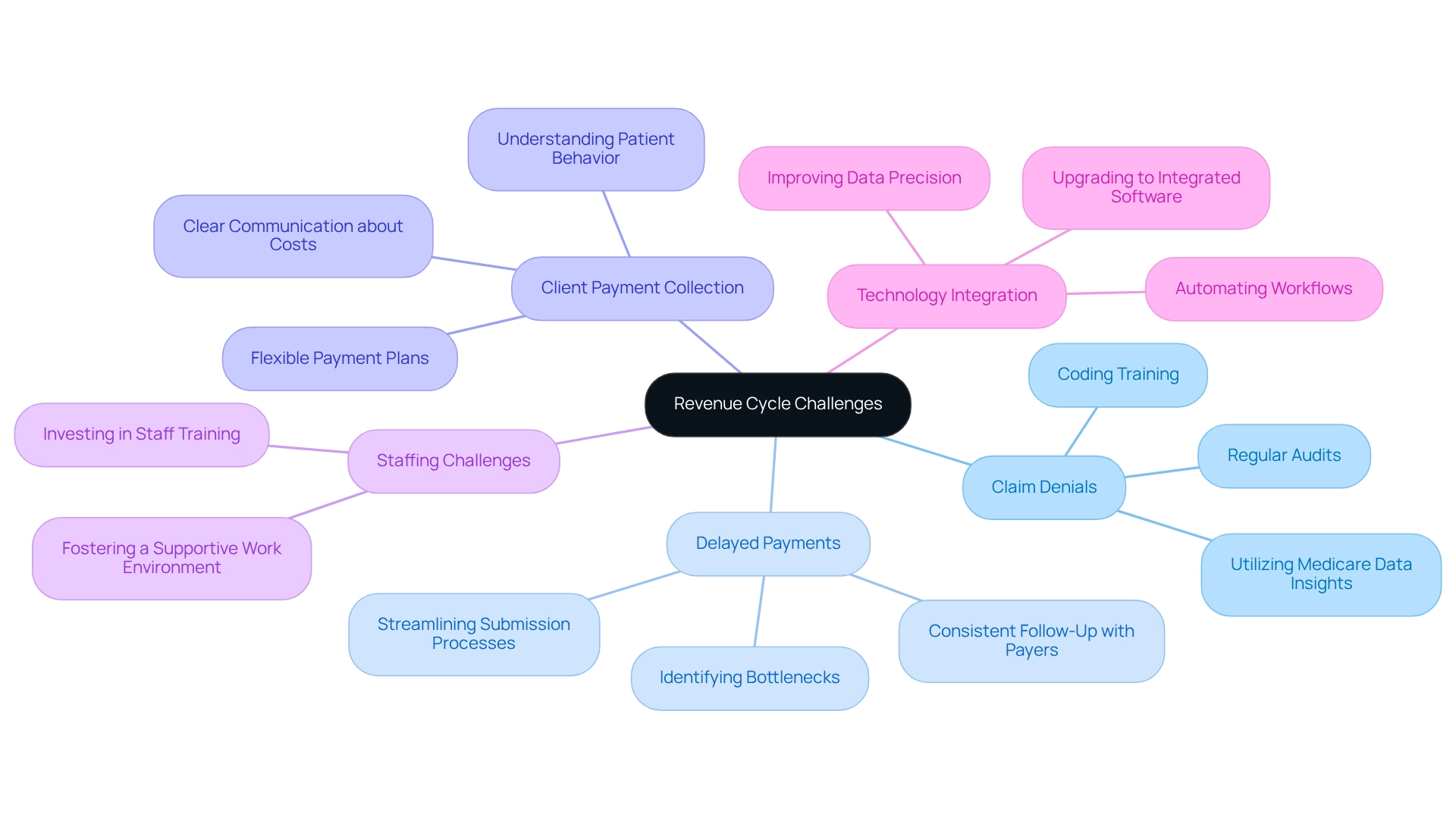

Common challenges in the revenue cycle encompass several critical areas:

- Claim Denials: Frequently attributed to coding errors or incomplete information, claim denials pose a significant challenge. To mitigate this issue, comprehensive training for coding staff and regular audits are essential to ensure accuracy. A recent study emphasized that nearly 60% of respondents faced delays in care due to coverage rejections, underscoring the necessity of effectively addressing denial issues. By utilizing CareSet’s extensive Medicare data insights, which include detailed coding systems like ICD, NDC, and HCPCS, healthcare organizations can attain a deeper understanding of the complexities surrounding denial issues and enhance their resolution strategies.

- Delayed Payments: The slow processing of requests can severely impact cash flow. Streamlining submission processes and maintaining consistent follow-up with payers are crucial steps to expedite payments. In 2023, 425 million requests were submitted to 175 insurers, illustrating the scale of the issue and the pressing need for efficient processing. CareSet’s insights into Medicare claims data can assist organizations in identifying bottlenecks and optimizing their revenue cycle management, particularly through the analysis of treatment pathways and associated coding.

- Client Payment Collection: Many individuals face challenges in paying their bills, leading to increased accounts receivable. Offering flexible payment plans and ensuring clear communication about costs upfront can significantly enhance collection rates. By understanding patient behavior through data, organizations can further improve collection strategies, especially when informed by CareSet’s insights into patient treatment pathways and payment trends.

- Staffing Challenges: High turnover rates within financial cycle management teams can disrupt operations and lead to inefficiencies. Investing in staff training and fostering a supportive work environment are crucial for retaining talent and maintaining operational continuity.

- Technology Integration: Outdated systems can greatly hinder efficiency and precision in billing activities. Upgrading to integrated income cycle management software can automate workflows, improve data precision, and enhance overall performance. CareSet emphasizes the importance of utilizing advanced data solutions to streamline these processes, ensuring that coding systems are effectively integrated into the workflow.

Addressing these challenges is vital for healthcare organizations aiming to optimize their revenue cycle performance. Insights from the case study titled “Consumer Behavior Regarding Claim Appeals” indicate that consumers seldom file formal appeals after receiving a denial of coverage, which may exacerbate the negative effects of claim denials on individual health and financial stability. By implementing successful strategies and leveraging technology, organizations can significantly reduce delayed payments and improve patient outcomes. As CareSet emphasizes, empowering clients to make informed decisions based on accurate data is crucial in navigating these challenges.

Leverage Data Analytics for Revenue Cycle Optimization

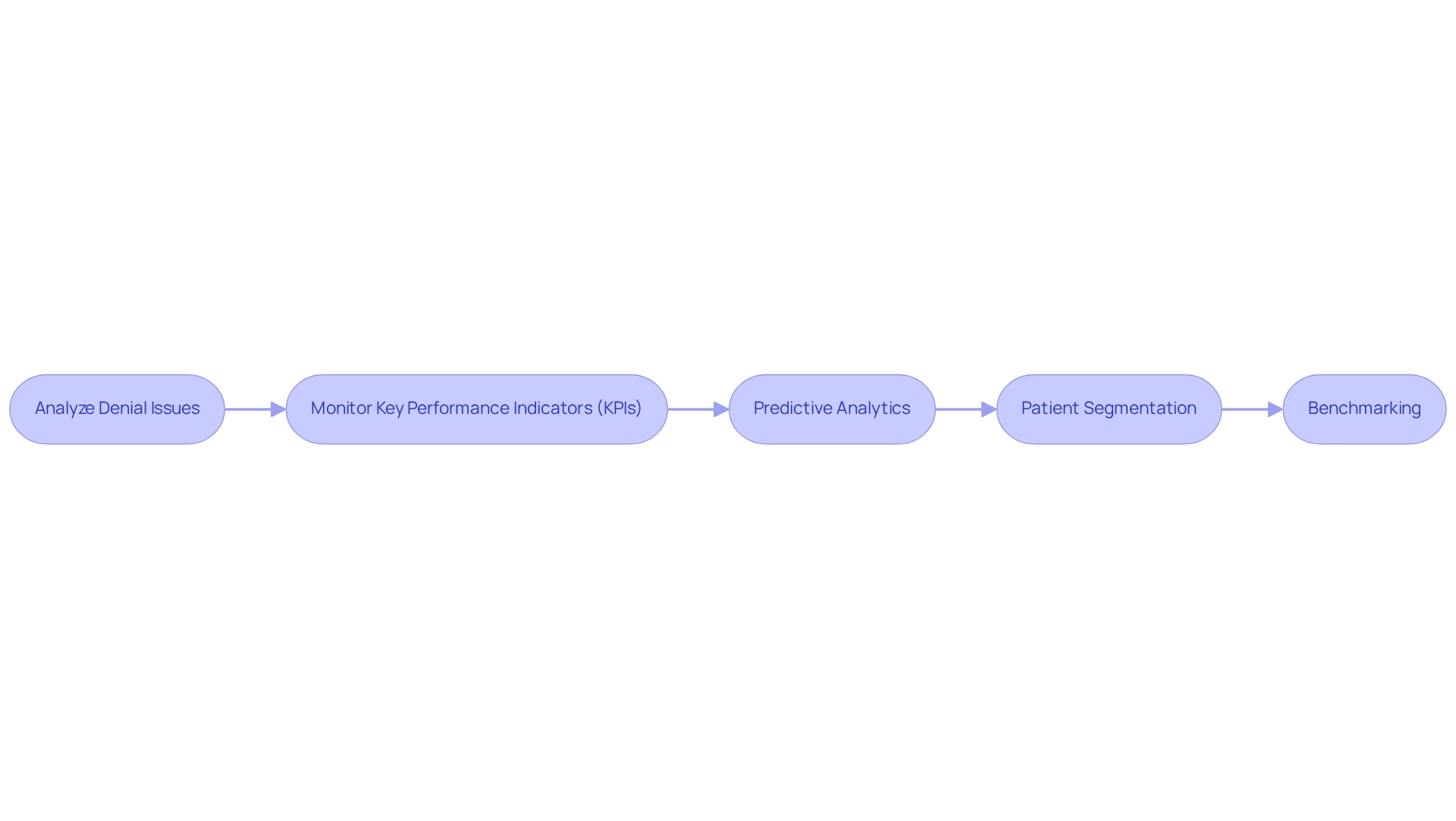

To effectively optimize the revenue cycle through data analytics, healthcare organizations should implement the following strategies:

- Analyze Denial Issues: Utilize analytics to uncover patterns in denied submissions, enabling targeted training initiatives and process enhancements that can reduce future denials.

- Monitor Key Performance Indicators (KPIs): Regularly track essential metrics such as days in accounts receivable and claim rejection rates to assess performance and pinpoint areas needing improvement.

- Predictive Analytics: Employ predictive models to foresee cash flow patterns and recognize potential income shortfalls, enabling proactive financial management.

- Patient Segmentation: Examine patient demographics and payment behaviors to customize billing strategies, thereby improving collection rates and overall patient satisfaction.

- Benchmarking: Assess your financial cycle performance against industry standards to identify gaps and set clear improvement goals.

As stated by Invensis, a leader in financial cycle management services for over 20 years, utilizing data analytics is essential for improving operational efficiency. Susan Collins, a Cycle Management professional, emphasizes that “to succeed in implementing cycle metrics, healthcare organizations need expert support to prioritize a culture of data-driven decision-making and continuous improvement.”

Furthermore, findings from the case study titled ‘Revenue Cycle Metrics Improvement Strategies’ highlight that tactics like optimizing billing procedures and employing automated systems can greatly improve cycle metrics and maximize profitability. Collaborating with VISAYA KPO enables healthcare providers to concentrate on patient care while enhancing financial cycle management.

By harnessing the power of data analytics, healthcare organizations can make strategic decisions that significantly enhance their revenue cycle management and bolster their financial health.

Conclusion

The intricate world of Revenue Cycle Management (RCM) is essential for the financial sustainability of healthcare organizations. By understanding and mastering the key components—ranging from patient registration to denial management—providers can optimize their billing processes and enhance operational efficiency. Implementing the critical steps outlined in the revenue cycle not only improves cash flow but also fosters long-term strategic growth, ensuring that organizations can deliver quality care while maintaining financial health.

Addressing common challenges such as claim denials, delayed payments, and staffing issues is imperative for healthcare organizations. By leveraging technology and investing in staff training, these challenges can be mitigated, allowing organizations to streamline their operations and improve patient outcomes. Moreover, the integration of data analytics into RCM processes serves as a powerful tool for identifying trends, optimizing performance, and making informed decisions that drive financial success.

Ultimately, as the healthcare landscape continues to evolve, the importance of effective RCM cannot be overstated. Organizations that embrace these practices will not only enhance their financial performance but also improve patient satisfaction, positioning themselves for success in an increasingly competitive environment. Embracing the principles of RCM today will pave the way for a more efficient and sustainable healthcare future.