Overview

This article delves into the mastery of the 0636 Revenue Code, a vital component for enhancing billing strategies within healthcare, particularly concerning outpatient services under Medicare. Accurate coding, paired with appropriate HCPCS numbers, is emphasized as essential for ensuring compliance and maximizing reimbursement.

Case studies illustrate the positive impact of these practices, showcasing improved claim submissions and a notable reduction in denials when implemented effectively.

As healthcare professionals navigate the complexities of billing, understanding and applying these principles can lead to significant improvements in financial outcomes.

Introduction

In the intricate landscape of healthcare billing, the 0636 Revenue Code stands as a pivotal element for ensuring accurate reimbursement for outpatient drugs under Medicare. This code’s significance transcends mere coding; it serves as a lifeline for healthcare providers navigating the complexities of billing regulations.

As the healthcare industry evolves, grasping the nuances of this code becomes increasingly crucial, especially in a climate where claim denials can jeopardize patient care and provider revenue alike.

This article explores the essential aspects of the 0636 Revenue Code, providing insights into its implementation, troubleshooting common pitfalls, and highlighting best practices that can enhance billing processes and optimize financial sustainability in healthcare settings.

Understand the 0636 Revenue Code

The Revenue Code plays a critical role in the billing of medications that require comprehensive coding under Medicare, particularly within outpatient hospital services. This regulation specifically pertains to drugs and biologicals that are separately payable, making accurate reimbursement imperative. When utilizing the 0636 revenue code designation, it is crucial to pair it with the appropriate Healthcare Common Procedure Coding System (HCPCS) numbers. This combination is vital for compliance with Medicare invoicing requirements and helps prevent claim denials.

For example, when seeking reimbursement for injectable medications, each drug must be documented on a separate line along with its corresponding HCPCS code. This approach not only ensures compliance but also streamlines the invoicing process, ultimately enhancing cash flow for healthcare providers. As we approach 2025, understanding the nuances of the Revenue Code becomes increasingly important, as it directly influences outpatient hospital services and reimbursement rates.

Specific diseases classified by ICD, including certain cancers and chronic conditions, are often managed using this Revenue Code, underscoring its importance across various therapeutic areas. Data indicates that effective application of the Revenue Code can significantly improve compliance with billing practices. CareSet leverages over 100 external data sources for its analysis, highlighting the importance of accurate data in the invoicing process. By examining Medicare claims data, CareSet offers insights into patient treatment pathways and provider interventions, demonstrating how the 0636 revenue code integrates into the broader context of Medicare A, B, and D benefits. Patients typically progress from diagnosis to treatment through a series of stages involving consultations, diagnostic testing, and treatment planning, all of which are influenced by the 0636 revenue code and the coding systems in place. Case studies reveal successful implementations by healthcare providers, showcasing improved accuracy in their invoicing processes, leading to fewer denials and enhanced revenue cycles. Furthermore, the Technology Assessment for National Coverage Determinations (NCDs) underscores the necessity of thorough evaluations in ensuring compliance with payment protocols. As healthcare professionals navigate the complexities of Medicare invoicing, familiarity with the relevant designations will be a pivotal factor in refining their billing strategies and securing financial sustainability.

Implement the 0636 Revenue Code in Your Billing Process

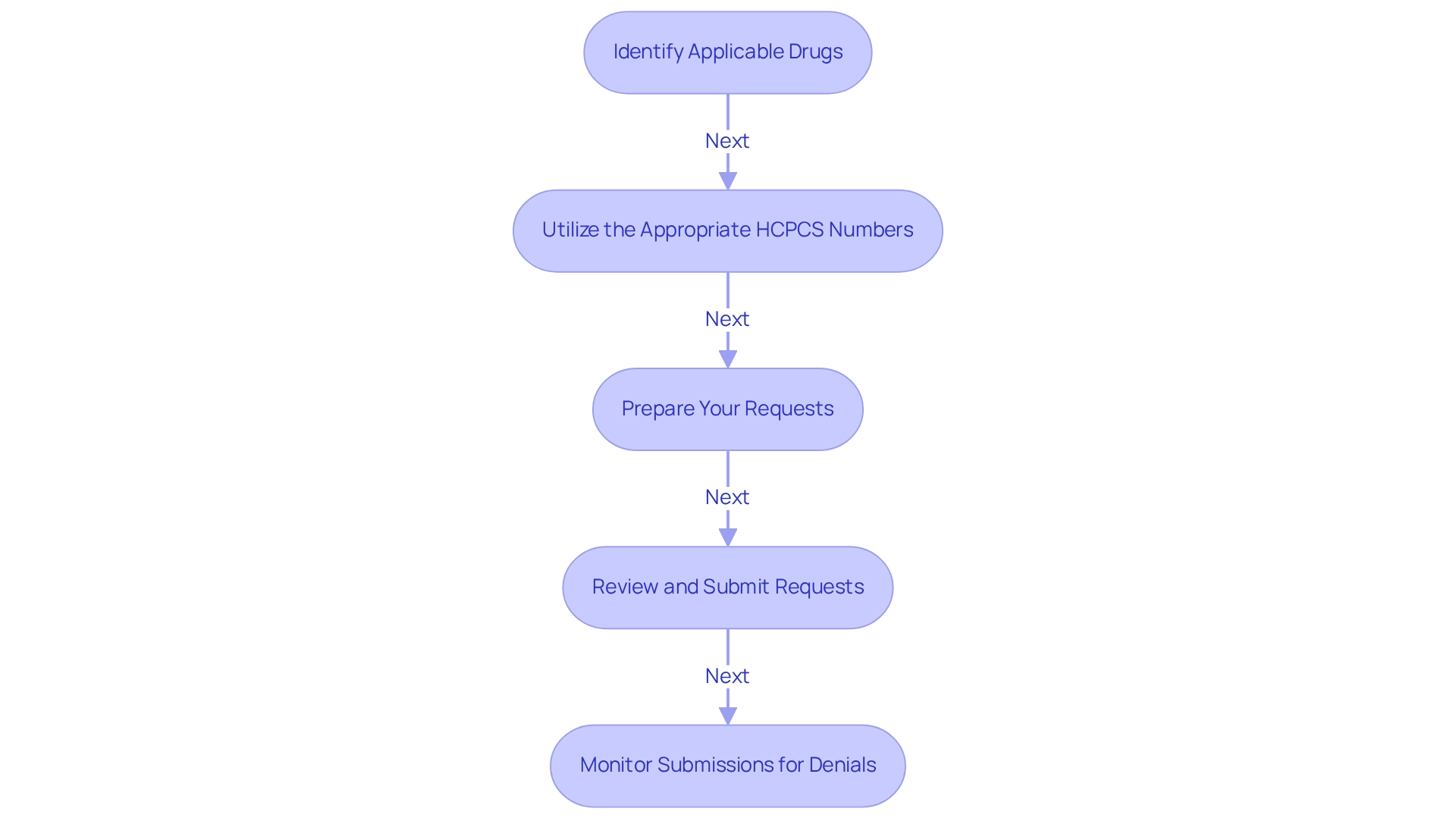

To effectively implement the 0636 Revenue Code in your billing process, adhere to the following steps:

-

Identify Applicable Drugs: Begin by determining which outpatient medications at your facility require billing under the 0636 revenue code. This regulation is specifically for drugs that are separately payable, ensuring compliance with Medicare guidelines and facilitating the navigation of treatment pathways defined by ICD, NDC, and HCPCS classifications. Consider medications utilized in the management of diabetes or hypertension, which are often linked to particular ICD classifications.

-

Utilize the Appropriate HCPCS Numbers: It is vital to match the designated identifier with the suitable HCPCS numbers for each medication charged. Precise programming is essential to avoid denial of requests, as erroneous entries can result in considerable revenue loss. As one billing expert pointed out, “Utilizing the appropriate HCPCS numbers with the Revenue Classification is essential for ensuring that submissions are handled seamlessly and effectively,” which is critical for preserving the integrity of the patient experience through Medicare.

-

Prepare Your Requests: When organizing requests, input the 0636 revenue code in the specified revenue designation area. Each medication should be listed on a separate line, accompanied by its corresponding HCPCS identifier to maintain clarity and compliance. This step is essential for aligning with the treatment interventions that providers utilize throughout the patient journey, from diagnosis to treatment.

-

Review and Submit Requests: Before submission, perform a comprehensive examination of all requests for accuracy. Ensure that the revenue classification aligns with the HCPCS classifications and that all required documentation is included to support your requests. According to CMS, “To prevent triggering a copay or deductible, institutional providers should bill monoclonal antibodies similar to vaccines,” highlighting the importance of correct billing practices in the context of Medicare benefits.

-

Monitor submissions for denials: After submission, actively observe your submissions for any denials related to the 0636 revenue code. If a request is denied, promptly investigate the cause and make necessary adjustments to enhance future submissions. This proactive approach is vital for maintaining a healthy revenue cycle and ensuring that patients receive the treatments they need without unnecessary delays.

By adhering to these best practices, healthcare institutions can improve their invoicing procedures, resulting in better cash flow and fewer denial issues. Facilities that have effectively implemented the Revenue Code have reported a 30% rise in successful claims submissions, underscoring the significance of careful billing practices. Additionally, the Technology Assessment for NCDs illustrates how comprehensive evaluations can lead to informed decisions regarding coverage, further enhancing the overall quality of healthcare provided under Medicare.

Troubleshoot Common Issues with the 0636 Revenue Code

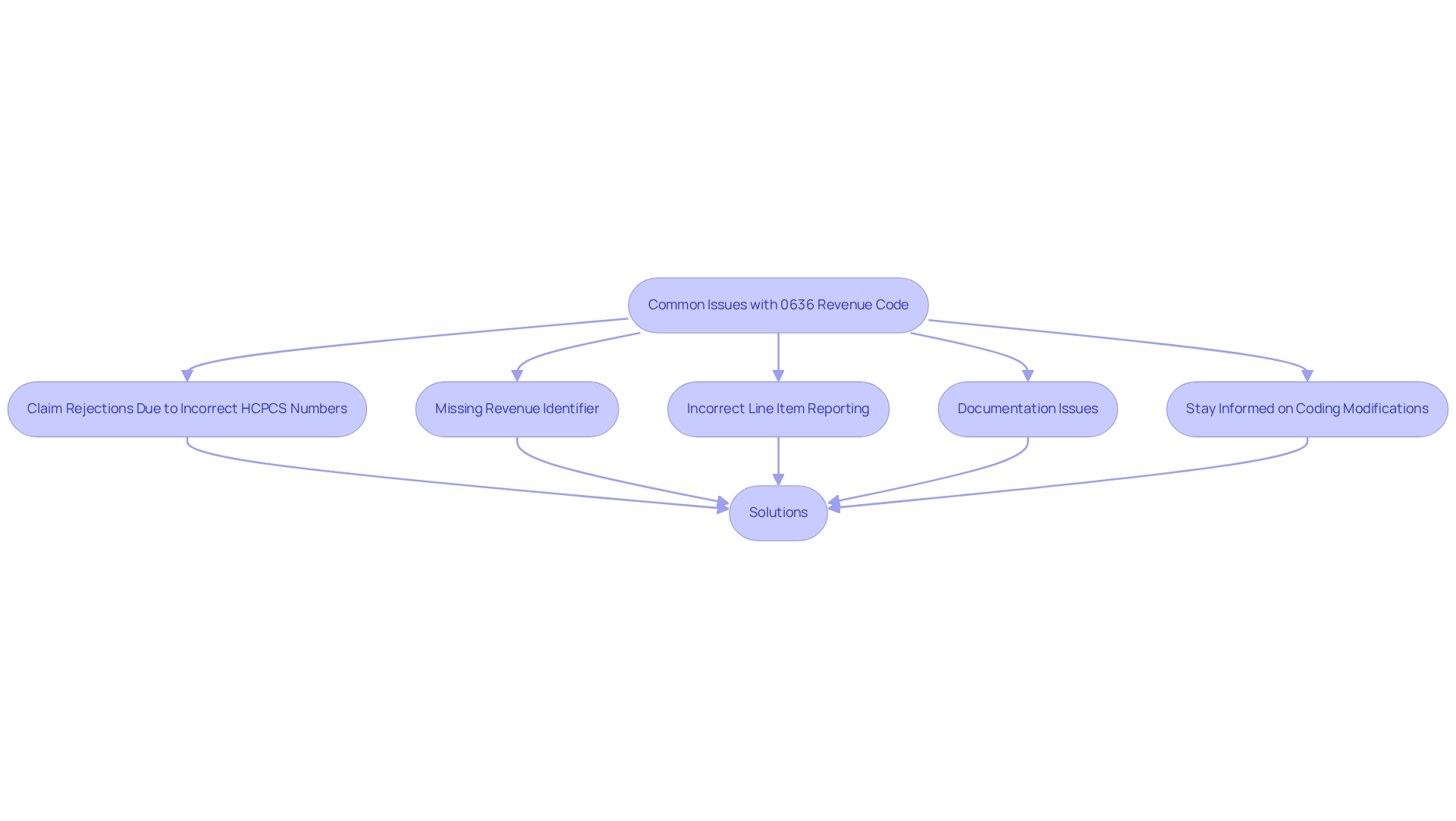

When employing the Revenue Code, several frequent problems may arise that significantly impact the patient experience through Medicare treatment pathways. Understanding how to effectively troubleshoot these issues is essential for healthcare providers.

-

Claim Rejections Due to Incorrect HCPCS Numbers: It is critical to ensure that the HCPCS numbers used align accurately with the medications billed under the specified identifier. Each drug must have a specific HCPCS designation that corresponds to its description to avoid denials, which can disrupt the treatment process for patients navigating from diagnosis to cure.

-

Missing Revenue Identifier: Incorporating the relevant designation in every claim regarding applicable medications is essential. Claims submitted without this identifier are likely to face denial, potentially delaying necessary treatments for patients.

-

Incorrect Line Item Reporting: Each medication charged under the specified reference should be listed on a distinct line. Listing multiple drugs on the same line can lead to confusion and subsequent denials, complicating the patient’s treatment pathway.

-

Documentation Issues: It is imperative to verify that all necessary documentation is attached to substantiate the assertions. Incomplete documentation can cause delays or denials, impacting revenue flow and patient access to care.

-

Stay Informed on Coding Modifications: Regularly examining updates from the Centers for Medicare & Medicaid Services (CMS) concerning the relevant code and associated payment practices is crucial. Alterations in coding guidelines can significantly influence how submissions should be made. Staying informed about these updates will help prevent future issues and ensure smoother navigation through Medicare benefits.

In a practical scenario, during an outpatient encounter on March 1, 2024, 5 units of Drug X and 3 units of Drug Y were administered, which underscores the importance of accurate coding and billing practices related to the 0636 revenue code in real-world applications. Addressing these typical challenges is vital for enhancing revenue cycle management and reducing denials, which can create financial pressures on patients, especially those requiring chronic or expensive treatments. A case study titled ‘Financial Impact of Denied Claims’ illustrates that denials can lead to significant financial burdens for patients, particularly those with chronic illnesses or high-cost treatments, potentially forcing them to delay or forgo necessary medical care. Therefore, implementing effective billing strategies and considering outsourcing medical billing can be viable solutions for healthcare providers to optimize revenue cycle management and reduce claim denials.

Conclusion

The 0636 Revenue Code is pivotal in the healthcare billing landscape, particularly concerning outpatient drugs under Medicare. Its proper implementation is essential for ensuring accurate reimbursements and preventing claim denials that can disrupt patient care and impact provider revenue. By grasping the nuances of this code, healthcare professionals can navigate the complexities of billing regulations more effectively.

Implementing best practices—such as pairing the 0636 code with the correct HCPCS codes and ensuring accurate claim submissions—can significantly enhance billing processes. Facilities that adopt these strategies frequently observe a marked improvement in their revenue cycles, underscoring the importance of meticulous attention to detail in billing practices. Furthermore, proactively monitoring claims for denials and addressing common issues can streamline the billing process and optimize financial sustainability.

In a healthcare environment where financial pressures are mounting, mastering the use of the 0636 Revenue Code is not merely beneficial; it is imperative. This knowledge aids in maintaining compliance with Medicare requirements and ensures that patients receive the timely treatments they need. As the healthcare landscape continues to evolve, staying informed and adapting billing strategies will be crucial for providers aiming to thrive amidst ongoing challenges.