Overview

The article provides a comprehensive step-by-step guide for mastering health insurance claims. It details essential processes for:

- Filing claims

- Verifying coverage

- Understanding medical coding

The significance of accurate documentation and coding is emphasized, as these factors are critical for improving reimbursement rates and reducing claim denials. Supported by statistics and insights from CareSet’s analysis of Medicare data, the article highlights the crucial role of precision in the claims process. By focusing on these elements, readers will gain a robust understanding of the intricacies involved in health insurance claims.

Introduction

Navigating the complexities of health insurance claims presents a formidable challenge for both patients and healthcare providers. With a diverse array of claims—spanning medical, dental, and pharmacy—grasping the nuances of each type is crucial for ensuring successful reimbursement. This article explores the intricacies of filing claims, emphasizes the importance of verifying insurance coverage, and underscores the critical role of accurate medical coding. By meticulously breaking down the steps involved and highlighting common pitfalls, readers will acquire valuable insights that can streamline the claims process, mitigate denials, and ultimately enhance patient care.

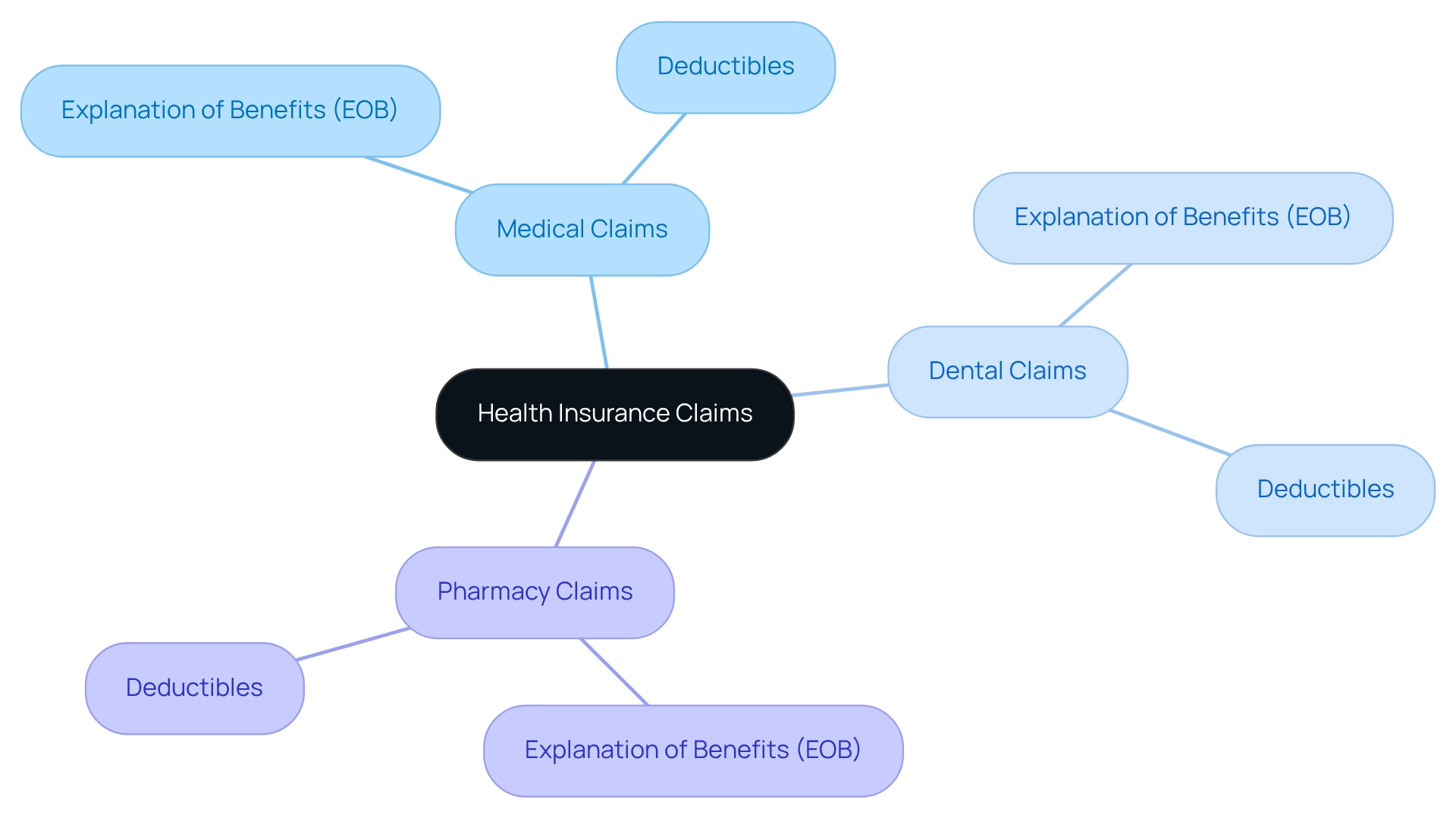

Understand Health Insurance Claims

Health insurance claims are official appeals for payment that healthcare providers submit to coverage firms following the provision of services. It is essential to understand the various types of health insurance claims, including:

- Medical claims

- Dental claims

- Pharmacy claims

Each type has its specific requirements and processes. Familiarity with terms like:

- ‘Explanation of Benefits (EOB)’, which outlines what coverage includes

- ‘deductibles’, the amounts payable before your plan activates

is crucial. Grasping these fundamental concepts will empower you to manage the claims process more effectively.

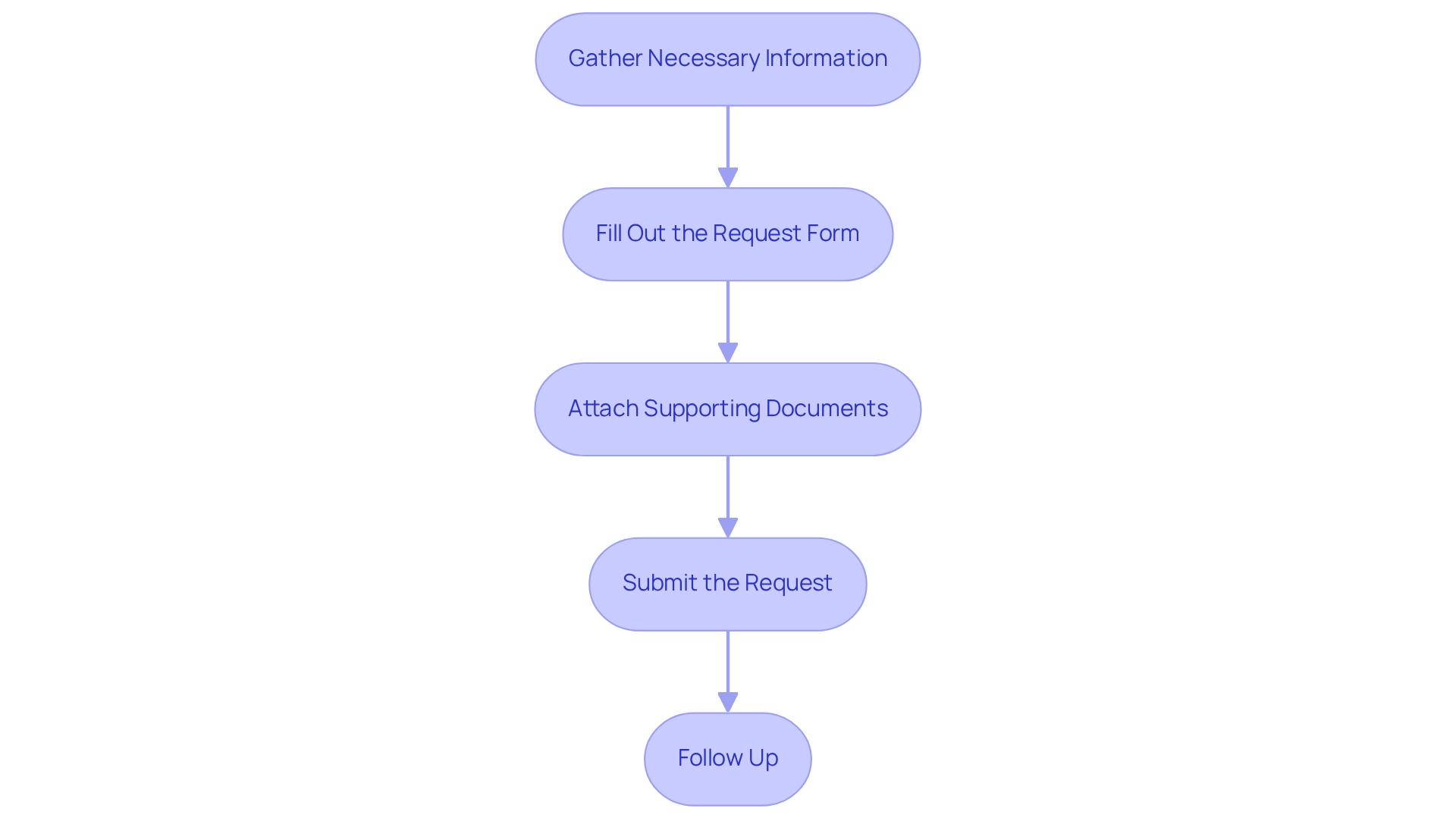

File a Medical Claim: Step-by-Step Process

- Gather Necessary Information: Begin by assembling all essential documents, including the itemized bill from your healthcare provider, your policy number, and any required referral forms. Accurate documentation is crucial for a seamless process, particularly given that CareSet analyzes over $1.1 trillion in annual Medicare data. This highlights the scale and importance of precision in submissions, as comprehensive insights can significantly enhance provider engagement and drug utilization.

- Fill Out the Request Form: Acquire the appropriate request form from your insurance provider’s website or customer service. Ensure that all information is completed accurately and aligns with the documents you have gathered to prevent common errors that can delay health insurance claims processing. Remember, meticulous processing of requests is vital for achieving broader strategic objectives in healthcare, especially when leveraging [innovative Medicare data solutions](https://ibscdc.org/Case_Studies/IT and Systems/IT and Systems/CRM-Cigna Corporation Case Studies.htm) from CareSet.

- Attach Supporting Documents: Include the itemized bill along with any other necessary documentation, such as receipts or referral letters. Missing documents frequently lead to rejection, so double-check your attachments. This reinforces the importance of thorough preparation in submission processes, further supported by CareSet’s insights into health insurance claims, medication use, and consumer journey mapping.

- Submit the Request: Forward the completed request form and supporting documents to your insurance company. Many insurers facilitate electronic submissions, which can expedite the process; however, traditional mail is also an option if preferred. Citing successful case studies can provide insights into effective submission strategies, illustrating how CareSet identifies 15% more targets and 250% more patients than leading vendors.

- Follow Up: After submission, diligently monitor your status. If you do not receive confirmation within a reasonable timeframe, reach out to your provider to ensure your request is being processed. This proactive approach can swiftly resolve any issues. Additionally, be mindful of common mistakes to avoid when submitting health insurance claims, such as incomplete forms or missing documentation, to enhance your chances of a successful outcome.

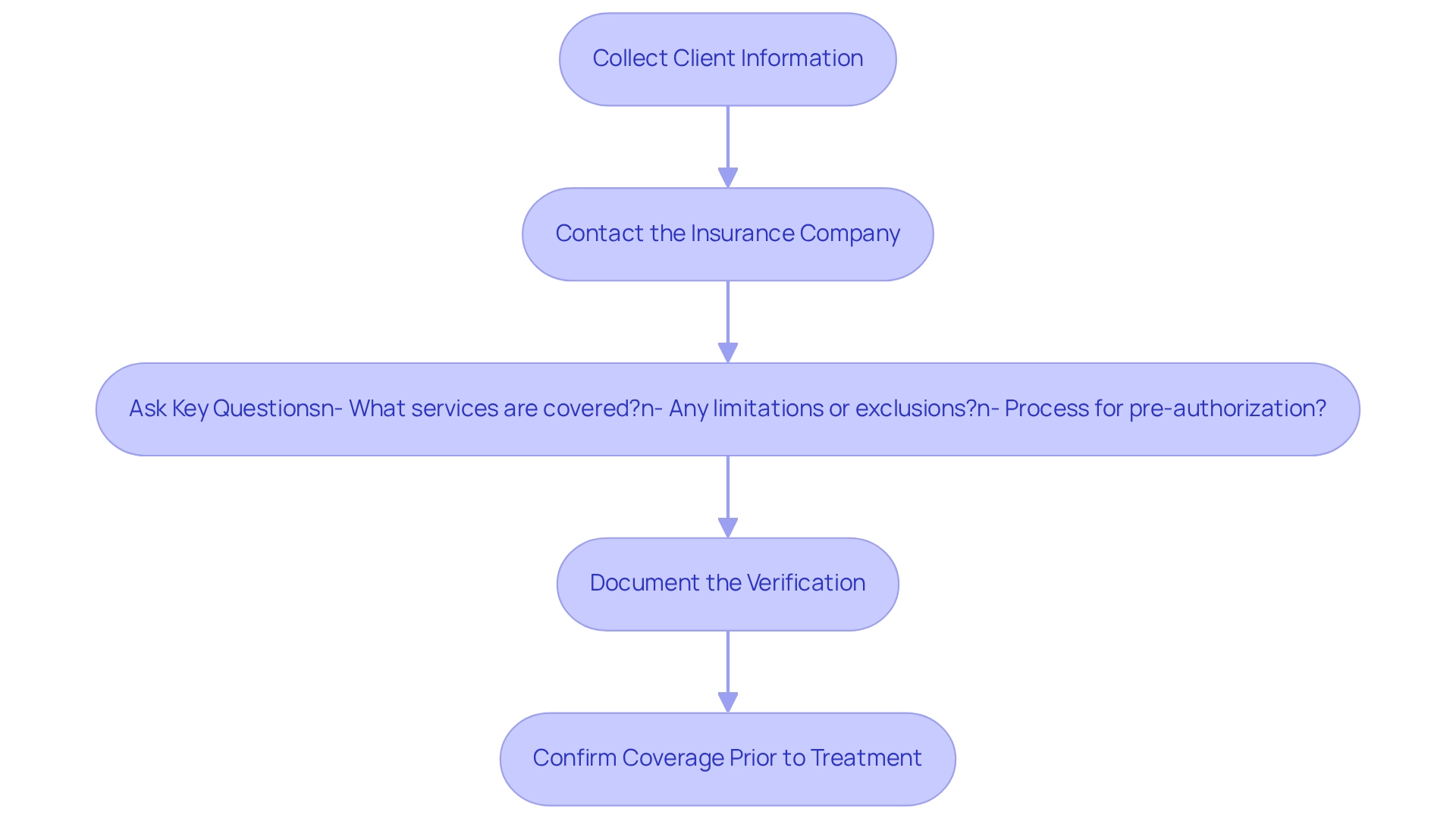

Verify Insurance Coverage and Eligibility

-

Collect Client Information: Begin by gathering essential client details, including the provider’s name, policy number, and group number. Accurate information is crucial for a smooth verification process.

-

Contact the Insurance Company: Reach out to the insurance provider through their customer service line or online portal. Provide the individual’s information and inquire about coverage for the specific services needed.

Ask Key Questions: Confirm the individual’s eligibility for coverage. Inquire about co-pays, deductibles, and any pre-authorization requirements for the services. Key questions to ask include:

- What services are covered under the patient’s plan?

- Are there any limitations or exclusions?

- What is the process for obtaining pre-authorization?

Understanding these details can prevent unexpected costs and delays in treatment.

- Document the Verification: Maintain a detailed record of the verification process, including the date, time, and name of the representative you spoke with. This documentation is crucial for settling any disagreements that might occur later.

Confirming coverage prior to treatment is essential, as it can significantly impact care and financial planning. In 2025, the average time required to confirm coverage has improved to approximately 15 minutes; however, it remains a critical step in the healthcare process. Statistics indicate that thorough verification can reduce claim denials by up to 30% and enhance client satisfaction. Effective insurance verification processes often involve clear communication and proactive follow-up, ensuring that all necessary information is confirmed before services are provided. Experts emphasize the importance of asking specific questions to clarify coverage details, which can lead to more efficient patient care and better outcomes. As noted by Cigna management, insights gained from previous projects underscore the necessity for effective processing systems to prevent financial harm and enhance service delivery.

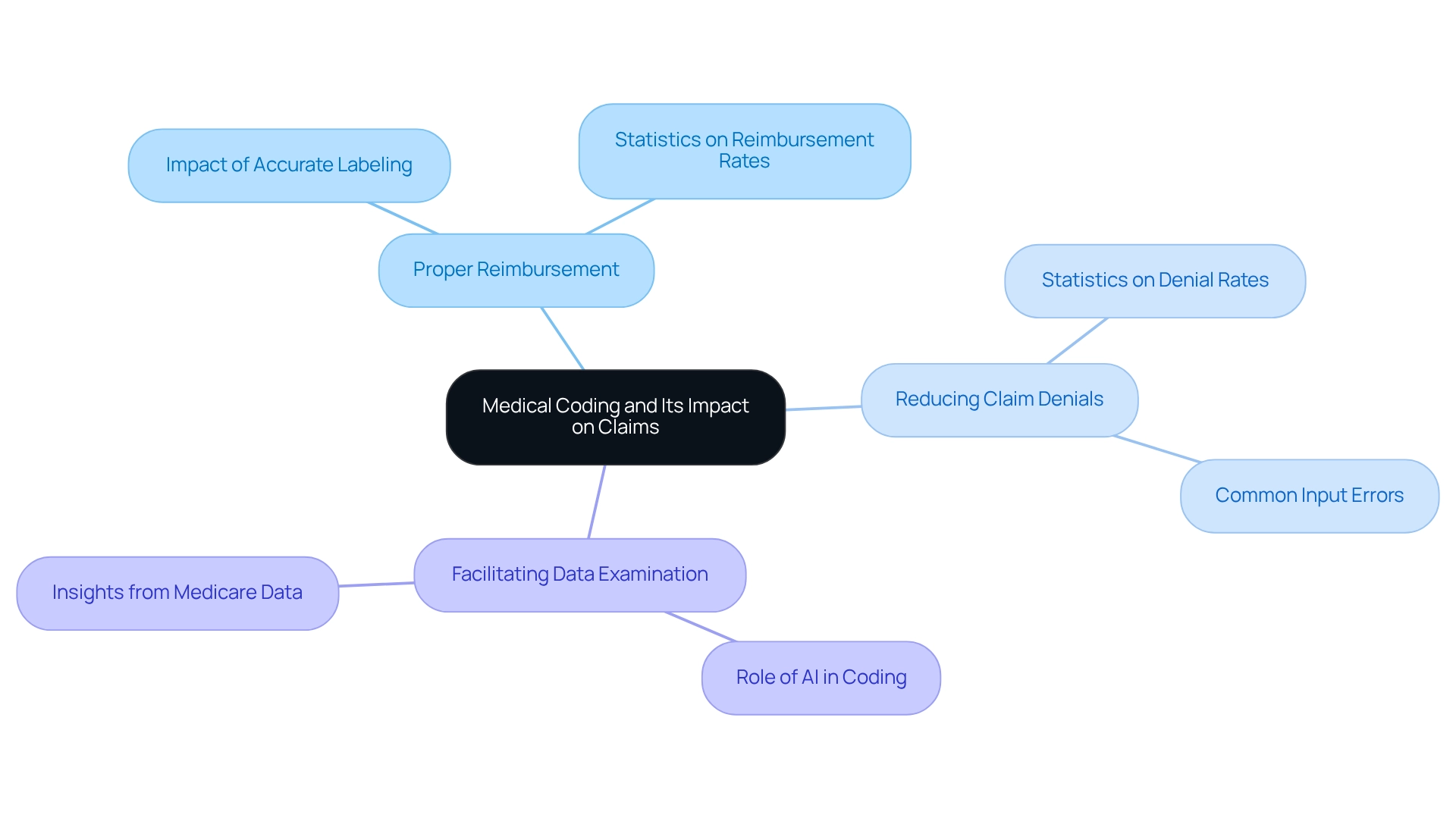

Understand Medical Coding and Its Impact on Claims

Medical classification is the process of converting healthcare services, diagnoses, and procedures into standardized codes essential for billing and health insurance claims. The importance of precise programming cannot be overstated, as it directly affects several key areas:

- Ensures Proper Reimbursement: Precise classification is vital for healthcare providers to receive appropriate payment for services rendered. In 2025, statistics show that requests with accurate labeling have a reimbursement rate considerably greater than those with mistakes. CareSet’s examination of more than $1.1 trillion in yearly Medicare claims data highlights the significance of accurate classification in maximizing reimbursement, illustrating how data-driven insights can enable providers to enhance their billing processes.

- Reduces Claim Denials: A staggering percentage of claims—estimated at 30%—are rejected due to input errors. These inaccuracies not only postpone payments but also heighten administrative burdens, making it essential for providers to uphold current classification practices. By integrating over 100 external data sources, CareSet offers insights that can assist in recognizing frequent errors in documentation and decrease denial rates, ultimately improving the efficiency of health insurance claims.

- Facilitates Data Examination: Appropriate programming boosts the capacity to monitor healthcare trends and results, offering valuable insights that can guide future healthcare choices and enhance care for individuals. CareSet’s comprehensive Medicare data solutions empower healthcare stakeholders with actionable insights derived from the classification process, enabling better strategic planning and patient management.

To mitigate the risk of classification errors, it is essential to stay informed about the latest guidelines and ensure that all documentation is thorough and precise. Continuous education and training in medical classification are essential for decreasing denials of health insurance claims and enhancing reimbursement rates. Embracing operational efficiencies provided by AI in coding and billing can further enhance accuracy and reduce costs. As the healthcare landscape evolves, adopting these practices will be crucial for maintaining operational efficiency and financial health.

Conclusion

Navigating the complexities of health insurance claims is essential for both patients and providers, directly impacting the efficiency of reimbursements and the quality of patient care. Understanding the different types of claims—medical, dental, and pharmacy—empowers individuals to approach the claims process with greater confidence. Familiarity with key terms, such as Explanation of Benefits and deductibles, equips patients to advocate effectively for their needs.

The step-by-step process for filing medical claims underscores the importance of accuracy and thoroughness. From gathering necessary documentation to diligently following up on submitted claims, each stage is critical in minimizing denials and ensuring timely payments. Moreover, verifying insurance coverage and eligibility before treatment is paramount, as it prevents unexpected costs and enhances patient satisfaction.

Furthermore, the impact of accurate medical coding cannot be overstated. Proper coding guarantees that healthcare providers receive appropriate reimbursement while significantly reducing the likelihood of claim denials. With the integration of data-driven insights, such as those provided by CareSet, healthcare professionals can optimize their billing processes and improve operational efficiency.

In summary, mastering the intricacies of health insurance claims not only streamlines the reimbursement process but also enhances the overall patient experience. By emphasizing preparation, verification, and accuracy, both patients and providers can collaborate effectively to navigate the complexities of healthcare with greater ease and efficiency. Ultimately, a well-informed approach to claims management fosters better outcomes for all parties involved, paving the way for improved healthcare delivery.