Overview

The article delineates strategies that healthcare professionals can employ to adeptly manage denial claims from insurance companies. It underscores the significance of comprehending common denial reasons, implementing preventative measures, and effectively navigating the appeal process. By emphasizing that efficient denial management can substantially mitigate financial losses for healthcare organizations, the article serves as a vital resource for professionals seeking to enhance their operational efficacy.

Introduction

In the intricate landscape of healthcare, denial claims represent a formidable challenge for providers striving for timely reimbursement for services rendered. With nearly 18% of claims denied by insurers in 2025, grasping the nuances of denial claims is more critical than ever. This article explores the prevalent reasons behind these denials, including:

- Lack of medical necessity

- Incorrect coding

It also highlights effective strategies that healthcare professionals can implement to mitigate these issues. By examining the appeal process and leveraging technology, organizations can not only enhance their claims management but also improve patient care. As the industry evolves, mastering the art of denial management becomes essential for sustaining financial health and ensuring access to quality healthcare services.

Define Denial Claims in Healthcare

Denial claims in healthcare occur when an insurance company declines to reimburse a healthcare provider for a billed expense. This denial claims follows the submission of a claim, indicating that the payer has assessed the request and concluded that the service does not meet the necessary criteria for payment. Common reasons for denial claims include:

- A lack of medical necessity

- Incorrect coding

- Insufficient documentation

As of 2025, approximately 18% of healthcare requests lead to denial claims from insurers, underscoring the critical need for healthcare professionals to understand and effectively manage these requests. Recent trends indicate a growing complexity in denial claims, with previous authorization refusal rates increasing, raising concerns about access to care.

Moreover, the strategic imperative to handle denial claims efficiently has gained prominence for many organizations; effective denial claims management strategies have led to a significant decrease in cash write-offs—from an average of $1 million to just over $400K. Notably, Kaiser Permanente boasts the lowest rejection rate among major health insurance providers at only 6%, setting a benchmark for the industry.

Understanding denial claims is essential for healthcare providers to navigate the intricacies of billing and ensure appropriate payment for the services rendered. Additionally, the adoption of management software for requests has shown improvements in processing and billing workflows. However, the uptake has declined markedly from 62% in 2022 to 31% in 2024, indicating challenges in establishing effective rejection management solutions.

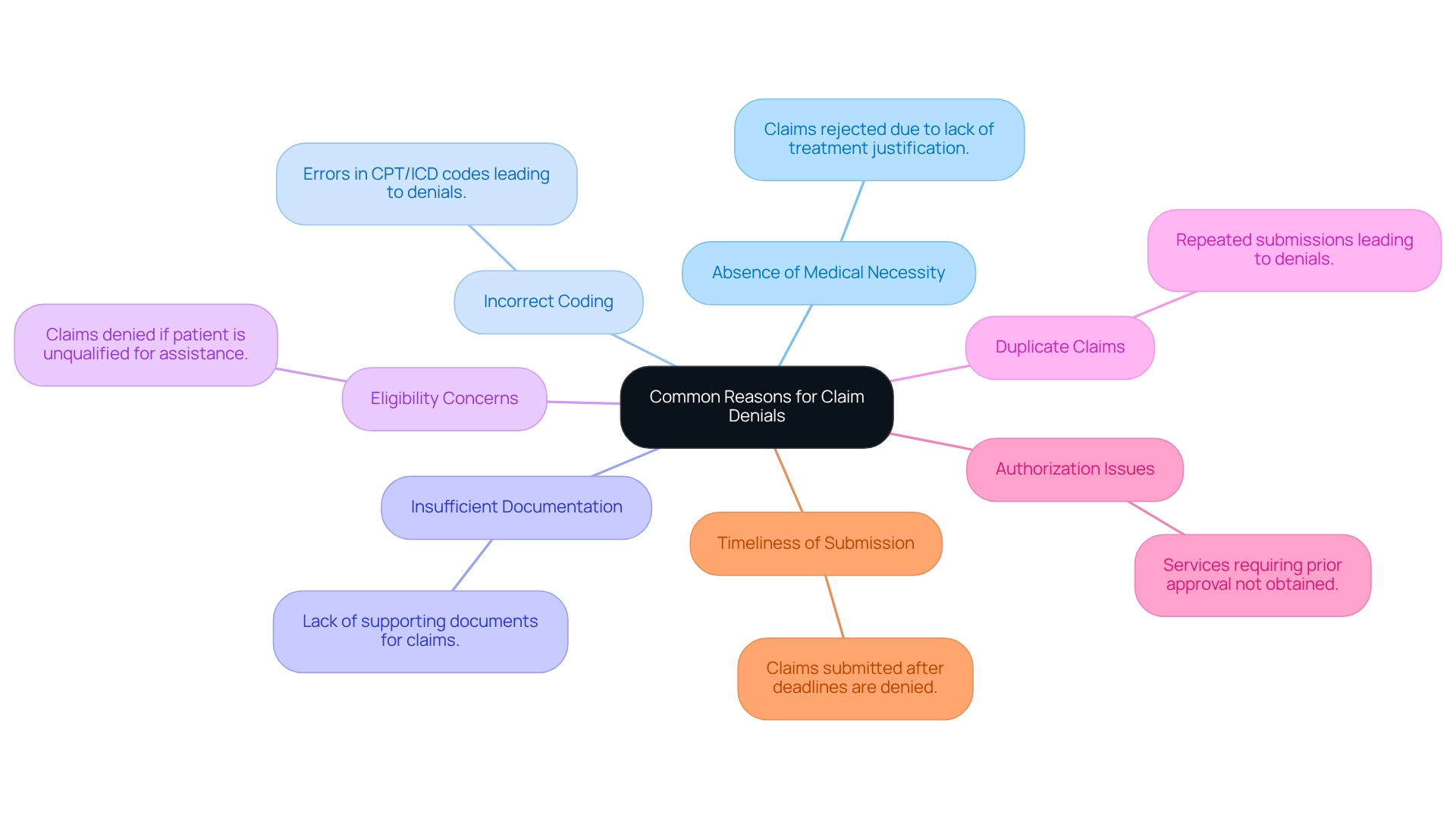

Identify Common Reasons for Denial Claims

Common reasons for claim denials include:

- Absence of Medical Necessity: Claims may be rejected if insurers conclude that the treatment does not meet their medical necessity standards—a prevalent reason for rejections. In 2025, statistics indicate that medical necessity refusals remain a significant challenge, underscoring the importance of clear documentation and justification for services rendered.

- Incorrect Coding: Errors in coding, such as the use of outdated or incorrect CPT/ICD codes, can lead to substantial refusals. Accurate coding is crucial; even minor mistakes can result in denial claims. By leveraging CareSet’s comprehensive Medicare data insights, providers can ensure they are using the correct codes, which helps in reducing the risk of denial claims.

- Insufficient Documentation: Claims lacking adequate supporting documentation to validate the work performed are often denied. This emphasizes the need for thorough record-keeping and comprehensive documentation practices. CareSet’s integration of over 100 external data sources can provide deeper insights into documentation requirements, aiding healthcare providers in enhancing their practices.

- Eligibility Concerns: If a patient is determined to be unqualified for assistance at the time of treatment, the request may be rejected. Ensuring patient eligibility prior to service delivery is essential to mitigate this risk.

- Duplicate Claims: Submitting the same claim repeatedly can lead to refusals for duplication. Healthcare providers must implement robust systems to track submissions and avoid redundancy.

- Authorization Issues: Services requiring prior approval that were not permitted can result in rejection. It is critical for providers to verify authorization requirements specific to each service and secure necessary approvals before proceeding with treatment.

- Timeliness of Submission: Claims submitted after the payer’s deadline may be denied, regardless of their validity. For instance, a study revealed that submissions made after the deadline can result in a 20% rise in rejection rates. Adhering to submission deadlines is essential for effective processing of requests.

Comprehending these frequent causes for denial claims is crucial for medical professionals to manage the process efficiently. A recent analysis by KFF showed that 34% of rejections arise from general ‘other’ reasons, encompassing administrative problems and exceeding benefit limits. By addressing these areas, medical organizations can enhance their management processes and improve revenue flow, ultimately resulting in better patient satisfaction and the capacity to invest in new projects. As Tom Bonner, Principal Product Manager, observed, “AI is the tool hospitals require for improved medical billing rejection prevention and management,” highlighting the significance of technology in tackling these issues. Additionally, utilizing CareSet’s integration of over 100 external data sources can offer deeper insights into rejection patterns, enabling providers to develop more effective strategies for minimizing refusals.

Implement Strategies to Prevent Denial Claims

To effectively prevent denial claims, healthcare professionals should adopt the following strategies:

- Verify Patient Information: Ensuring accurate patient demographics and insurance details is crucial. Verifying this information before submitting requests can significantly decrease the chances of rejections.

- Educate Staff: Regular training sessions for billing and coding personnel are essential. By enhancing their knowledge and skills, organizations can reduce mistakes that often lead to rejections.

- Utilize Technology: Implementing advanced billing software can help identify potential errors before submission, streamlining the process and minimizing rejections. CareSet integrates more than 100 external data sources for comprehensive insights, enhancing the effectiveness of these technologies.

- Prior authorization is essential to ensure that all necessary approvals are obtained before providing services that require them, as this can help prevent costly denial claims.

- Routine evaluations of submission requests enable organizations to identify denial claims trends and address underlying issues, resulting in improved procedures.

- Clear Documentation: Maintaining thorough documentation that supports the medical necessity of services rendered is critical. This clarity can bolster claims and reduce refusals.

- Stay Informed: Being aware of changes in payer policies and coding requirements ensures compliance and helps prevent refusals due to outdated practices.

Investing in these strategies not only enhances claims management effectiveness but also allows healthcare teams to focus more on patient care. For instance, organizations that have outsourced their claims management have reported improved efficiency and the ability to allocate internal resources towards enhancing patient experiences. As Joshua Gayman, Revenue Cycle Manager at UT Medical Center, emphasizes, “Minimizing refusals upfront would enhance our revenue, which could be directed into current and upcoming investments that support our mission.” This underscores the importance of investing in outsourced services, which can free internal teams to focus on maintenance and patient experience while improving overall rejection management.

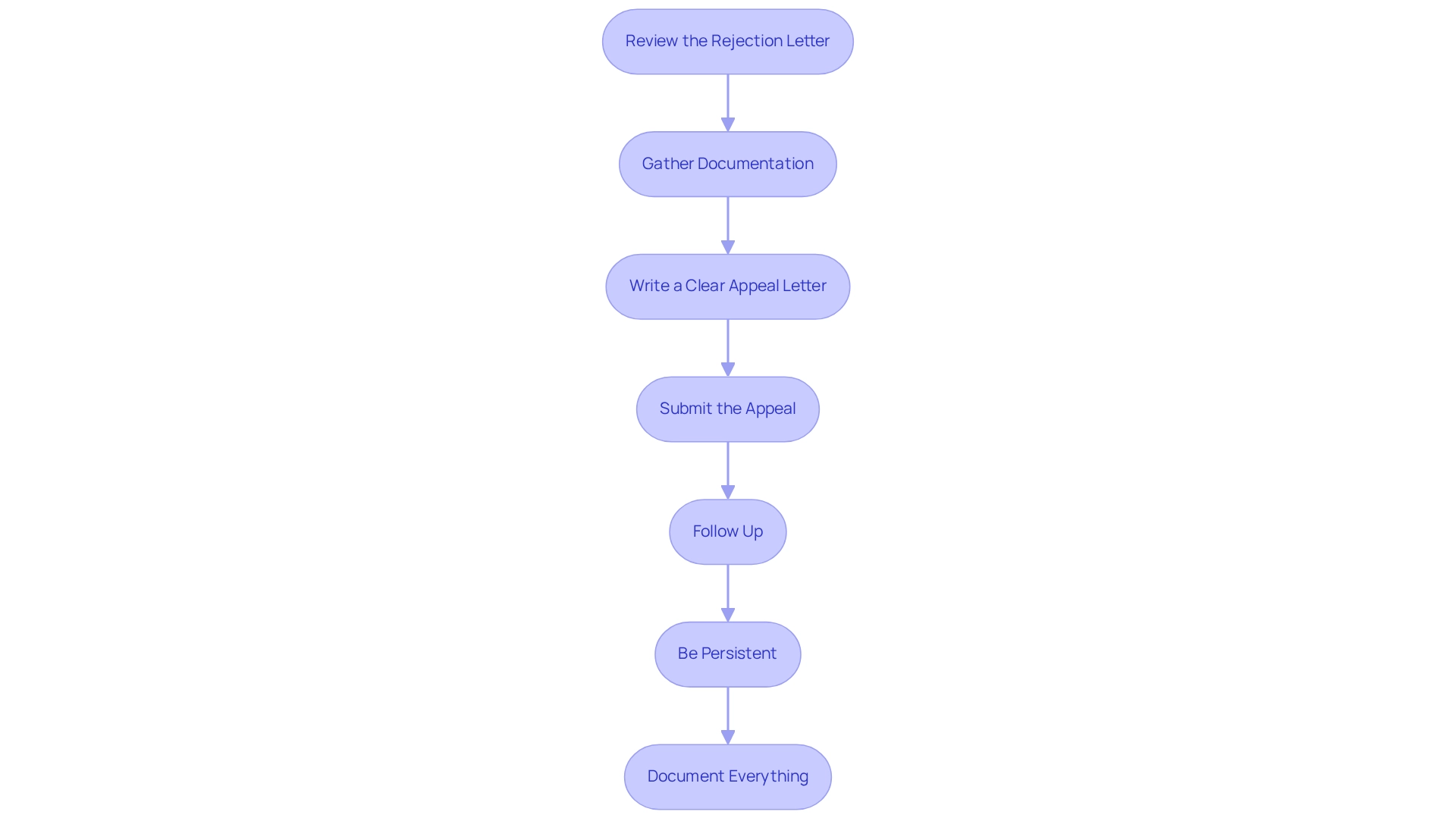

Navigate the Appeal Process for Denied Claims

Navigating the appeal process for rejected requests necessitates a systematic approach to ensure success. To achieve this, follow these essential steps:

- Review the Rejection Letter: Start by thoroughly understanding the specific reasons for the rejection as outlined in the insurer’s letter. This clarity is crucial for formulating an effective response.

- Gather Documentation: Collect all relevant documentation that supports your assertion, including medical records, billing information, and any additional evidence that substantiates the necessity of the services provided.

- Write a Clear Appeal Letter: Draft a concise appeal letter that directly addresses the reasons for denial. Include evidence and reasoning for your assertion, ensuring that your arguments are well-supported and clearly articulated.

- Submit the Appeal: Adhere to the insurer’s guidelines for submitting the appeal, paying close attention to deadlines and required formats to avoid further complications.

- Follow Up: After submission, maintain regular communication with the insurer to check on the status of the appeal. This proactive approach can help expedite the review process.

- Be Persistent: If the appeal is denied again, carefully review the reasons provided. Adjust your strategy as needed and consider escalating the appeal if justified.

- Document Everything: Keep meticulous records of all communications and submissions related to the appeal process. This documentation will be essential for future requests and appeals.

Statistics indicate that the average duration required to address denied appeals in 2025 is significantly influenced by the thoroughness of the initial submission and follow-up efforts. Notably, cash write-offs have decreased by 57%, from an average of $1 million to just over $400K, underscoring the financial impact of effective appeal processes. A zero-tolerance mindset towards avoidable refusals, as emphasized in recent case studies, highlights the significance of clean claims and thorough audits prior to submission. As Jennifer Mueller states, “Revenue Cycle Workforce Development Beyond Automation: The Need for Human Skills in an Evolving RCM Landscape,” this emphasizes the necessity of human oversight in the appeal process. In addition, establishing a successful denial management system demands time and ongoing oversight. By adopting these strategies, healthcare professionals can enhance their appeal success rates and improve the financial health of their organizations.

Conclusion

Understanding denial claims in healthcare is crucial for maintaining financial health and ensuring quality patient care. With approximately 18% of claims denied as of 2025, the reasons behind these denials—such as lack of medical necessity, incorrect coding, and insufficient documentation—underscore the complexities healthcare providers face. By identifying these common pitfalls, professionals can implement effective strategies to reduce the likelihood of denials. This includes:

- Verifying patient information

- Educating staff

- Utilizing advanced technologies

Moreover, the appeal process serves as a vital avenue for recovering denied claims. A systematic approach, from reviewing denial letters to gathering supporting documentation and crafting clear appeal letters, can significantly enhance the chances of successful resolutions. The financial implications are substantial; organizations that adopt rigorous denial management processes can dramatically reduce cash write-offs, thereby improving their revenue cycle.

Ultimately, navigating denial claims transcends mere financial recovery; it fosters an environment where healthcare professionals can concentrate on delivering quality care. By mastering denial management, organizations position themselves to thrive in an evolving healthcare landscape, ensuring they can continue to provide essential services to their communities. The integration of technology, combined with diligent processes and staff education, sets the stage for a more efficient and effective claims management system, benefiting both providers and patients alike.