Overview

This article examines effective strategies for managing Medicare premiums, with a particular focus on the Income-Related Monthly Adjustment Amount (IRMAA) and its implications for beneficiaries in 2025. Understanding the income thresholds associated with IRMAA is crucial for beneficiaries, as it directly impacts their healthcare costs.

The article outlines several strategies, including:

- Maximizing retirement contributions

- Appealing IRMAA determinations

These strategies can empower individuals to navigate their healthcare expenses more effectively. By implementing these strategies, beneficiaries can avoid unexpected surcharges and better manage their financial responsibilities.

Introduction

As the landscape of Medicare evolves, understanding the Income-Related Monthly Adjustment Amount (IRMAA) becomes increasingly vital for beneficiaries. This additional charge on Part B and Part D premiums can significantly impact monthly expenses, particularly for those with higher incomes.

With the upcoming adjustments in 2025, beneficiaries must navigate new income thresholds and recalibrated brackets that could lead to unexpected surcharges.

This article delves into the intricacies of IRMAA, offering insights on:

- How to calculate Modified Adjusted Gross Income (MAGI)

- The implications of life changes on premium calculations

- Effective strategies to manage and potentially reduce these surcharges

By staying informed and proactive, beneficiaries can better prepare for the financial implications of their Medicare coverage.

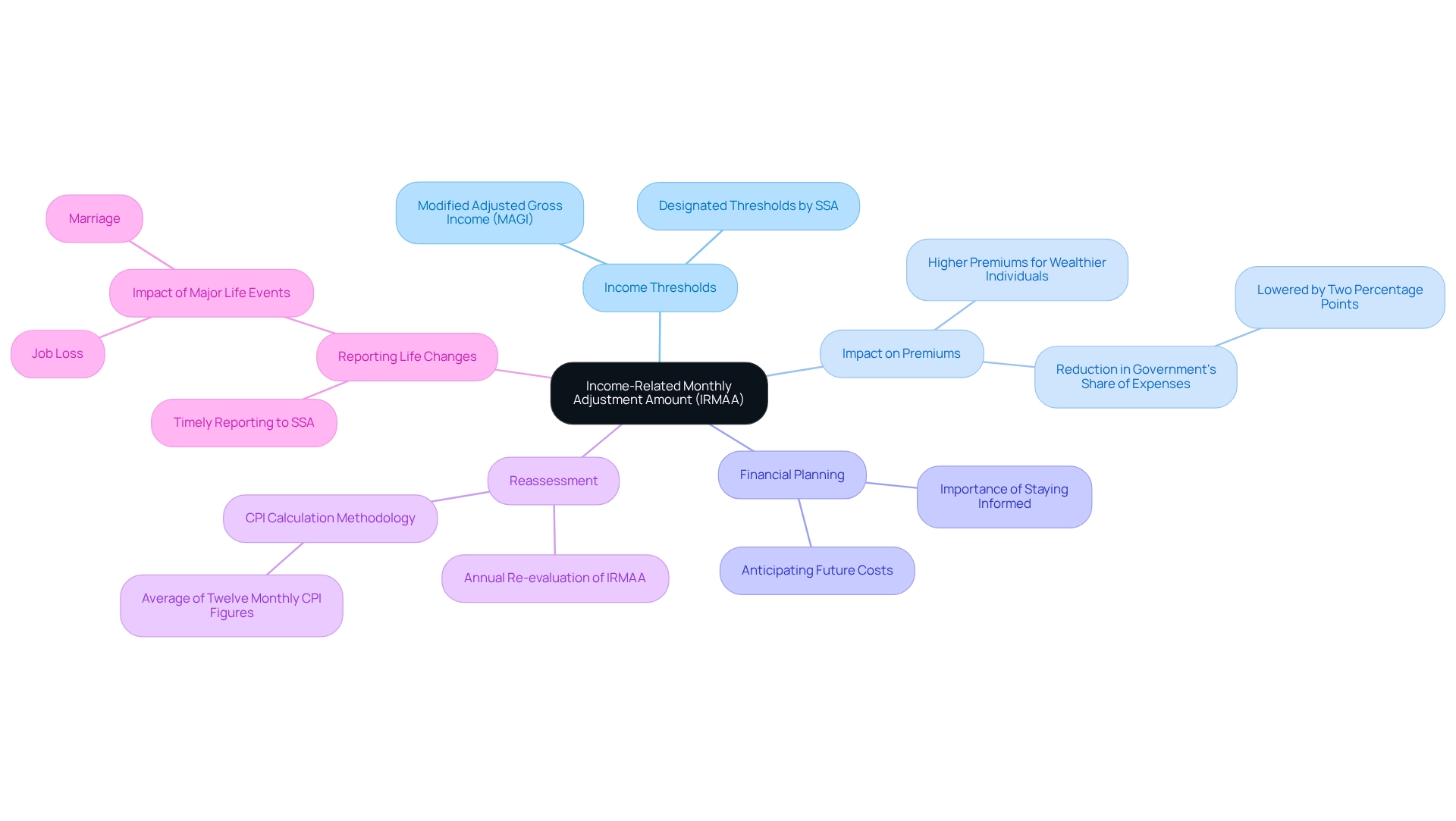

Define IRMAA and Its Role in Medicare Premiums

The Income-Related Monthly Adjustment Amount represents an additional fee that individuals enrolled in the program may face concerning their Part B and Part D premiums, contingent upon their income levels. Specifically, this extra charge affects individuals whose modified adjusted gross income (MAGI) surpasses designated thresholds established by the Social Security Administration (SSA). This fee aims to ensure that higher-income individuals contribute their fair share toward healthcare coverage costs, thereby alleviating some of the financial burden on the government.

Understanding the income-related monthly adjustment amount is crucial for effective financial planning, as it can substantially elevate monthly expenses for those impacted. In 2025 IRMAA, these adjustment amounts will be reassessed to reflect shifts in income and economic conditions, underscoring the need for recipients to stay informed. Notably, the calculation methodology for these brackets is based on the average of twelve monthly Consumer Price Index (CPI) figures, potentially leading to increased premiums even when prices remain unchanged. This indicates that recipients might face higher costs despite no significant changes in their financial situations.

Statistics indicate that a significant portion of individuals receiving healthcare assistance is affected by the income-related monthly adjustment amount, with wealthier individuals incurring higher premiums. For instance, these additional premiums have effectively reduced the government’s share of total Part B and D expenses by two percentage points, illustrating how income-related adjustments influence overall healthcare costs for beneficiaries.

Real-world scenarios underscore the importance of notifying the SSA about major life events, such as marriage or job loss, as these changes can directly affect an individual’s income-related adjustment tier. This highlights the necessity for recipients to remain informed and proactive in managing their healthcare expenses, as timely reporting can lead to adjustments in their premium assessments. Expert opinions emphasize the significance of income-related adjustments within the program, reinforcing its role in ensuring equitable contributions from recipients based on their financial circumstances. Therefore, comprehending the income-related monthly adjustment amount is vital not only for current financial planning but also for anticipating future healthcare coverage costs.

Explore the 2025 IRMAA Brackets and Changes

For 2025, the IRMAA brackets have been updated to reflect new income thresholds, which are as follows:

-

Single Filers:

- $106,000 or less: No IRMAA

- $106,001 to $133,000: $406.90

- $133,001 to $162,000: $476.40

- $162,001 to $498,000: $546.30

- Above $498,000: $607.80

-

Married Filing Jointly:

- $212,000 or less: No IRMAA

- $212,001 to $266,000: $406.90

- $266,001 to $324,000: $476.40

- $324,001 to $498,000: $546.30

- Above $498,000: $607.80

These adjustments represent a modest increase from previous years, significantly impacting higher-income beneficiaries’ Medicare premiums. Importantly, individuals whose earnings surpassed $106,000 (MAGI) on their 2023 taxes should prepare for surcharges in addition to their standard Part B premium under the 2025 IRMAA. As David Fei, CFP®, ChFEBC℠, AIF®, states, “If your earnings surpassed $106,000 (MAGI) on your 2023 taxes, then you can anticipate some additional charges on top of your original full Part B premium.” Furthermore, the surcharges for the year 2025 IRMAA are recalculated each year based on earnings from two years earlier, allowing for potential reductions if earnings decline. For instance, individuals experiencing a notable decrease in earnings due to retirement or other life changes may contest their IRMAA determination, as illustrated in the case study titled ‘IRMAA Appeal.’ This procedure allows for adjustments in health insurance charges based on current financial situations, providing support for individuals affected by significant earnings fluctuations. This flexibility underscores the importance of understanding how earnings threshold adjustments related to the 2025 IRMAA can influence Medicare costs and overall financial planning for beneficiaries.

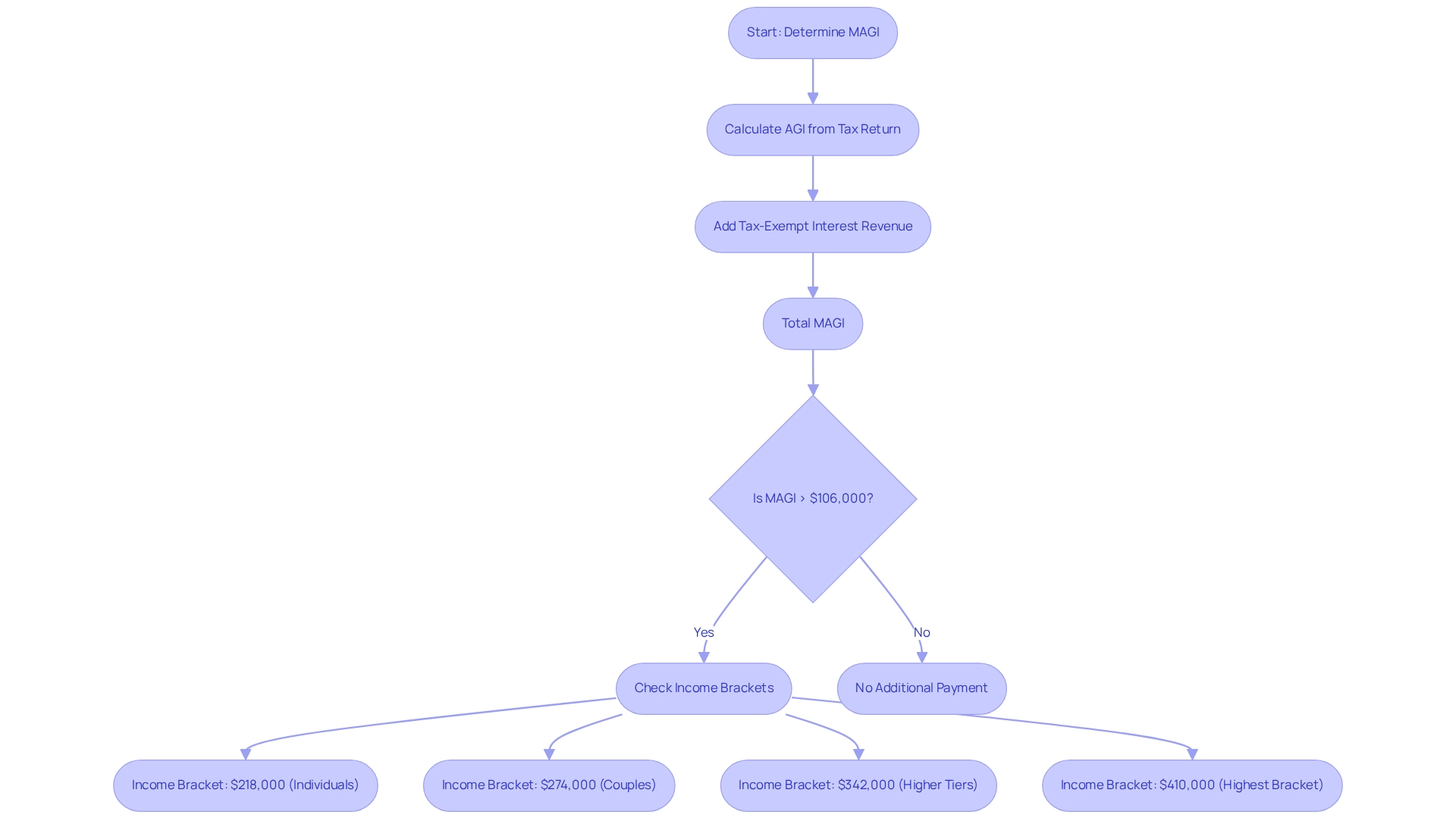

Calculate IRMAA: Understanding MAGI and Its Impact

To calculate your income-related monthly adjustment amount, begin by determining your Modified Adjusted Gross Income (MAGI). MAGI is derived from your Adjusted Gross Income (AGI) reported on your tax return, with the addition of any tax-exempt interest revenue. For example, if your AGI is $100,000 and you have $5,000 in tax-exempt interest, your MAGI would total $105,000. This MAGI is then compared against the income-related brackets to ascertain whether you owe a surcharge.

It is crucial to note that the income used for this calculation is based on your tax return from two years prior. Therefore, for the 2027 calculations, your 2025 irmaa tax return will serve as the reference point. The anticipated income-related monthly adjustment amounts for 2027 are established at:

- $218,000 for individuals

- $274,000 for couples

- $342,000 for higher tiers

- $410,000 for the highest bracket

Monitoring your earnings levels and adapting your strategies is essential, particularly as Medicare continues to evolve. Financial planners emphasize the significance of understanding MAGI in determining premium obligations, as it directly influences your costs. As David Fei, CFP®, ChFEBC℠, AIF® states, “If your earnings surpassed $106,000 (MAGI) on your 2023 taxes, then you can anticipate an additional payment on top of your original full part B premium.”

Furthermore, individuals who believe their income-related adjustment is inaccurate or who have experienced life changes affecting their earnings can apply for a reassessment using Form SSA-44 and seek a formal appeal through the Office of Medicare Hearings and Appeals. This underscores the necessity for recipients to be proactive in calculating their MAGI to avoid unexpected costs.

Implement Strategies to Manage and Reduce IRMAA Surcharges

Beneficiaries can adopt several effective strategies to manage and potentially reduce their 2025 IRMAA surcharges.

- Maximizing retirement contributions is a key tactic. Increasing contributions to tax-deferred retirement accounts, such as a 401(k) or traditional IRA, can significantly lower your Adjusted Gross Income (AGI), which in turn reduces your Modified Adjusted Gross Income (MAGI). In 2023, the average IRA contribution was $1,500, up from $1,300 in the third quarter of 2023, according to Fidelity. This benchmark serves as a guide for beneficiaries in optimizing their contributions.

- Charitable contributions also play a vital role. Participating in charitable giving can effectively decrease your taxable earnings, thereby potentially reducing your MAGI. In 2025, individuals can make qualified charitable distributions (QCDs) of up to $108,000, representing a strategic move for retirees. Notably, the percentage of Americans planning to donate on Giving Tuesday rose from 35% in 2021 to 42% in 2022, illustrating a growing trend in charitable giving that can enhance tax strategies.

- Additionally, tax-efficient withdrawals are crucial. Strategically withdrawing funds from tax-advantaged accounts can help minimize your taxable earnings. For instance, utilizing Roth IRA funds for expenses can prevent an increase in your MAGI.

- Moreover, appealing Income-Related Monthly Adjustment Amount decisions is an option. If you experience a significant life change that impacts your income, such as retirement or job loss, you can contest your determination. Submitting Form SSA-44 to the Social Security Administration (SSA) can initiate this process.

- Lastly, consulting a financial advisor can be beneficial. Collaborating with a financial consultant who specializes in health insurance can provide customized strategies tailored to your specific financial circumstances. Their expertise can assist in navigating the complexities of income-related adjustments and enhance your financial planning.

These approaches not only aim to reduce surcharges but also promote overall financial well-being. This ensures that beneficiaries can retain their Medicare coverage without facing excessive financial strain. Furthermore, with Americans’ total credit card balance reaching $1.182 trillion as of the first quarter of 2025 IRMAA, effective expense management becomes crucial for maintaining financial stability and reducing costs associated with IRMAA.

Conclusion

Navigating the intricacies of the Income-Related Monthly Adjustment Amount (IRMAA) is essential for Medicare beneficiaries, particularly with the upcoming changes in 2025. Understanding how to calculate Modified Adjusted Gross Income (MAGI) and the implications of life changes on premium assessments can significantly influence monthly expenses. The adjustments to IRMAA brackets reflect a proactive approach to ensuring that higher-income individuals contribute fairly to Medicare costs; however, they also require beneficiaries to remain vigilant and informed.

Beneficiaries can take actionable steps to manage and potentially reduce their IRMAA surcharges. By maximizing retirement contributions, engaging in charitable giving, and making strategic withdrawals, individuals can lower their MAGI and alleviate some of the financial burdens associated with Medicare premiums. Furthermore, the ability to appeal IRMAA determinations in light of life changes provides an essential safety net for those who may experience sudden shifts in income.

In summary, staying informed about IRMAA and its implications is not merely a matter of financial prudence; it is a necessary strategy for maintaining affordable Medicare coverage. By understanding the calculations, remaining aware of income thresholds, and employing effective financial strategies, beneficiaries can navigate the complexities of Medicare with greater confidence and security. Now is the time for beneficiaries to take charge of their financial planning and prepare for the potential impacts of IRMAA on their healthcare costs.