Overview

The article presents crucial insights into the changes in Medicare premiums for 2025, specifically detailing their implications for beneficiaries and healthcare providers. Notably, the Medicare premium for Part B is set to rise to $185.00, accompanied by a $2,000 out-of-pocket cap for Part D. This adjustment aims to enhance affordability for millions of individuals. It is essential for stakeholders to refine their strategies in light of these financial changes, ensuring they remain responsive to the evolving landscape of healthcare financing.

Introduction

As the landscape of Medicare evolves, the impending changes in premiums and benefits for 2025 are set to significantly impact millions of beneficiaries across the United States. With healthcare costs on the rise, understanding the nuances of these adjustments is essential for both providers and recipients. Notably, increased premiums for high-income individuals and the introduction of caps on out-of-pocket expenses for prescription drugs reflect a broader trend towards balancing affordability and access.

Stakeholders must navigate these changes with care, leveraging comprehensive data insights to adapt their strategies and ensure that patient care remains a priority amidst financial pressures. As these developments unfold, the implications for healthcare access, cost management, and overall beneficiary well-being are profound and warrant close attention.

CareSet: Comprehensive Insights into 2025 Medicare Premium Changes

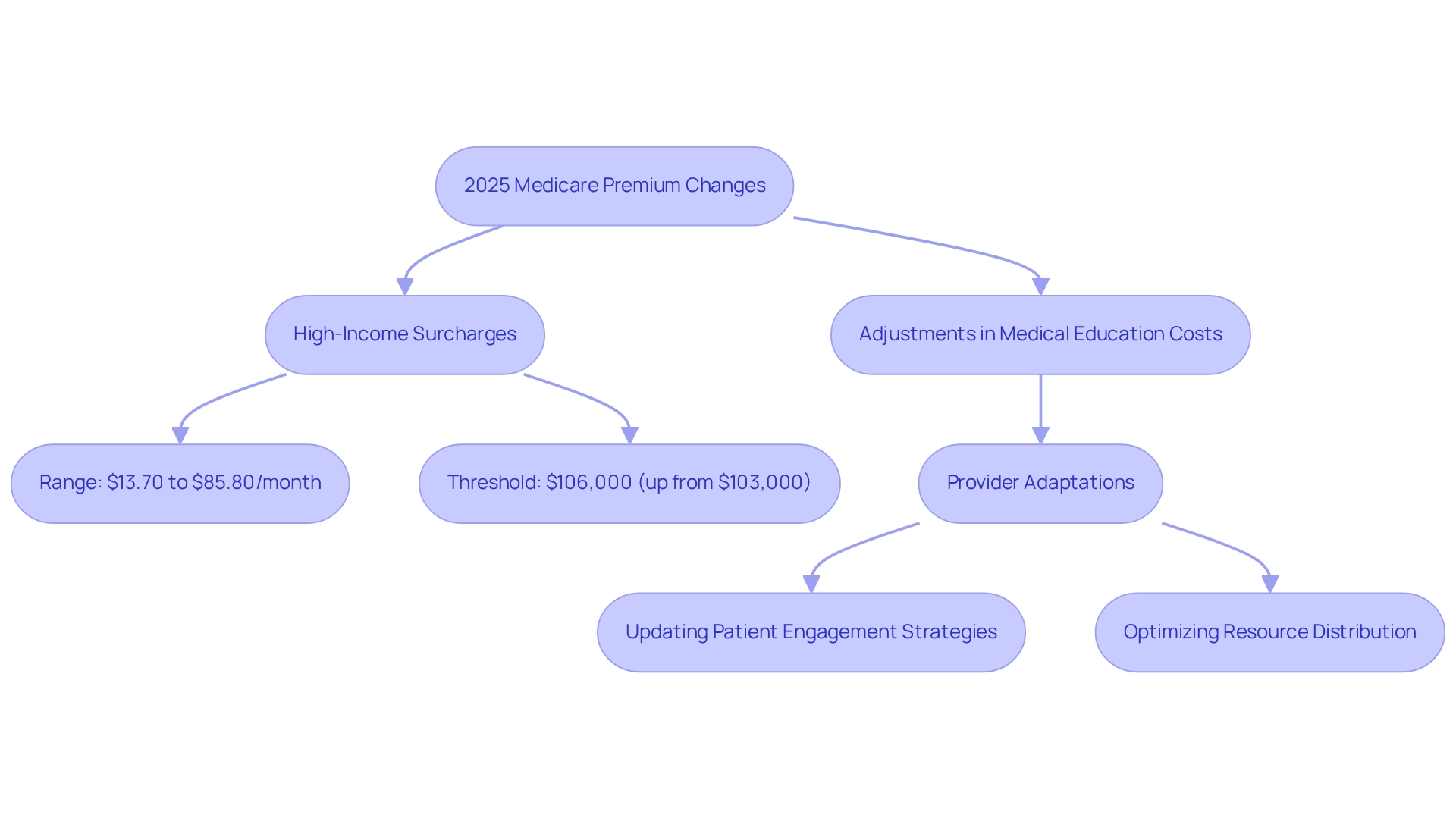

Since its inception in 2011, CareSet has established itself as a leader in healthcare data analysis, providing stakeholders with critical insights derived from over $1.1 trillion in annual claims data. As we approach 2025, it is vital for healthcare providers and beneficiaries to comprehend the implications of the 2025 Medicare premium changes, including the finalized updates to Part D benefits designed to enhance access and affordability, with high-income surcharges projected to range from $13.70 to $85.80 per month in 2025. Notably, the threshold at which the surcharge begins will rise to $106,000 for individuals, an increase from $103,000 in 2024, as noted by health insurance broker Louise Norris. This adjustment signifies a broader trend of escalating thresholds, which stakeholders must factor into their strategic planning for the 2025 Medicare premium, as CareSet’s comprehensive analysis indicates that these premium changes will profoundly impact patient care strategies.

For example, the Centers for Medicare & Medicaid Services (CMS) is implementing technical adjustments related to medical education costs, anticipated to stabilize growth rates for Medicare Advantage payments. This stabilization is essential for ensuring sufficient funding and upholding the quality of care delivered to beneficiaries. The 2025 Rate Announcement suggests that the rebasing and re-pricing impact will hinge on the finalization of the average geographic adjustment index, underscoring the necessity for vigilant monitoring.

Real-world examples demonstrate how medical providers are adapting to these changes. A regional medical system, for instance, has begun updating its patient engagement strategies to align with the new premium structures, ensuring they can continue to deliver effective care while navigating the evolving landscape. This proactive approach not only helps maintain patient satisfaction but also optimizes resource distribution in light of new financial realities.

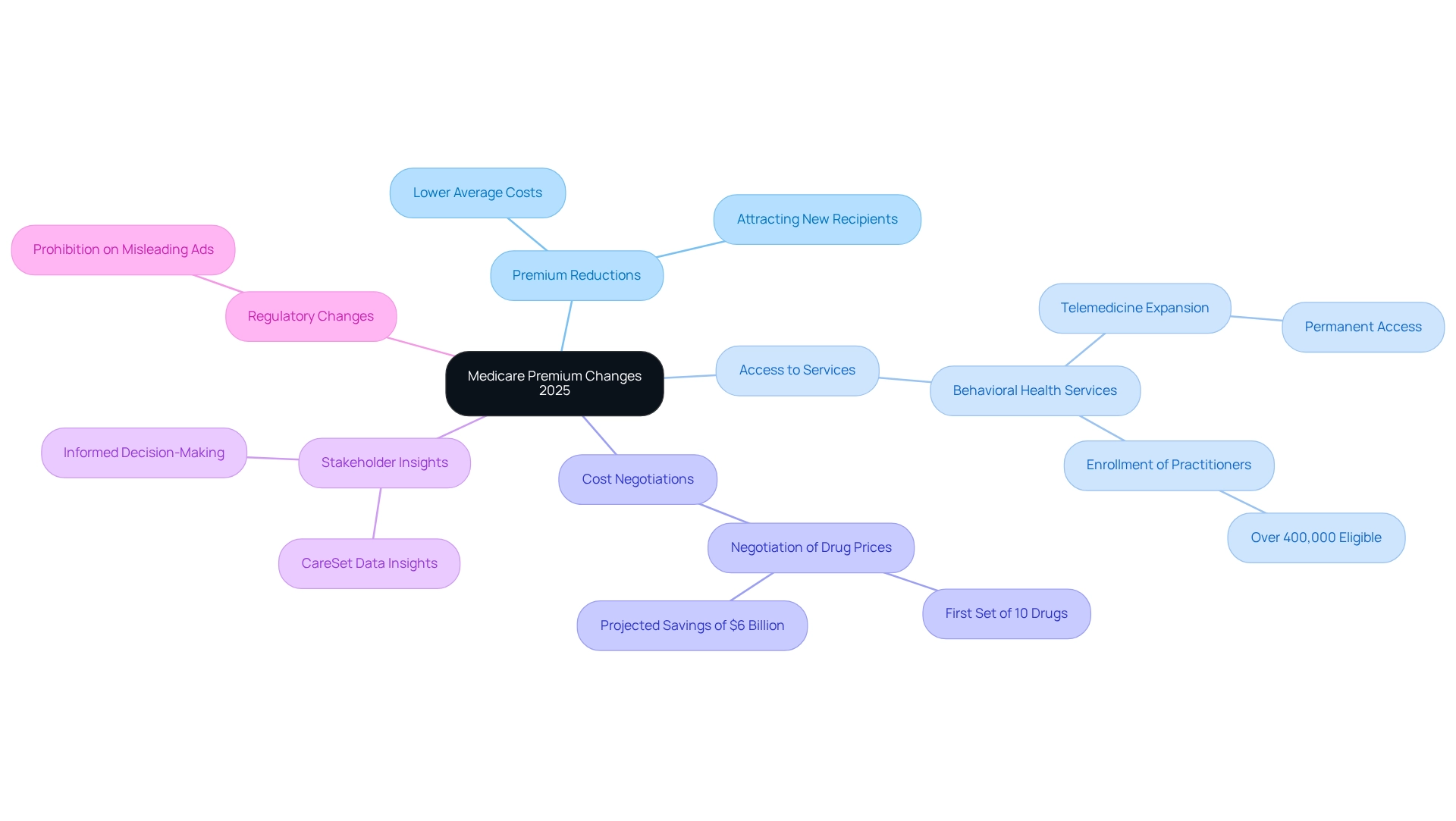

In light of these developments, expert opinions emphasize the importance of robust data analysis. Stakeholders are urged to leverage CareSet’s extensive insights, including its innovative data science products designed to assist drug launches and enhance medical strategies, to inform their plans. This ultimately aims to improve patient outcomes and optimize service delivery. As the landscape evolves, CareSet remains dedicated to providing timely and relevant insights that empower clients to make informed decisions in this dynamic environment.

CMS: Official Details on 2025 Medicare Premiums and Deductibles

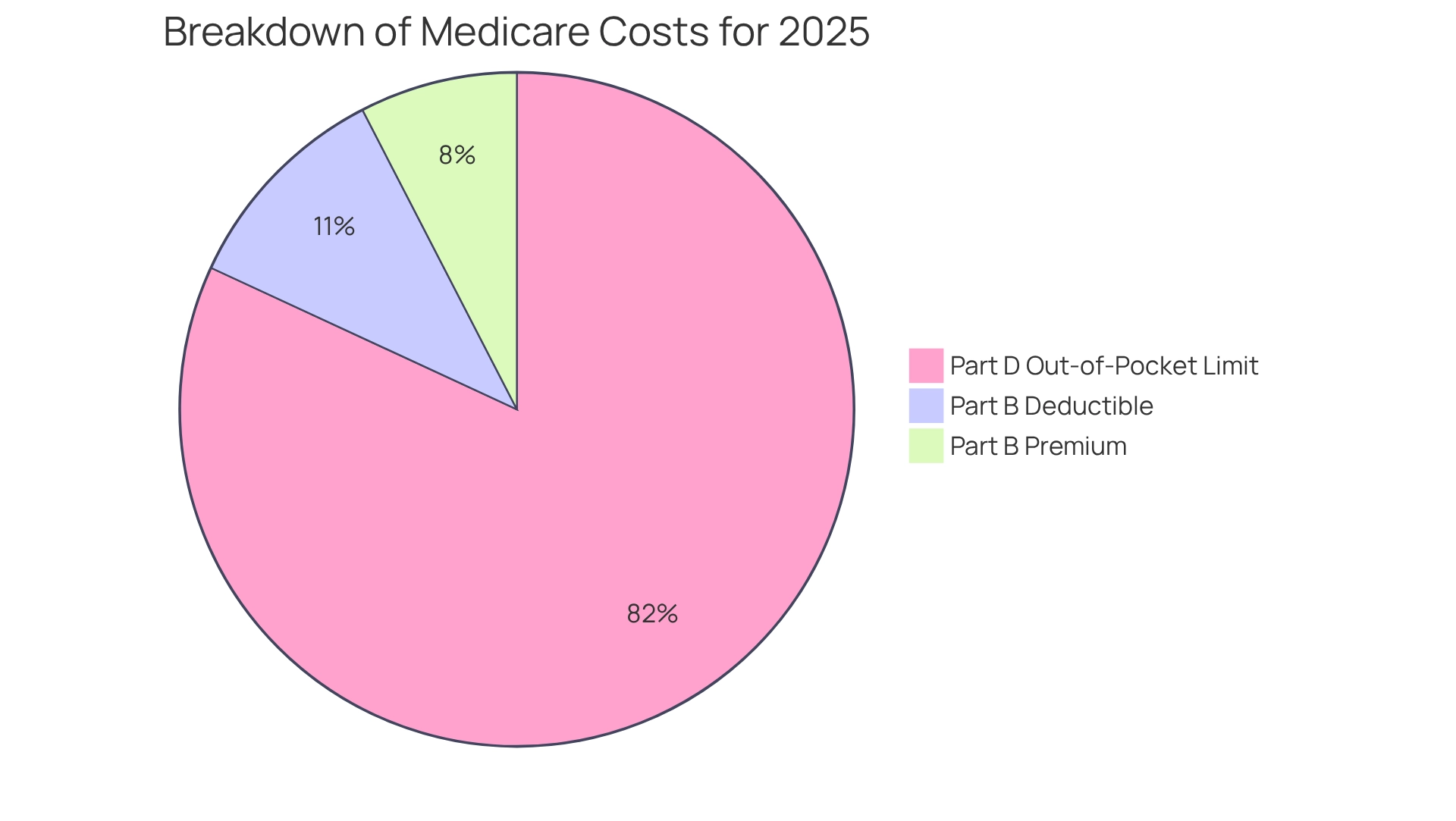

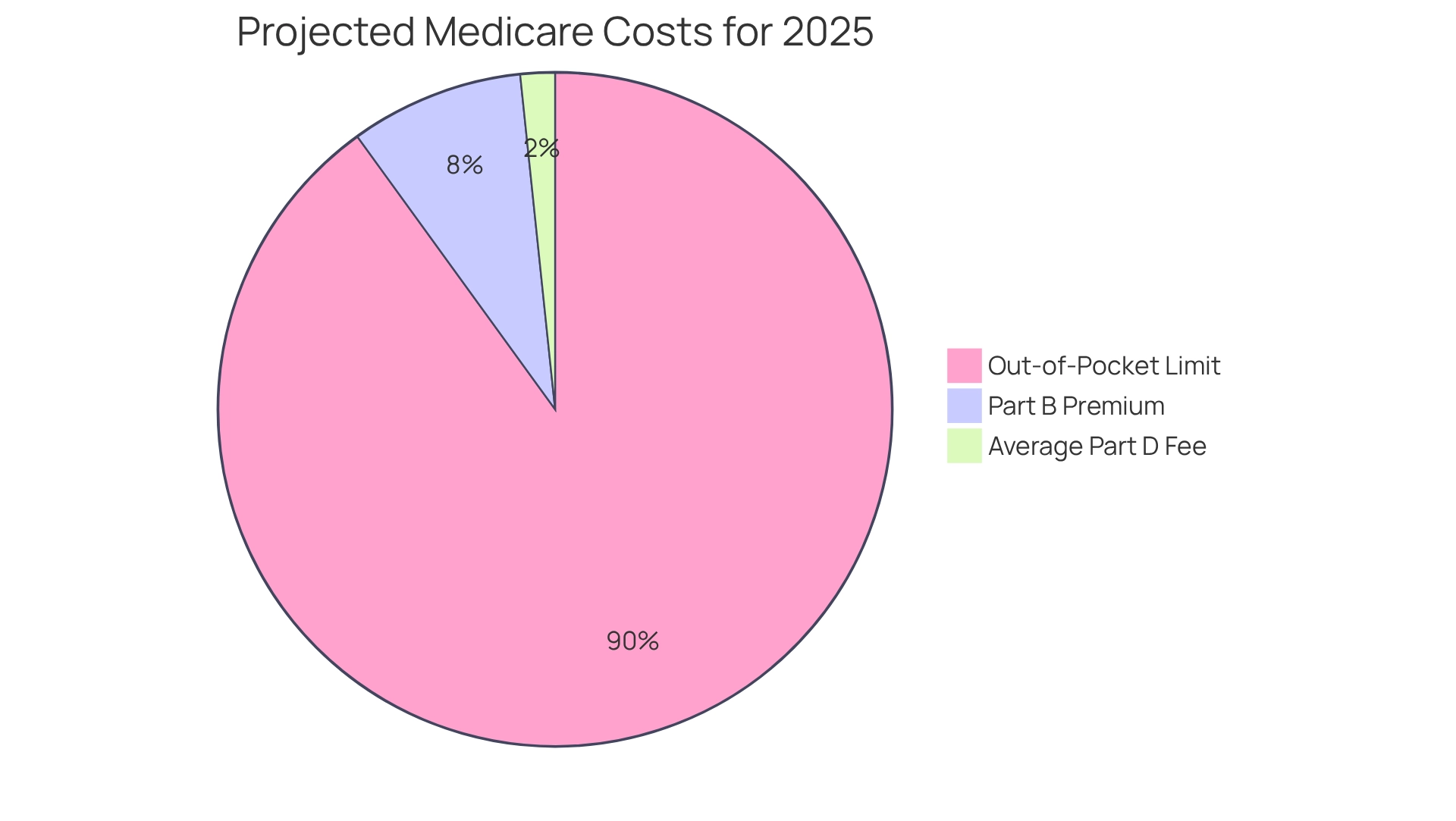

In 2025, the Centers for Medicare & Medicaid Services (CMS) announced that the 2025 Medicare premium for health insurance Part B will rise to $185.00, an increase from $174.70 in 2024. This modification underscores the continuous trend of rising medical expenses, aimed at ensuring the financial viability of the program while addressing the needs of its recipients. Additionally, the yearly deductible for Part B will increase to $257, further highlighting the financial adjustments that beneficiaries must navigate. These changes are substantial, impacting millions of Americans who rely on government health insurance for their medical needs, necessitating careful planning and consideration for both beneficiaries and medical organizations.

CareSet’s comprehensive healthcare data insights can empower stakeholders to better understand these changes and their implications. A significant alteration for Part D in the 2025 Medicare premium is the introduction of a $2,000 out-of-pocket limit on prescription drug expenses, anticipated to assist nearly 3.2 million Americans in saving money on their medications. The case study titled ‘Introduction of Out-of-Pocket Cap for Part D’ illustrates the positive impact of this change on recipients. According to the CMS, ‘Those not yet receiving Social Security benefits but paying Medicare Part B each month will need to make sure they are paying the increased tally, beginning in January.’ Furthermore, individuals who are married and submit separate tax returns may experience varying amounts based on their modified adjusted gross income.

These factors emphasize the importance of awareness and planning among recipients and medical organizations alike. CareSet’s data solutions can offer valuable insights to navigate these complexities effectively.

IRMAA: How Income Affects Your 2025 Medicare Premiums

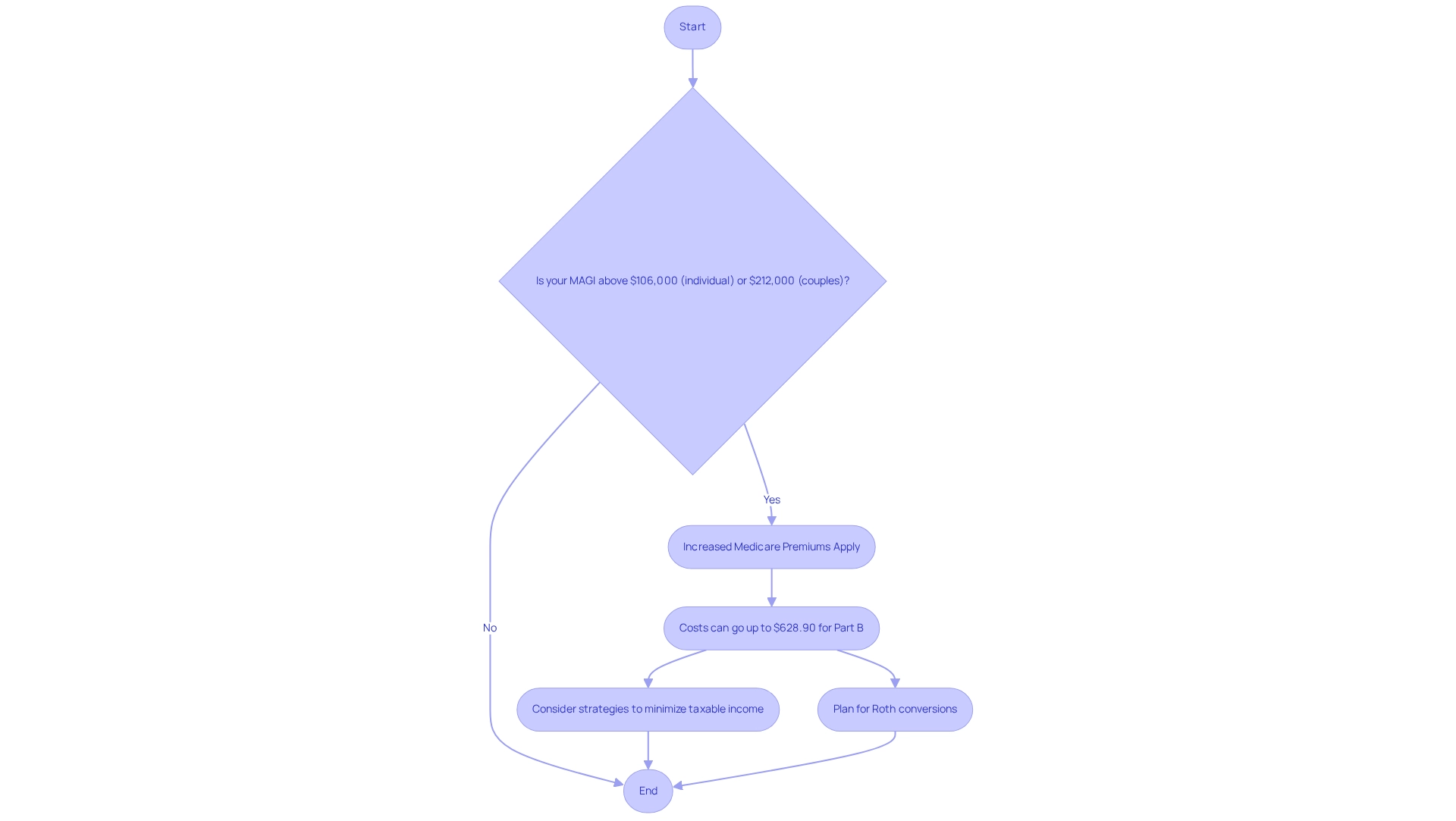

In 2025, recipients with a modified adjusted gross income (MAGI) exceeding $106,000 for individuals and $212,000 for couples will face increased 2025 Medicare premiums due to the Income-Related Monthly Adjustment Amount (IRMAA). The additional charges can vary widely, with some individuals facing monthly costs as high as $628.90 for Part B coverage. This adjustment underscores the necessity of understanding income thresholds, as recipients must anticipate these healthcare costs to effectively manage their budgets.

Real-world examples illustrate how high-income beneficiaries navigate these increased costs. For instance, some individuals strategically withdraw from retirement accounts to minimize their taxable income, thereby mitigating their IRMAA impact. This approach not only aids in managing healthcare premiums but also enhances overall financial well-being.

Beneficiaries should also be aware that the open enrollment period for the 2025 Medicare premium concludes on December 7, which is critical for making informed choices about their health coverage. The thresholds for the 2025 Medicare premium IRMAA reflect a significant shift, with income brackets adjusted to account for inflation. These changes can lead to considerable increases in healthcare costs, making it essential to remain cognizant of financial circumstances. Financial analysts emphasize the importance of strategizing around the MAGI thresholds to avert unexpected cost increases. As Donna LeValley, a retirement writer, advises, “To avoid this risk, be sure to properly time a Roth conversion; you can then avoid the IRMAA when you convert and take distributions.”

As the landscape of healthcare costs evolves, understanding the implications of IRMAA becomes vital for beneficiaries. By actively monitoring their income and seeking professional financial guidance—such as the comprehensive financial planning approach advocated by Katelyn Murray—individuals can mitigate the impacts of these changes and ensure their medical needs are met without undue financial strain.

Humana: Navigating Medicare Premium Changes for 2025

Humana has revealed that nearly one-third of its Advantage plans will lower the 2025 Medicare premium for Part B. This strategic initiative is designed to attract individuals who may be hesitant due to rising medical expenses. With the anticipated decrease in the average Advantage plan cost, recipients can look forward to more budget-friendly options that enhance their access to essential services.

In addition to premium reductions, it is crucial to note that over 400,000 behavioral health practitioners nationwide can enroll in the federal health program, underscoring the significance of access to a diverse range of medical services for recipients. As Kimberly Lankford, a contributing writer specializing in Medicare and personal finance, points out, “Medicare permanently expanded access to telemedicine for behavioral health services,” further highlighting the necessity of understanding available medical options.

As recipients navigate these changes, grasping the services offered by major providers like Humana becomes vital for making informed decisions regarding their medical coverage. Notably, healthcare providers are increasingly leveraging premium reductions to attract participants, fostering a competitive landscape that prioritizes affordability and access. The recent prohibition on Medicare Advantage advertisements referencing benefits not available in the region where the ad is displayed stresses the importance of recipients being well-informed.

In light of these developments, recipients are encouraged to investigate the specific plans available to them, as the availability of benefits may differ based on the plan and the subgroup of recipients. This proactive approach will empower them to enhance their medical choices related to the 2025 Medicare premium. Furthermore, with the health program now authorized to negotiate medication costs with pharmaceutical companies, starting with a group of 10 high-cost drugs, enrollees can anticipate substantial savings, estimated at around $6 billion, which will improve the affordability of essential medications.

To further empower stakeholders, CareSet’s comprehensive healthcare data insights can provide valuable information on how these cost changes may impact beneficiaries and the overall healthcare landscape. By utilizing these insights, stakeholders can make more informed decisions and effectively navigate the evolving healthcare environment.

Medical News Today: Breakdown of 2025 Medicare Costs

In 2025, the Medicare premium for the typical Part B charge is projected to rise to $185, while the average national base fee for Part D will be around $36.78. This figure represents an average and may vary based on coverage, deductibles, and out-of-pocket expenses. A significant advancement is the implementation of a limit on yearly out-of-pocket medication expenses, capped at $2,000. This measure aims to ease financial burdens on recipients and demonstrates a broader commitment to controlling healthcare costs while ensuring access to vital services.

These modifications are part of ongoing efforts to enhance affordability within the healthcare program. With over 95% of Advantage plans currently offering additional coverage for dental, hearing, vision, and fitness services, recipients are likely to experience improved overall care choices. The impact of these cost changes is substantial, particularly in light of the recent expansion of the Drug Price Negotiation Program under the 2022 Inflation Reduction Act. In January 2024, 15 additional medications were incorporated into this program, allowing the Centers for Medicaid Services (CMS) to negotiate prices for specific drugs. The first set of negotiated prices is expected to yield significant savings for patients starting in 2027. Consequently, individuals receiving Medicare services may experience lower expenses for additional medications, further enhancing their access to essential treatments.

Healthcare economists emphasize that these premium modifications and the out-of-pocket limits are crucial for ensuring that recipients can afford their medications without compromising their financial stability. As noted in the Social Security announcement on October 10, 2024, these financial adjustments are essential for maintaining the purchasing power of beneficiaries. The strategic modifications in medical expenses for the 2025 Medicare premium not only aim to enhance patient access but also reflect a commitment to long-term sustainability in health financing. For pharmaceutical companies, understanding these changes is vital for developing effective market access strategies that align with the evolving healthcare landscape. CareSet’s extensive healthcare data insights can empower pharmaceutical firms to navigate these changes efficiently, ensuring they remain competitive and responsive to the needs of Medicare recipients.

SSA: Understanding Higher Premiums for High-Income Beneficiaries in 2025

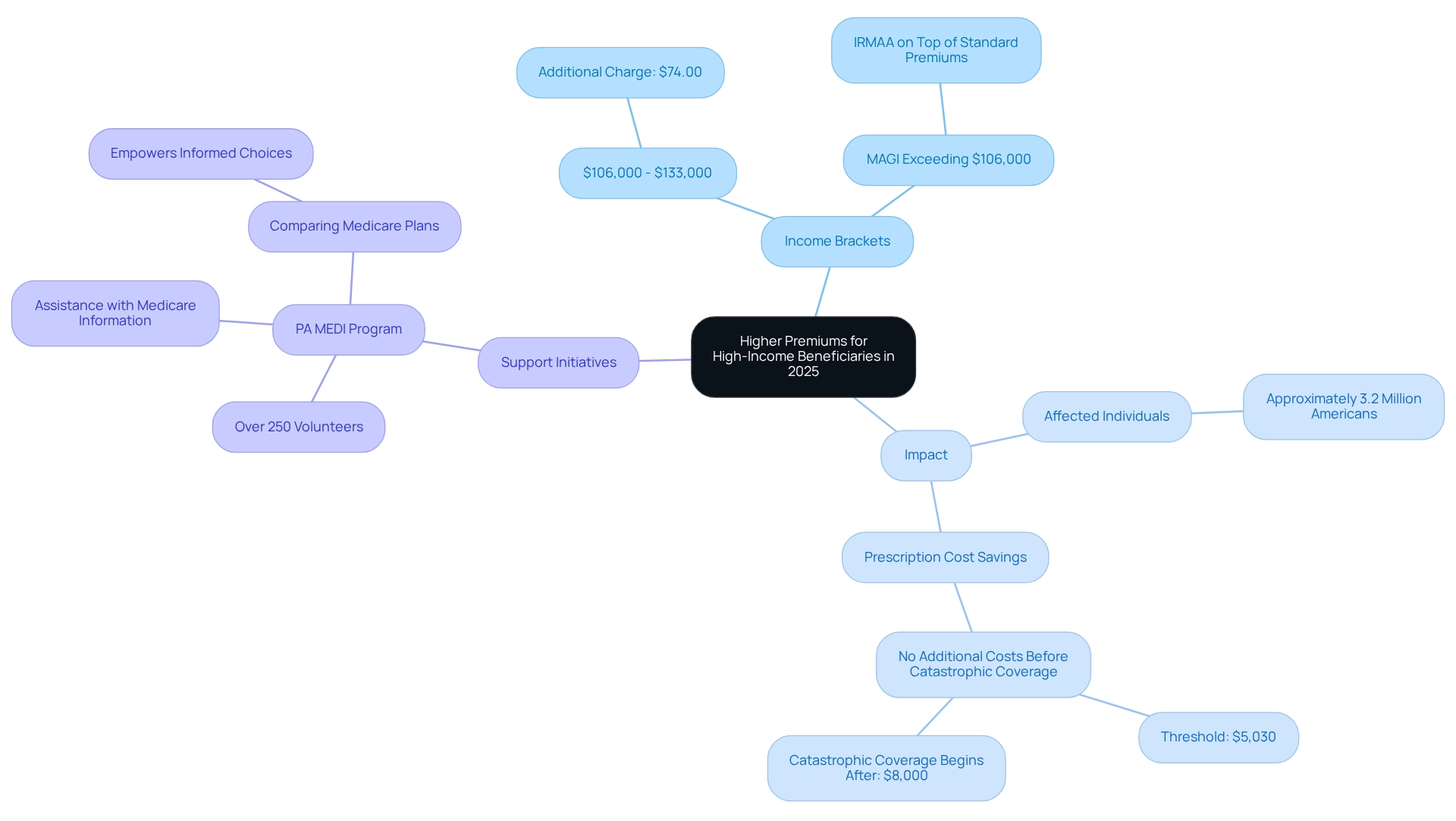

The Social Security Administration (SSA) has announced that recipients with higher incomes will experience changes to their Part B charges in 2025. Specifically, individuals earning between $106,000 and $133,000 will incur an additional charge of $74.00, in addition to the standard fee. This tiered structure is designed to ensure that those with greater financial means contribute more to the healthcare program, thereby supporting its long-term viability.

This adjustment is part of a broader strategy aimed at alleviating the financial burden on lower-income recipients while ensuring that higher-income individuals pay their fair share. The tiered premium system is expected to impact nearly 3.2 million Americans, assisting them in reducing prescription costs as they navigate their medical options. Notably, individuals who have spent $5,030 on prescriptions will not incur additional costs before reaching catastrophic coverage, which begins after $8,000 has been expended.

Moreover, initiatives such as PA MEDI, which boasts over 250 volunteers statewide assisting the public with healthcare information, play a critical role during the Annual Open Enrollment Period. By helping individuals compare Advantage and Part D prescription drug plans, PA MEDI empowers recipients to make informed choices tailored to their healthcare needs, potentially leading to significant cost savings and improved access to essential medications. A case study illustrates how PA MEDI aids beneficiaries in evaluating options, underscoring the importance of informed decision-making during the enrollment phase.

As the SSA continues to refine its approach to healthcare costs, insights from experts highlight the necessity of understanding how these changes affect high-income beneficiaries. For instance, David Fei, CFP®, ChFEBC℠, AIF®, indicates that those whose Modified Adjusted Gross Income (MAGI) exceeds $106,000 can expect to pay additional Income-Related Monthly Adjustment Amounts (IRMAA) on top of their standard premiums. This further emphasizes the need for strategic financial planning regarding healthcare coverage. Additionally, leveraging comprehensive healthcare data solutions from CareSet, which encompasses insights from over 62 million beneficiaries and 6 million providers, can empower healthcare stakeholders to effectively navigate these changes. By grasping the broader implications of price adjustments and patient demographics, pharmaceutical market access managers can formulate informed strategies that enhance patient access to necessary medications throughout the pharmaceutical lifecycle. CareSet’s extensive claims data, totaling over $900 billion annually, provides vital insights into treatment trends and provider connections, enabling stakeholders to make data-informed decisions that align with the evolving landscape of healthcare.

AHA: Impact of 2025 Medicare Premium Changes on Healthcare Access

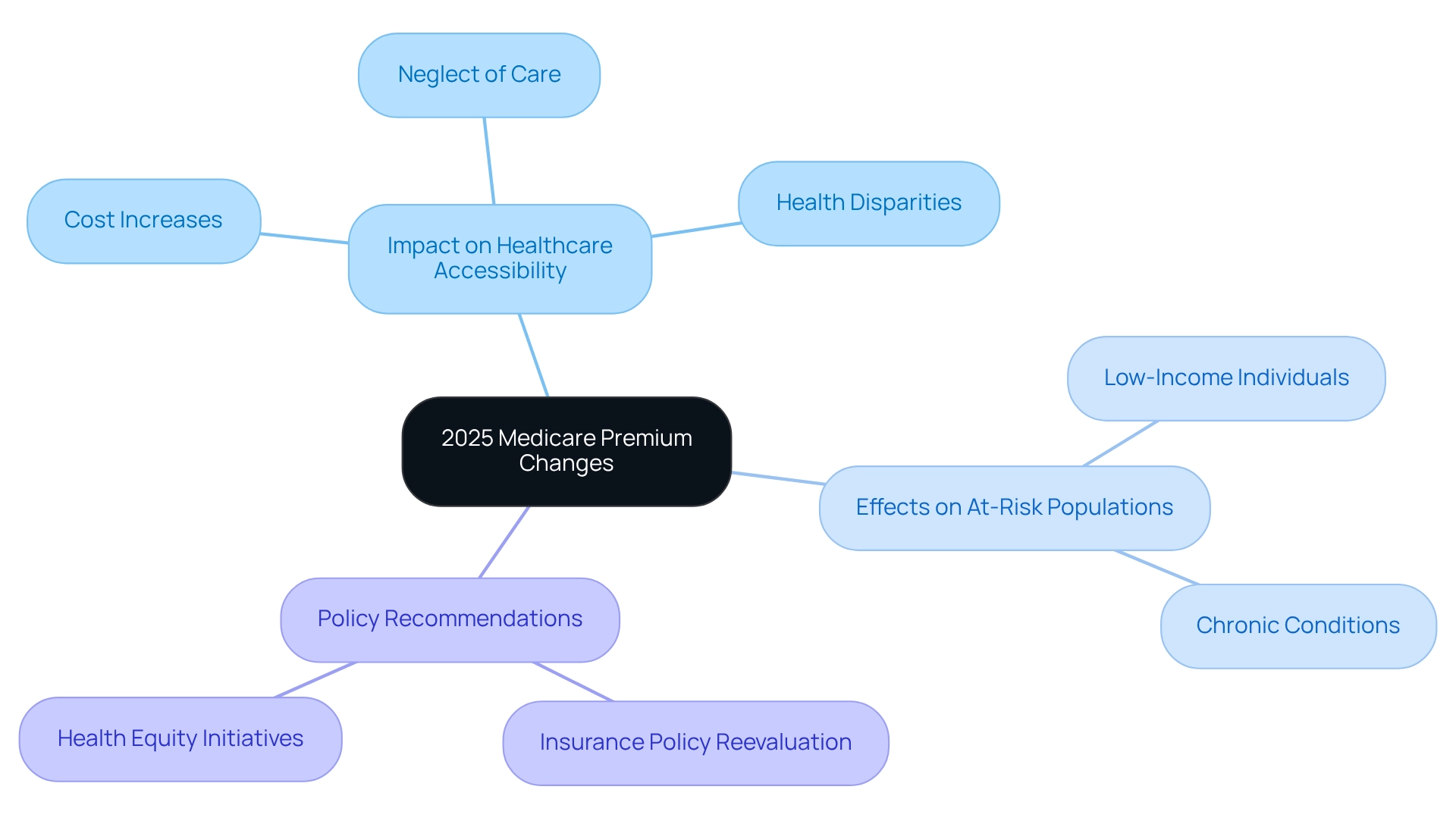

The American Hospital Association (AHA) has articulated significant concerns regarding the impact of escalating Medicare costs on healthcare accessibility for at-risk populations. With the 2025 Medicare premium costs projected to rise, many beneficiaries may find themselves unable to afford essential medical services, leading to a troubling trend of care neglect due to financial constraints. This scenario is particularly alarming as it threatens to exacerbate existing health disparities, underscoring the urgent need for policymakers to consider the broader implications of these cost increases.

In a recent report, the AHA emphasized that rising expenses could disproportionately affect low-income individuals and those with chronic conditions, who already encounter barriers to accessing care. Real-world examples demonstrate how these increasing costs can dissuade patients from pursuing necessary treatments, ultimately jeopardizing their health outcomes. The AHA warns that without intervention, the mounting financial burden of insurance premiums, especially the 2025 Medicare premium, could lead to a significant decline in access to medical services, particularly among the most vulnerable populations. Experts from the AHA have called for a reevaluation of insurance policies to ensure that rising premiums do not further entrench health inequalities. They advocate for initiatives that prioritize equitable access to care, aligning with overarching public health objectives. As highlighted by the Center for American Progress, the Hospital Insurance Trust Fund is projected to face bankruptcy by 2036 unless legislative measures are enacted, amplifying the urgency of the AHA’s call for swift action. Furthermore, the ASCQR Program’s focus on health equity and social determinants illustrates the evolving landscape of Medicare policies and their effects on access to medical services.

In this context, CareSet’s extensive medical data insights can significantly empower healthcare stakeholders. By leveraging insights from over 62 million recipients and 6 million providers, CareSet enables pharmaceutical companies to engage more effectively with healthcare practitioners, particularly concerning treatment options such as the 4th line of therapy for conditions like Gastrointestinal Stromal Tumor (GIST). This data-driven approach not only enhances patient care but also supports business success in navigating the complexities of healthcare. The AHA contends that these adjustments align with the goals of the Cancer Moonshot, aiming to improve access to cancer-related care, thereby emphasizing the importance of safeguarding healthcare access for all individuals, especially those most susceptible to the adverse effects of rising costs.

CNY Homepage: Implications of Rising Medicare Premiums in 2025

Rising healthcare costs, particularly the 2025 Medicare premium, are generating significant concern among local recipients, especially those on fixed incomes. Many individuals express anxiety regarding how these increases will affect their ability to afford essential medications and treatments. Local advocacy organizations are actively urging lawmakers to consider these consequences when making adjustments to the healthcare program. Specialists emphasize that the financial strain from heightened costs could exacerbate existing challenges for at-risk groups, underscoring the necessity for stakeholders to advocate for more affordable medical solutions.

CareSet’s comprehensive Medicare data insights empower healthcare stakeholders to navigate these challenges effectively. By analyzing treatment pathways and provider interventions through frameworks like ICD, NDC, and HCPCS, stakeholders can attain a clearer understanding of patient journeys and the financial implications of escalating costs. Critical questions arise, such as:

- Which diseases do providers diagnose and treat?

- How do patients transition from diagnosis to treatment?

This data-driven approach is vital for formulating strategies that enhance patient care and ensure business success.

The No Surprises Act, effective since 2022, aims to provide patient protections that may alleviate some financial burdens; however, many recipients remain apprehensive about the implications of rising costs. As healthcare industry consultant Jim Hammond notes, “This tactic is considered surprise billing, in which hospitals can charge for an out-of-network service such as a cast or if a patient visits a facility owned by a hospital.” This highlights the complexities individuals face with increasing costs and the potential for unforeseen expenses. The implications of the No Surprises Act are substantial, as it seeks to mitigate these unexpected costs, yet its effectiveness remains uncertain in light of the rising 2025 Medicare premium.

Furthermore, case studies indicate that community reactions are evolving, with organizations mobilizing to address these issues through educational programs and direct assistance for those affected. For example, hospitals are increasingly leveraging automation to help patients manage insurance eligibility and estimate payments, thereby improving collections and enhancing the patient experience. The AKASA platform exemplifies how technology can aid in revenue cycle management, potentially alleviating some pressures for both medical providers and patients.

The unified voice of advocacy organizations underscores the critical need for changes that prioritize healthcare affordability, ensuring that recipients can maintain access to essential medical services without excessive financial strain. By leveraging insights from CareSet’s data on over 62 million beneficiaries and 6 million providers, stakeholders can more effectively advocate for solutions that address these pressing issues.

LACERS: Key Information on Medicare Part B Premiums for 2025

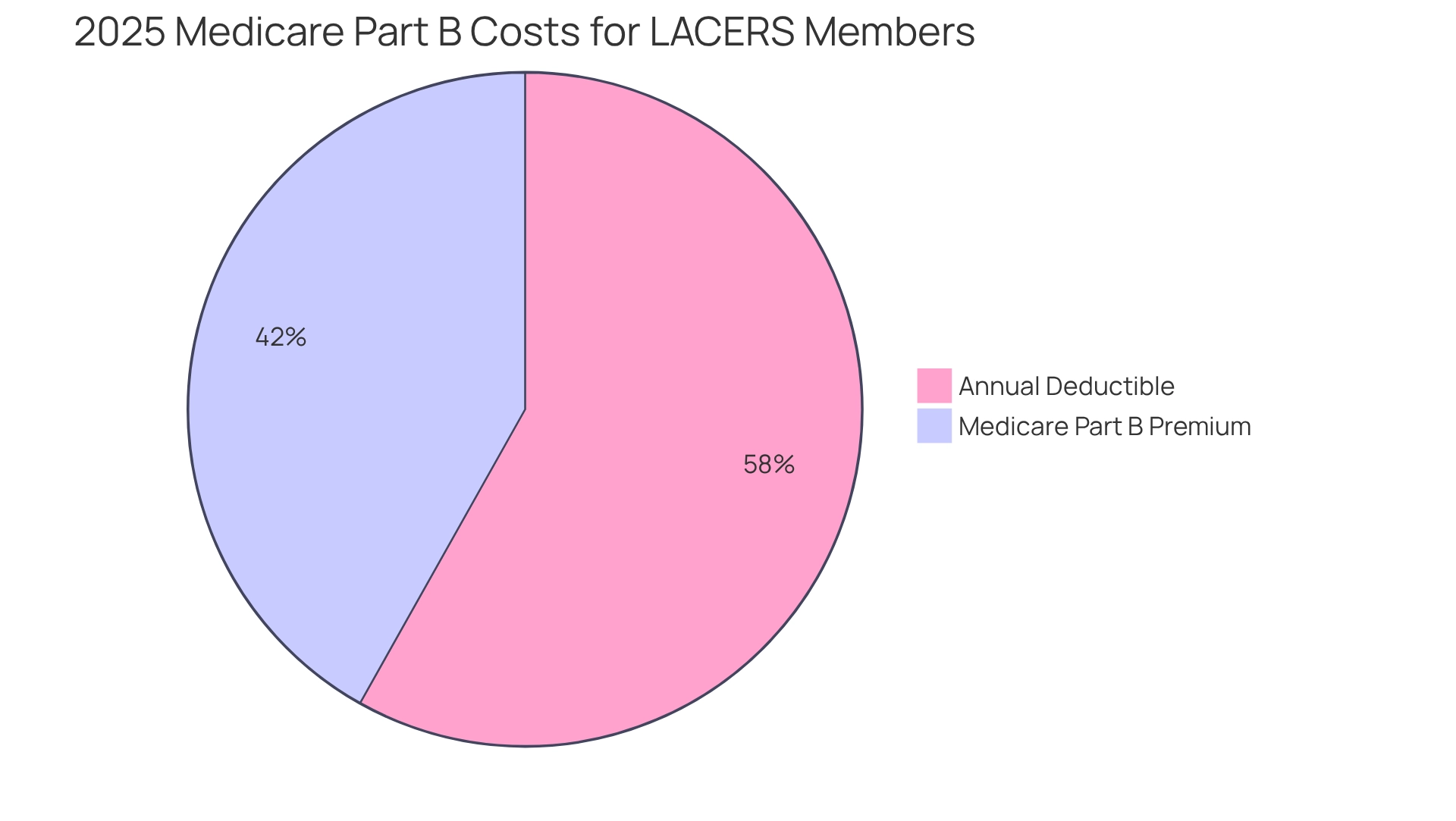

For LACERS members, the 2025 Medicare premium for regular health insurance Part B is set to be $185.00, accompanied by an annual deductible of $257. Understanding these costs is crucial for retirees as they plan their budgets and manage medical expenses.

Utilizing CareSet’s extensive data solutions allows stakeholders to gain insights into how these costs impact patient treatment pathways and overall health strategies.

LACERS is dedicated to equipping its members with the necessary resources to effectively navigate these changes.

YouStayWealthy: Financial Strategies for Managing 2025 Medicare Premium Changes

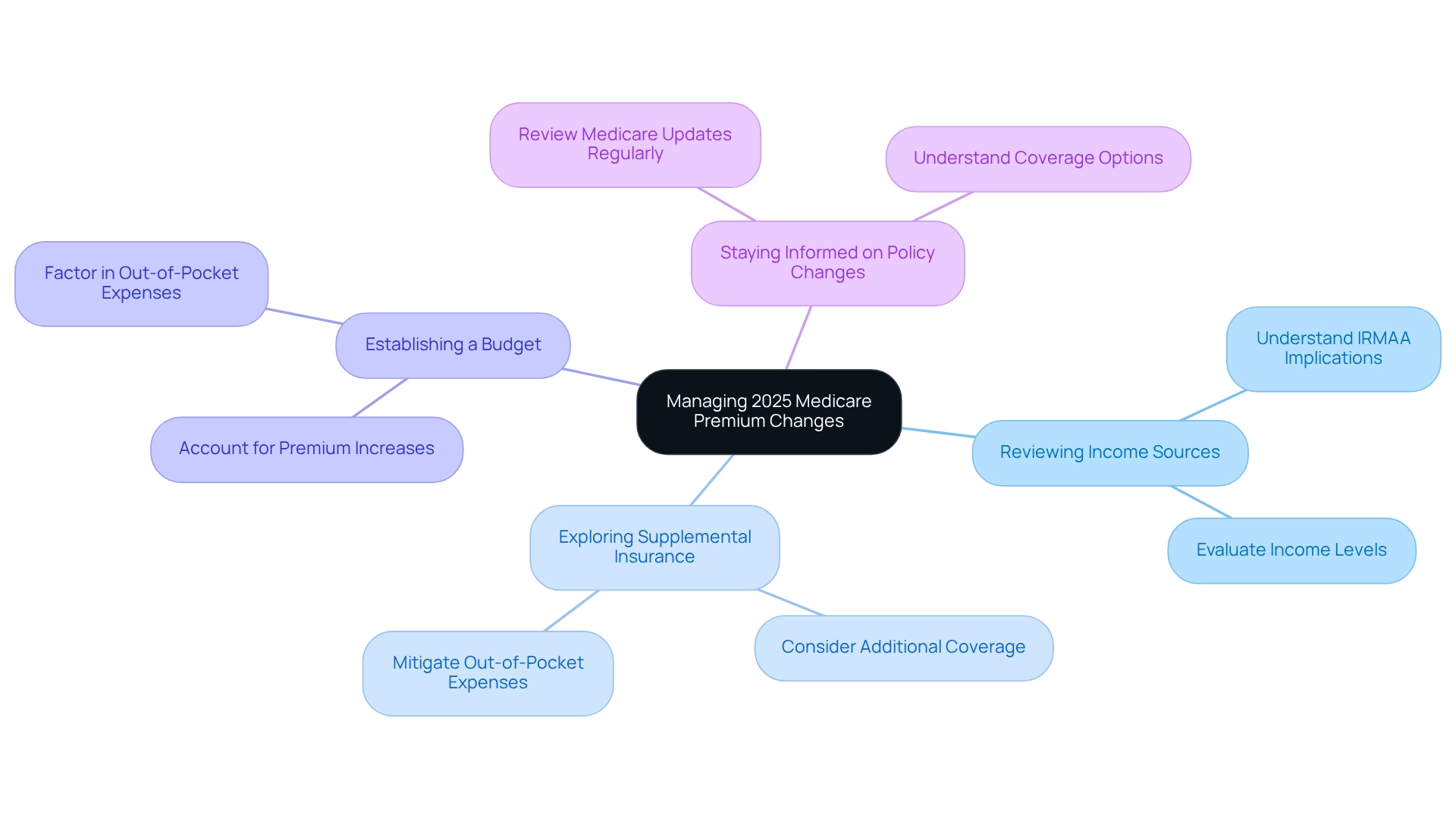

To effectively manage the increasing healthcare costs in 2025, including the 2025 Medicare premium, beneficiaries should adopt a multifaceted approach to financial management. Key strategies include:

- Reviewing Income Sources: Understanding the implications of the Income-Related Monthly Adjustment Amount (IRMAA) is crucial. Beneficiaries must evaluate their income levels, as greater earnings can lead to elevated costs that affect overall medical expenses.

- Exploring Supplemental Insurance Options: Considering supplemental insurance plans can provide additional coverage and potentially mitigate out-of-pocket expenses. These plans assist in covering costs not included in standard medical insurance, creating a safety net against rising medical costs.

- Establishing a budget that accounts for expected increases in health insurance premiums, such as the 2025 Medicare premium, is essential. Beneficiaries should factor in potential out-of-pocket expenses and adjust their financial strategies accordingly to ensure they can meet their medical needs.

- Staying Informed on Medicare Policy Changes: Keeping abreast of changes in Medicare policies is vital for making informed decisions. Beneficiaries ought to regularly review updates regarding the 2025 Medicare premium, coverage options, and premium adjustments to optimize their healthcare strategies.

Real-world examples illustrate how beneficiaries are adapting to these rising costs. A case study from the District of Columbia emphasizes the financial effects of policy changes on Part D participants, indicating a potential rise in out-of-pocket costs amounting to $6.1 million due to the repeal of the IRA. This underscores the importance of proactive financial planning in response to evolving healthcare landscapes. Furthermore, the first 10 drugs selected for negotiation will have their maximum fair prices published by September 2024, taking effect in January 2026, significantly impacting recipients’ budgeting strategies.

As Nicole Rapfogel, a former Senior Policy Analyst in Health Policy, remarked, “This perilous agenda prioritizes Big Pharma’s profits at the cost of millions of Part D enrollees who, if Project 2025 is implemented, may once again need to spend more out-of-pocket for the medications they require, obstructing both access and affordability.” This statement emphasizes the urgency of proactive financial planning.

By implementing these strategies, beneficiaries can better manage their healthcare expenses and ensure access to necessary services, ultimately enhancing their overall financial well-being in light of the rising 2025 Medicare premium.

Conclusion

Rising Medicare premiums in 2025 are set to have significant implications for millions of beneficiaries as they navigate increased costs and changes in coverage. The adjustments to both Medicare Part B and Part D, which include the introduction of out-of-pocket caps and income-related surcharges, highlight the necessity of understanding the financial landscape of healthcare. Stakeholders, including healthcare providers and beneficiaries, must remain vigilant in adapting to these changes to ensure continued access to essential services.

The proactive strategies outlined throughout this article—such as reviewing income sources, exploring supplemental insurance options, and maintaining awareness of policy changes—are crucial for beneficiaries to manage their healthcare expenses effectively. By leveraging resources like CareSet’s comprehensive data insights, stakeholders can make informed decisions that align with the evolving Medicare landscape, ultimately optimizing care delivery and improving patient outcomes.

As the healthcare environment continues to evolve, the emphasis on affordability and access remains paramount. Policymakers and industry leaders must prioritize initiatives that alleviate the financial burden on vulnerable populations, ensuring that Medicare remains a viable option for all beneficiaries. By fostering a collaborative approach and utilizing data-driven insights, it is possible to navigate these changes and enhance the overall quality of care within the Medicare system. The time for action is now; the implications of these premium adjustments will shape the future of healthcare access for millions.