Overview

The article presents a compelling exploration of effective claims management strategies in healthcare, underscoring the critical role of data-driven approaches and advanced technologies. By leveraging comprehensive Medicare data and innovative solutions, organizations can significantly enhance operational efficiency, accuracy, and patient outcomes. This assertion is supported by a variety of case studies and industry trends discussed throughout the content, illustrating the tangible benefits of these strategies.

Utilizing Medicare data not only improves operational metrics but also fosters a deeper understanding of patient needs, ultimately driving better healthcare delivery. The significance of these insights cannot be overstated, as they form the foundation for informed decision-making and strategic planning in the healthcare sector. As evidenced by various case studies, organizations that embrace these advanced technologies see marked improvements in their operational capabilities and patient satisfaction.

In conclusion, healthcare providers are encouraged to engage with CareSet’s insights to explore how they can implement these data-driven strategies effectively. By adopting a proactive approach to claims management, they can navigate the complexities of the healthcare landscape with greater confidence and success.

Introduction

In the rapidly evolving landscape of healthcare, effective claims management has emerged as a critical component for success. Healthcare organizations are under increasing pressure to optimize operations while upholding high standards of patient care. In this context, leveraging comprehensive data insights is more essential than ever.

This article explores innovative solutions provided by industry leaders, illustrating how advanced analytics, automation, and tailored strategies can revolutionize claims management processes. By enhancing accuracy and compliance, streamlining workflows, and mitigating risks, the insights presented here illuminate the pathway toward improved efficiency and superior patient outcomes within the healthcare sector.

CareSet: Leverage Comprehensive Medicare Data for Claims Management Success

CareSet excels in extracting and interpreting intricate Medicare reimbursement information, equipping medical organizations with essential insights to enhance their oversight processes. With access to over $1.1 trillion in yearly records, CareSet identifies treatment trends and provider networks, enabling organizations to make informed choices that improve patient care and optimize operations. This thorough examination not only allows for improved targeting of medical providers but also enhances the comprehension of patient experiences, which are essential for efficient claims management oversight.

The medical claims management market is anticipated to expand at a CAGR of 5.5% from 2023 to 2032, underscoring the growing significance of data-driven approaches in this field. Recent trends indicate that the Trump Administration is finalizing regulations for 2026 that will significantly impact consumer protections in Medicare Advantage (MA) plans, further emphasizing the necessity for precise information analysis. Additionally, the Centers for Medicare & Medicaid Services (CMS) has initiated reviews of television commercials for Medicare Advantage plans to ensure compliance with new marketing rules, illustrating the evolving regulatory landscape.

A notable case study highlights the expansion of dental, hearing, and vision benefits in Medicare Advantage plans, which are typically not covered by traditional Medicare. This transition not only renders MA plans more appealing to recipients but also indicates that similar expansions under traditional Medicare could enhance access to vital services for all recipients, emphasizing the necessity for medical organizations to adjust their reimbursement strategies accordingly.

By utilizing extensive Medicare information, which includes insights from over 62 million recipients and 6 million providers, medical organizations can implement effective reimbursement strategies that enhance efficiency and patient outcomes. CareSet’s groundbreaking analytics solutions further improve drug launch strategies and medical insights, equipping stakeholders with the resources needed to navigate the intricacies of reimbursement in the medical field. Specialist insights, including those from Trishita Deb, a market research and consulting professional with over 8 years of experience, emphasize the significance of analyzing assertions in improving processes related to claims and enhancing overall patient care.

Fleet Response: Optimize Fleet Claims Management with Tailored Solutions

CareSet offers tailored management solutions specifically designed to meet the unique challenges faced by organizations in the medical field. By employing customized approaches, such as proactive information analysis and efficient processing of requests, CareSet significantly reduces delays and lowers costs associated with medical claims. This method not only ensures that requests are handled promptly and efficiently but also allows medical managers to concentrate on critical operational tasks while upholding high service standards.

A notable case study, ‘PUTTING PATIENTS FIRST: Unlocking Medicare Information to Empower HCP,’ illustrates how CareSet’s extensive Medicare insights have empowered oncology treatment manufacturers to enhance their interactions with medical providers regarding late-stage treatment options, including Qinlock for Gastrointestinal Stromal Tumor (GIST). This data-driven approach has proven essential in improving provider interactions and optimizing treatment pathways.

Statistics reveal that organizations utilizing advanced medical billing solutions experience significant improvements; for instance, studies indicate that 30% of medical providers reported fewer denial occurrences after implementing comprehensive data analytics tools. Furthermore, effective claims management strategies for handling requests have been linked to improved patient outcomes, with 25% of medical organizations noting increased patient satisfaction due to timely processing of claims management requests. Industry leaders emphasize the importance of minimizing costs related to claims management through customized solutions. By adopting innovative strategies for request management, organizations can enhance their operations, leading to better resource allocation and heightened overall efficiency. The latest advancements in healthcare management for 2025 highlight the integration of technology that enhances data accuracy and processing speed, ultimately benefiting healthcare organizations by providing actionable insights and fostering a culture of accountability.

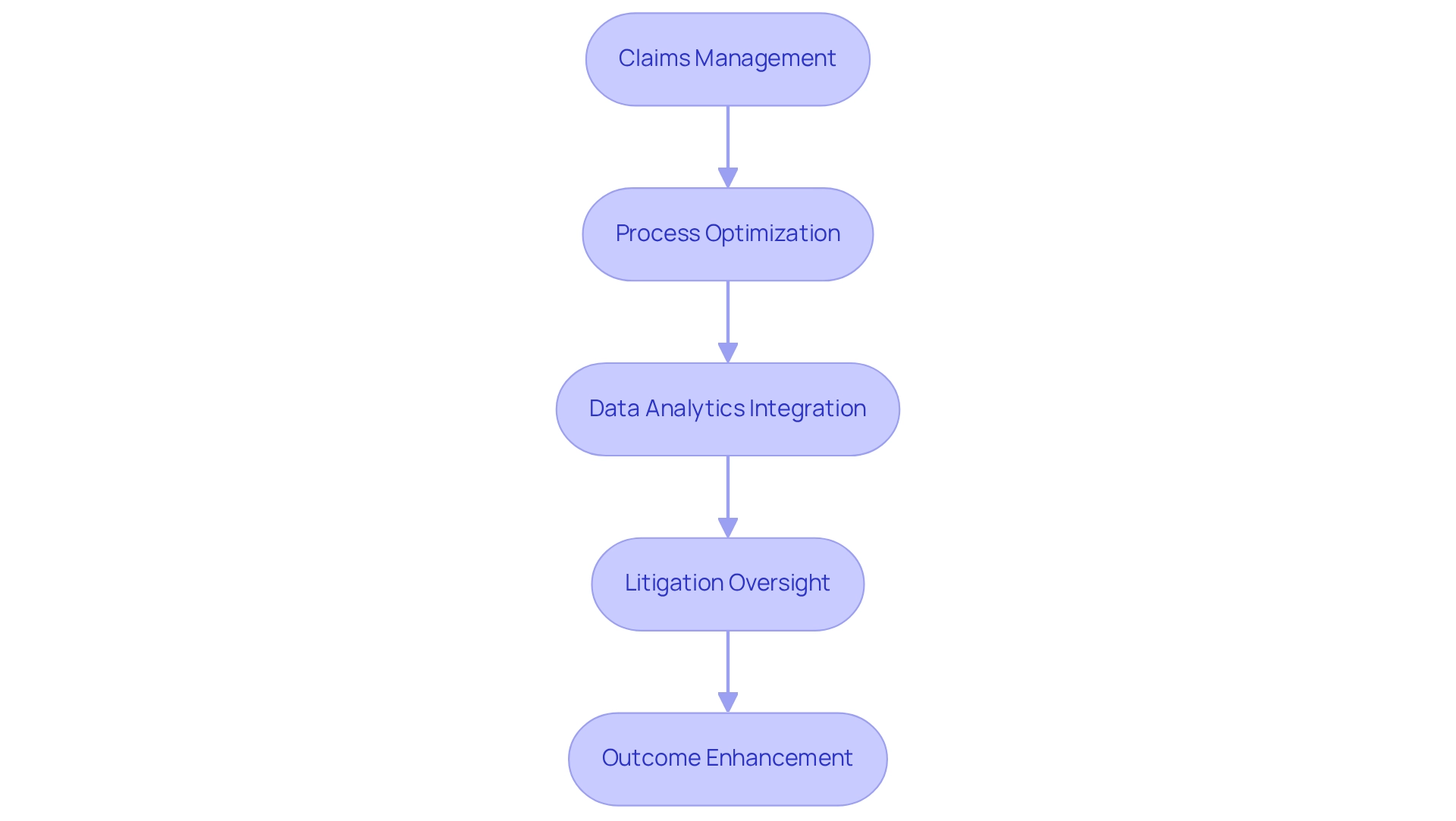

ClaimDeck: Streamline Claims with Process-Driven Litigation Management

ClaimDeck offers a robust platform for claims management through a process-oriented approach. By leveraging advanced technology and analytics, ClaimDeck empowers organizations to optimize their processes, significantly reducing legal costs while enhancing case outcomes. This structured methodology not only boosts efficiency but also facilitates improved monitoring and administration of requests, enabling organizations to respond swiftly to any challenges that may arise during litigation.

Focusing on litigation oversight and analytics provides a competitive edge in the insurance sector, as companies can dramatically enhance their case management capabilities, with adjusters now overseeing up to 120 cases each, compared to just 40 previously. This efficiency is further supported by insights from industry experts, including Sajid Kadri, who notes that leading carriers are integrating legal information to develop predictive models that inform decisions regarding counsel selection and case budgeting. Such innovations underscore the transformative impact of technology on claims management, ultimately leading to better outcomes and streamlined processes.

Integrating CareSet’s extensive Medicare information insights can further empower stakeholders in the medical field, particularly pharmaceutical and biotech firms, by providing actionable intelligence derived from over 62 million beneficiaries and 6 million providers. This data-driven strategy not only enhances patient care but also fosters strategic growth and informed decision-making throughout the pharmaceutical lifecycle.

A case study titled “Long-term Strategic Growth” illustrates how a comprehensive approach to requests, combined with CareSet’s insights, not only addresses urgent information needs but also encourages long-term strategic expansion for collaborators in the medical sector, enhancing patient outcomes and refining the lifecycle oversight of pharmaceutical products.

Guidewire: Modernize Healthcare Claims with Comprehensive Software Solutions

Guidewire provides robust software solutions that revolutionize claims management for medical insurance. By harnessing advanced technology, Guidewire automates request processing, significantly enhancing information accuracy and ensuring compliance with stringent regulatory standards. This modernization streamlines workflows, enabling medical providers to concentrate on delivering high-quality patient care while ensuring that requests are processed swiftly and accurately.

In the evolving landscape of medical services, grasping the complexities of Medicare request information is crucial. CareSet’s comprehensive insights into Medicare data empower medical stakeholders by clarifying patient treatment pathways, from diagnosis to lines-of-therapy. This information not only informs providers about the diseases they identify and manage but also elucidates the interventions specified by NDC and HCPCS codes, facilitating a seamless patient experience from diagnosis to treatment.

Experts in the field underscore the imperative for reimbursement operations to evolve from reactive back-office functions into pivotal differentiators within the medical sector. As articulated by Merlyn Evans, Advisory Architect at Ricoh USA, ‘Claims management operations that have been traditionally treated as outputs of a ‘reactive back office’ will have to become a powerful differentiator; innovative in nature, uncompromising on customer service, multifaceted in the capability of its talent, and capable of driving strong results.’ This transformation highlights the necessity for medical organizations to adopt innovative technologies that not only streamline processing but also bolster security protocols.

The integration of automation in medical processing has revealed substantial benefits, particularly in enhancing operational efficiency and mitigating risks associated with regulatory compliance, including adherence to HIPAA and other information protection regulations. For instance, workflow automation has proven effective in assisting hospitals in maintaining 100% compliance, thereby lowering the risk of data breaches.

As the global AI in Fraud Detection Market continues to expand, the trend towards advanced fraud detection solutions becomes increasingly apparent. This growth emphasizes the importance of leveraging advanced technologies that can refine processing procedures while ensuring robust security measures.

In 2025, the latest software solutions for medical billing are set to further enhance accuracy and efficiency. By utilizing platforms such as Guidewire, organizations can expect significant improvements in their management processes, ultimately leading to better patient outcomes and optimized operational performance.

HealthEdge: Enhance Claims Accuracy and Compliance for Healthcare Providers

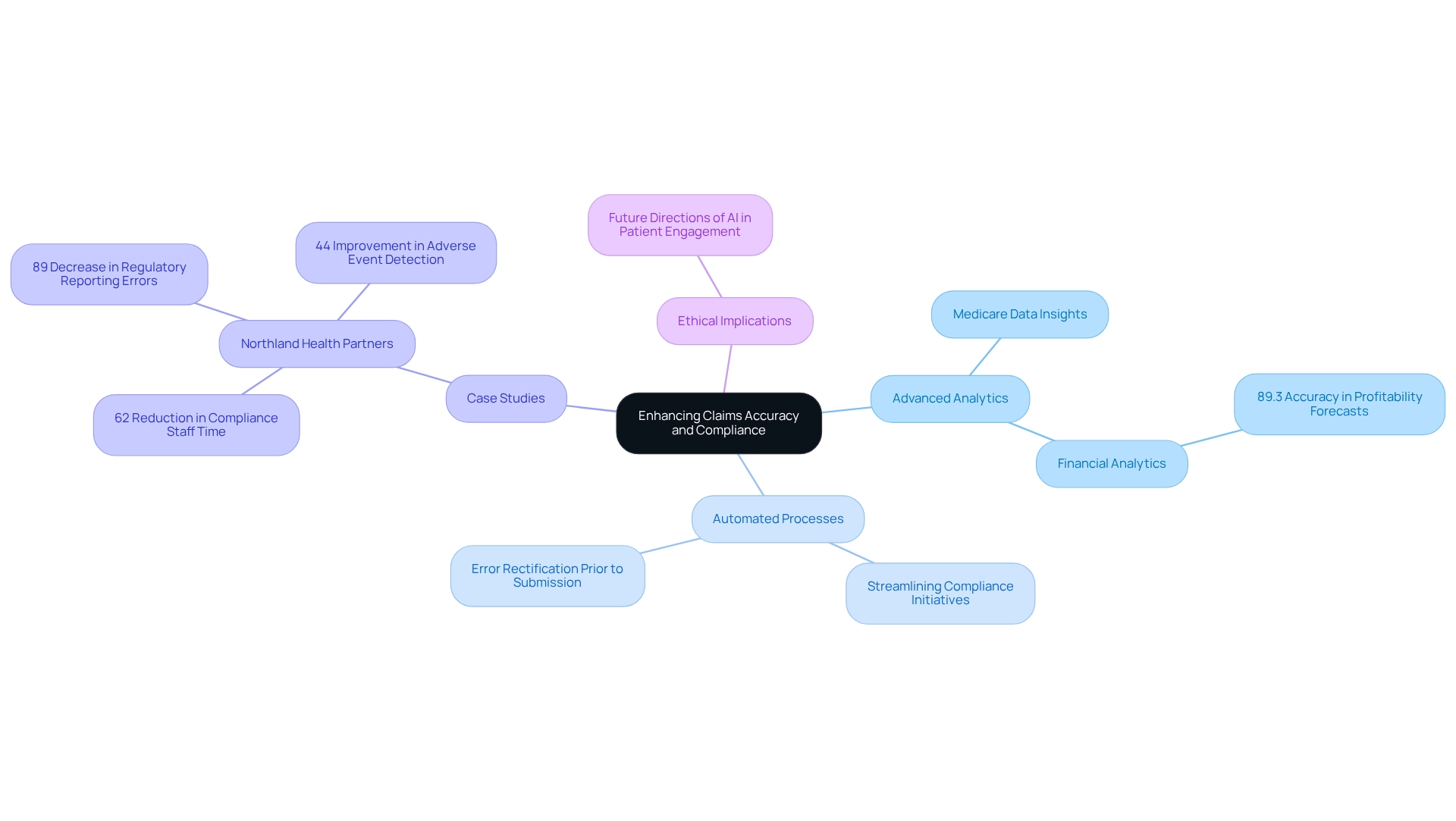

CareSet delivers innovative solutions that significantly enhance accuracy and compliance for healthcare providers by leveraging extensive Medicare data insights. Through the application of advanced analytics and automated processes, CareSet empowers organizations to proactively identify and rectify errors prior to submission. This strategic approach not only diminishes the probability of denials but also ensures adherence to the ever-evolving regulatory landscape, ultimately leading to improved financial outcomes.

Recent advancements in accuracy solutions indicate that organizations utilizing advanced analytics have witnessed substantial gains, with some reporting accuracy increases of up to 89%. A case study featuring Northland Health Partners exemplifies this, showcasing a remarkable 62% reduction in compliance staff time and an 89% decrease in regulatory reporting errors following the implementation of CareSet’s cloud-based regulatory analytics. Furthermore, this implementation resulted in a 44% enhancement in adverse event detection and an improved capacity to attract and retain qualified personnel. These outcomes underscore the vital role of data-driven strategies in refining claims management processes.

Moreover, the integration of automated systems has proven to streamline compliance initiatives, allowing healthcare providers to focus on patient care while ensuring that requests are managed efficiently and accurately. As noted by Sarah Lee, medical organizations employing financial analytics for service line evaluation have achieved 89.3% accuracy in profitability forecasts, facilitating evidence-based decisions regarding which services to improve, maintain, or restructure.

As the healthcare landscape continues to evolve, the adoption of advanced analytics—particularly those offered by CareSet—will be essential for organizations aiming to reduce denials and enhance overall operational efficiency. It is equally important to consider the ethical implications and future trajectories of AI in patient engagement, as these factors will shape the realm of medical analytics.

Comarch: Manage Healthcare Claims with Effective Risk Solutions

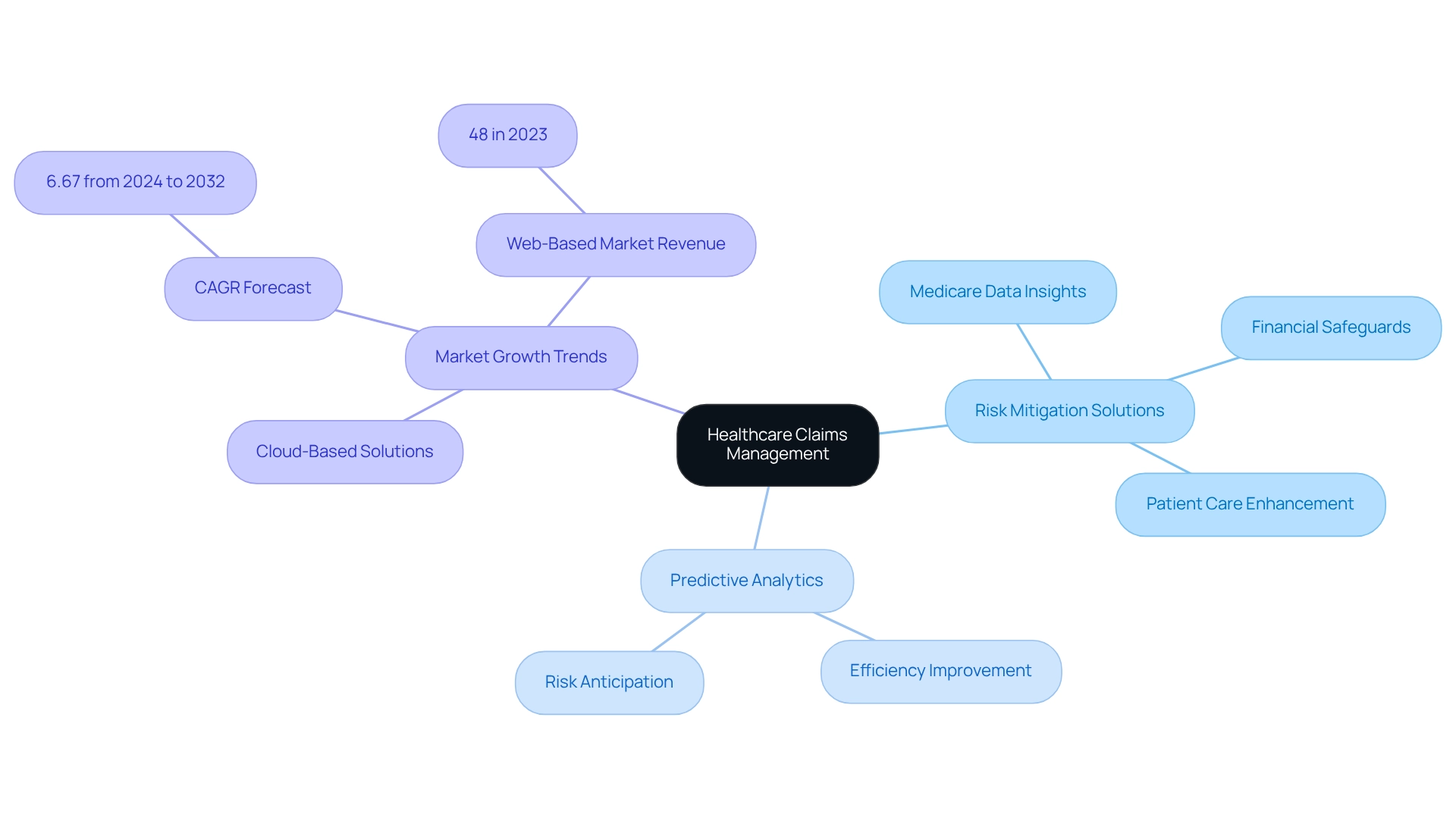

CareSet delivers innovative risk mitigation solutions specifically tailored for medical reimbursements, leveraging extensive Medicare data insights and predictive analytics. This proactive approach to claims management empowers organizations to identify potential risks and formulate effective mitigation strategies, ultimately enhancing patient care and driving business success. By analyzing patient treatment pathways—navigating from diagnosis through lines of therapy and incorporating ICD, NDC, and HCPCS codes—these solutions not only safeguard against financial losses but also enable providers to prioritize quality patient care.

The claims management sector in medical reimbursement is poised for significant growth, driven by increasing awareness and the demand for efficient processing of requests. Notably, the cloud-based sector is expected to expand rapidly, facilitating access to request-related data anytime and anywhere. In 2023, web-based solutions represented 48% of the market revenue, highlighting their appeal due to accessibility and scalability. As healthcare providers increasingly pursue secure and scalable solutions, cloud-based systems are projected to experience a compound annual growth rate (CAGR) of 6.67% from 2024 to 2032.

Predictive analytics serves a crucial role in this landscape, enhancing efficiency in handling by enabling organizations to anticipate and address risks before they escalate. Experts in risk assessment underscore the importance of these analytics in claims management to optimize request processing and improve overall operational efficiency. As Brian Cronk, Vice President of National IME Services at CorVel, observes, “Many injured workers crave a sense of ‘normalcy’ and are eager to return to their typical, daily routines.” This statement underscores the human element in managing requests, emphasizing the need for efficient solutions that improve patient experiences. Furthermore, understanding how Medicare Part D Plans authorize treatments and the associated costs is vital for refining processing strategies. As the industry evolves, staying abreast of the latest trends in risk oversight will be essential for medical organizations aiming to enhance their processing procedures.

Quadax: Automate Healthcare Claims Management for Enhanced Efficiency

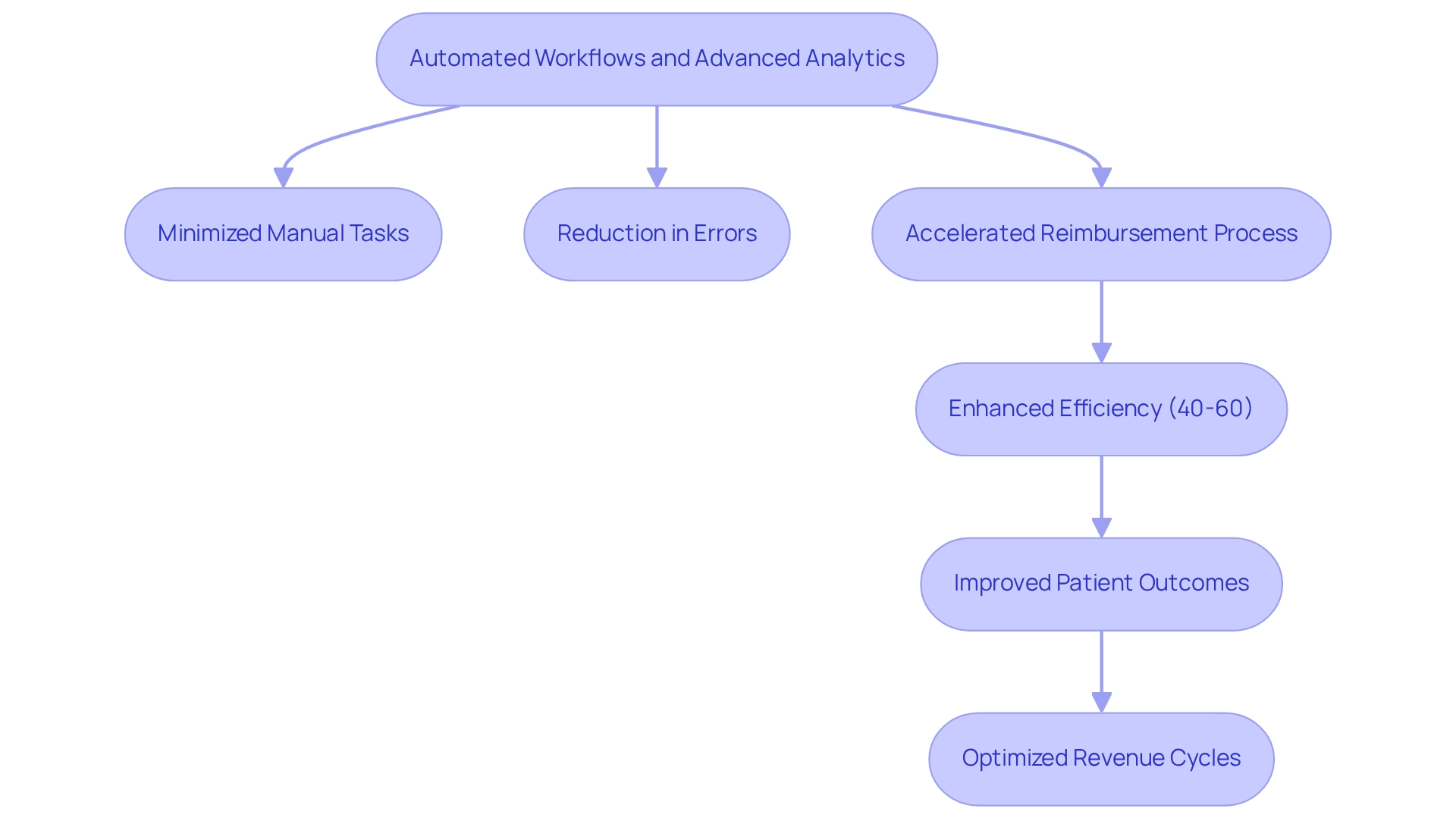

Quadax excels in automating claims management related to medical reimbursements, significantly improving both efficiency and precision. By utilizing automated workflows and advanced analytics, Quadax simplifies processes, effectively minimizing the time and effort associated with manual tasks. This automation leads to a substantial reduction in errors and accelerates the reimbursement process, ensuring that healthcare providers receive prompt payments. Consequently, providers can focus on delivering quality care rather than navigating cumbersome administrative processes.

Recent advancements in automation indicate that organizations can enhance efficiency by 40-60%, while also reducing manual errors by up to 90%. Such improvements not only optimize operational workflows but also yield a return on investment in under 12 months. For instance, ENTER’s clean submission rates have surged to over 99% without manual intervention, demonstrating the effectiveness of automation in achieving high-quality outcomes. Moreover, the integration of new technologies, such as augmented reality and blockchain, is set to revolutionize the automation of requests, facilitating near-instantaneous resolution for straightforward instances, as highlighted in the case study titled ‘The Role of Emerging Technologies in Claims Automation.’

Industry leaders recognize the transformative potential of automation in processing requests. As noted by Sarah Lee, “Claims automation is not merely changing how insurance companies process claims—it’s fundamentally redefining the relationship between insurers and their customers in the digital age.” By embracing these advanced analytics and automation strategies, organizations can significantly decrease the claims management lifecycle, ultimately leading to improved patient outcomes and optimized revenue cycles.

Conclusion

The healthcare landscape is undergoing a transformative shift, with innovative claims management solutions emerging as vital tools for enhancing operational efficiency and patient care. By leveraging comprehensive Medicare data, organizations can optimize their claims processes, leading to improved accuracy, reduced costs, and increased compliance with regulatory standards. The integration of advanced analytics and automation is proving essential in navigating the complexities of claims management, allowing healthcare providers to focus on what truly matters: delivering high-quality patient care.

As highlighted throughout the article, industry leaders like CareSet, Fleet Response, ClaimDeck, Guidewire, HealthEdge, Comarch, and Quadax are at the forefront of this evolution. Their tailored strategies and cutting-edge technologies are not only streamlining workflows but also empowering healthcare organizations to make data-driven decisions that enhance patient outcomes. The projected growth of the healthcare claims management market underscores the urgency for organizations to adopt these innovative solutions to remain competitive and responsive to changing regulations.

In conclusion, embracing advanced claims management strategies is no longer just an option; it is imperative for healthcare organizations aiming to thrive in a rapidly evolving environment. By prioritizing data insights and automation, stakeholders can unlock significant efficiencies, mitigate risks, and ultimately foster a healthcare system that prioritizes both operational success and superior patient experiences. The future of healthcare claims management is bright, driven by a commitment to innovation and excellence in patient care.