Overview

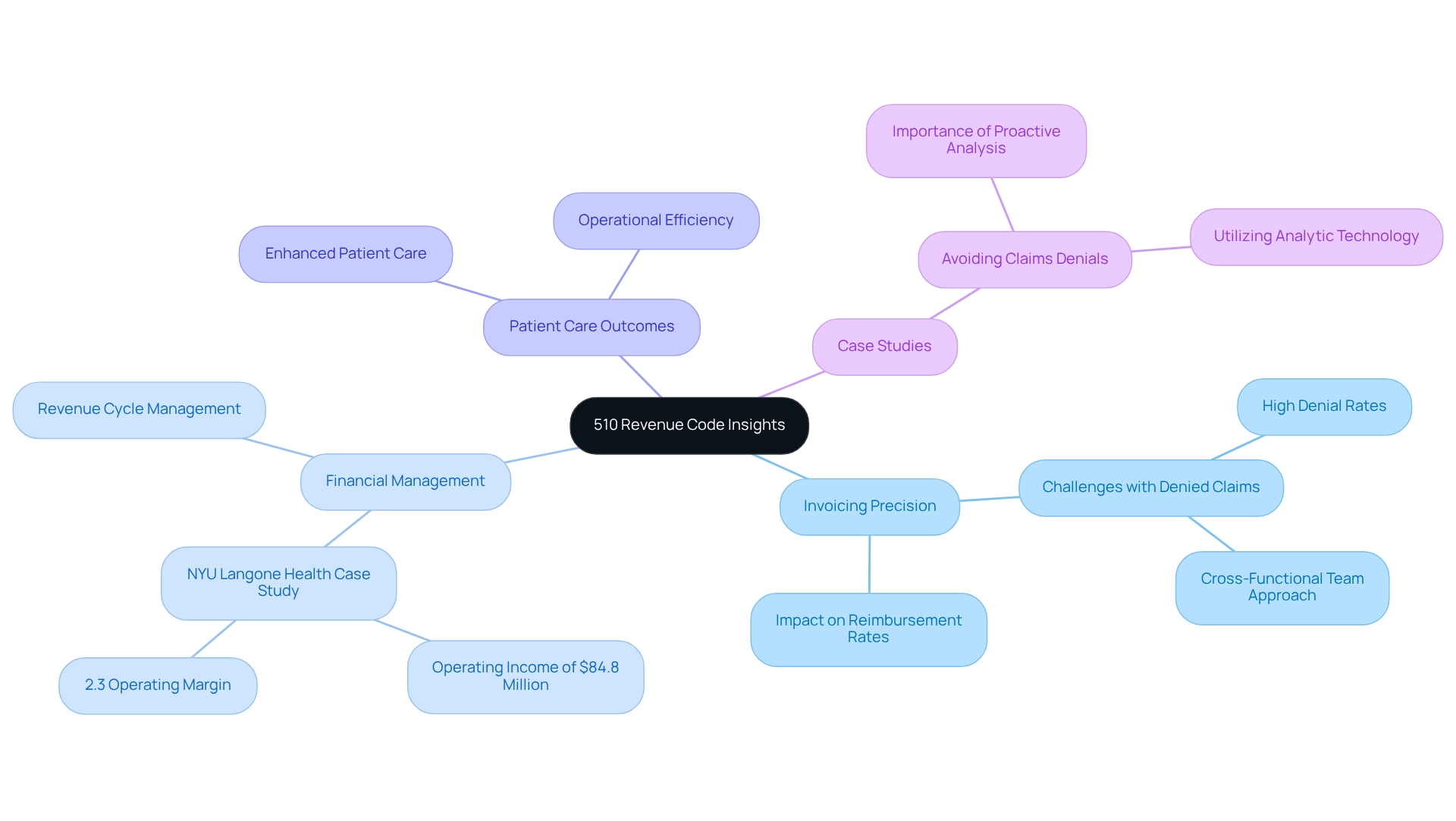

This article underscores the importance of the 510 revenue code for healthcare professionals, highlighting its crucial role in enhancing billing accuracy and optimizing reimbursement rates. By detailing the ways in which a thorough understanding and effective implementation of this code can bolster financial performance, reduce claim denials, and ultimately elevate patient care outcomes, the discussion emphasizes better resource management and operational efficiency. Such insights not only inform healthcare providers but also encourage them to engage further with the implications of this code on their practices.

Introduction

In the intricate world of healthcare billing, the 510 revenue code emerges as a pivotal element that significantly impacts both financial sustainability and patient care. As healthcare providers navigate the complexities of Medicare reimbursement, a thorough understanding of this code becomes essential for optimizing billing practices and ensuring compliance with the ever-evolving regulations. By delving into comprehensive data insights and leveraging advanced analytics, organizations can uncover trends and address challenges that influence their bottom line.

This article examines the significance of the 510 revenue code, its implications for billing accuracy, and the strategies healthcare professionals can employ to enhance operational efficiency and ultimately improve patient outcomes.

CareSet: Comprehensive Medicare Data Insights for the 510 Revenue Code

CareSet excels in extracting and interpreting intricate Medicare claims data, providing comprehensive insights into the 510 revenue code, which is vital for charging general clinic visits that do not fit into specific subcategories. By examining over $1.1 trillion in yearly claims data, CareSet offers medical professionals practical insights that greatly improve invoicing precision and patient care outcomes. Their thorough examination reveals trends and gaps in data, enabling providers to enhance financial cycle management effectively.

The impact of the 510 revenue code on invoicing precision is significant, as it directly influences reimbursement rates and the overall fiscal well-being of medical organizations. For instance, NYU Langone Health reported an operating income of $84.8 million, achieving a 2.3% operating margin, underscoring the importance of efficient invoicing practices. Real-world examples illustrate how medical service providers have successfully improved their invoicing precision by utilizing insights derived from the 510 revenue code. By leveraging CareSet’s Medicare data insights, organizations can proactively address billing challenges, ultimately leading to enhanced patient care and operational efficiency.

In a landscape characterized by high denial rates for claims, the significance of accurate coding cannot be overstated. A recent case study revealed that establishing a cross-functional team to analyze denial trends can considerably reduce the incidence of denied claims. CareSet’s commitment to delivering high-quality, comprehensive Medicare insights ensures that clients can navigate these complexities with confidence, fostering long-term strategic growth in the medical sector. As Michael Young, President and CEO, emphasizes, “Accurate coding is not just about compliance; it’s about ensuring that healthcare organizations thrive in a challenging environment.

Understanding the 510 Revenue Code: Key Definitions and Applications

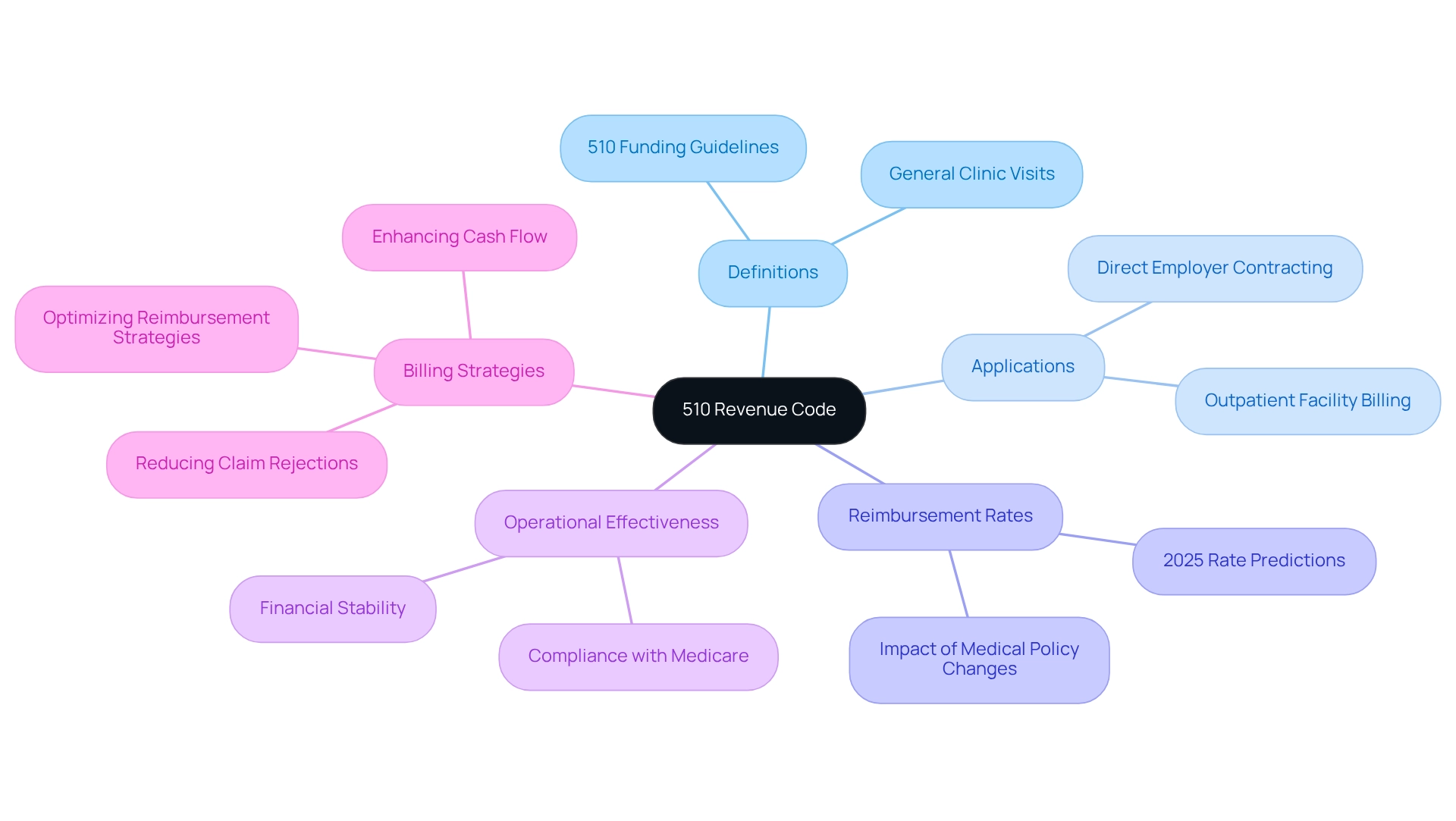

Comprehending the 510 funding regulations: Essential Definitions and Uses

The 510 funding guidelines are specifically allocated for general clinic visits that do not fall into more defined categories. This system is predominantly utilized by outpatient facilities to bill for services rendered in a clinic environment. Grasping the 510 revenue code is crucial for medical providers, as it greatly affects reimbursement rates and compliance with Medicare billing guidelines. Precise implementation of this system is essential for guaranteeing that facilities obtain suitable compensation for their services, thus strengthening the financial stability of the practice.

In 2025, reimbursement rates linked to the 510 billing category are anticipated to mirror continuous changes in medical policy and economic circumstances. Facilities that effectively utilize this system can optimize their reimbursement strategies, enhancing their overall financial performance. For example, medical providers have successfully adopted the 510 financial classification to simplify invoicing procedures, leading to enhanced cash flow and decreased claim rejections.

Additionally, the significance of the 510 financial classification goes beyond simple adherence; it is vital for the operational effectiveness of outpatient centers. By precisely classifying services under this classification, providers can guarantee they are not only compliant with Medicare requirements but also positioned to enhance their income potential. As the medical field continues to evolve, understanding and applying the 510 revenue code will remain a key competency for professionals in the billing and reimbursement landscape, while CareSet integrates more than 100 external data sources to underscore the importance of accurate billing and reimbursement strategies.

By utilizing CareSet’s comprehensive medical data insights, facilities can gain a deeper understanding of reimbursement trends and optimize their strategies accordingly. A case study on direct employer contracting in healthcare illustrates how facilities can gain better control over pricing and patient access, leading to more favorable deals and reduced reliance on traditional payer models. As Nathan Rave, Director at AMSURG, noted, ‘Excellent summary. Thank you for sharing.’ This underscores the increasing acknowledgment of the 510 income classification’s role in enhancing reimbursement strategies.

Furthermore, it is essential to recognize that hospitals in American Samoa, Guam, the Northern Mariana Islands, and the Virgin Islands are excluded from OPPS, introducing another layer of complexity to the implementation of the 510 financial classification in different contexts.

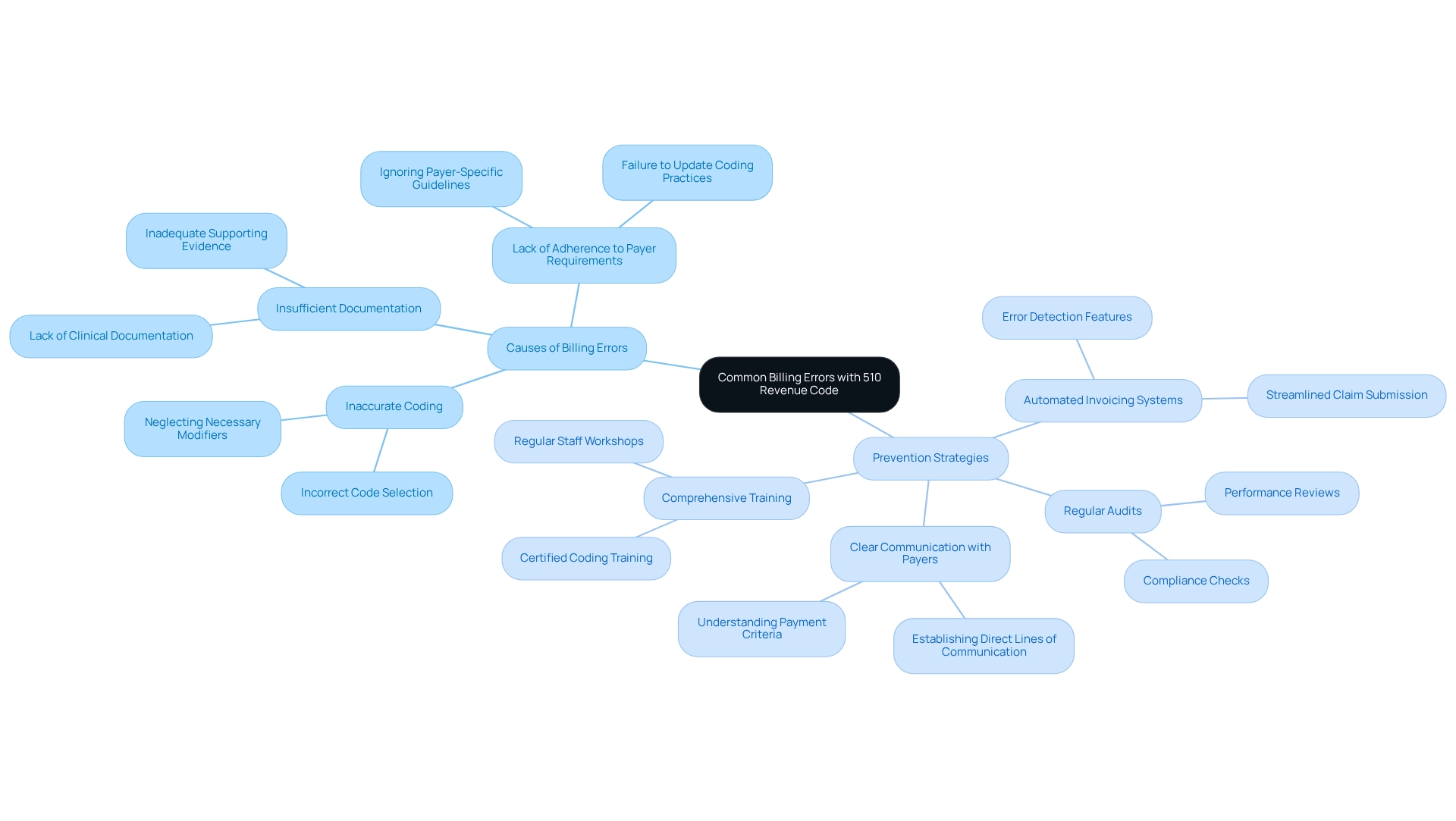

Common Billing Errors with the 510 Revenue Code: Prevention Strategies

Frequent invoicing mistakes related to the 510 revenue code often stem from inaccurate coding, insufficient documentation, and a lack of adherence to payer-specific requirements. These mistakes can lead to significant financial repercussions; the medical sector loses approximately $36 billion annually due to coding errors. To mitigate these risks, healthcare providers should prioritize comprehensive training for financial staff, emphasizing the importance of accuracy in coding and documentation. Implementing automated invoicing systems can also help identify discrepancies before claims are submitted, further reducing the potential for errors.

Regular audits of submitted claims are essential to ensure compliance with coding guidelines and payer requirements. Creating clear communication pathways with payers enhances understanding of their specific payment criteria, which is crucial for reducing denials and delays in reimbursement. For instance, medical organizations that have invested in certified coding training have reported increased operational efficiency and enhanced profitability, illustrating the strategic importance of such initiatives. Experts suggest that invoicing specialists concentrate on frequent errors in relation to the 510 revenue code submissions, such as neglecting necessary modifiers or failing to provide sufficient clinical documentation. As reported by the Journal of the American Medical Association, medical expenditure in the U.S. reached $346 billion in 2018, with nearly $200 billion linked to invoicing and insurance-related activities, emphasizing the financial consequences of invoicing mistakes. By embracing a proactive strategy for training and adherence, healthcare providers can significantly improve their financial accuracy and overall cycle management. Furthermore, independent practices may benefit from consulting a buyer’s guide for EHR payment solutions to enhance their payment methods and improve primary care delivery.

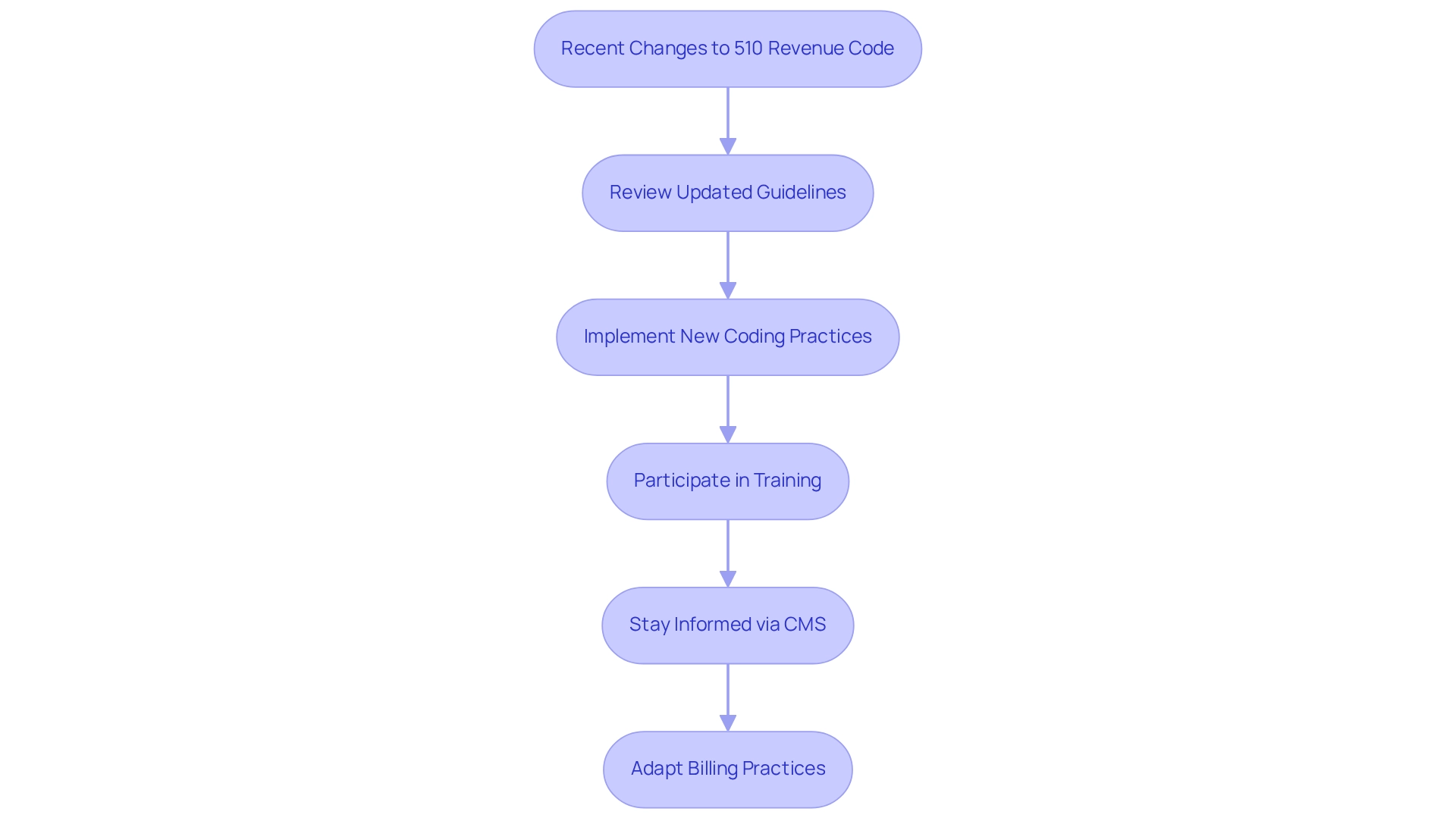

Recent Changes to the 510 Revenue Code: What Healthcare Professionals Need to Know

Recent updates to the 510 financial code reflect significant changes in charging guidelines and reimbursement rates, as outlined in the 2025 Medicare Physician Fee Schedule. These changes are crucial for medical professionals aiming to ensure compliance and optimize their reimbursement potential. The Centers for Medicare & Medicaid Services (CMS) has underscored the necessity of precise coding and thorough documentation to mitigate penalties and facilitate timely payments. Notably, the incorporation of the current add-on G-code for outpatient assessment and management (E/M) visit complexity allows for reporting on the same day as annual wellness visits, streamlining the payment process and enhancing revenue collection for medical providers.

Healthcare providers are encouraged to stay informed about these updates by regularly consulting CMS announcements and participating in training sessions. This proactive approach not only aids in compliance but also enhances the overall efficiency of billing practices. As the medical landscape evolves, professionals must adapt to these changes to maintain their financial viability and ensure quality patient care.

Statistics indicate that there have been notable adjustments in reimbursement rates for the 510 revenue code, with recent data revealing an increase of approximately 5% in certain categories. This necessitates a thorough understanding of the new guidelines. CareSet’s advanced Medicare data analytics provide insights into how medical organizations can navigate these changes successfully, leading to improved financial outcomes and enhanced patient services. By embracing these updates, medical professionals can better position themselves in a competitive market, ultimately benefiting both their practices and the patients they assist.

As Nancy M. Enos, a coding specialist, emphasizes, “CHI services concentrate on tackling wider health requirements within communities through methods like collaborating with local resources to support patients.” This underscores the importance of adjusting billing practices to meet evolving medical demands. Additionally, with CMS extending the compliance assessment date for electronic prescribing for controlled substances in long-term care facilities to January 1, 2028, healthcare professionals must remain vigilant in navigating these regulatory changes.

Medicare Reimbursement Policies Related to the 510 Revenue Code

Medicare reimbursement policies for the 510 revenue code necessitate that claims be presented with accurate documentation to validate the services charged. Providers must ensure that the services provided correspond accurately with the descriptions linked to the 510 revenue code to mitigate the risk of claim denials. Grasping the typical reimbursement rates for this classification is crucial for efficient financial planning and operational effectiveness. Recent data from CareSet, which encompasses insights from over 62 million beneficiaries and 6 million providers, indicates significant variations in reimbursement rates across different facilities. This data highlights performance metrics showing disparities in procedure volumes, particularly in the 25th and 75th percentiles across condition categories, underscoring the need for providers to stay informed about these metrics.

To maintain compliance with Medicare billing policies, medical providers should implement regular audits of their billing practices. These audits can assist in recognizing inconsistencies and opportunities for enhancement, ensuring compliance with documentation requirements for the 510 revenue code. As Chiquita Brooks-LaSure, Administrator of the Centers for Medicare & Medicaid Services, noted, “This final rule with comment period is subject to the Congressional Review Act provisions…” highlighting the importance of compliance with evolving Medicare policies.

Furthermore, insights from CareSet’s comprehensive Medicare data solutions reveal how providers can analyze patient treatment pathways and understand which treatments are being approved by Medicare Part D Plans. A case study on the incremental reduction of target PCR for cancer hospitals illustrates the practical implications of Medicare reimbursement policies, demonstrating how these policies are applied in medical settings. Expert insights suggest that thorough documentation not only supports successful claims but also enhances overall operational performance. By aligning their practices with Medicare’s stringent requirements, providers can optimize their reimbursement processes and improve financial outcomes. Practical advice for ensuring adherence to documentation for 510 claims includes:

- Keeping thorough records of services provided

- Performing regular training for staff on the 510 revenue code billing procedures

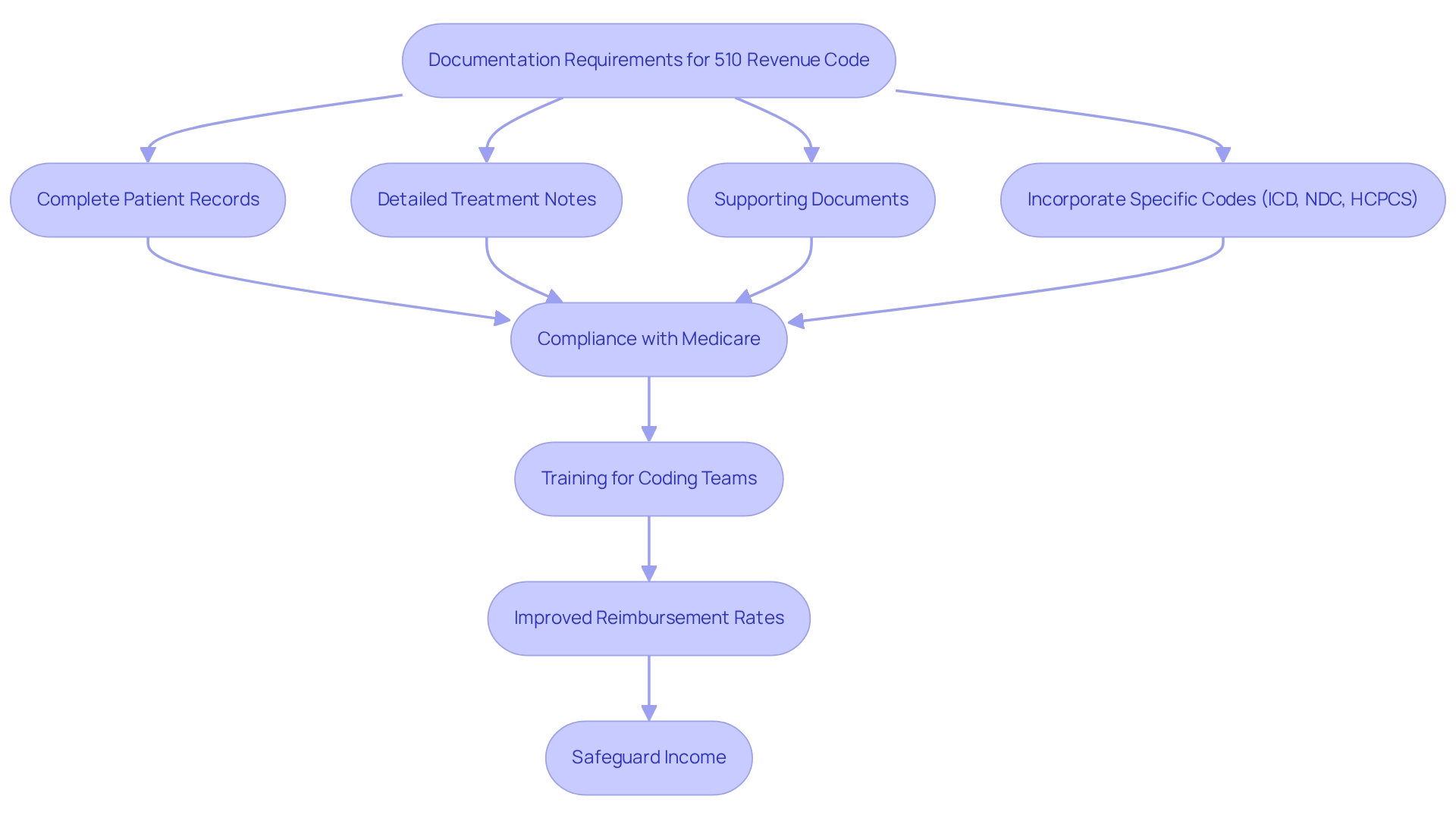

Documentation Requirements for the 510 Revenue Code: A Guide for Healthcare Professionals

Billing under the 510 revenue code necessitates meticulous attention to documentation, as medical professionals must ensure that all relevant records are complete and precise. This includes comprehensive patient records, detailed treatment notes, and any supporting documents that substantiate the services provided. Documentation must explicitly outline the nature of the visit, the services rendered, and any required follow-up care, while also incorporating specific codes such as ICD, NDC, HCPCS, and the 510 revenue code to clarify the interventions involved.

Organized and thorough records not only bolster compliance with Medicare requirements but also streamline claims processing, significantly reducing the risk of audits. Enhanced training for coding teams has been shown to improve accuracy in coding, which is essential for optimizing the financial cycle and ensuring medical facilities receive appropriate compensation for services rendered. This training directly correlates with improved reimbursement rates, underscoring the importance of investing in coding education.

Statistics reveal that facilities must be reimbursed for the use of their resources, including supplies and staff, making accurate documentation even more critical. By adhering to optimal documentation methods, medical organizations can enhance their claims approval rates and ultimately safeguard their income, stabilizing their bottom line in an increasingly complex medical environment. Furthermore, understanding the interplay between ICD, NDC, and HCPCS classifications is crucial for providers as they navigate the patient journey from diagnosis through treatment, ensuring that all interventions are accurately documented and reimbursed. As Jennifer Mueller notes, “Beyond Automation: The Need for Human Skills in an Evolving RCM Landscape,” emphasizing that human expertise remains vital in addressing these documentation challenges.

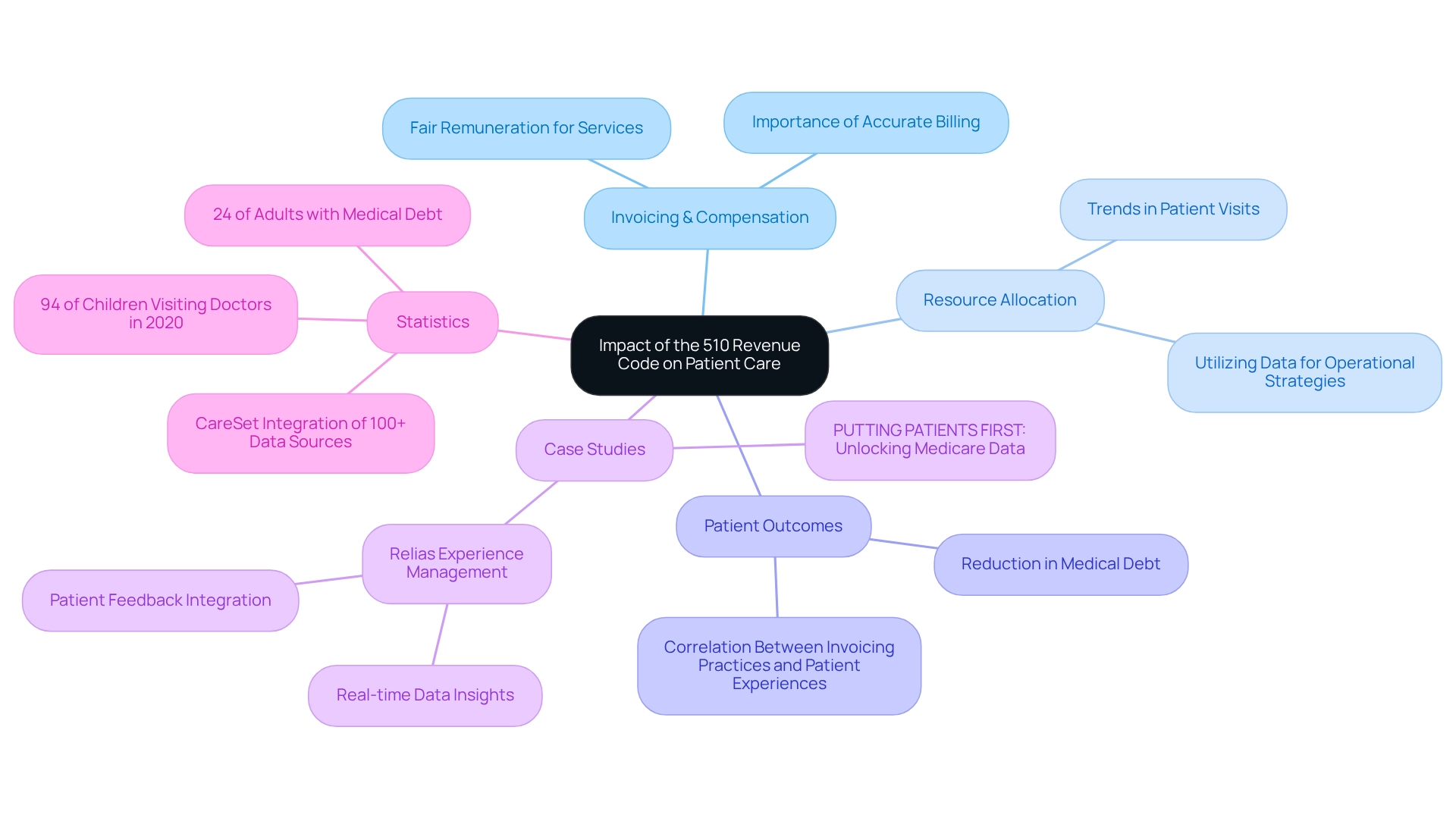

Impact of the 510 Revenue Code on Patient Care: Insights for Healthcare Providers

The 510 financial classification plays a pivotal role in shaping patient care provision, directly influencing the invoicing and compensation processes for medical services. Accurate billing under this regulation is essential to ensure that providers receive fair remuneration for their services, a critical factor in sustaining effective care delivery models. Furthermore, a comprehensive understanding of the 510 revenue code empowers medical providers to recognize trends in patient visits and service utilization, which leads to more efficient resource allocation and ultimately enhances patient outcomes. For example, medical organizations that effectively utilize 510 revenue code data can refine their operational strategies. A pertinent case study, ‘PUTTING PATIENTS FIRST: Unlocking Medicare Data to Empower HCP,’ illustrates this point by focusing on the 4th line of therapy for Gastrointestinal Stromal Tumor (GIST). By utilizing insights from Medicare data, these organizations can foster better engagement with medical providers, facilitating timely discussions regarding treatment options such as Qinlock. This approach not only elevates patient care but also drives business success through informed decision-making.

Statistics reveal a significant correlation between precise invoicing practices and patient outcomes; for instance, a well-executed invoicing system can lead to a reduction in medical debt, which affects approximately 24% of adults with outstanding medical bills. This relationship underscores the importance of the 510 revenue code in alleviating financial burdens on patients, thereby enhancing their overall experience with medical care. Additionally, with 94% of children under age 18 visiting a doctor in 2020, accurate charging practices become even more critical in pediatric care, ensuring that children receive the necessary services without facing financial hurdles.

Moreover, understanding the ‘See Buy & Bill Administration’ context is crucial for providers as they navigate the treatment pathways from diagnosis to recovery. Expert insights highlight the need for flexibility in medical invoicing methods, with figures like Ashwani Bhatia, MD, advocating for a responsive strategy to evolving patient needs in 2025. By leveraging comprehensive data insights, including those from CareSet, which integrates over 100 external data sources, medical professionals can refine their care strategies, address service delivery gaps, and ultimately improve patient outcomes. The impact of the 510 revenue code extends beyond mere invoicing; it is a vital component of the broader framework for medical sustainability and quality enhancement.

Communicating the Importance of the 510 Revenue Code to Healthcare Teams

Effective communication regarding the 510 financial classification is essential for fostering a culture of adherence within medical teams. Regular training sessions should be implemented to educate staff on the significance of accurate coding and documentation. Open discussions about payment practices can help identify common challenges and promote best practices among team members. By emphasizing the significance of the 510 revenue code related to patient care and financial sustainability, medical leaders can motivate their teams to concentrate on invoicing precision. Notably, organizations that invest in training have observed enhancements in financial practices, with statistics indicating that well-trained teams are more effective in upholding compliance and improving patient satisfaction.

Moreover, it is vital for medical teams to examine payer policies on modifier usage and standard classifications, as this understanding is critical for precise coding and compliance. Brittany K. King emphasizes that “creating a training program doesn’t have to be overwhelming. Follow these simple steps (and download our interactive workbook) so you can get started on building an effective employee training program.” Furthermore, case studies reveal that a considerable segment of consumers, particularly millennials, are open to changing providers for an improved payment experience. This trend underscores the necessity for healthcare teams to concentrate on effective communication and training approaches related to the 510 revenue code to retain patients and enhance overall satisfaction.

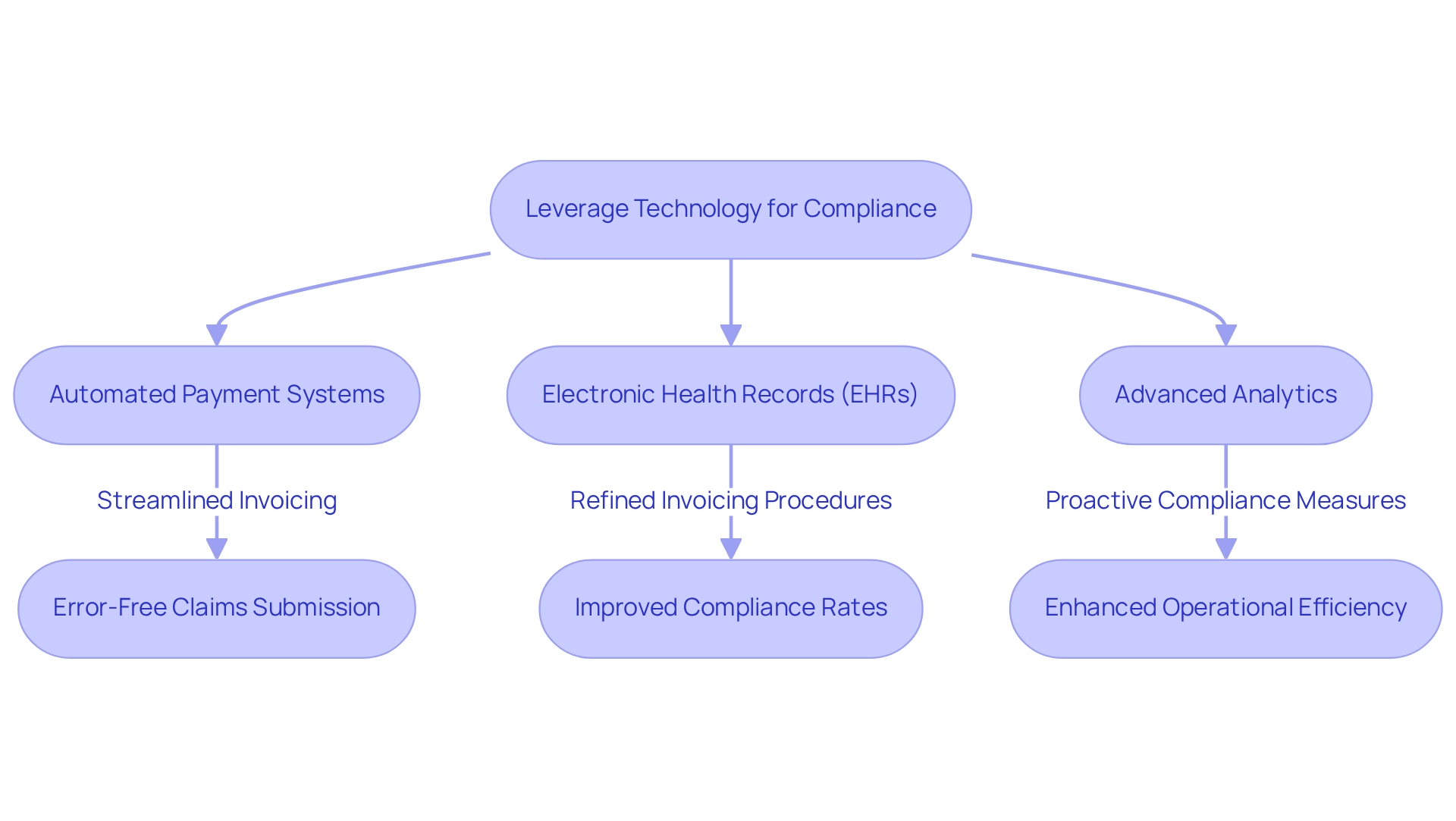

Leveraging Technology for Compliance with the 510 Revenue Code

Healthcare providers can significantly enhance adherence to the 510 revenue code by leveraging technology, especially through the use of automated payment systems and electronic health records (EHRs). These advanced tools ensure accurate documentation capture and error-free claims submission. For instance, automated invoicing systems streamline the invoicing process, alleviating administrative burdens and reducing the risk of non-compliance with Medicare regulations.

Moreover, integrating advanced analytics, such as those offered by CareSet, enables providers to discern patterns in billing practices, allowing for proactive measures to address potential compliance issues before they escalate. CareSet’s comprehensive Medicare data solutions, which include insights from over 62 million beneficiaries and 6 million providers, empower healthcare stakeholders to make informed decisions that bolster compliance and operational efficiency. With over $900 billion in claims processed annually and more than 14 years of claims data, organizations utilizing AI-driven analytics can achieve more precise financial projections, essential for effective budget planning. This capability underscores the pivotal role of technology in enhancing compliance and financial management.

The significance of EHRs in improving financial accuracy cannot be overstated. Numerous medical service providers have successfully adopted EHR systems to refine their invoicing procedures related to the 510 revenue code, resulting in increased compliance rates and fewer claim denials. As the implementation of technology in medical invoicing continues to rise, the impact of these automated systems on compliance rates is becoming increasingly evident, with many organizations reporting substantial improvements in their invoicing precision and effectiveness.

As Rahul Shrimali noted, “Technology-enabled medical devices have progressed at a rapid pace and begun to dominate our lives,” highlighting the broader influence of technology in medical services, including payment systems and EHRs. Furthermore, automated invoicing systems can facilitate prior authorizations from health insurance companies, further enhancing compliance and operational efficiency.

In summary, by integrating technology into their billing procedures, medical organizations not only enhance compliance with the 510 revenue code but also improve overall operational efficiency, ultimately leading to better patient care and financial outcomes. CareSet’s unique approach to healthcare analytics exemplifies how leveraging comprehensive data insights can inform strategy for the entire lifecycle of pharmaceuticals, fostering long-term strategic growth and compliance within the healthcare industry.

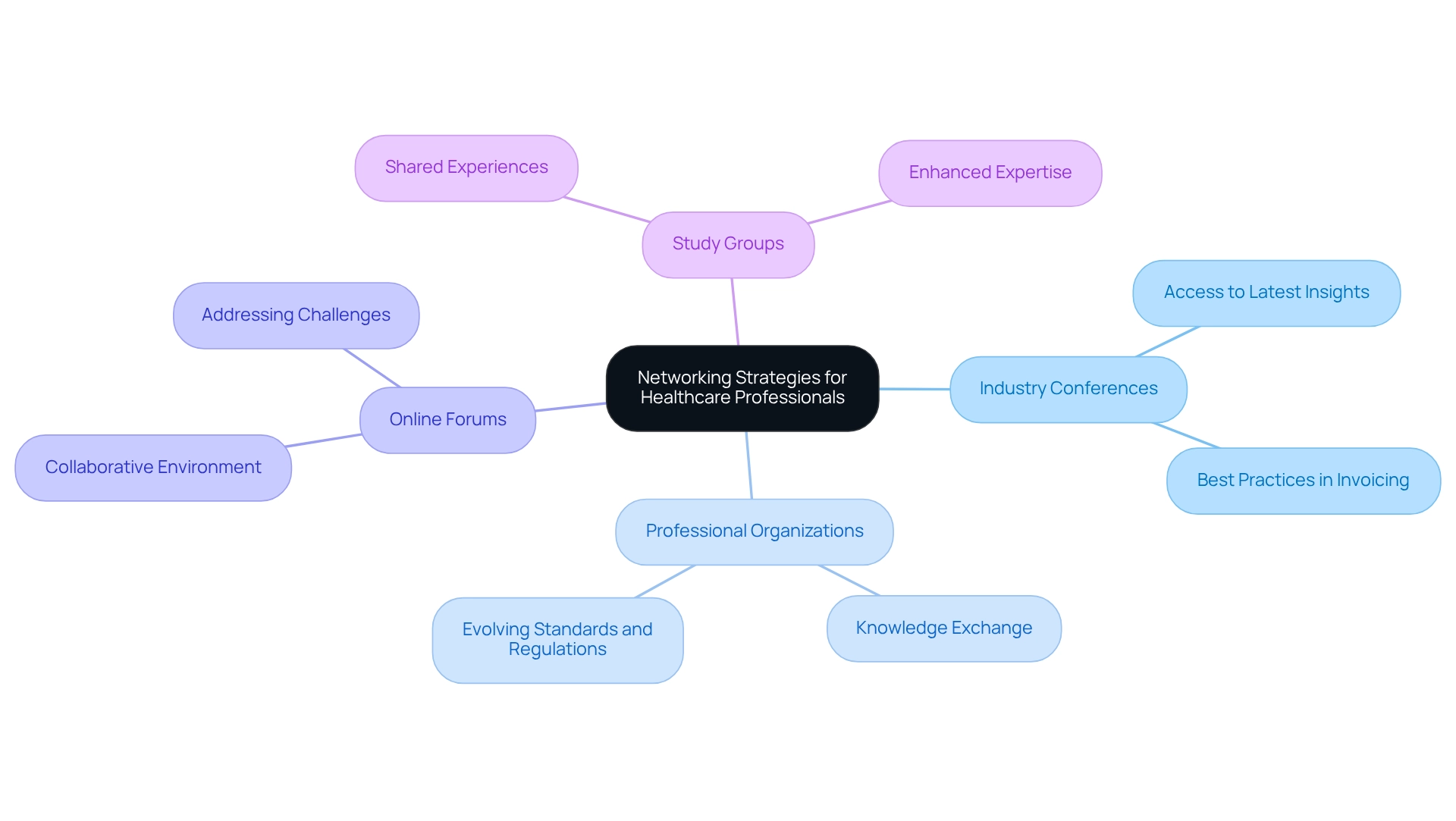

Networking Strategies for Healthcare Professionals to Discuss the 510 Revenue Code

Healthcare professionals can significantly deepen their understanding of the 510 revenue code by engaging in strategic networking. Engaging actively in industry conferences not only provides access to the latest insights but also fosters discussions on best practices in invoicing. Notably, involvement in professional organizations and events establishes a robust network that benefits both careers and the medical community.

Joining professional groups focused on medical invoicing enhances knowledge exchange and keeps members informed about evolving standards and regulations. Moreover, participating in online forums and forming study groups with peers cultivates a collaborative environment where challenges related to the 510 revenue code can be collectively addressed.

By building a strong professional network, medical providers can stay updated on billing practices, share valuable experiences, and ultimately enhance their expertise in navigating the complexities of reimbursement. As Christine L. remarked, ‘Everyone was prompt and helpful. Guidance and suggestions excellent.’ This underscores the supportive nature of professional networks.

Furthermore, statistics indicate that networking can significantly enhance career prospects and knowledge acquisition for medical professionals. By leveraging these networking strategies, healthcare professionals can effectively navigate the complexities associated with the 510 revenue code.

Conclusion

Understanding the significance of the 510 revenue code is paramount for healthcare providers aiming to enhance their billing practices and optimize patient care. The critical role of accurate coding and comprehensive documentation directly influences reimbursement rates and financial sustainability. By leveraging advanced analytics and insights from organizations like CareSet, healthcare professionals can identify trends, mitigate billing errors, and navigate the complexities of Medicare regulations effectively.

Various strategies are highlighted to bolster compliance and operational efficiency, such as:

- Implementing automated billing systems

- Providing regular training for staff

- Maintaining proactive communication with payers

These measures not only reduce the risk of claim denials but also ensure that healthcare facilities receive appropriate compensation for their services. Furthermore, understanding recent updates to the 510 revenue code allows providers to adapt their practices in a rapidly evolving healthcare landscape.

Ultimately, the 510 revenue code transcends being merely a billing tool; it is a pivotal component in fostering a sustainable healthcare system that prioritizes patient outcomes. By embracing the insights and strategies discussed, healthcare professionals can enhance their billing accuracy, improve financial performance, and deliver superior care to their patients. The commitment to mastering the intricacies of this code will serve as a foundation for ongoing success in the healthcare industry.