Overview

The 2025 Medicare Part B deductible is set to rise to $257, a reflection of ongoing adjustments in healthcare costs that will significantly impact beneficiaries’ out-of-pocket expenses. This adjustment, alongside increasing premiums and the introduction of a $2,000 out-of-pocket cap, highlights the critical need for strategic financial planning. Recipients must navigate these changes to manage their healthcare costs effectively and ensure they are prepared for future expenses.

Introduction

As the landscape of Medicare evolves, 2025 brings significant changes that could impact millions of beneficiaries. Adjustments to deductibles, premiums, and out-of-pocket costs mean that understanding these shifts is crucial for effective financial planning and healthcare management.

CareSet, a leader in Medicare data analysis, offers invaluable insights into these changes, enabling stakeholders to navigate the complexities of Medicare claims and optimize patient care strategies.

This article delves into the upcoming modifications, highlighting their implications for beneficiaries and providing essential strategies to adapt to the new healthcare environment. From understanding the financial ramifications of increased deductibles to exploring enrollment options, staying informed is key to making the most of Medicare in 2025.

CareSet: Comprehensive Medicare Data Analysis for 2025 Changes

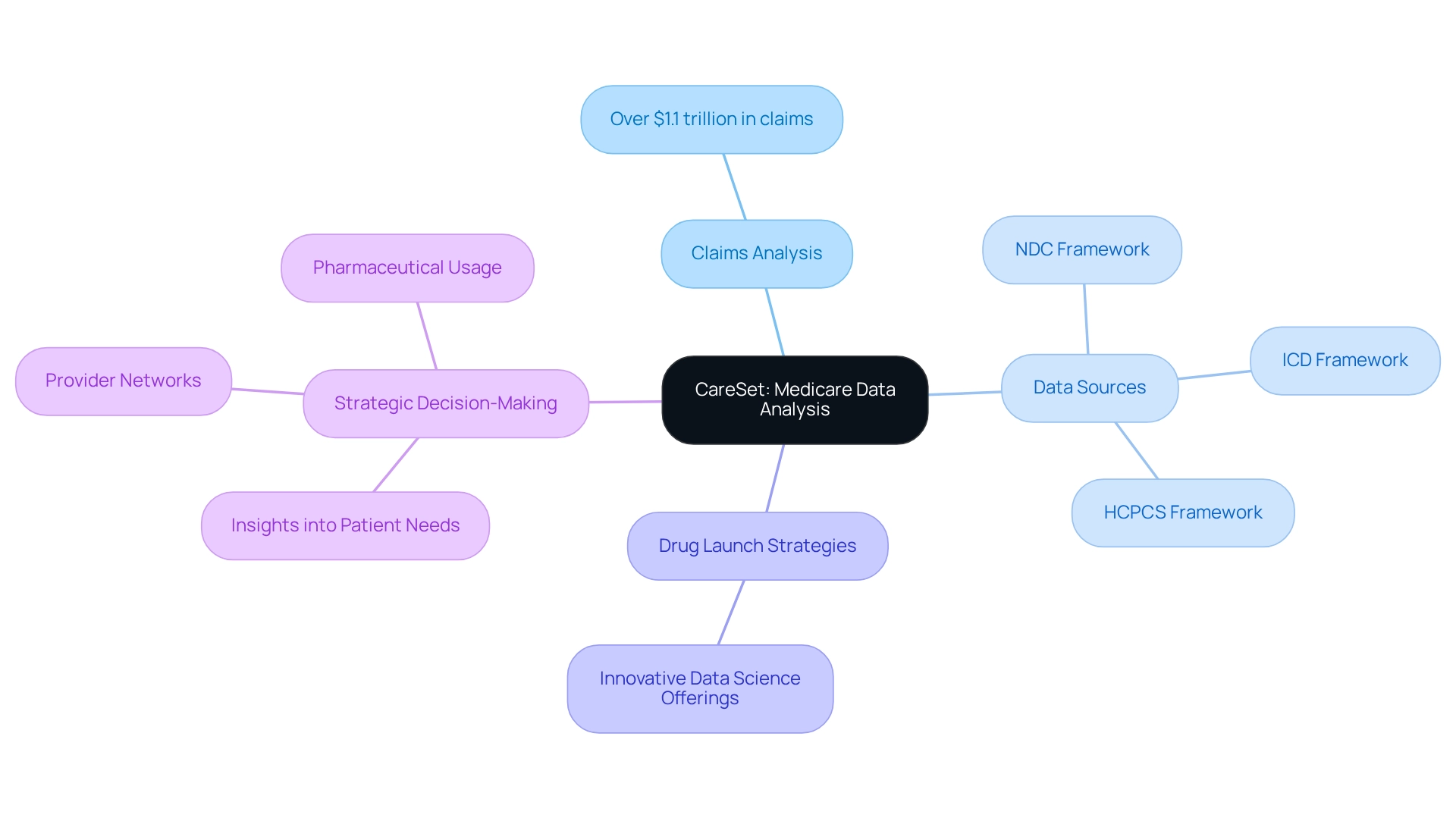

Since 2011, CareSet has been at the forefront of healthcare data analysis, providing stakeholders with crucial insights into the complexities of claims. As we approach the pivotal changes of 2025, CareSet’s extensive analysis of over $1.1 trillion in annual claims data will be vital for navigating the evolving landscape of the 2025 Medicare Part B deductible and premiums. By leveraging a diverse array of data sources, including ICD, NDC, and HCPCS frameworks, CareSet empowers clients to make informed decisions that not only enhance patient care but also optimize medical strategies.

Moreover, with the advent of innovative data science offerings, CareSet is poised to support drug launch strategies and deliver deeper insights into patient needs, provider networks, and pharmaceutical usage. This comprehensive approach ultimately strengthens strategic medical decision-making, positioning CareSet as an indispensable partner in the healthcare sector. As we look ahead, engaging with CareSet’s insights will be crucial for stakeholders aiming to navigate the complexities of the healthcare landscape effectively.

New Deductible Amount: What to Expect in 2025

In 2025, the Medicare Part B deductible will rise to $257, increasing from $240 in 2024. This $17 adjustment reflects ongoing changes in healthcare costs and utilization patterns. Beneficiaries must prepare for this shift, as the 2025 Medicare Part B deductible will impact their out-of-pocket expenses before health services begin covering medical costs. Understanding these developments is crucial for stakeholders, particularly Pharmaceutical Market Access Managers, who navigate the complexities of claims data and patient treatment pathways.

CareSet empowers healthcare strategies with insights derived from over 62 million individuals and 6 million providers, enabling a comprehensive analysis of how these deductible changes impact patient journeys and treatment approvals.

Out-of-Pocket Costs: Financial Implications of the 2025 Deductible

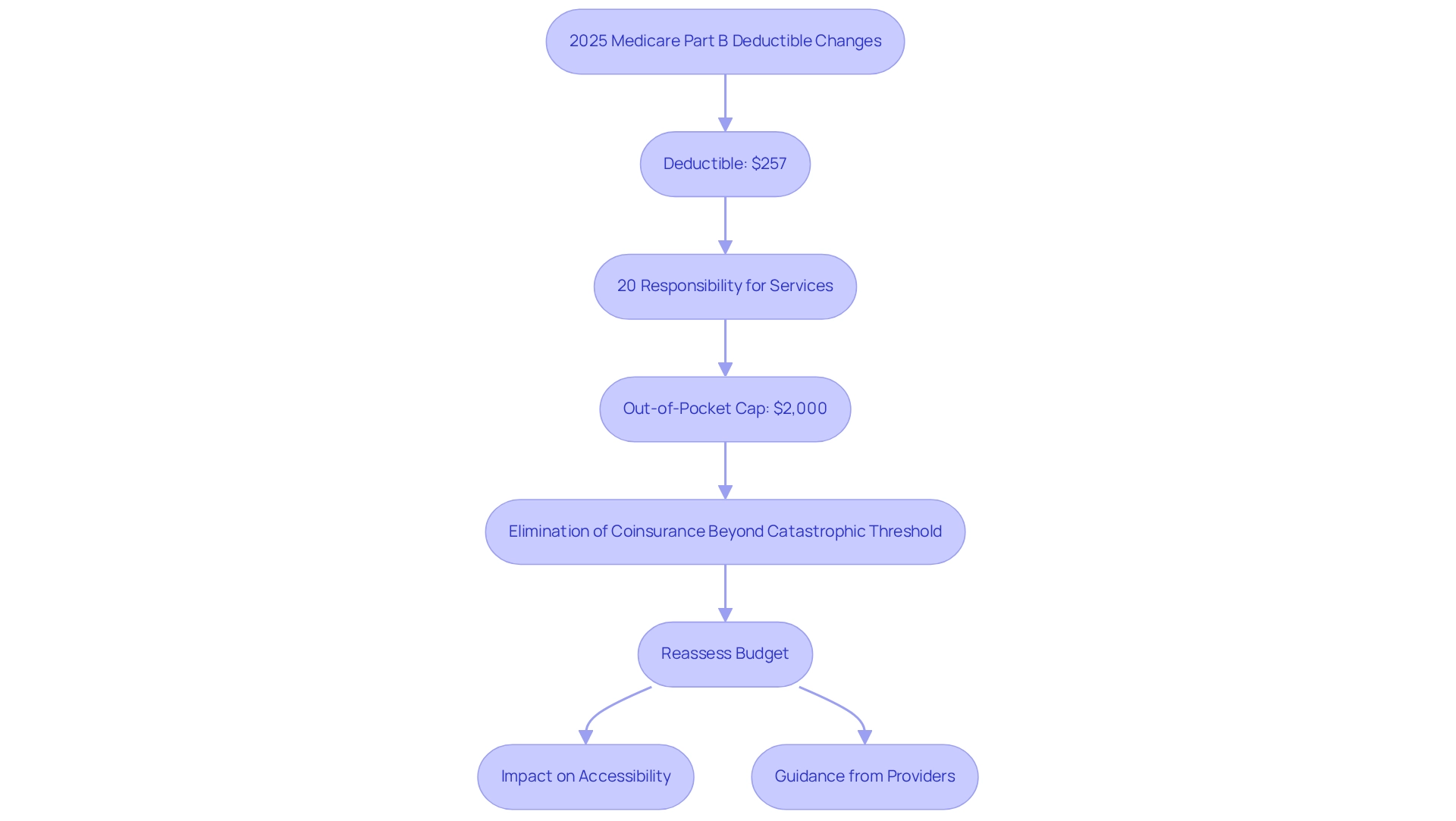

The deductible for Medicare Part B in 2025 is established at $257, encouraging recipients to prepare for higher out-of-pocket expenses before Medicare coverage begins. After this deductible, recipients are accountable for 20% of the Medicare-approved amounts for services, which can impose significant financial burdens on those requiring regular medical care. This adjustment underscores the importance of strategic financial planning to mitigate the impacts of rising medical costs.

Financial experts emphasize the need for recipients to reassess their budgets in light of these changes. With the introduction of a $2,000 cap on out-of-pocket expenses in 2025, recipients will gain a clearer perspective on their maximum potential costs, facilitating more effective financial management. This limit is expected to enhance healthcare accessibility, equity, and affordability by curtailing government expenditures on prescription drugs and limiting price increases.

Moreover, starting in 2024, the elimination of coinsurance beyond the catastrophic threshold will alleviate financial pressures for individuals with high medication costs. This modification is anticipated to significantly reduce out-of-pocket expenses for those who reach elevated spending thresholds on medications, thus improving affordability and accessibility within the healthcare system.

As individuals navigate their treatment pathways, comprehending the implications of these deductible increases is vital. Providers play an essential role in guiding patients from diagnosis to treatment, employing ICD, NDC, and HCPCS codes to delineate interventions and facilitate care. For instance, common conditions such as diabetes, hypertension, and cancer are often identified and managed using specific ICD codes, which directly influence the treatment options available to patients.

Additionally, patients must transition from diagnosis to treatment through healthcare benefits, which include Parts A, B, and D. It is crucial for recipients to recognize which therapies are approved by Part D Plans and the associated costs, as these factors significantly impact their financial responsibilities. Case studies exemplify the real-world ramifications of these deductible increases. For example, individuals who previously faced considerable out-of-pocket expenses for medications may experience relief as the new policies are implemented, particularly with the expected decrease in costs for those reaching high spending levels. As these changes unfold, it is imperative for individuals utilizing the program to stay informed and adjust their financial strategies accordingly, ensuring they are prepared for the evolving landscape of medical expenses, particularly the 2025 Medicare Part B deductible.

Medicare Part B Premiums: Changes and Their Impact in 2025

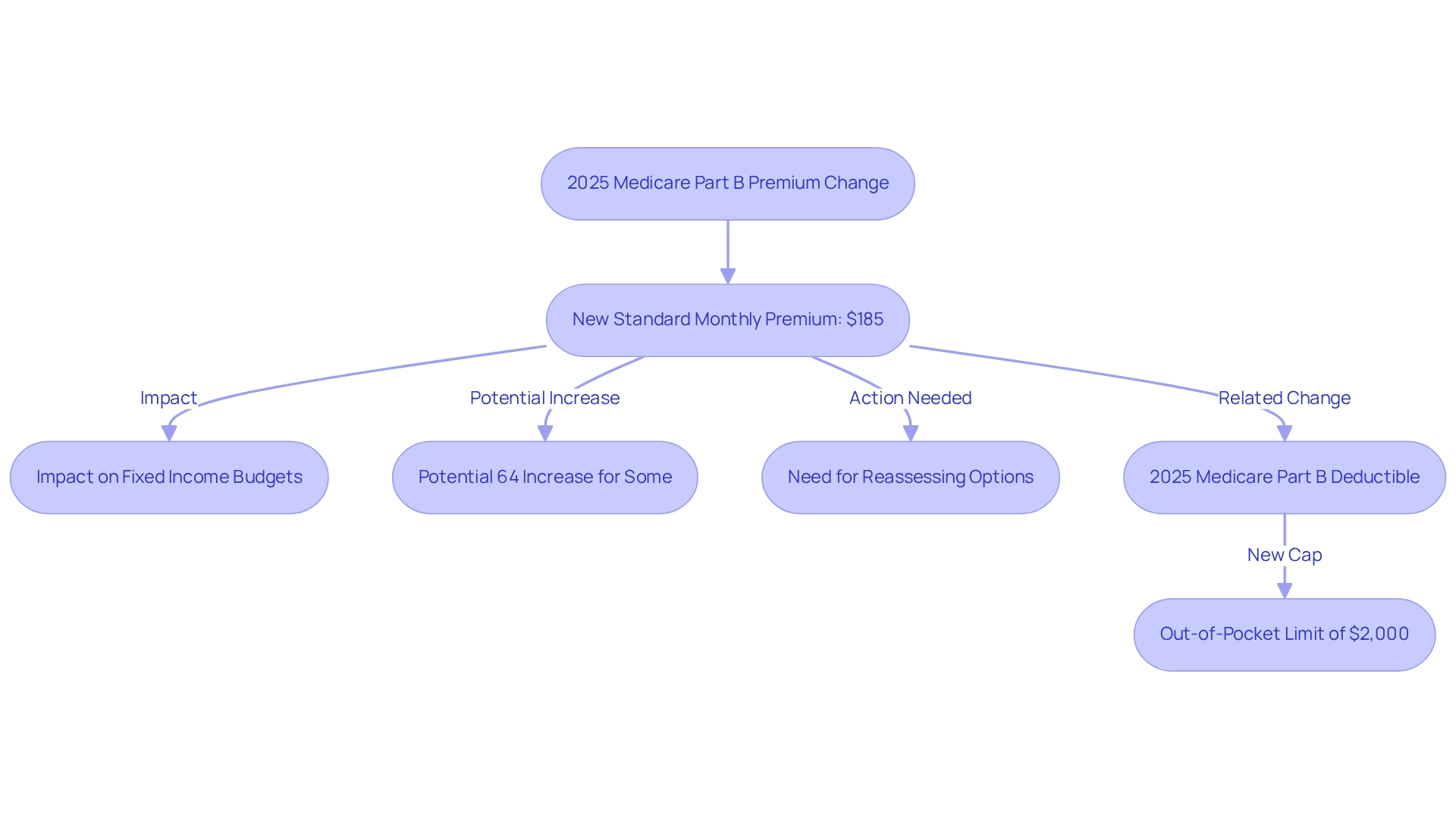

In 2025, the standard monthly premium for Medicare Part B will increase to $185, which reflects a rise of $10.30 from the previous year, and this change is relevant to the 2025 Medicare Part B deductible. This adjustment is primarily influenced by rising medical expenses, which are expected to significantly impact the financial planning of millions of recipients.

As medical economists observe, such premium hikes can exert pressure on budgets, particularly for individuals on fixed incomes. For instance, another user’s monthly premium could rise by as much as 64% if they remain with their current plan, underscoring the urgent need for recipients to reassess their options. Understanding these developments is crucial for recipients as they prepare for their medical costs in the upcoming year.

Furthermore, the financial landscape for those on Medicare is evolving, especially with the introduction of the 2025 Medicare Part B deductible and a $2,000 out-of-pocket limit for Part D. This cap is anticipated to alleviate some financial burdens, benefiting approximately 3.2 million Americans by making prescription medications more affordable.

It is essential to observe how this cap interacts with the rising premiums, particularly in relation to the 2025 Medicare Part B deductible, as it may provide some relief amidst increasing expenses. Historical patterns indicate that Part B premiums have consistently escalated over the years, reflecting broader shifts in medical costs. For example, premiums have experienced a steady increase since 2021, highlighting the ongoing nature of these adjustments.

As recipients navigate these changes, resources from organizations like the National Council on Aging (NCOA) can provide valuable guidance on selecting the most appropriate Medicare plans and navigating enrollment and coverage options. With the right information, recipients can better manage their healthcare expenditures amidst these rising costs.

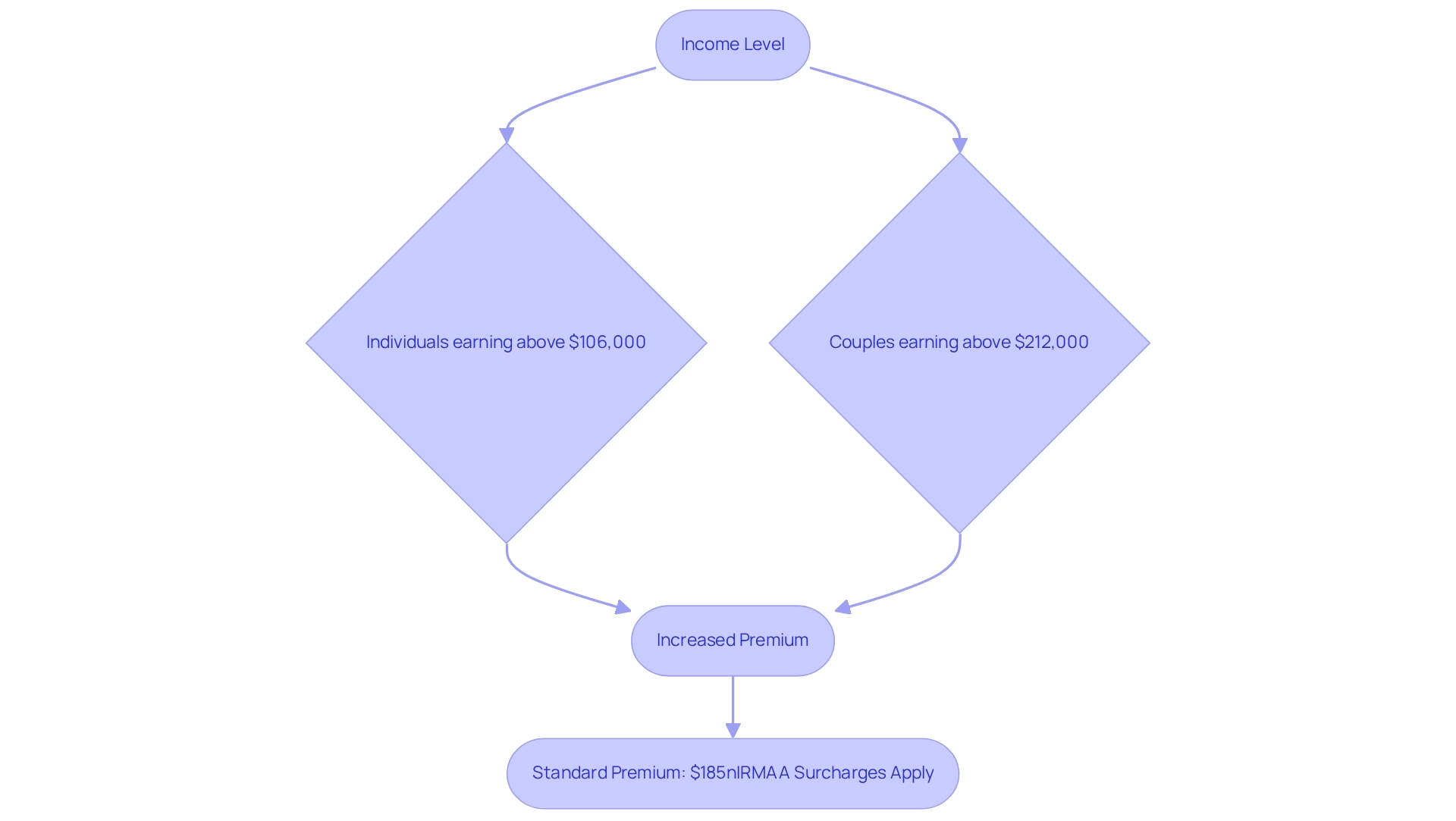

Income-Related Adjustments: Understanding IRMAA for 2025

In 2025, the Income-Related Monthly Adjustment Amount (IRMAA) will impact recipients with higher incomes. The standard premium of $185 will see an increase for individuals earning above $106,000 and couples earning above $212,000. These IRMAA surcharges can substantially elevate monthly premiums, making it essential for higher-income recipients to grasp their potential costs. Understanding these financial implications is crucial for effective financial planning and management.

Broader Medicare Changes: Contextualizing the 2025 Deductible

The increase in the 2025 Medicare Part B deductible is a vital element of a broader strategy aimed at addressing soaring medical expenses and enhancing the sustainability of the program. This adjustment is not an isolated event; it coincides with significant modifications to Part D and Advantage plans, collectively signifying a concerted effort to manage expenses while maintaining access to essential healthcare services. Healthcare policy experts emphasize that these changes are designed to improve payment accuracy and ensure that recipients receive the necessary support. Catherine Howden, Director at CMS, notes that the finalized updates to the Part D risk adjustment model are crucial for plan sponsors to formulate precise bids for the upcoming calendar year. This reflects a commitment to optimizing patient outcomes and the overall lifecycle management of pharmaceutical products, which directly relates to the implications of the Part B deductible increase.

Statistics indicate that direct subsidy payments to plans will constitute 54% of total Part D spending in 2025. This shift in funding is significant as it affects the overall financial framework of the program, potentially influencing the affordability of Part B services for beneficiaries. Furthermore, reinsurance payments to Part D plans are expected to represent 17% of overall expenditures, indicating a notable decrease from prior years. This shift in financial obligation for catastrophic medication expenses highlights the evolving framework of funding and its implications for the Part B deductible.

Real-world examples illustrate the impact of these adjustments. As recipients explore their choices, understanding the background of the 2025 Medicare Part B deductible and the broader developments is crucial for making informed decisions. To effectively manage these changes, recipients should consider reviewing their health plans and exploring available resources to ensure they are maximizing their benefits. With CareSet’s extensive healthcare data solutions, which include insights from over 62 million individuals and 6 million providers, stakeholders can gain a deeper understanding of patient needs, provider networks, and pharmaceutical utilization. This information enhances medical strategies and aids informed decision-making, ensuring that the program remains viable and responsive to the needs of its recipients.

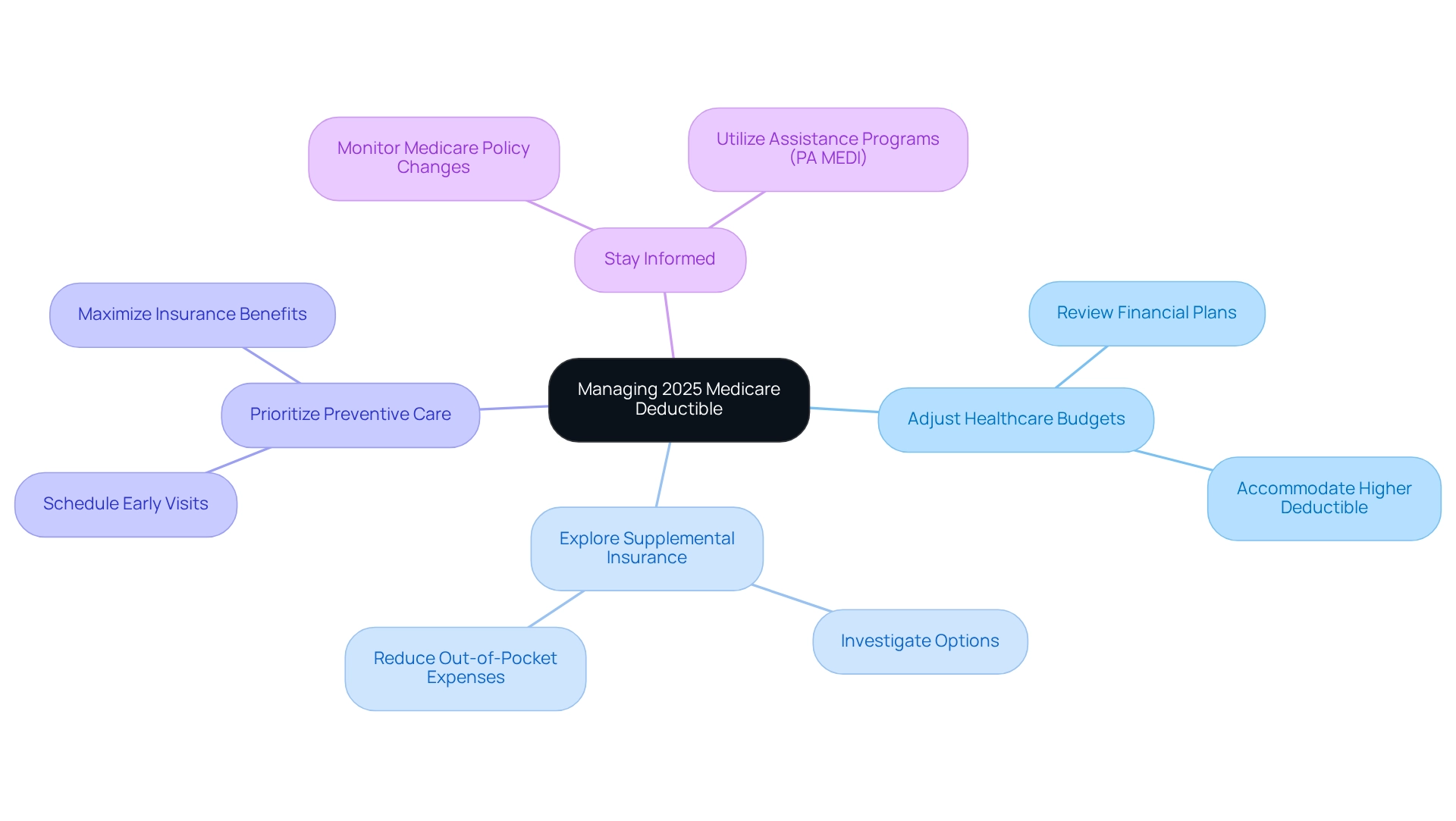

Preparation Strategies: How to Manage the 2025 Medicare Deductible

To effectively manage the 2025 Medicare Part B deductible, recipients should implement several key strategies. First, it is essential to adjust healthcare budgets. Review and modify your healthcare budgets to accommodate the higher deductible, ensuring that financial plans reflect these changes. Next, consider exploring supplemental insurance. Investigating supplemental insurance options can help cover the deductible, providing an additional layer of financial protection. Statistics indicate that a substantial fraction of healthcare beneficiaries utilize supplemental insurance, which can significantly reduce out-of-pocket expenses.

Additionally, prioritize preventive care. Schedule preventive care visits early in the year to maximize health insurance benefits before the deductible is met, leading to considerable savings. It is also crucial to stay informed. Keeping abreast of changes in Medicare policies and available resources, such as assistance programs like PA MEDI, can help individuals understand their Medicare options and make necessary adjustments throughout the year.

Notably, statistics reveal that 99% of PDP enrollees are in plans that opted into the voluntary premium stabilization program for 2025, underscoring the importance of understanding plan options. Furthermore, the Inflation Reduction Act is anticipated to enhance access to essential medications, which will also impact budgeting strategies for recipients. Financial planning specialists advocate for proactive oversight of medical expenses, emphasizing the necessity for recipients to prepare for potential increases in their out-of-pocket costs. By applying these approaches, recipients can more effectively manage their medical finances and ensure they are prepared for upcoming developments. Incorporating insights from healthcare advisors can further assist individuals in making informed choices about their Medicare plans.

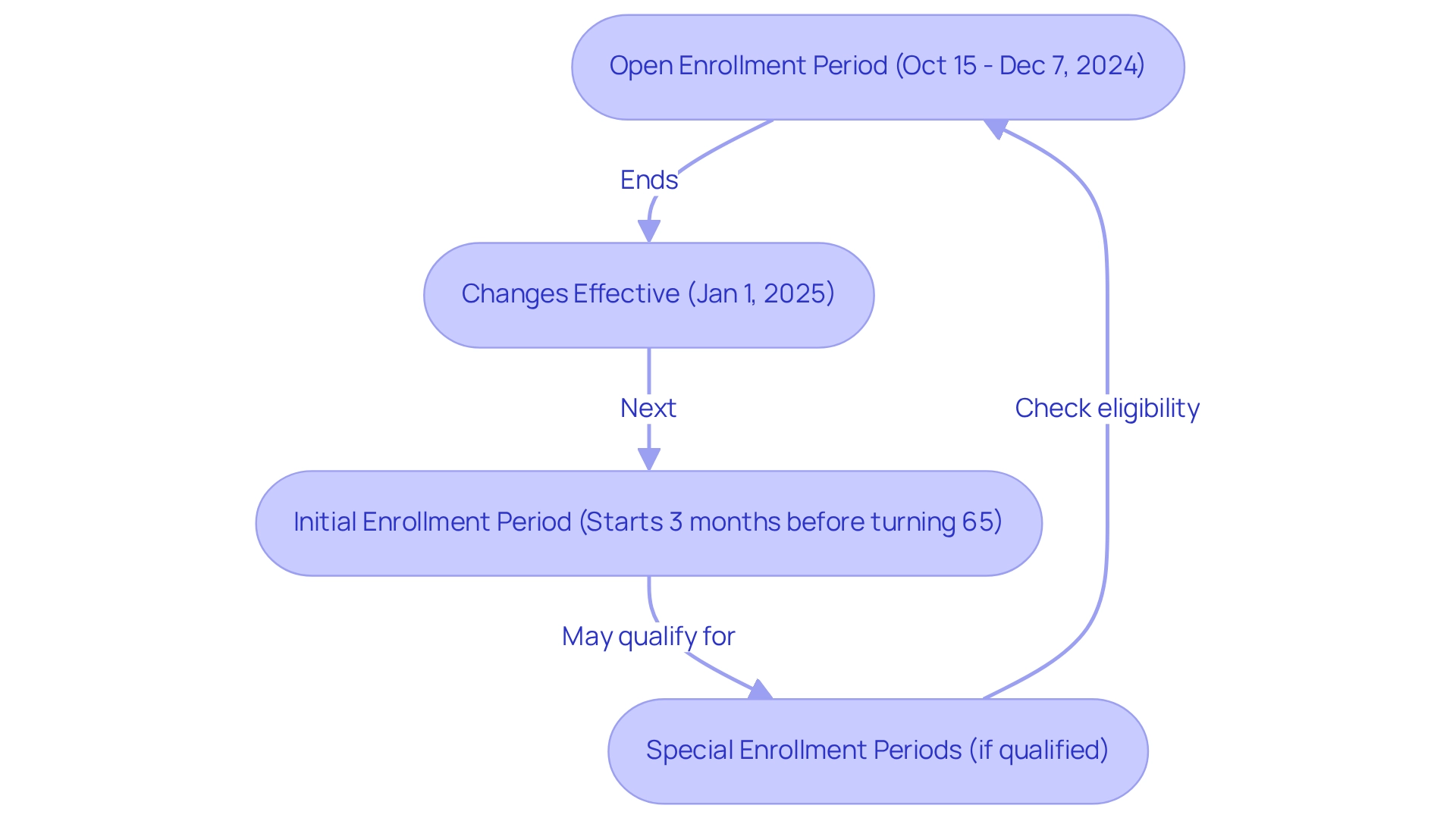

Enrollment Periods: Key Dates for 2025 Medicare Changes

Beneficiaries are urged to mark their calendars for the critical enrollment dates in 2025. First, the Open Enrollment Period runs from October 15 to December 7, 2024, with changes taking effect on January 1, 2025. Additionally, the Initial Enrollment Period for new beneficiaries commences three months prior to their 65th birthday.

It is also important to note that Special Enrollment Periods may be available for those who qualify due to specific life events. Staying informed about these dates is essential to prevent gaps in coverage.

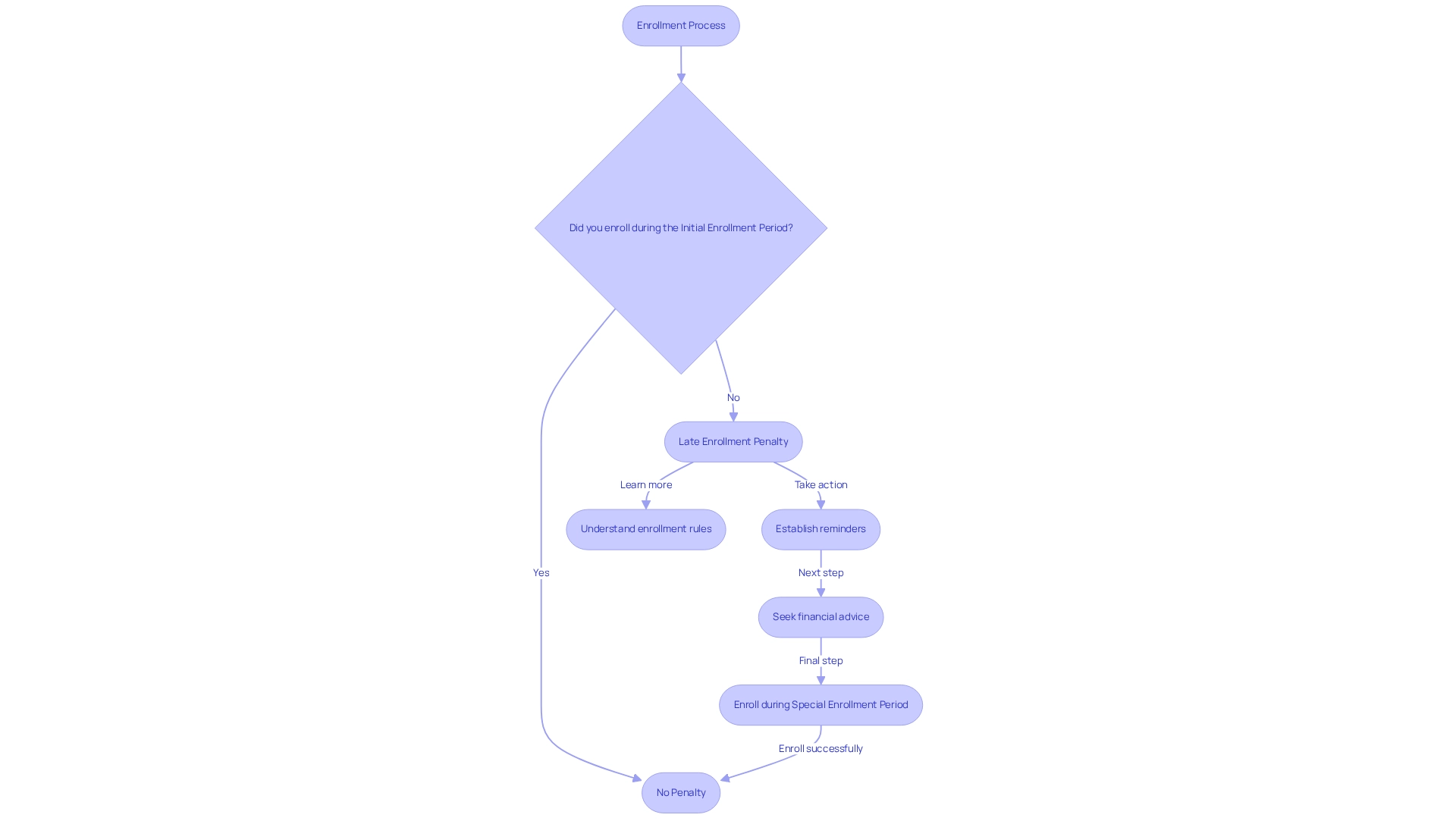

Late Enrollment Penalties: Avoiding Additional Costs in 2025

Beneficiaries must acknowledge that failing to enroll in the program during the specified times can lead to substantial late enrollment fees. Specifically, for Medicare Part B, the penalty amounts to 10% of the premium for each 12-month period of delay. For instance, if an individual delays enrollment for two years, their premium could increase by 20%. To avoid these penalties, it is essential for recipients to enroll during their Initial Enrollment Period or to qualify for a Special Enrollment Period if they miss the initial window.

Statistics suggest that nearly 1 million recipients incur late enrollment penalties each year, underscoring the critical importance of timely enrollment. This situation is compounded by the financial implications of Medicare policies, such as the estimated savings of $0.514 billion from delinquent tax debts, which highlights the broader financial landscape individuals must navigate. Financial advisors emphasize that understanding the enrollment rules is essential for maximizing benefits. As Dana Anspach, a certified financial planner, noted, “To make the most of your money, it is essential that you develop a working knowledge of the rules or find trusted advisors to guide you,” reinforcing the necessity for recipients to be proactive in their enrollment decisions.

Real-world examples illustrate the consequences of delayed enrollment. For instance, an individual who postponed enrollment for three years faced an additional $600 in yearly premiums due to penalties. Such cases starkly highlight the financial impact of inaction.

To evade the penalties in 2025 related to the Medicare Part B deductible, recipients should:

- Actively oversee their enrollment periods

- Establish reminders for important dates

- Seek advice from reliable financial consultants

This proactive approach ensures they make well-informed choices regarding their health coverage.

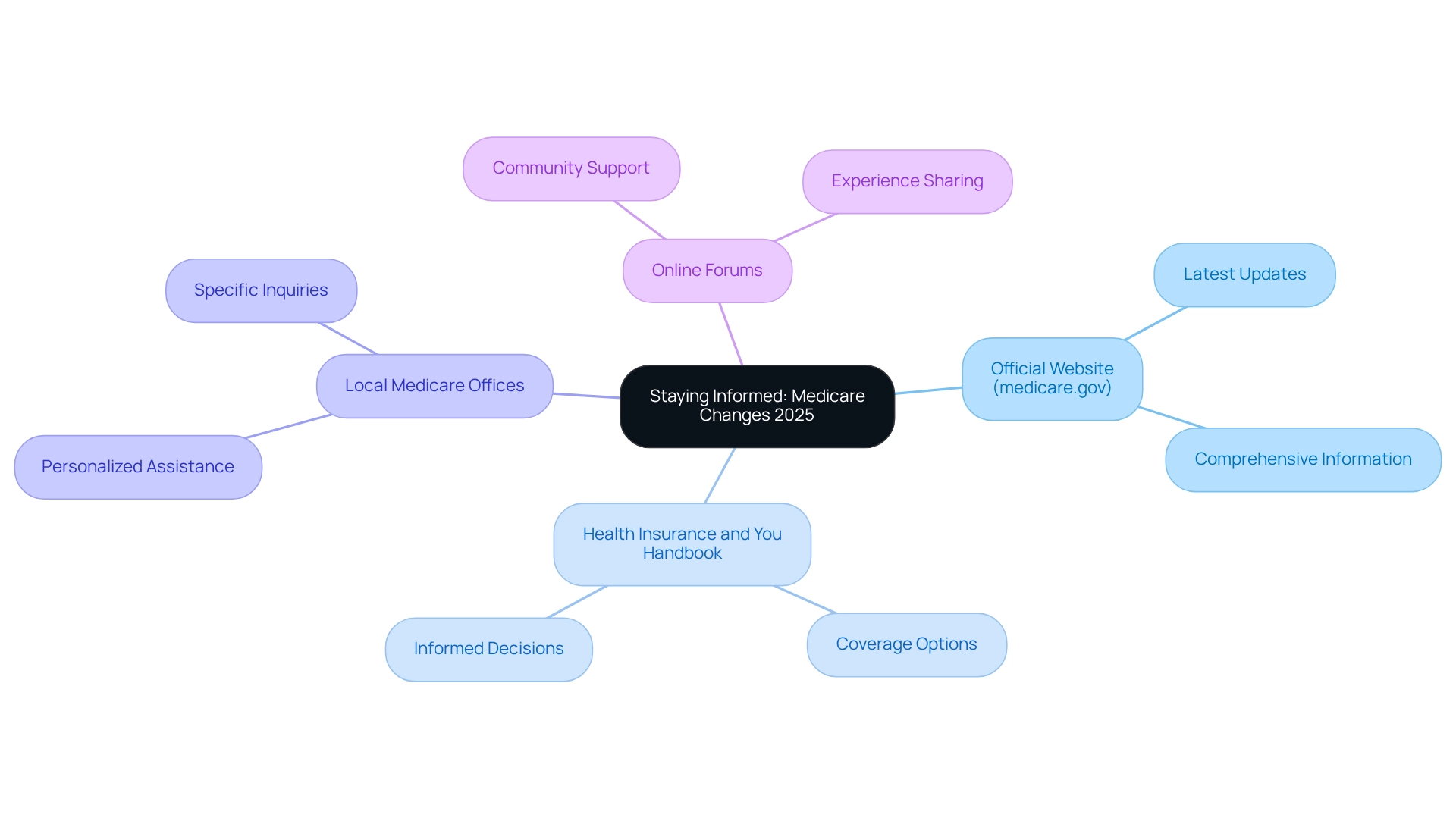

Staying Informed: Resources for Understanding 2025 Medicare Changes

To stay informed about the changes to the healthcare program in 2025, including the 2025 Medicare Part B deductible, beneficiaries should utilize the following essential resources:

- The official website (medicare.gov) serves as a primary source for updates and information, ensuring that users have access to the latest developments.

- The Health Insurance and You Handbook offers comprehensive details regarding various coverage options, which is crucial for making informed decisions.

- Local Medicare offices and helplines provide personalized assistance, allowing beneficiaries to address specific inquiries and concerns.

- Online forums and community groups present a platform for beneficiaries to share experiences and seek advice, fostering a sense of community and support.

Conclusion

The changes to Medicare in 2025 present significant implications for beneficiaries, encompassing increased deductibles and premiums alongside the introduction of out-of-pocket caps. Understanding these adjustments is essential for effective financial planning, as beneficiaries prepare for higher out-of-pocket expenses and navigate the complexities of their healthcare options. By staying informed about the new deductible of $257 and the standard monthly premium increase to $185, individuals can better manage their healthcare budgets and explore supplemental insurance options for additional financial protection.

Moreover, the introduction of a $2,000 cap on out-of-pocket spending aims to enhance the affordability of healthcare, particularly for those who require frequent medical attention. Beneficiaries should prioritize preventive care and utilize available resources to navigate these changes effectively. Organizations like CareSet provide invaluable insights into Medicare data, empowering stakeholders to make informed decisions that optimize patient care.

As the enrollment periods approach, beneficiaries must remain vigilant to avoid late enrollment penalties that could further strain their finances. By marking key dates and understanding their options, individuals can ensure they are prepared for the evolving landscape of Medicare in 2025. Ultimately, proactive management and informed decision-making are crucial for maximizing benefits and ensuring access to necessary healthcare services in this changing environment.