Overview

This article presents crucial insights into the upcoming changes in the 2024 Part B premium for Medicare, emphasizing the factors contributing to the increase and its effects on beneficiaries. The standard monthly fee is set to rise to $174.70, a shift driven by rising healthcare costs and demographic changes. This situation necessitates careful financial planning for the approximately 60 million individuals who depend on government health insurance. Understanding these adjustments is vital for beneficiaries to navigate their healthcare expenses effectively.

Introduction

As Medicare beneficiaries prepare for the significant changes in 2024, the adjustments to Part B premiums and deductibles are poised to reshape the financial landscape of healthcare. With the standard monthly premium escalating to $174.70 and the annual deductible rising to $240, millions of individuals who depend on Medicare must adeptly navigate these new costs amidst persistent healthcare inflation. This article explores the multifaceted implications of these changes, highlighting the strain on beneficiaries’ budgets and the potential repercussions for healthcare providers and the broader system. By analyzing key trends and data, stakeholders can gain valuable insights into how these adjustments will influence access to care and financial planning, ultimately facilitating informed decisions in an increasingly complex healthcare environment.

CareSet: Comprehensive Medicare Data Analysis for 2024 Part B Premium Insights

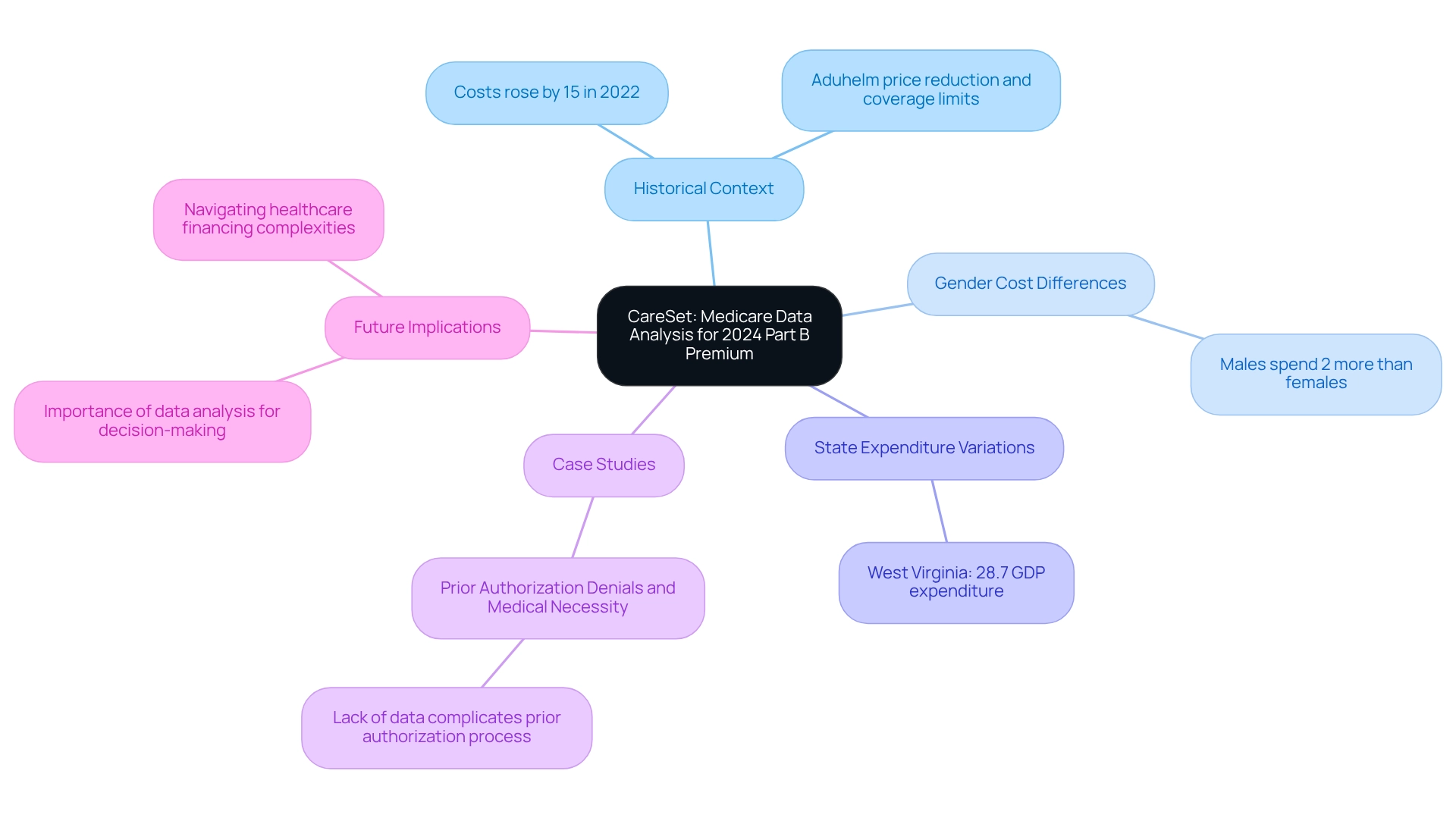

Since its inception in 2011, CareSet has established itself as a leader in healthcare data analysis, focusing on the extraction and interpretation of intricate claims information. By analyzing over $1.1 trillion in annual claims, CareSet equips stakeholders with vital insights into treatment patterns and provider networks. This analytical prowess is crucial for deciphering the implications of the 2024 part b premium changes, as precise data analysis is fundamental for informed decision-making within the medical field.

CareSet’s dedication to quality and its advanced healthcare analytics capabilities enable a comprehensive understanding of patient journeys and provider impacts. The insights obtained from over 62 million beneficiaries and 6 million providers empower decision-makers in the medical field to navigate the complexities of financing effectively. The influence of Medicare data analysis on Part B fee insights cannot be overstated. For example, the 2024 pricing adjustments reflect broader trends in healthcare expenditure and patient demographics. Significantly, expenditures for older adults indicate that men face costs roughly 2% greater than women, underscoring the necessity for customized approaches in cost evaluations. Additionally, West Virginia had the highest health expenditure as a portion of GDP at 28.7% in 2020, demonstrating the differing financial pressures among states that can impact cost assessments.

Real-world instances of healthcare claims data analysis illustrate how variations in costs are impacted by several factors, including medication pricing and coverage restrictions. A significant case study involves the prior authorization denials related to medical necessity, where the lack of detailed data on denial reasons complicates efforts to enhance the prior authorization process and ensure equitable access to necessary services. Furthermore, the absence of details regarding employers providing retiree benefits complicates the evaluation of consequences for beneficiaries, further highlighting the difficulties in comprehending cost changes.

As we look forward to 2024, the expected adjustments in the 2024 part b premium costs are guided by thorough data analysis. Analysts emphasize that understanding these shifts is essential for stakeholders aiming to navigate the complexities of healthcare financing. Dawn Nici, a previous staff editor, observed that “costs rose by nearly 15% in 2022 in expectation of a surge in spending for the drug, but Aduhelm’s producer Biogen subsequently reduced the price, and CMS restricted its coverage of the drug to individuals in clinical trials.” This context on past value changes underscores the importance of analyzing current trends.

The insights obtained from medical claims data not only reveal current trends but also enable decision-makers in the health sector to optimize their strategies effectively. In summary, CareSet’s commitment to providing high-quality insights into healthcare positions it as an invaluable resource for understanding the evolving landscape of the 2024 part b premium. By leveraging extensive claims data, CareSet enables its clients to make informed decisions that ultimately enhance patient care and optimize healthcare outcomes. To learn more about how CareSet can assist your strategic choices in navigating healthcare complexities, contact us today.

2024 Part B Premium Increase: What Beneficiaries Should Expect

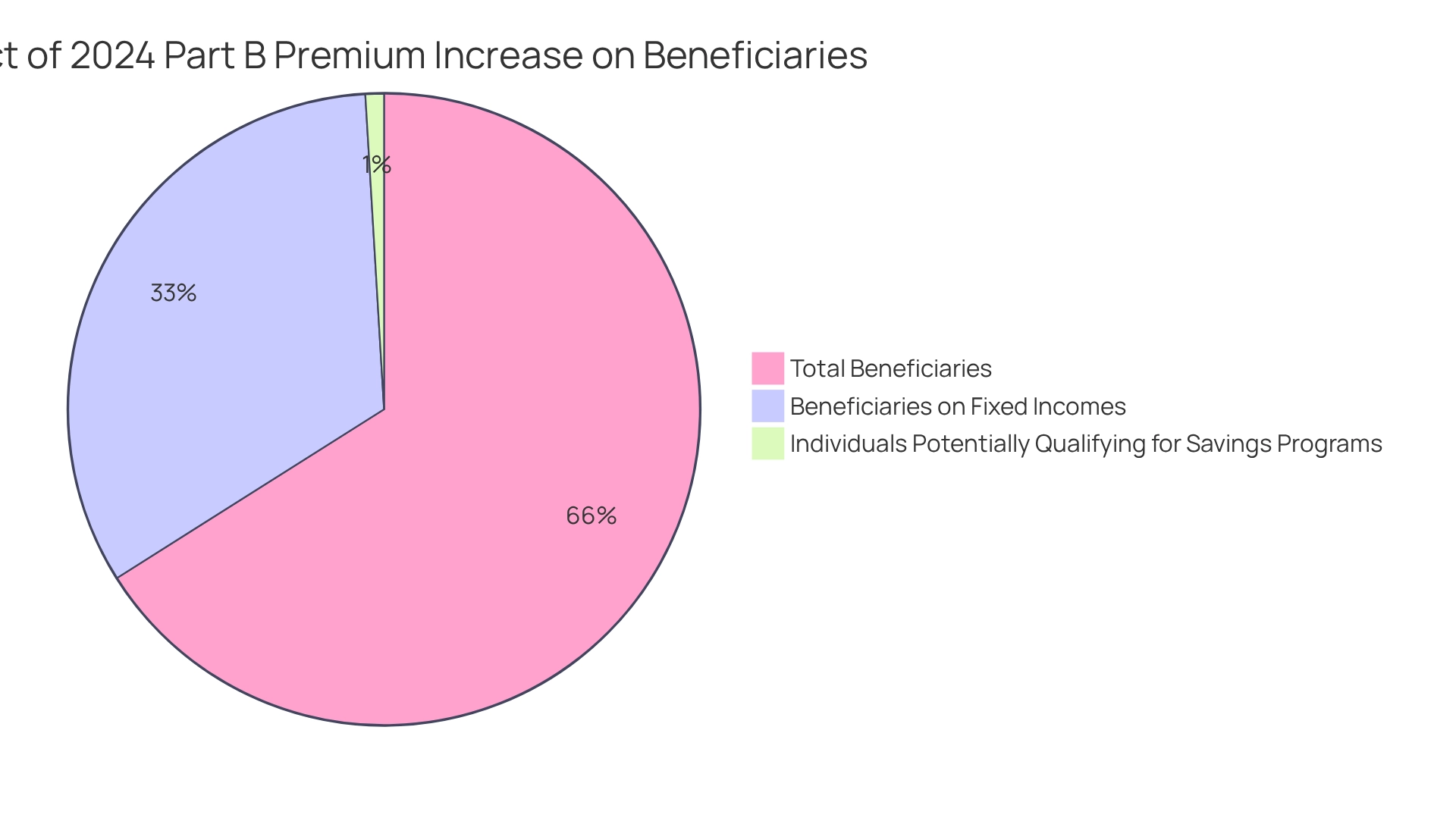

In 2024, the standard monthly fee for the 2024 part b premium will increase to $174.70, reflecting a rise of $9.80 from last year’s charge of $164.90. This adjustment addresses the ongoing inflation in healthcare costs, affecting approximately 60 million individuals who depend on government health insurance for their medical services. The increase in the 2024 part b premium is particularly critical for those with fixed incomes, as even a slight rise in earnings can lead to higher premium categories, complicating financial planning for many.

The adjustments in premiums are part of a broader trend observed in healthcare programs, where rising expenses necessitate regular modifications to sustain the program’s viability. For instance, in 2024, the Part A inpatient hospital deductible will also increase to $1,632, further impacting recipients’ financial obligations for hospital care. This connection underscores the cumulative effect of escalating costs on recipients’ overall healthcare expenses.

As the expansion of the Part D Low-Income Subsidy (LIS) aims to mitigate some prescription drug costs for eligible individuals, understanding these changes is essential for effective financial management. With an estimated 860,000 individuals potentially qualifying for Savings Programs, these initiatives could provide crucial support to those affected by the cost increase, alleviating financial strain.

Healthcare economists emphasize the importance of managing these cost escalations carefully, as even minor fluctuations in income can significantly affect recipients’ financial responsibilities. Therefore, it is imperative for beneficiaries to remain informed about these changes and proactively reassess their financial strategies in light of the increase in the 2024 part b premium.

Stay updated with CareSet’s latest insights and analyses to enhance your understanding of healthcare data and improve patient care strategies.

2024 Part B Deductible Changes: Financial Implications for Patients

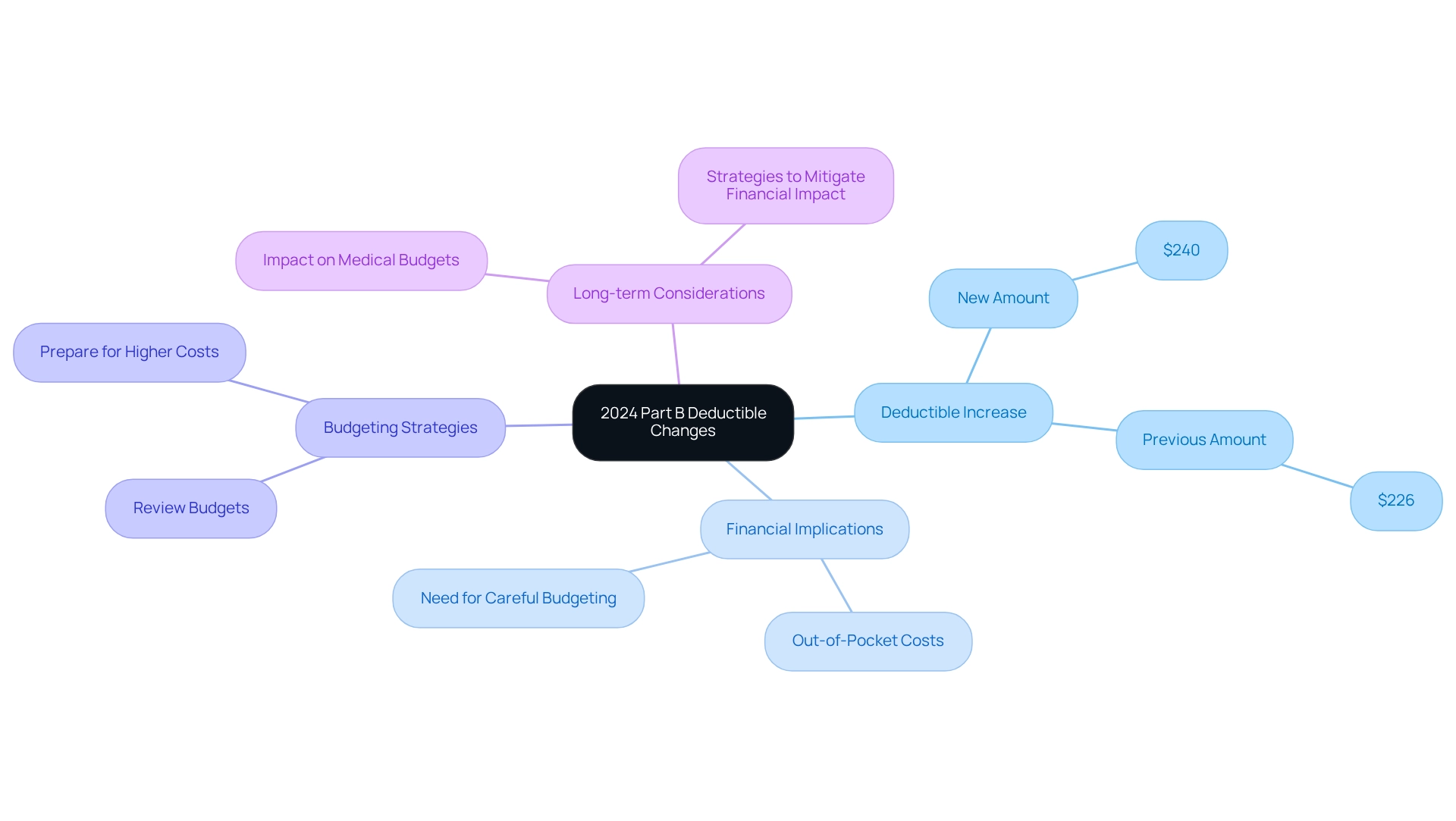

In 2024, the yearly deductible associated with the 2024 Part B premium will increase to $240, up from $226 in 2023. This $14 increase signifies that recipients will face greater out-of-pocket costs before the program begins to cover their medical expenses. Such changes necessitate careful budgeting, particularly since nearly 99% of Medicare recipients do not pay a premium for Part A due to their qualifying work history. The rise in the Part B deductible underscores the importance of understanding medical expenses, especially as beneficiaries navigate their financial responsibilities.

Financial advisors recommend that individuals review their budgets to accommodate these changes, ensuring preparedness for the higher out-of-pocket costs associated with their medical needs. This adjustment is particularly crucial in light of the stability projected in Advantage and Prescription Drug programs for 2025, which may influence overall medical spending patterns. As recipients adapt to these changes, they should consider the long-term implications for their medical budgets and explore strategies to mitigate the financial impact.

As noted by The Senior Citizens League, ‘We are relieved to learn that the increase in the 2024 Part B premium won’t be as high as we initially feared,’ emphasizing the necessity of staying informed about these shifts. CareSet’s comprehensive approach to healthcare data analysis empowers both medical organizations and recipients by providing insights into drug usage and treatment pathways. CareSet’s monthly Medicare updates deliver critical insights, including prevalent diseases diagnosed and treated by providers, as well as how patients navigate their treatment journeys. By leveraging information from over 62 million recipients and 6 million providers, CareSet aids stakeholders in effectively managing these financial adjustments, ensuring informed decision-making amidst rising costs.

Out-of-Pocket Costs: How the 2024 Part B Premium Affects Patients

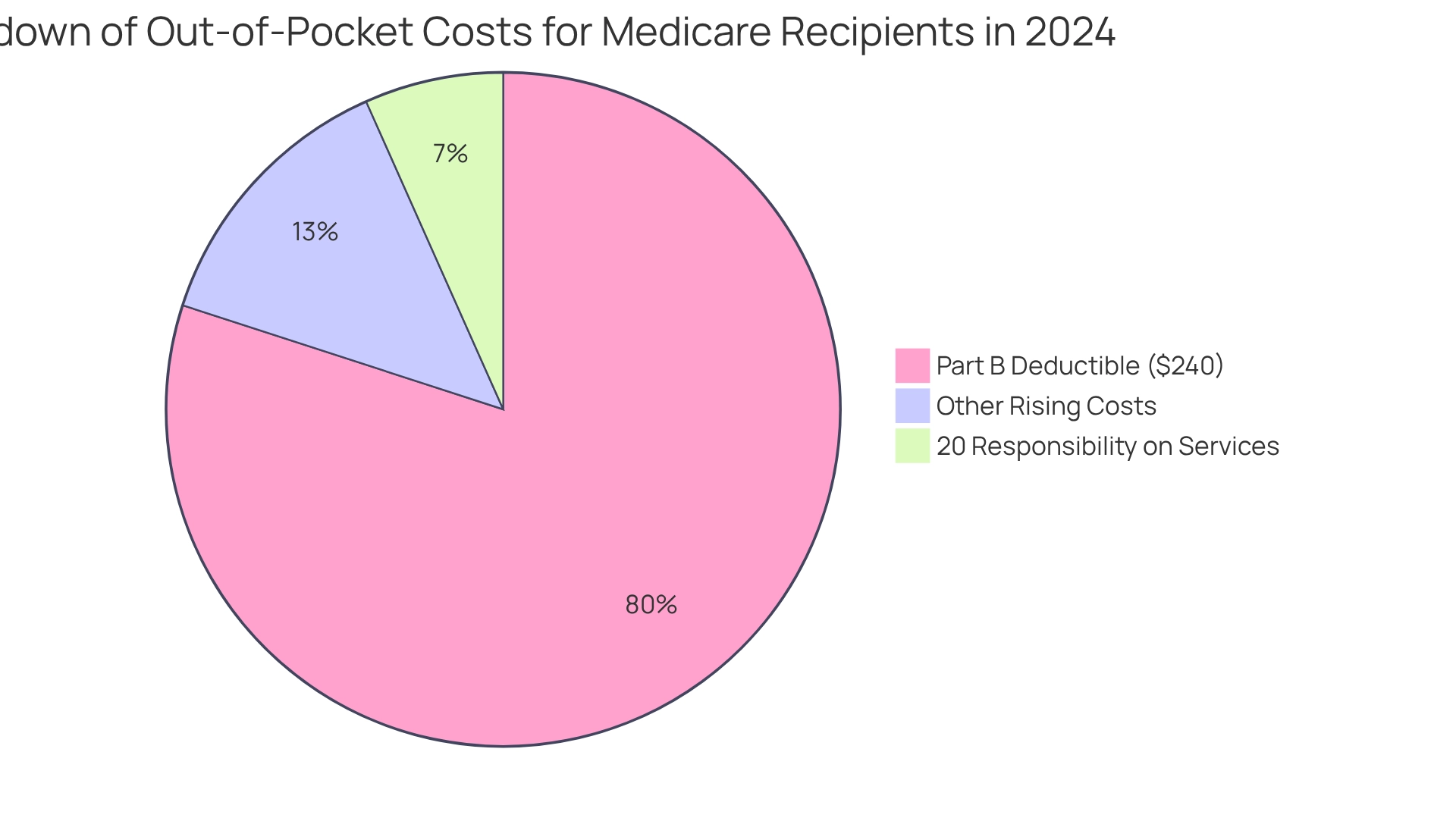

The increase in the 2024 part B premium and deductible will lead to elevated out-of-pocket expenses for recipients seeking medical services. Following the deductible, recipients are responsible for 20% of the Medicare-approved amount for most services, significantly raising their overall medical costs. This financial strain is particularly alarming for individuals on fixed incomes, as they may find it challenging to accommodate these escalating costs within their budgets.

In 2024, the part B deductible of $240 is part of the overall 2024 part B premium for the health insurance program, which is an increase from $226 in 2023. This trend reflects a pattern of consistent rises that directly affect recipients’ financial preparedness for healthcare expenses. As costs continue to climb, the pressure on family finances intensifies, underscoring the importance for recipients to understand these changes and their implications for medical access.

Statistics indicate that out-of-pocket medical expenses for Medicare recipients are anticipated to rise, further complicating their ability to manage healthcare costs effectively. Notably, while the out-of-pocket expense for insulin products will remain capped at $35 monthly across all Part D plans, the overall increase in Part B charges raises concerns about affordability for other essential services. Experts stress that policymakers must tackle these challenges to ensure that seniors and individuals with disabilities retain consistent and affordable access to necessary medications and services. As Stephen J. Ubl, President and CEO, stated, “Policymakers should focus on fixing the flaws of the IRA and tackling the system-wide abuses by insurers and PBMs to ensure seniors and people with disabilities have consistent and affordable access to medicines.”

Overall, the rise in the 2024 part B premium not only impacts patient spending but also raises critical concerns about healthcare access, as increased costs may deter recipients from seeking vital medical care. By leveraging CareSet’s extensive healthcare data insights, stakeholders can more effectively analyze patient treatment pathways and provider interventions, fostering strategic decision-making that addresses the needs of recipients. The case study titled ‘2024 Part B Premium: What Recipients Should Expect’ emphasizes how the 2024 part B premium significantly influences recipients’ overall medical expenses and budgeting strategies, reinforcing the necessity for awareness and planning in light of these changes.

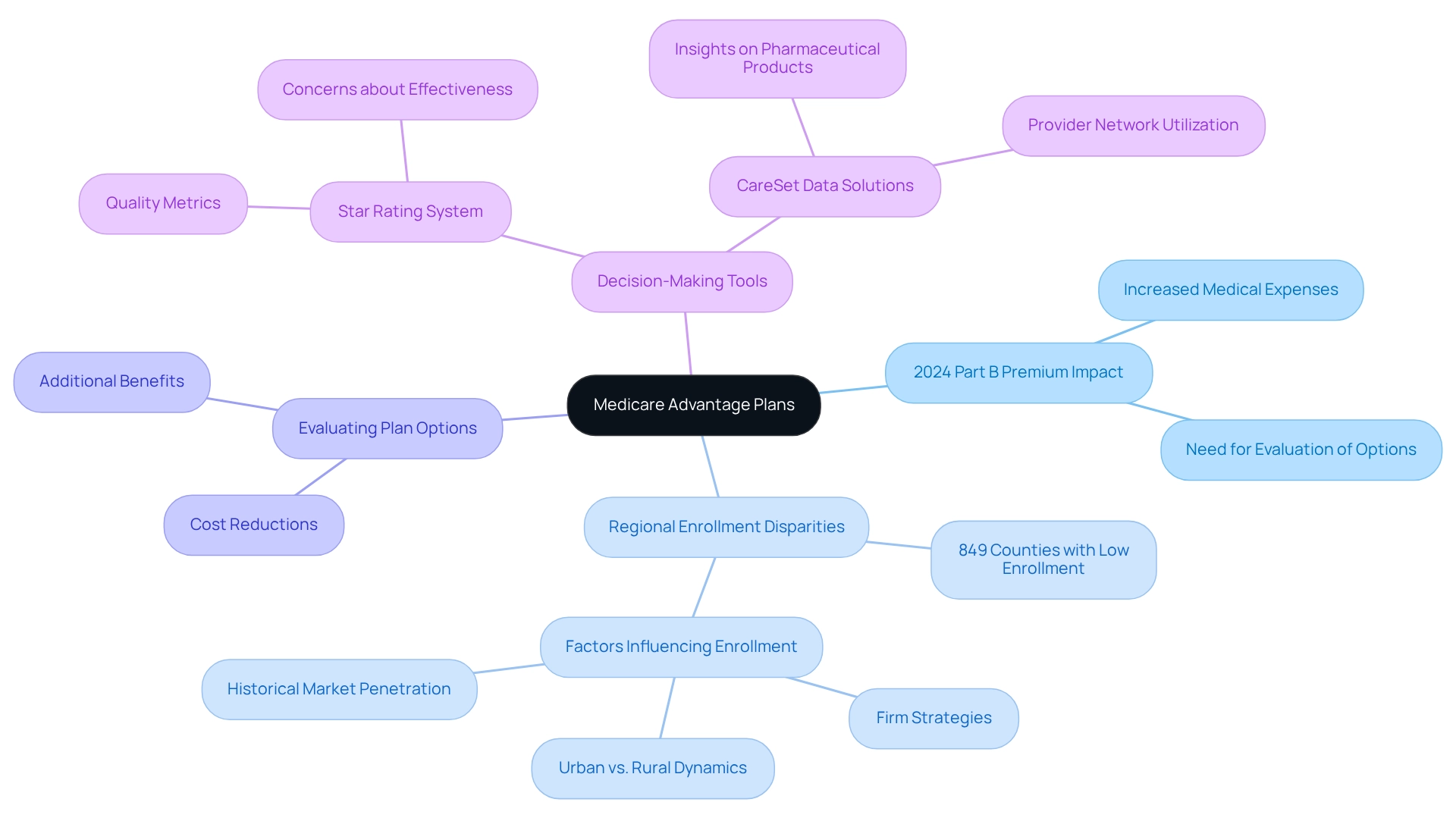

Medicare Advantage Plans: Navigating Coverage with the 2024 Part B Premium

As the typical Part B charge increases, individuals enrolled in Medicare Advantage plans are poised to experience changes in their overall medical expenses. Many of these plans incorporate the Part B fee into their pricing structures, making it essential for recipients to evaluate their options meticulously to ensure optimal value for their healthcare needs. Notably, certain plans may offer premium reductions or additional benefits that could alleviate the effects of rising costs, although specific statistics regarding these offerings remain unspecified in external sources.

Statistics reveal that 849 counties have fewer than one-third of their healthcare recipients enrolled in Advantage plans, highlighting significant regional disparities in enrollment. This variation can be attributed to factors such as local firm strategies, urban versus rural dynamics, and historical market penetration. As Tricia Neuman notes, “The broad disparity in county enrollment rates indicates several elements, including variations in firm strategy, urbanization of the county, payment rates, number of individuals covered, health care utilization patterns, and historical market penetration of Medicare Advantage.” This difference is particularly noteworthy as recipients navigate the implications of the 2024 Part B premium.

In assessing their options, recipients must consider how the 2024 Part B cost increase may affect their specific Advantage plans. Enrollment figures may differ from KFF estimates due to the inclusion or exclusion of certain plan types, which is a critical factor in understanding the overall landscape. Evaluating opportunities for cost reductions or enhanced benefits can provide a pathway to offset rising expenses, ensuring that recipients maintain access to essential healthcare services without compromising their financial stability. Moreover, with CareSet’s extensive healthcare data solutions, stakeholders can gain insights into the utilization of pharmaceutical products and provider networks, further assisting recipients in their decision-making amid these cost changes. The Centers for Medicare and Medicaid Services (CMS) employs a star rating system to evaluate Advantage plans based on quality metrics, which can also aid individuals in making informed choices.

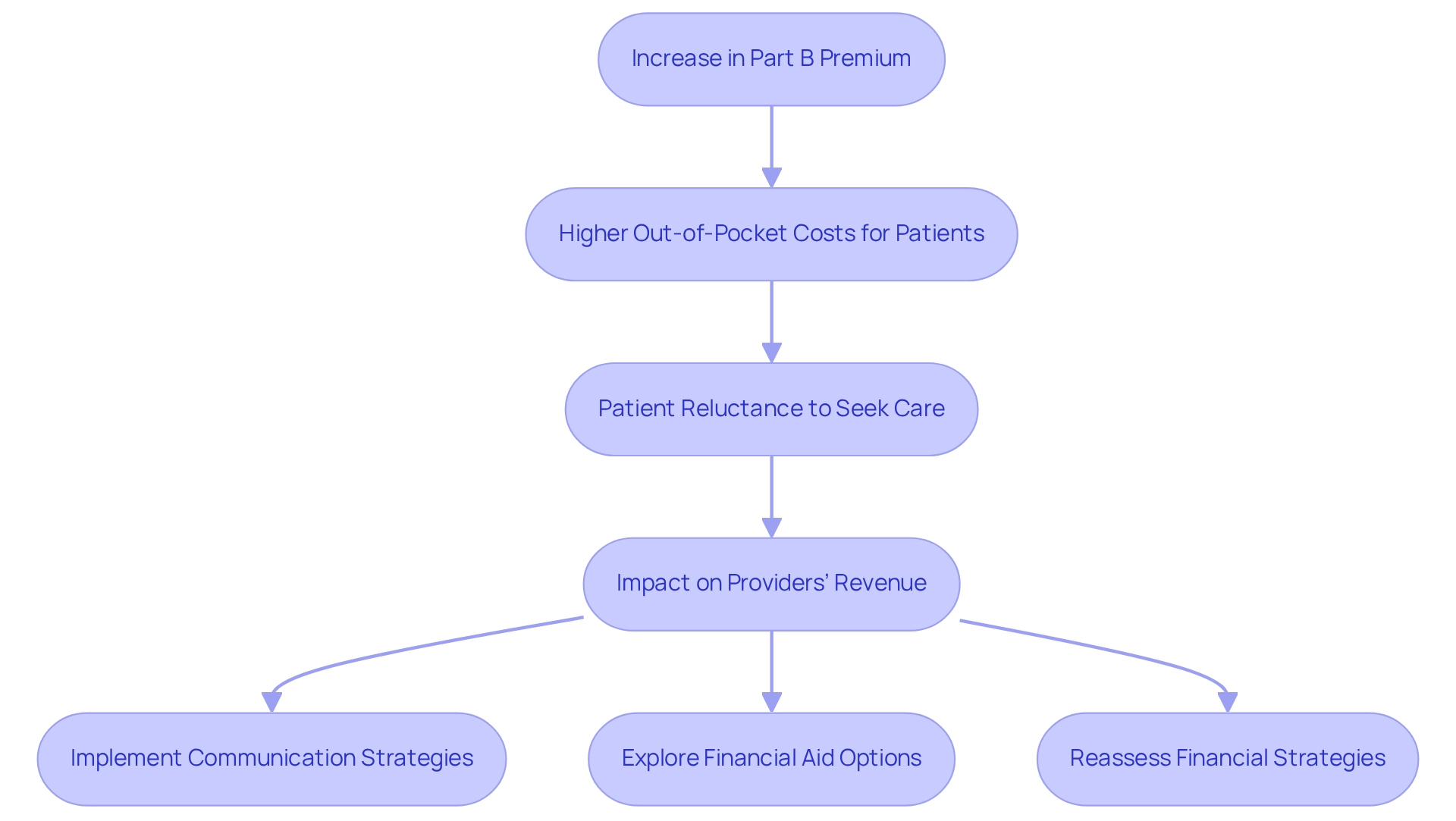

Impact on Healthcare Providers: Navigating Changes in the 2024 Part B Premium

The rise in the Part B fee presents significant challenges for medical providers, particularly regarding patient access to treatment. As out-of-pocket costs increase, many patients may hesitate to seek essential medical services, which can negatively impact providers’ revenue streams. A recent study indicates that a considerable percentage of patients express reluctance to pursue care due to escalating expenses, underscoring the urgent need for providers to address these issues proactively.

In light of the Social Security Administration’s announcement of a 3.2% cost-of-living adjustment (COLA) for 2024, which raises the average monthly retirement benefit, many beneficiaries remain concerned that rising Medicare costs and deductibles may offset these benefits. This situation emphasizes the financial pressures individuals face, making it imperative for medical providers to implement effective communication strategies to inform patients about the new rate changes and their potential impact on medical costs. Additionally, exploring financial aid programs or flexible payment options can alleviate the burden on patients, encouraging them to continue seeking necessary treatments.

Healthcare economists stress the importance of fostering a confident patient base, as this can significantly contribute to recovery and enhance providers’ Net Promoter Scores. By facilitating open discussions about expenses and available assistance, providers can build trust and encourage patients to prioritize their health despite rising costs, particularly due to the 2024 Part B premium increase, prompting numerous medical providers to reassess their financial strategies to ensure sustainability. This includes analyzing the impact on their revenue and investigating innovative methods to manage patient access amid these escalating costs, particularly those related to the 2024 Part B premium.

As the landscape shifts, remaining attuned to patient needs and adapting to the evolving economic environment will be vital for providers striving to maintain quality care and financial stability. Furthermore, leveraging comprehensive Medicare data solutions from CareSet, which integrates insights from over 62 million beneficiaries and 6 million providers, can empower healthcare stakeholders to better understand patient behaviors and needs in light of rising costs, ultimately enhancing patient care and supporting business success.

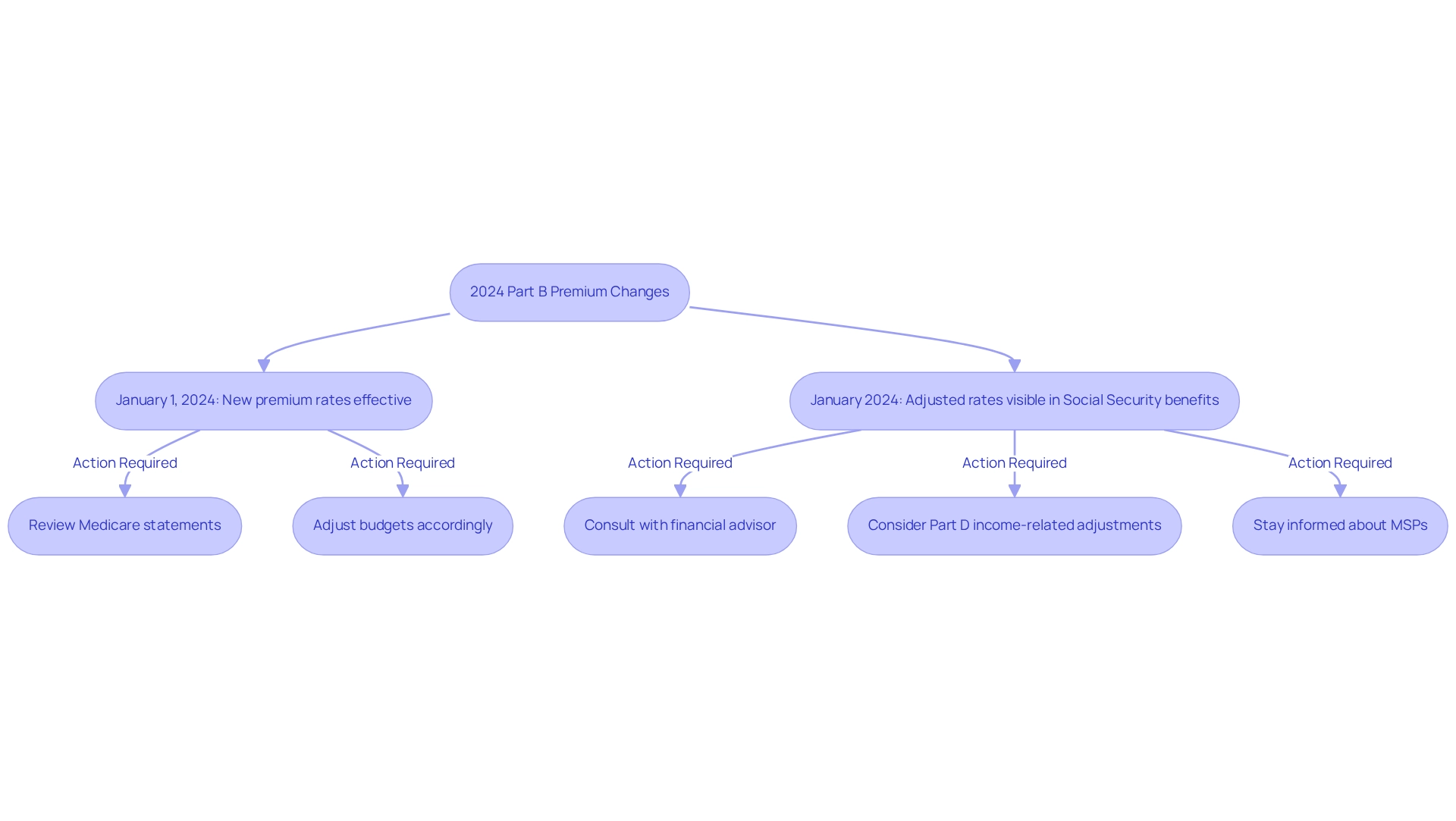

Timeline for 2024 Part B Premium Changes: Key Dates to Remember

The modifications to the 2024 Part B premium and deductible will officially take effect on January 1, 2024. Beneficiaries should expect to see these revised rate adjustments reflected in their Social Security benefits starting that same month. It is essential for beneficiaries to thoroughly review their Medicare statements and adjust their budgets accordingly as these changes approach. Key dates to note include:

- January 1, 2024: New premium rates and deductibles become effective.

- January 2024: Adjusted pricing rates will be visible in Social Security benefits.

Moreover, the Department of Health and Human Services (HHS) and CMS have streamlined the enrollment process for Medicare Savings Programs (MSPs), potentially aiding approximately 860,000 individuals by improving access to medical services and lowering prescription drug costs. This initiative underscores the importance of staying informed about coverage adjustments and available support programs, ensuring recipients can navigate their healthcare choices effectively.

For uninsured individuals aged 65 and older with fewer than 30 quarters of coverage, the full premium will be $505 per month, reflecting a $1 decrease from 2023. Additionally, it is vital to consider the 2024 Part D income-related monthly adjustment amounts, which may impact individuals with higher incomes. As Gavin Gillison, CFP®, emphasizes, “You should not assume that any information provided serves as the receipt of, or as a substitute for, personalized investment advice from Waverly Advisors, LLC.” To prepare for these changes, recipients are encouraged to review their financial plans and consult with a financial advisor to ensure informed decisions regarding their Medicare coverage.

Incorporating insights from CareSet’s extensive medical data solutions can empower stakeholders to better understand these significant changes and their implications. By leveraging data from over 62 million beneficiaries and 6 million providers, stakeholders can obtain valuable insights into patient needs and provider networks, enabling informed decisions that enhance patient care and drive business success.

Rationale Behind the 2024 Part B Premium Increase: Key Factors

The increase in the 2024 part b premium is primarily driven by escalating medical expenses, particularly the surging costs of physician-administered medications and broader inflationary trends within the healthcare sector. As healthcare expenditures continue to rise, the financial sustainability of the program faces significant challenges, necessitating adjustments to subscription rates. Additionally, demographic shifts, including an increasing number of individuals receiving government health benefits, exacerbate these financial pressures. This growing population not only elevates demand for services but also intensifies the need for funding to ensure the program’s long-term viability.

In this context, it is essential to acknowledge that the Part B subsidy stands at approximately 75 percent for individuals with incomes below the applicable thresholds, underscoring the financial implications for those affected by the subsidy increase. Furthermore, the 2024 part b premium includes an annual deductible set at $240.00 for all beneficiaries, which further emphasizes the financial impact of these changes. Moreover, CareSet’s comprehensive approach to data analysis, as demonstrated in the case study titled ‘Putting Patients First: Unlocking Data to Empower HCP,’ illustrates how organizations can leverage insights from over 62 million beneficiaries and 6 million providers to navigate the complexities of the program effectively. This positions CareSet as a vital partner for pharmaceutical and biotech companies seeking to refine their strategies and engage meaningfully with healthcare providers.

Consequently, these factors collectively elucidate the rationale behind the adjustments to the Part B fee, reflecting the ongoing evolution of healthcare economics. Furthermore, the Secretary’s determination indicates that the announcement regarding these changes is unlikely to significantly impact state or local governments, providing a broader perspective on the ramifications of healthcare reforms.

Medicare Funding and the 2024 Part B Premium: An Overview

Funding for the program is derived from a multifaceted strategy that includes payroll taxes and contributions from general revenue. Notably, the 2024 part b premium is structured to cover approximately 25% of the program’s total expenses, with the remainder sourced from general revenue. As healthcare costs continue to escalate, the necessity for increased premiums, particularly the 2024 part b premium, becomes increasingly apparent, ensuring that the program can sustain its provision of essential services to recipients. In 2024, the landscape of healthcare funding will be pivotal in assessing the program’s sustainability. For instance, dual-eligible beneficiaries, who constitute 20% of recipients, account for an astonishing 34% of total expenditures, underscoring the financial strain on the system. This reality emphasizes the critical need for a resilient funding structure capable of adapting to rising costs while preserving service quality.

Real-world instances illustrate the crucial role healthcare premiums play in financing program costs. For example, Baptist Health successfully boosted admissions by 6% through the implementation of AI and data-driven insights, showcasing how effective management of medical resources can enhance operational efficiency and patient outcomes. CareSet’s comprehensive data solutions for health insurance recipients empower medical stakeholders by providing insights from over 62 million individuals and 6 million providers, enabling them to analyze patient treatment pathways and make informed decisions, particularly regarding the implications of the 2024 part b premium on healthcare funding. As financial specialists in the medical sector emphasize, ‘Together, these two programs assist in protecting extremely low-income beneficiaries from possibly unaffordable out-of-pocket medical and long-term care expenses.’ This perspective aligns with CareSet’s mission to improve patient outcomes through data leadership, ensuring stakeholders can effectively navigate the complexities of medical funding while committing to enhancing patient care and reducing costs.

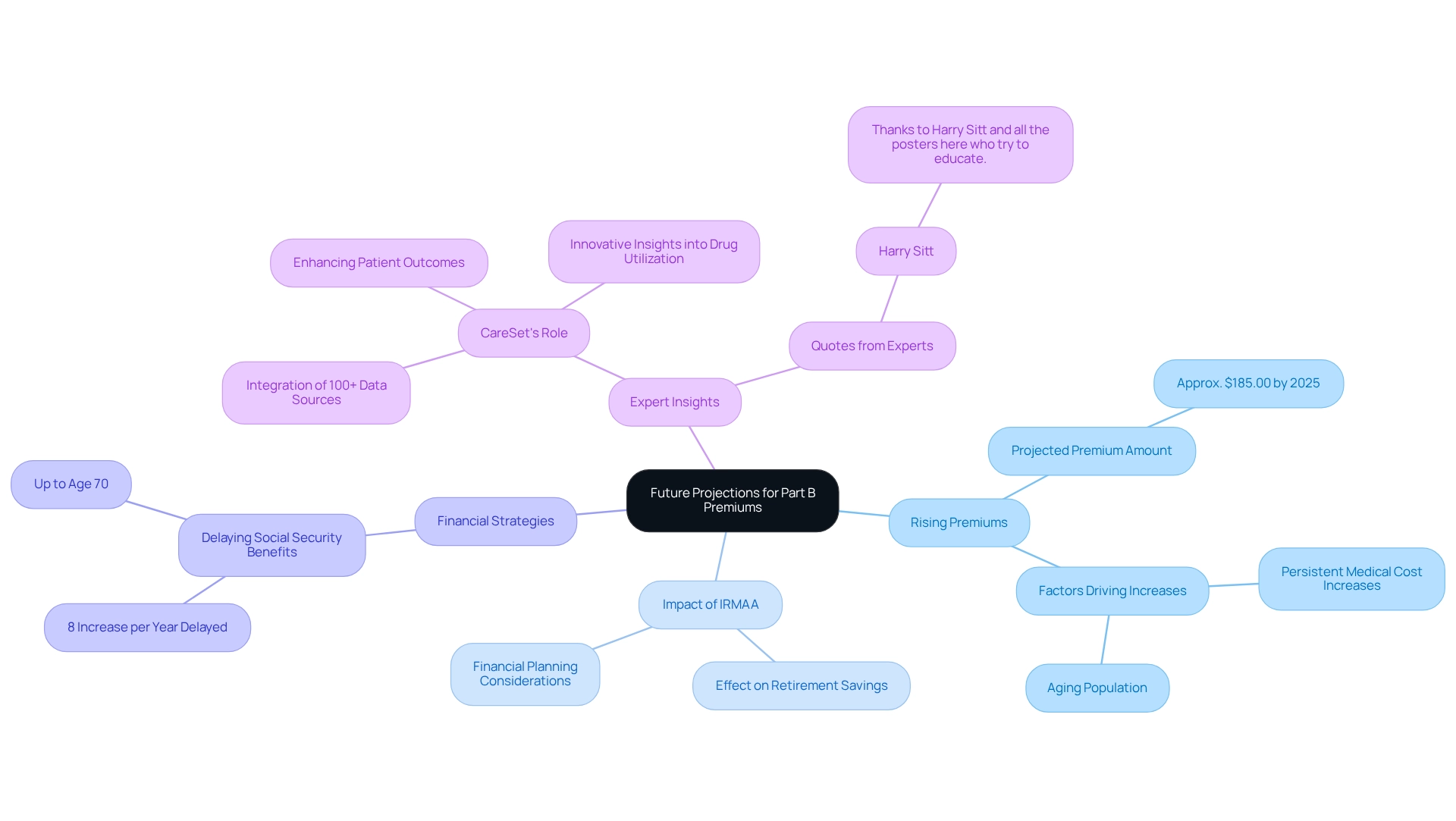

Future Projections for Part B Premiums: What to Expect Beyond 2024

Anticipating 2025 and the subsequent years, forecasts suggest that Medicare Part B charges are likely to continue their upward trajectory, driven by persistent increases in medical costs and an aging population. Analysts predict that the standard monthly premium could reach approximately $185.00 by 2025, representing a notable rise from previous years. This trend underscores the importance for recipients to proactively manage their healthcare expenses.

Healthcare economists stress that the dialogue surrounding the Income-Related Monthly Adjustment Amount (IRMAA) is vital, as it can profoundly affect retirement savings and financial planning. As recipients brace for these escalating costs, real-world examples underscore the necessity for strategic financial adjustments. For instance, delaying Social Security benefits beyond the full retirement age can yield an 8% increase in retirement benefits for each year postponed, up to age 70, providing a potential buffer against rising healthcare expenses.

Moreover, expert projections indicate that the trend of increasing healthcare costs will persist beyond 2025, demanding continuous vigilance from beneficiaries. As noted by Harry Sitt, “Thanks to Harry Sitt and all the posters here who try to educate,” it is crucial for stakeholders to remain informed. CareSet’s monthly Medicare updates play an essential role in enhancing provider engagement by offering innovative insights into drug utilization and treatment pathways. This empowers stakeholders to adeptly navigate these changes, ensuring they are well-prepared for the evolving landscape of medical expenses. CareSet’s cutting-edge healthcare data insights not only bolster pharmaceutical strategies through comprehensive analysis and patient journey mapping but also promote long-term strategic growth for partners within the healthcare sector.

Conclusion

The anticipated changes to Medicare Part B premiums and deductibles in 2024 will significantly impact millions of beneficiaries, necessitating careful financial planning and awareness. The increase in the standard monthly premium to $174.70 and the annual deductible rising to $240 reflects ongoing healthcare inflation, posing challenges particularly for those on fixed incomes. As healthcare costs continue to rise, beneficiaries must navigate these changes while considering the implications for their overall healthcare expenses.

Additionally, these adjustments are part of a broader trend affecting not only beneficiaries but also healthcare providers. The financial strain on patients may lead to decreased access to necessary medical services, adversely affecting providers’ revenue streams. The importance of transparent communication about these changes, along with the exploration of financial assistance programs, cannot be overstated, as it encourages patients to prioritize their health despite rising costs.

Looking forward, trends suggest that premium increases may persist beyond 2024, driven by demographic shifts and escalating healthcare expenditures. Stakeholders are urged to utilize resources such as CareSet’s comprehensive Medicare data insights to make informed decisions that enhance patient care and optimize financial strategies. By staying informed and proactive, beneficiaries can better navigate the complexities of Medicare, ensuring they maintain access to essential healthcare services while effectively managing their financial responsibilities.