Overview

The article delivers critical insights into the 2024 Medicare Part B deductible, established at $240, marking an increase from $226 in 2023. This change holds substantial implications for beneficiaries’ healthcare budgeting and financial planning. Understanding these costs is essential for effectively managing overall medical expenses and exploring strategies to mitigate out-of-pocket payments. By grasping the significance of this increase, beneficiaries can make informed decisions regarding their healthcare finances.

Introduction

Navigating the intricate world of Medicare can indeed be a daunting task, particularly given the complexities surrounding Part B deductibles. As healthcare costs continue to rise, understanding the nuances of these deductibles becomes increasingly vital for beneficiaries and stakeholders alike.

With the Medicare Part B deductible set to increase to $240 in 2024, the financial implications are profound, impacting millions who rely on this essential program. This article delves into the various factors influencing Part B deductibles, including:

- Legislative changes

- Income-related adjustments

- The impact of Medicare Advantage plans

By exploring these elements, beneficiaries can better prepare for their healthcare expenses and make informed decisions that enhance their financial well-being in an evolving healthcare landscape.

CareSet: Comprehensive Medicare Data Analysis for Understanding Part B Deductibles

CareSet excels in extracting and interpreting intricate claims data, providing stakeholders with crucial insights into Part B deductibles as part of its comprehensive data solutions. Analyzing over $1.1 trillion in annual claims data, CareSet clarifies the complexities of healthcare costs, including the 2024 Medicare Part B deductible, which is established at $240. This figure significantly impacts patient care strategies, influencing how pharmaceutical companies and medical organizations allocate resources and develop treatment plans.

By leveraging insights from over 62 million individuals and 6 million providers, CareSet empowers clients to make informed decisions that enhance treatment outcomes and optimize market access. This extensive data analysis not only aids in understanding the deductible but also highlights trends and patterns that can inform strategic initiatives.

CareSet employs advanced methodologies in data analysis, ensuring high-quality, complete insights without flawed projections. This commitment is exemplified in the case study titled ‘Putting Patients First: Unlocking Healthcare Data to Empower HCP,’ showcasing how transparency and data leadership enable clients to navigate the complexities of the healthcare landscape effectively.

As Dana Anspach, a certified financial planner, aptly states, ‘To make the most of your money, it is essential that you develop a working knowledge of the rules or find trusted advisors to guide you.’ This underscores the importance of comprehending healthcare expenses in making strategic choices.

2024 Medicare Part B Deductible Amount: What Beneficiaries Should Expect

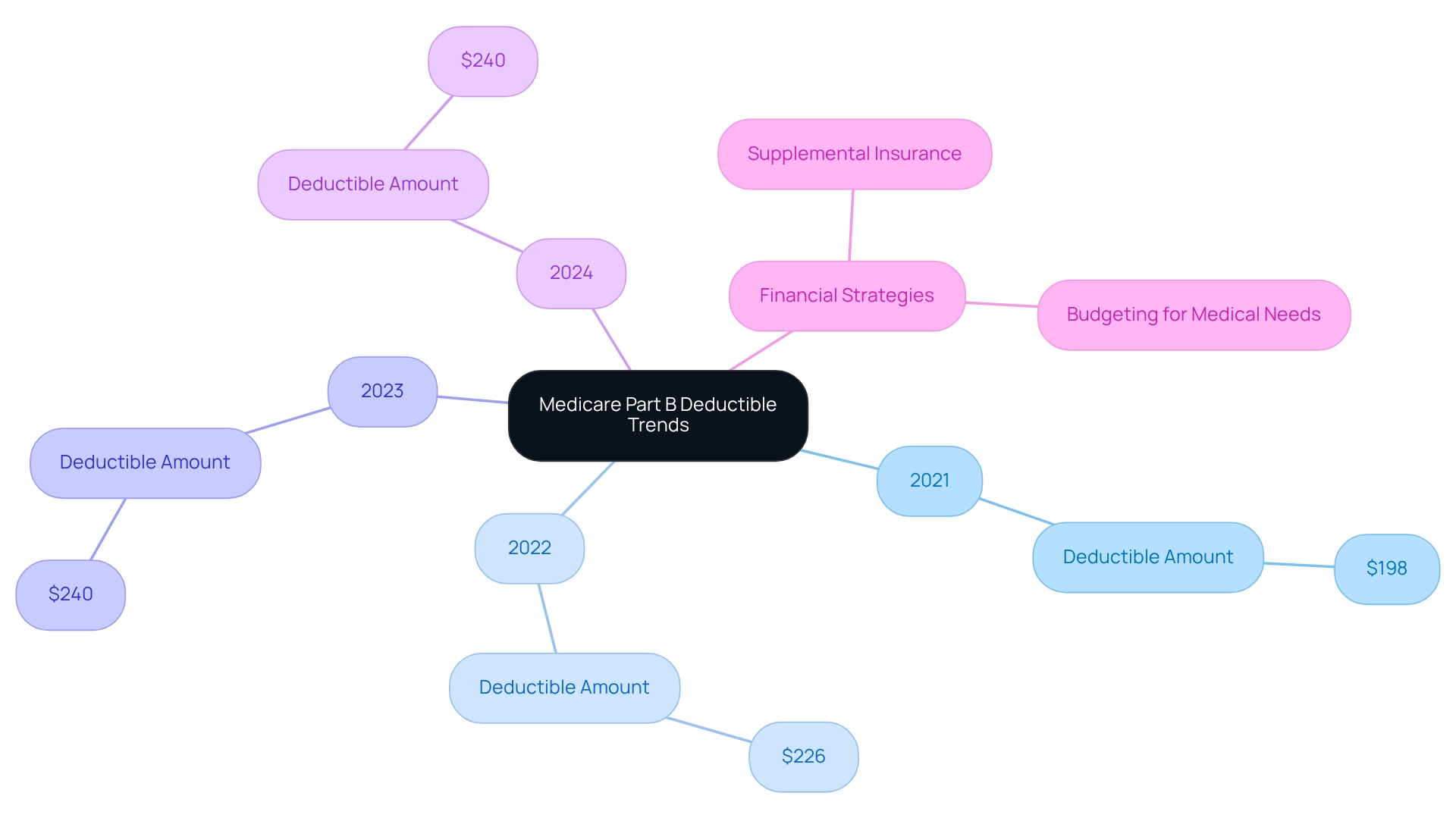

In 2024, the Medicare Part B deductible is established at $240, marking an increase from $226 in 2023. Beneficiaries are required to pay this amount out-of-pocket before Medicare initiates coverage for medical services. Understanding the 2024 Medicare Part B deductible is vital because it significantly impacts overall medical costs and budgeting for expenses.

Financial advisors underscore the necessity of planning for these out-of-pocket costs, especially given the consistent upward trend in deductibles over recent years. Notably, the deductible has escalated from $198 in 2021 to the current figure, highlighting the imperative for recipients to adjust their financial strategies accordingly.

Kimberly Lankford, a contributing writer recognized for her expertise in economic journalism, stresses the importance of grasping healthcare expenses to effectively manage medical costs. With approximately 99% of Medicare recipients not incurring a Part A premium, the 2024 Medicare Part B deductible becomes a crucial factor in managing medical expenses. This statistic illustrates the broader economic landscape for recipients as they navigate these changes.

Many are exploring various strategies to mitigate out-of-pocket expenses, such as utilizing supplemental insurance plans or enhancing their budgeting for medical needs. CareSet’s comprehensive medical data insights empower recipients to better understand their financial obligations, ensuring they are informed as they prepare for their medical requirements. By leveraging CareSet’s resources, individuals can adeptly navigate the complexities of healthcare expenses and make informed decisions regarding their medical financing.

2024 Medicare Part B Premium Changes: Implications for Deductibles

In 2024, the standard monthly premium for Medicare Part B is projected to rise to $174.70, reflecting an increase from $164.90 in 2023. This adjustment, along with the increase of the 2024 Medicare Part B deductible to $233, will lead to heightened out-of-pocket expenses for beneficiaries, significantly impacting their financial burden. Such increases can hinder access to essential medical services, particularly for seniors on fixed incomes.

The anticipated rise in premiums extends beyond mere numbers; it signifies broader trends in medical affordability. Under optimistic assumptions, the surplus in healthcare funding could reach $175.7 billion by the end of December 2025. However, this surplus does not alleviate the urgent economic pressures faced by recipients, who may still struggle to afford essential treatments.

Real-world examples illustrate how premium adjustments can affect access to medical services. Many seniors may find themselves weighing the costs of necessary treatments against their limited budgets, potentially leading to delays in care. Support initiatives, such as the Extra Help program and the Savings Program, aim to provide monetary assistance to individuals with restricted means; however, gaps persist for those who remain ineligible for the 2024 Medicare Part B deductible. Expert evaluations indicate that escalating premiums correlate with increased out-of-pocket expenses, further straining the economic resources of individuals reliant on health insurance, especially concerning the 2024 Medicare Part B deductible. Economists have noted that the economic burden of these rising costs can diminish access to essential healthcare services, ultimately impacting patient outcomes.

As the healthcare landscape evolves, understanding the implications of these premium changes is vital for stakeholders in the pharmaceutical industry, especially in strategizing market access and patient engagement initiatives. CareSet’s extensive Medicare data insights empower stakeholders to effectively tackle these challenges, ensuring they remain informed and proactive in addressing the needs of Medicare recipients. By analyzing provider interventions and patient journeys through frameworks like ICD, NDC, and HCPCS, CareSet equips pharmaceutical market access managers with actionable insights that can enhance patient care and drive business success.

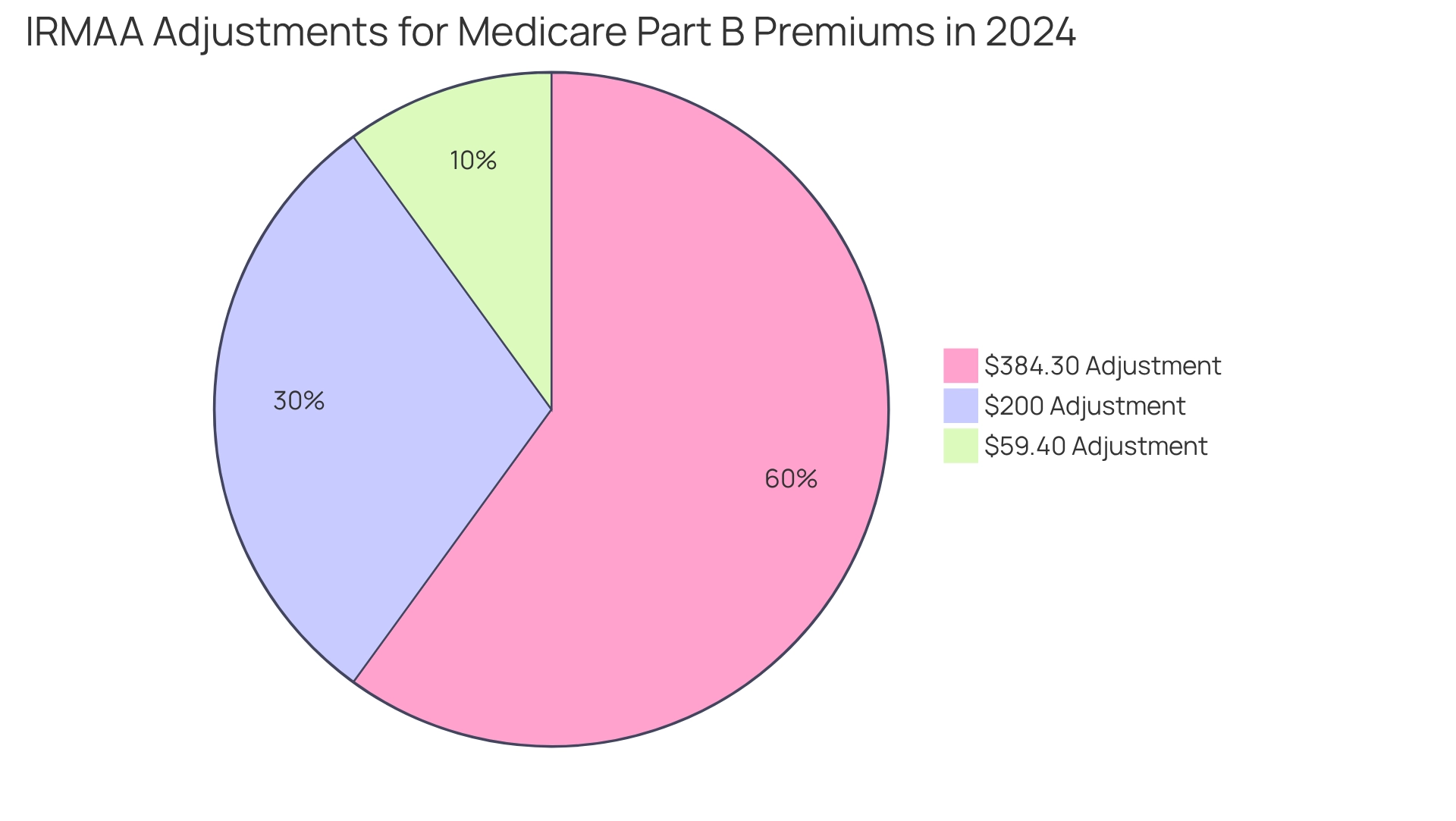

Income-Related Monthly Adjustment Amount (IRMAA) and Its Impact on Part B Deductibles

Beneficiaries with higher incomes encounter the Income-Related Monthly Adjustment Amount (IRMAA), which can substantially increase their Part B premiums. In 2024, IRMAA adjustments range from $59.40 to $384.30, added to the standard premium, depending on income levels. This increase not only elevates monthly expenses but also complicates budgeting related to the 2024 Medicare Part B deductible, as the higher premiums can strain overall financial plans.

Regular monitoring of IRMAA trends is essential for beneficiaries to navigate these complexities effectively, as it enables them to prepare for intricate rules. Wealth advisors increasingly recognize the importance of integrating healthcare coverage into their services, emphasizing early preparation to mitigate the financial impact of IRMAA on medical costs.

For instance, Todd Morrissey, President of Healthcare Solutions at Advisors Excel, highlights common challenges faced by individuals nearing eligibility for the program, particularly regarding enrollment timing and the implications of employer coverage. Such insights underscore the necessity for recipients to adequately prepare for the economic ramifications of IRMAA on their Part B expenses.

As Denise Williams, CPA, CFP®, aptly states, “We’re here to help.

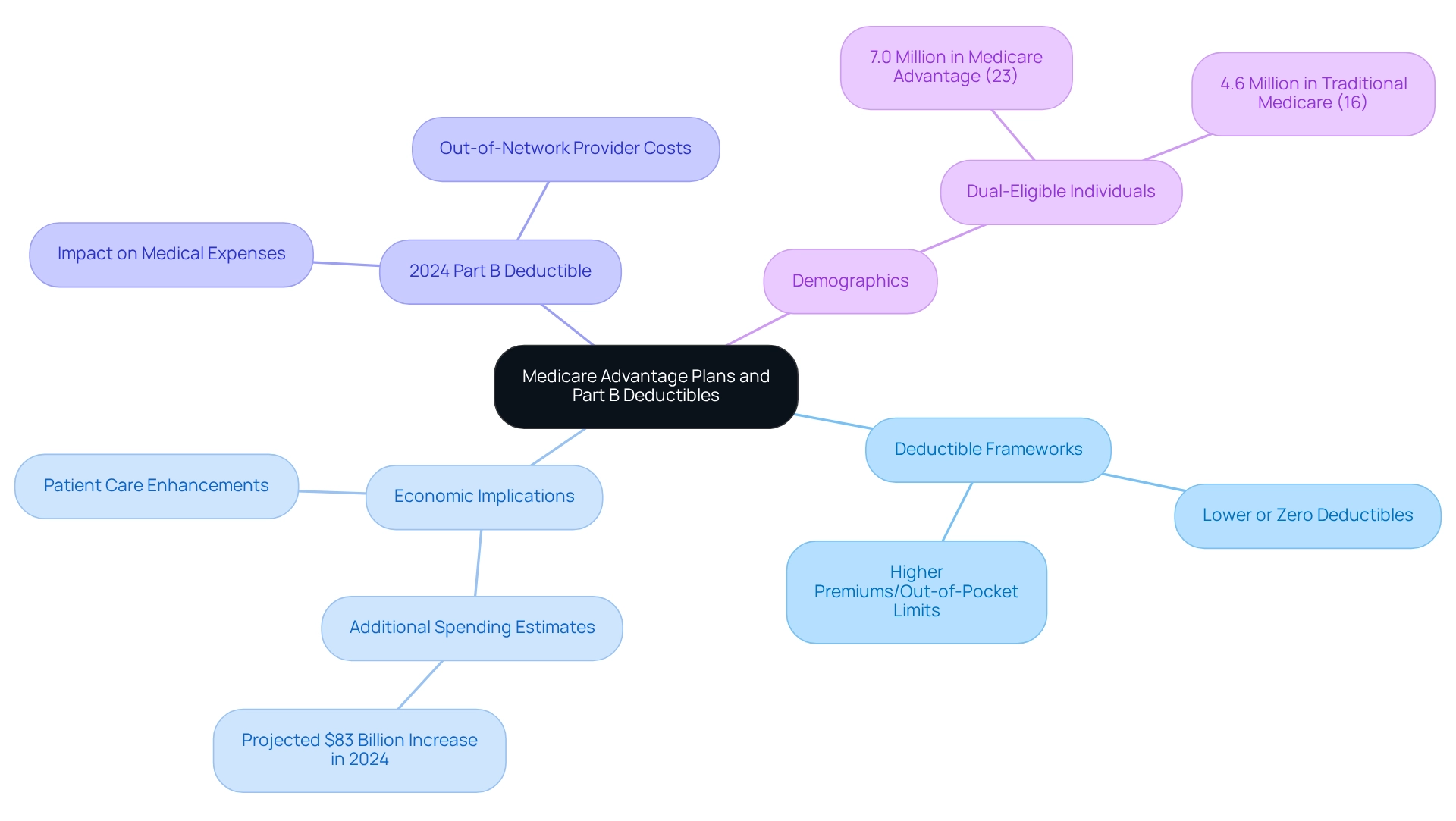

Medicare Advantage Plans: How They Affect Part B Deductibles

Medicare Advantage plans present distinctive deductible frameworks that set them apart from traditional Medicare, often leading to varied economic implications for recipients. While certain Advantage plans may feature lower or even zero deductibles, this benefit is frequently balanced by higher premiums or increased out-of-pocket limits. Such complexity underscores the necessity for a thorough evaluation of options, as the decision between Original Medicare and Medicare Advantage can significantly influence overall medical expenses, particularly with respect to the 2024 Medicare Part B deductible.

In 2024, the financial landscape for program enrollees is further complicated by rising costs associated with Advantage plans, which are projected to result in an estimated $83 billion in additional spending compared to traditional options. This discrepancy prompts critical questions about the sustainability of current payment methods and their effectiveness in managing costs while enhancing patient care, as highlighted in recent evaluations.

Moreover, data reveals that individuals eligible for both programs constituted a larger number and proportion of Medicare Advantage participants, with 7.0 million (23%) compared to 4.6 million (16%) in traditional health insurance in 2022, according to analysts in the medical field. This situation emphasizes the need for tailored strategies to address specific medical needs, particularly concerning the 2024 Medicare Part B deductible.

As recipients navigate these choices, understanding the intricacies of deductible frameworks, including the 2024 Medicare Part B deductible and the potential for substantial out-of-pocket costs when utilizing out-of-network providers, becomes vital for optimizing their medical expenses.

By leveraging CareSet’s extensive data insights, stakeholders can more effectively analyze patient treatment pathways and provider interventions, ultimately enhancing both patient care and business outcomes. Utilizing NDC and HCPCS codes allows stakeholders to gain a clearer perspective on how providers diagnose and treat patients, alongside the financial ramifications of these treatments.

With insights derived from over 62 million recipients and 6 million providers, CareSet refines medical strategies that address the complexities of Advantage plans and their impact on the 2024 Medicare Part B deductible.

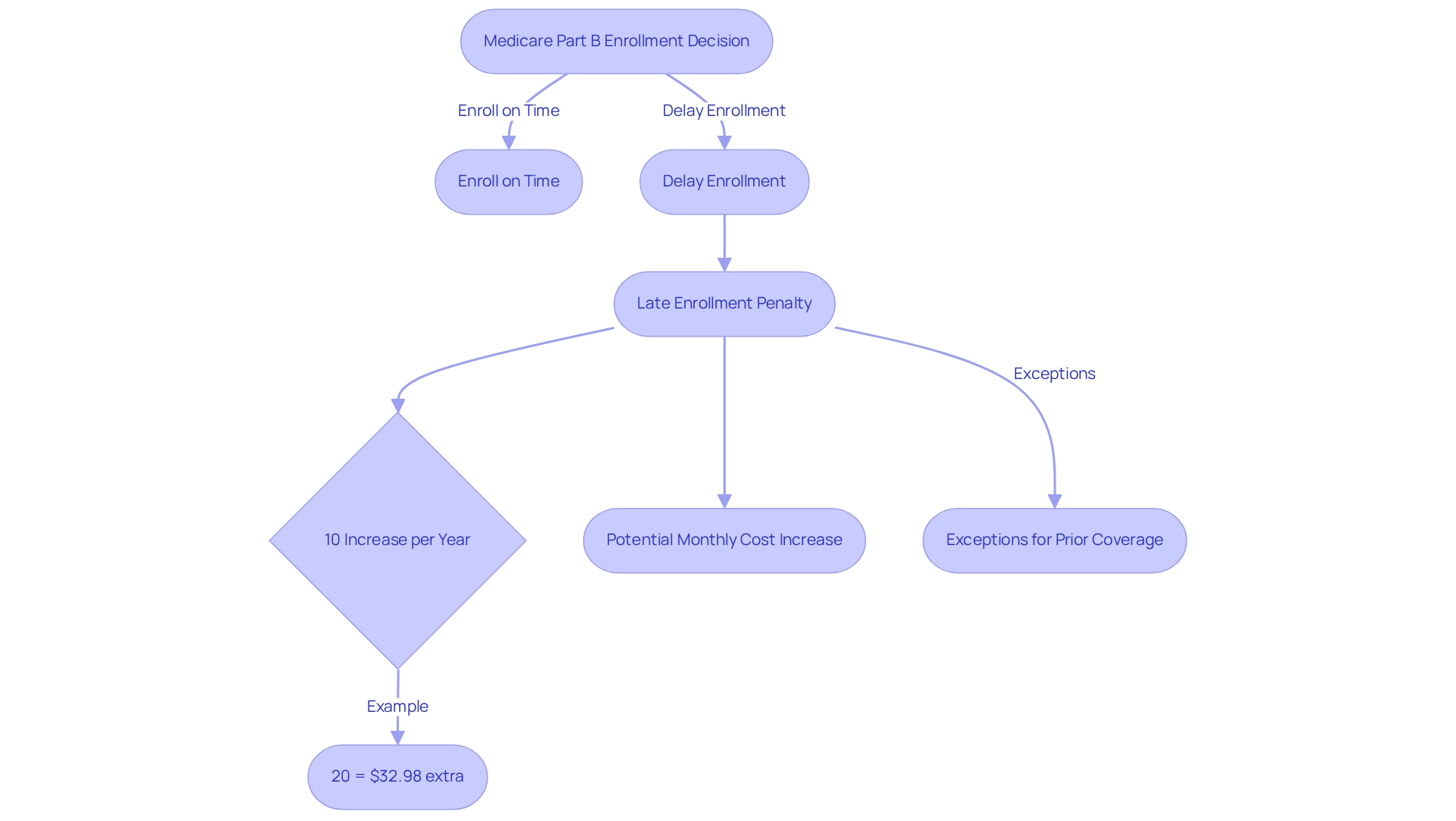

Late Enrollment Penalty for Medicare Part B: Consequences for Deductibles

Delaying enrollment in Medicare Part B can lead to a significant late enrollment penalty, adding 10% to the monthly premium for each full 12-month period that an individual could have enrolled but did not. This penalty not only increases the monthly financial strain but also complicates the management of the 2024 Medicare Part B deductible, ultimately impacting overall healthcare expenses for recipients. For instance, if an individual postpones enrollment for two years, their premium could increase by 20%, making it more challenging to afford essential medical services.

Financial advisors underscore the importance of timely enrollment to avoid these penalties, which can substantially impact a beneficiary’s budget. Ashlee Zareczny, Director of Operations, states, “The penalty for Part D is 1% of the average premium for every month you went without coverage.” This highlights the broader consequences of delayed enrollment across various healthcare components. The financial implications of these penalties can be profound; for example, the average monthly premium for Medicare Part B in 2024 is projected to be around $164.90, and considering the 2024 Medicare Part B deductible, a 20% penalty could add an additional $32.98 to the monthly cost.

Moreover, case studies reveal that individuals who meet criteria for exceptions—such as possessing prior creditable coverage—can evade these penalties, thereby lowering their overall medical expenses. This underscores the necessity for beneficiaries to understand their options and the potential consequences of late enrollment. Individuals who meet these criteria may not incur penalties, thus reducing their overall healthcare costs.

Statistics indicate that the late enrollment penalty for Medicare Part D can also increase the monthly premium by an additional $3.30, further amplifying the burden on those who postpone enrollment. It is crucial to note that this penalty is separate from the Part B penalties, emphasizing the need for recipients to be aware of the different implications of their enrollment choices. As recipients navigate their medical options, comprehending the consequences of delayed enrollment fees is essential for efficient budget planning and management of medical expenses. To avoid these penalties, beneficiaries should consider consulting with financial advisors to explore their options and ensure timely enrollment.

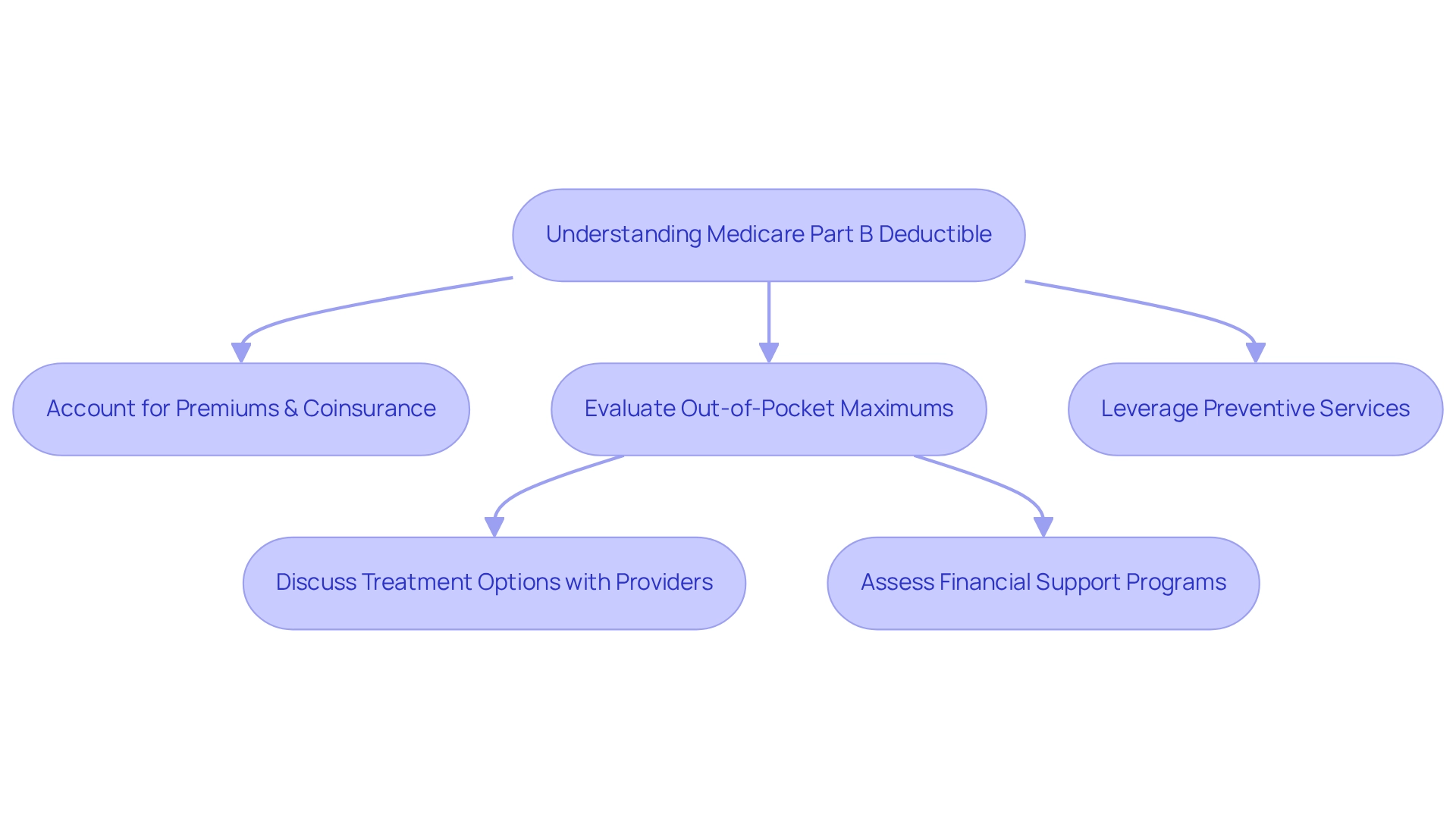

Managing Healthcare Costs: The Connection Between Part B Deductibles and Overall Expenses

Effectively managing medical costs necessitates a thorough understanding of how the Medicare Part B deductible integrates with overall expenses. Beneficiaries should account not only for the deductible but also for premiums, coinsurance, and potential out-of-pocket maximums when crafting their healthcare budgets. Strategies such as leveraging preventive services can significantly reduce costs, as these services are often covered without a deductible. Furthermore, grasping the nuances of coverage options enables recipients to make informed choices that can result in significant savings.

Real-world examples demonstrate how beneficiaries have successfully budgeted for healthcare costs. Individuals who actively interact with their medical providers to discuss treatment choices and expenses often discover methods to reduce out-of-pocket costs. Financial advisors highlight the significance of thorough budgeting for medical costs, recommending clients frequently assess their plans and modify their approaches according to evolving medical requirements.

Moreover, the relationship between the Medicare Part B deductible and overall medical expenses is critical. As medical expenses continue to rise, recipients must remain vigilant in managing their costs. Recent statistics indicate that CareSet enhances medical strategies with insights derived from over 62 million individuals and 6 million providers, underscoring the importance of data-driven decision-making in navigating these complexities. For instance, CareSet’s case study titled “PUTTING PATIENTS FIRST: Unlocking Medical Data to Empower HCP” on oncology treatment options illustrates how prompt interaction with medical providers can improve patient care and streamline treatment pathways, ultimately resulting in better monetary outcomes for recipients.

Additionally, recent policy suggestions intended to enhance monetary protections for healthcare recipients, such as limiting out-of-pocket expenses for Part D, highlight the necessity for recipients to remain updated on alterations that could affect their economic planning.

By adopting a proactive strategy to comprehend and manage medical expenses, recipients can enhance their financial stability and ensure access to essential medical services. CareSet’s comprehensive approach not only supports medical partners but also empowers recipients to navigate the intricacies of medical costs effectively.

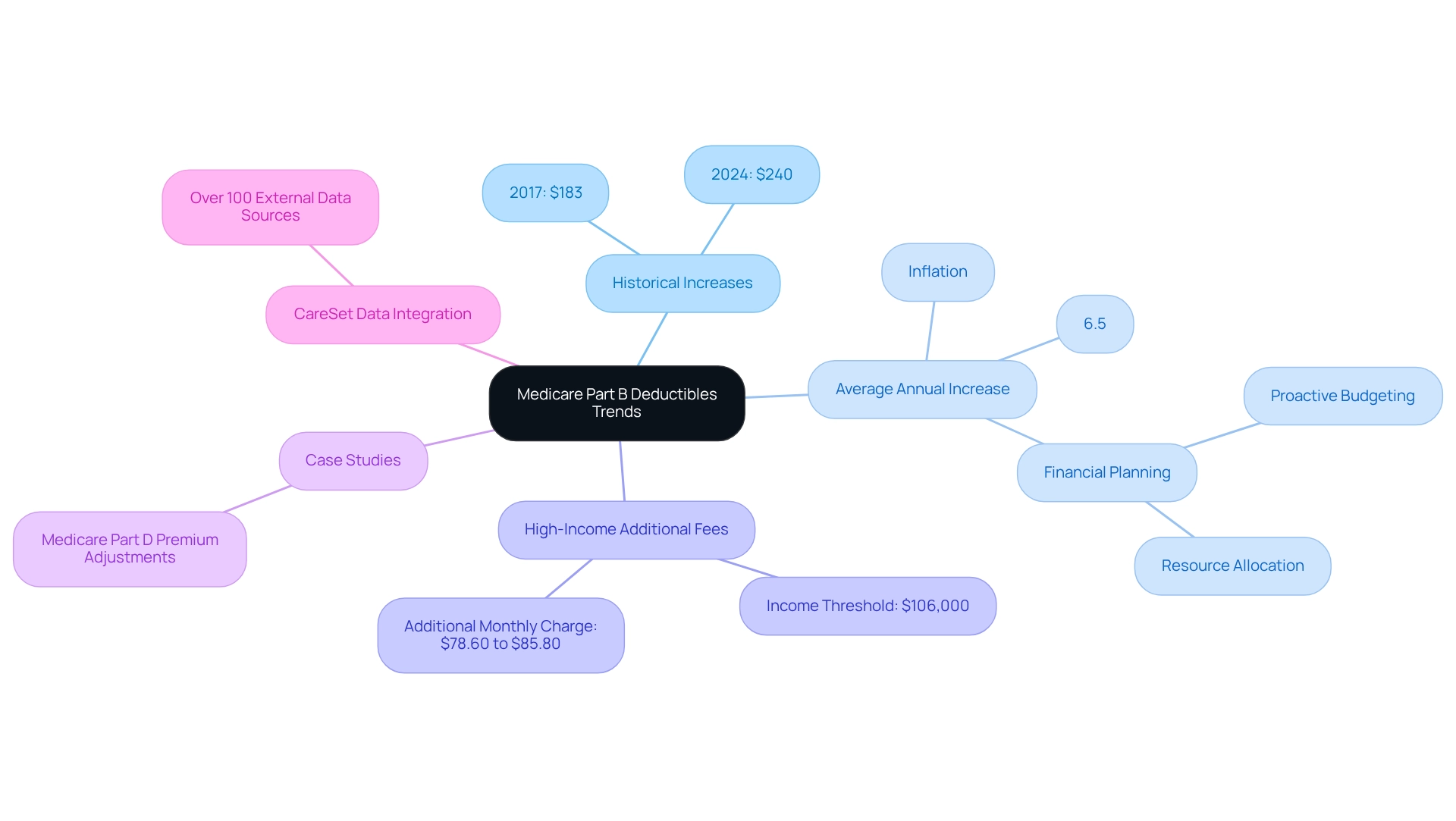

Historical Trends of Medicare Part B Deductibles: Insights for Future Planning

Over the past decade, Part B deductibles have seen a consistent upward trajectory, mirroring the broader trend of escalating medical expenses. For instance, the increase in the 2024 Medicare Part B deductible from $183 in 2017 to $240 is a significant rise that recipients must consider in their budgeting. This trend transcends mere numbers; it encapsulates the persistent challenges faced by recipients in managing their medical costs.

Statistical analysis reveals that the average annual increase in Medicare Part B deductibles has hovered around 6.5%, a rate that outpaces general inflation. Such patterns underscore the importance of proactive financial strategies. Beneficiaries can utilize historical data to forecast future increases, enabling them to allocate resources more effectively and mitigate the impact of rising costs on their financial plans.

Case studies exploring previous deductible adjustments illuminate the ramifications of these trends. For example, in 2025, high-income recipients will face additional fees based on adjusted gross income, with those earning $106,000 or more incurring an extra monthly charge ranging from $78.60 to $85.80, as noted by expert Margie Zable Fisher. This adds another layer of complexity to their financial landscape. Additionally, an analysis of how the 2024 Medicare Part B deductible fluctuations demonstrates how rising expenses affect recipients, reinforcing the overarching theme of economic consequences.

As medical economists indicate, these increasing 2024 Medicare Part B deductibles can significantly impact recipients’ long-term financial planning, necessitating a reevaluation of their medical budgets. Furthermore, CareSet’s integration of over 100 external data sources enhances the reliability of this analysis, providing a comprehensive view of the trends.

In summary, understanding the historical trends of Part B deductibles equips beneficiaries with the insights needed to navigate impending financial challenges, ensuring they are better prepared for the evolving medical landscape.

Legislative Changes and Their Impact on Medicare Part B Deductibles

Legislative changes exert a significant influence on Medicare policies, particularly regarding the adjustments to the 2024 Medicare Part B deductible. Recent reforms have been enacted with the objective of controlling healthcare costs, which may lead to modifications in the structures or amounts of the 2024 Medicare Part B deductible in the forthcoming years. For instance, the repayment amount for the final repayment year may be less than $3.00 to avert overpayment, reflecting a shift towards more manageable financial responsibilities for beneficiaries.

Real-world examples illustrate how these reforms impact healthcare policies and costs. Stakeholders, including pharmaceutical firms and medical organizations, must remain vigilant regarding these developments, as they directly affect market access and patient engagement strategies. CareSet’s extensive data insights on healthcare empower these stakeholders by providing actionable information derived from over 62 million individuals and 6 million providers, facilitating informed decision-making and strategic planning.

Integrating perspectives from medical consultants can further assist individuals in making informed decisions about their insurance plans. Expert opinions highlight the importance of understanding these legislative changes. As M. Kent Clemens noted, “The Part B rates and amounts announced in this document are effective January 1, 2025,” underscoring the necessity for beneficiaries to stay informed about the latest information. CareSet’s advanced data analytics for government programs not only address urgent data needs but also promote long-term strategic development for its partners, ensuring they are equipped with timely insights to effectively navigate the evolving medical landscape.

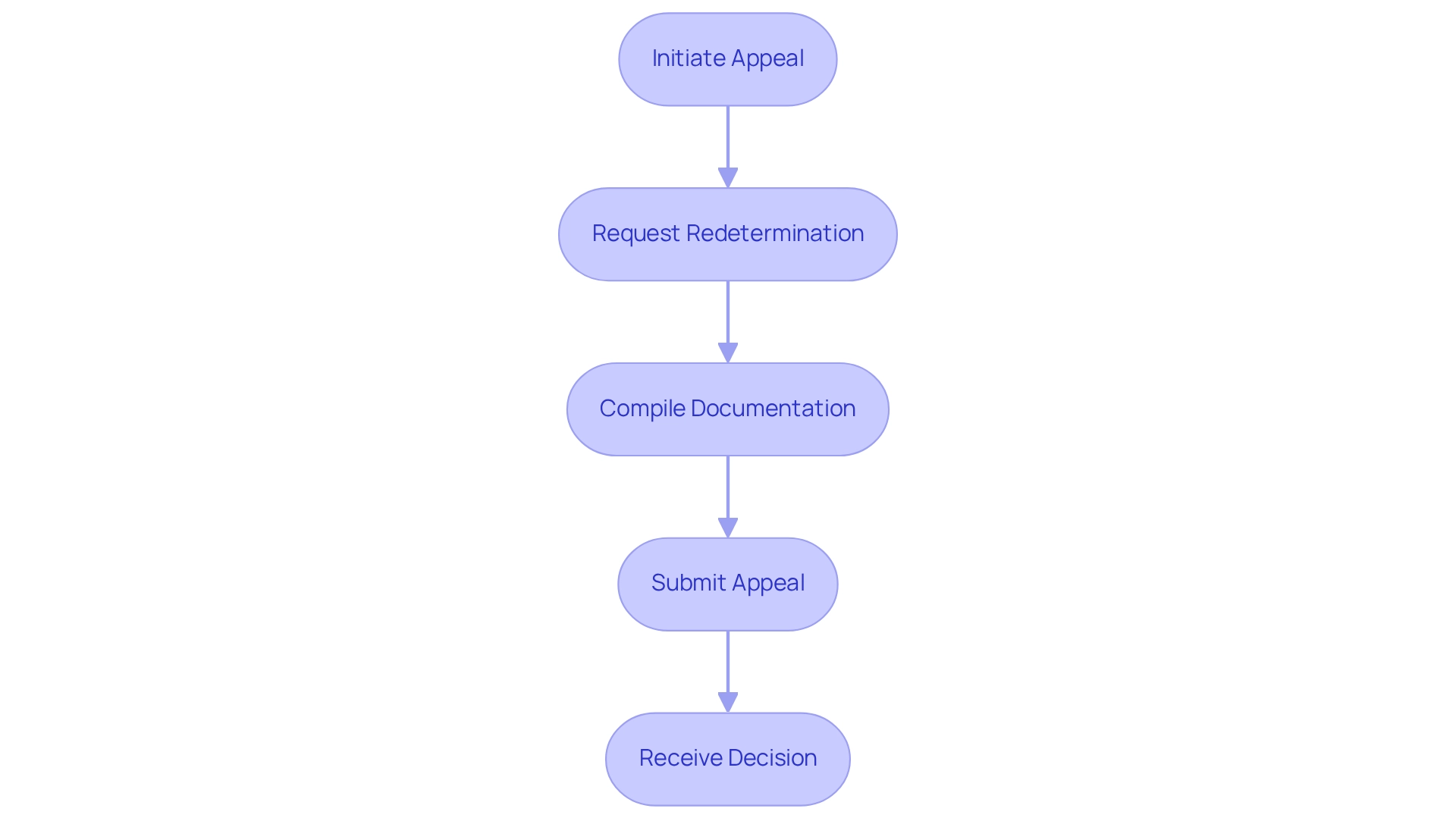

Navigating the Appeals Process for Medicare Part B Deductible Decisions

Recipients contesting choices related to their 2024 Medicare Part B deductible possess the right to appeal, a critical procedure for safeguarding their medical rights. The appeals process initiates with a request for redetermination from the Medicare contractor, necessitating individuals to compile all pertinent documentation and adhere to specified procedures. This meticulous approach is essential for ensuring that appeals are processed both efficiently and effectively.

Expert insights underscore the necessity of comprehending the breadth of prior authorization requirements when selecting plans, as this knowledge can substantially influence the appeals process. Legal professionals assert that recipients must remain cognizant of their rights during disputes, particularly in light of recent changes that limit the role of service providers in representing recipients. This shift is designed to prioritize the rights of recipients while permitting support from family members and advocacy groups. Jae Oh, CFP, notes, “It can be for a variety of reasons, although it can be daunting for the Advantage member to navigate that and interact with the healthcare provider as well as the Advantage plan carrier.”

Statistics reveal that the success rates of appeals for the 2024 Medicare Part B deductible can vary, highlighting the necessity for recipients to be thoroughly prepared. For example, a recent case study demonstrated how an individual successfully navigated the appeals process, ultimately overturning an unfavorable decision regarding their 2024 Medicare Part B deductible. Such instances serve as invaluable learning tools for others confronting similar challenges.

As the appeals landscape continues to evolve, it is crucial to stay informed about the latest news and updates. The implementation date for submitting appeal requests for retrospective and prospective appeals will be established following the publication of the final rule, further emphasizing the need for recipients to remain vigilant and proactive in managing their healthcare expenses. Additionally, beneficiaries should ensure they have all necessary documentation organized and readily available to bolster their appeal, significantly enhancing their chances of success.

Conclusion

Understanding the complexities of Medicare Part B deductibles is essential for beneficiaries navigating the financial landscape of healthcare. With the deductible set to rise to $240 in 2024, recognizing how this increase—along with rising premiums and income-related adjustments—impacts overall healthcare costs is vital. Beneficiaries must proactively plan for these expenses, considering strategies such as budgeting for out-of-pocket costs and exploring supplemental insurance options.

The intricate relationship between Medicare Advantage plans and Part B deductibles further complicates financial planning. While some plans may offer lower deductibles, they often come with higher premiums or out-of-pocket maximums. Therefore, a thorough evaluation of these options is crucial to ensure optimal healthcare expenditures. Additionally, awareness of the late enrollment penalty serves as a reminder that timely decisions are key to avoiding unnecessary financial burdens.

As healthcare costs continue to rise, beneficiaries must remain informed about legislative changes and their implications for Medicare policies. Utilizing resources like CareSet’s comprehensive data insights can empower stakeholders to make informed decisions that enhance patient care and financial well-being. Ultimately, by understanding the nuances of Medicare Part B deductibles and actively engaging in financial planning, beneficiaries can navigate the complexities of their healthcare needs more effectively, ensuring access to necessary services while managing expenses.