Overview

The primary objective of this article is to deliver essential insights regarding the changes in Medicare Part B premiums for 2025 and their implications for various stakeholders. Notably, the Part B premium is set to rise to $185.00. This increase underscores the necessity for meticulous financial planning among healthcare stakeholders, as these adjustments will directly influence budgeting, patient care strategies, and overall access to medical services. Stakeholders must recognize the significance of these changes to navigate the evolving landscape effectively.

Introduction

As the landscape of Medicare continues to evolve, significant changes are on the horizon for 2025, particularly regarding Part B premiums and deductibles. The standard monthly premium is set to rise to $185.00, prompting stakeholders across the healthcare spectrum to grapple with the implications of these adjustments. This increase not only affects budgeting and financial strategies for healthcare providers but also impacts patient access to essential services. Insights from CareSet, which analyzes data from millions of beneficiaries, alongside advocacy efforts from organizations like AARP, underscore the importance of understanding these changes. As beneficiaries and providers prepare for these shifts, the necessity of informed decision-making and strategic planning cannot be overstated, ensuring that both financial stability and quality patient care remain at the forefront of healthcare initiatives.

CareSet: Comprehensive Insights into 2025 Medicare Part B Premium Changes

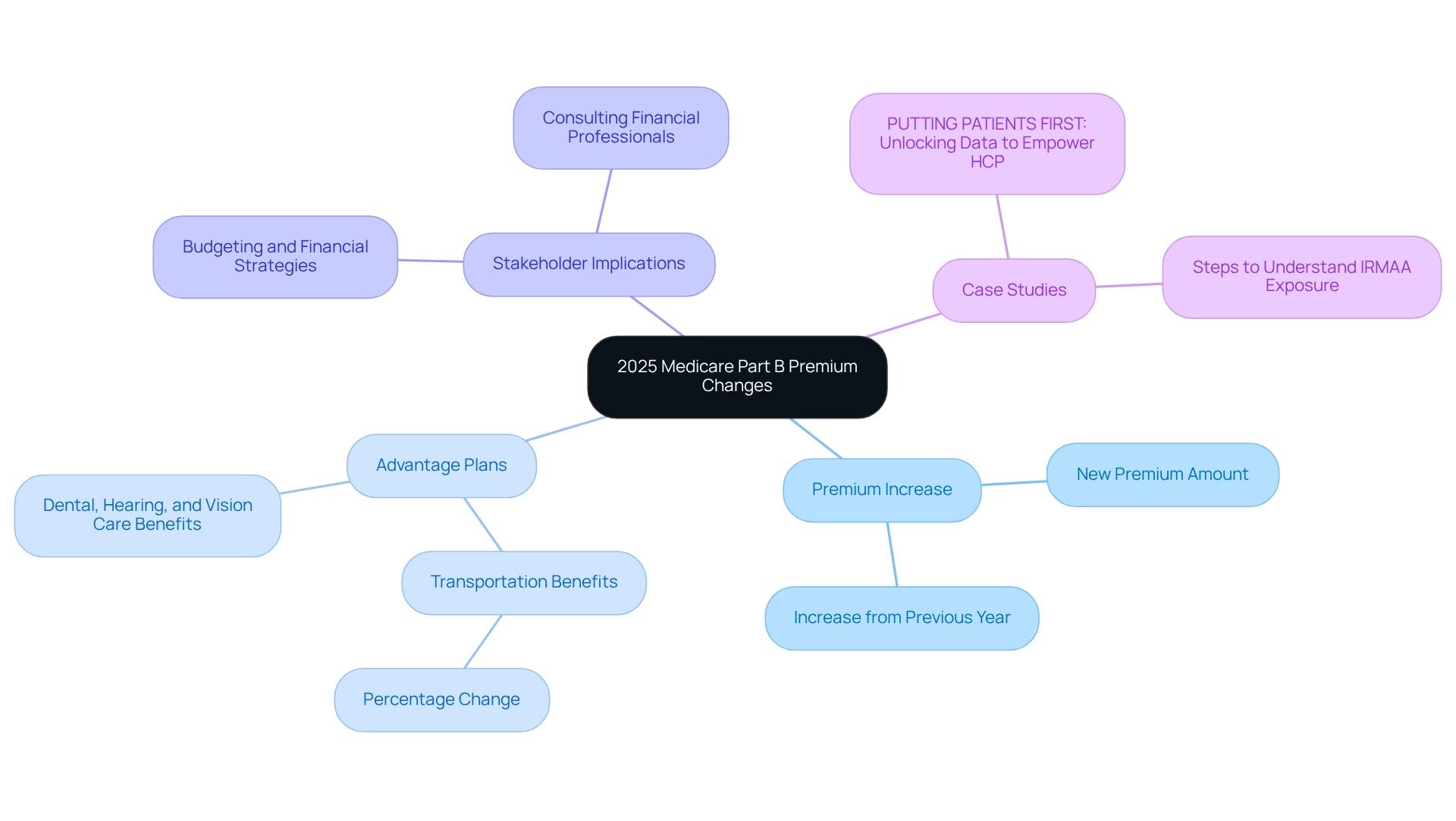

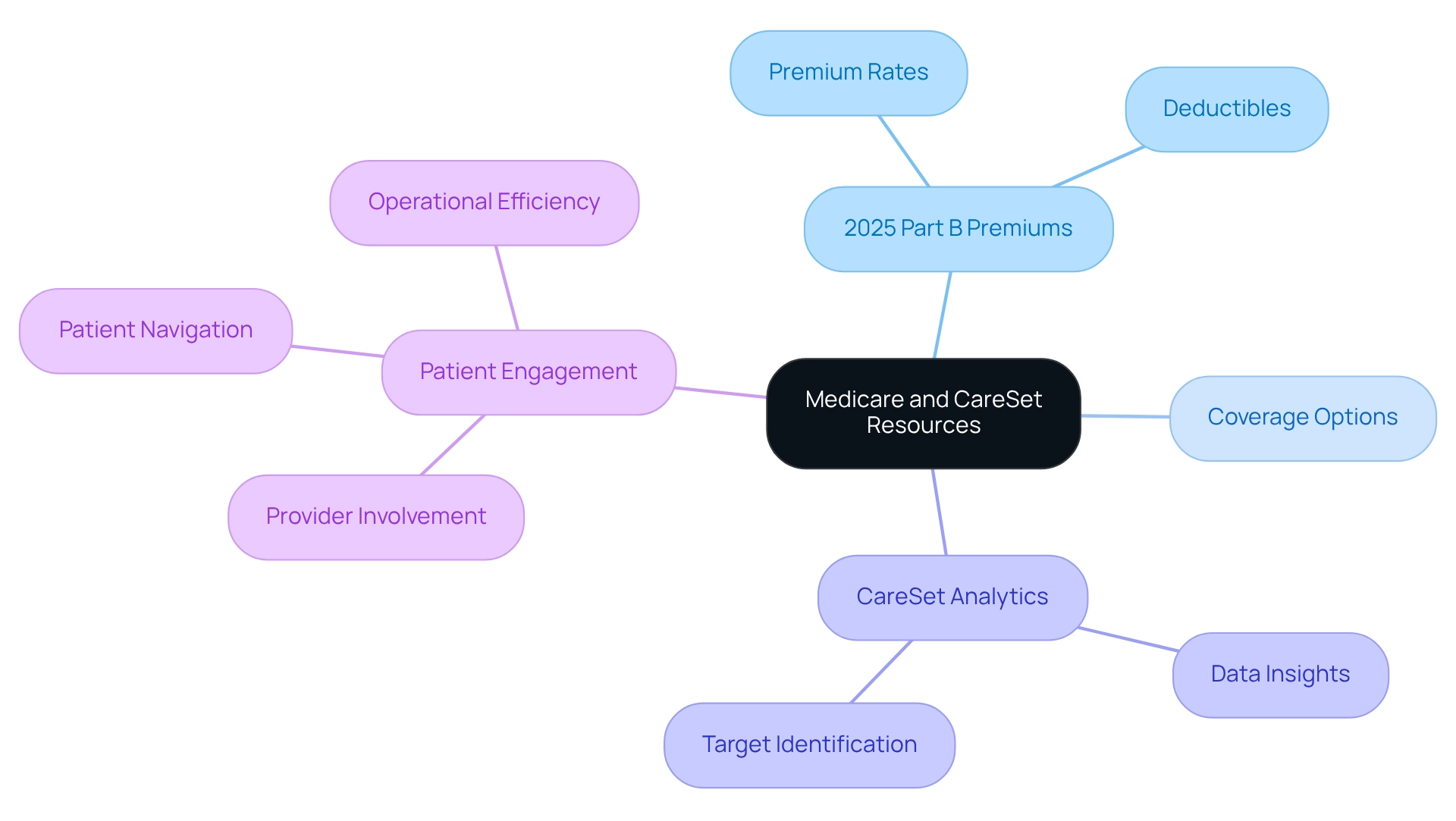

Since its inception in 2011, CareSet has emerged as a leader in healthcare data analysis, equipping participants with crucial insights into the evolving landscape of Part B premiums. For 2025, the 2025 part b premium is projected to increase to $185.00, reflecting a rise of $10.30 from the previous year. This adjustment holds significant implications for stakeholders within the pharmaceutical and healthcare sectors, as it directly influences budgeting and financial strategies for patient care initiatives.

Notably, the percentage of Advantage plans offering transportation benefits has decreased to 30%, down from 36% in 2024, highlighting the shifting benefits landscape that stakeholders must navigate. CareSet’s comprehensive analysis, exemplified in the case study ‘PUTTING PATIENTS FIRST: Unlocking Data to Empower HCP,’ not only underscores the implications of the 2025 part b premium but also explores their effects on patient access and treatment trends, particularly concerning oncology therapies like Qinlock for Gastrointestinal Stromal Tumor (GIST).

Amanda Rivera, a health insurance agent, remarked, “She took the time to explain and review the process,” underscoring the necessity of understanding these changes. Furthermore, it is advisable to consult financial professionals before making significant financial decisions to navigate these adjustments wisely.

CareSet also provides valuable insights from case studies, such as ‘Steps to Understand IRMAA Exposure,’ which aid individuals in effectively managing healthcare costs. Additionally, nearly all Advantage plans continue to offer dental, hearing, and vision care benefits, adding another layer of consideration for stakeholders.

By delivering actionable intelligence, backed by insights from over 62 million beneficiaries and 6 million providers, CareSet ensures that clients are well-prepared to navigate these developments efficiently, ultimately enhancing their strategic initiatives in a dynamic medical environment.

CMS: Official Announcement of 2025 Medicare Part B Premiums and Deductibles

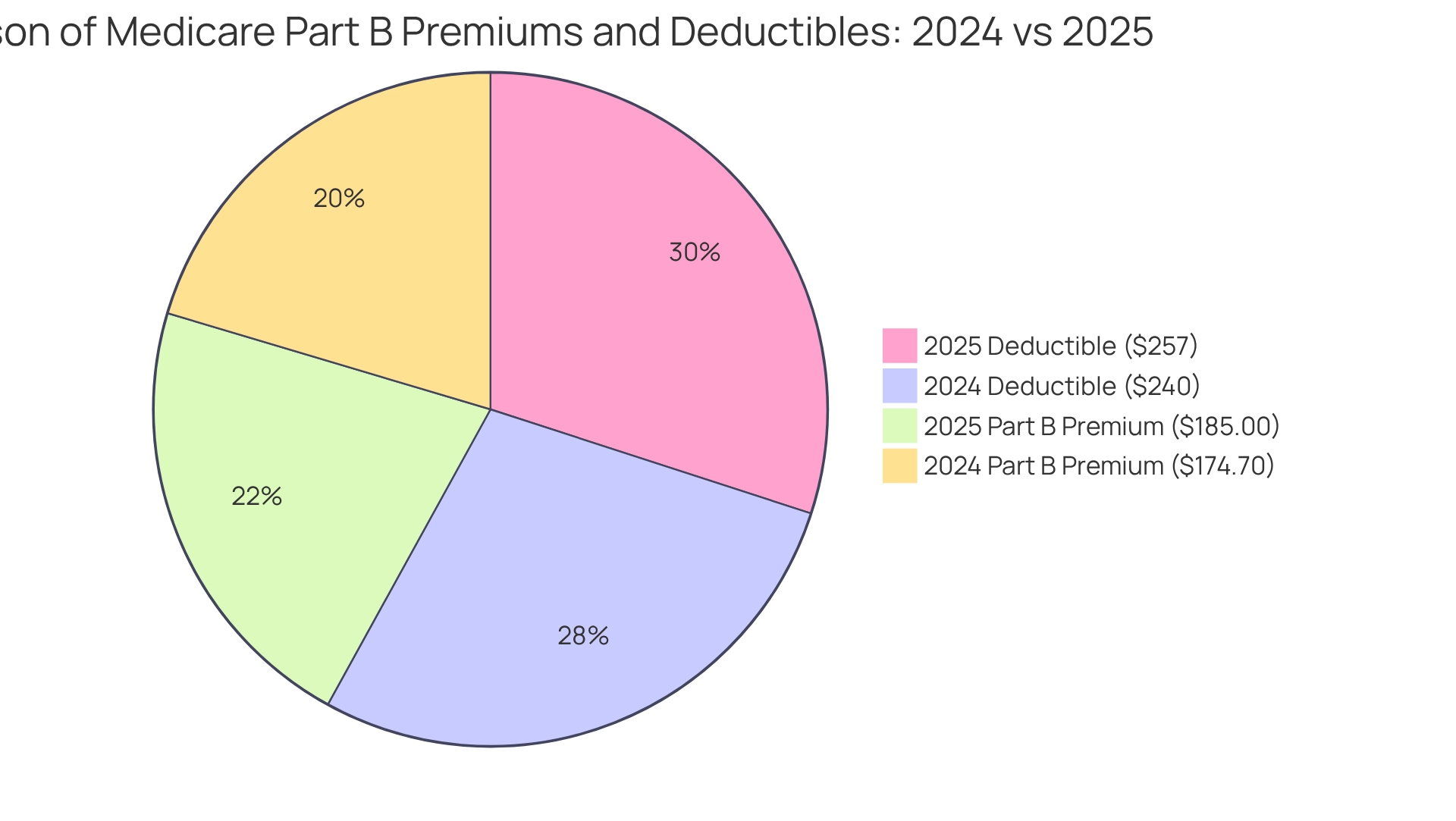

On November 8, 2024, the Centers for Medicare & Medicaid Services (CMS) announced a significant increase in the standard monthly premium for Medicare Part B, with the 2025 Part B premium rising to $185.00 from $174.70 in 2024. Additionally, the annual deductible for Part B services will increase to $257, compared to $240 the previous year.

These modifications reflect CMS’s response to ongoing medical cost escalations and economic challenges, necessitating careful consideration by stakeholders in their financial planning and patient support strategies. The increase in premiums and deductibles will directly impact out-of-pocket expenses for beneficiaries, thereby influencing their access to essential medical services and the overall budgeting strategies of medical organizations.

In this evolving landscape, CareSet’s comprehensive healthcare data insights can empower stakeholders by offering critical information on patient needs, provider networks, and pharmaceutical utilization. This data is essential for strategic decision-making, enabling organizations to navigate the complexities of healthcare effectively.

Furthermore, CMS has identified issues with excessive compensation leading to anti-competitive practices in healthcare enrollment. In response, the establishment of fixed compensation amounts for agents and brokers has been initiated. This regulatory change aims to promote fair practices and ensure that enrollees receive impartial assistance in selecting plans, further underscoring the dynamic nature of healthcare that stakeholders must adeptly navigate.

Kaiser Family Foundation: Analysis of Medicare Advantage Impact on Part B Premiums

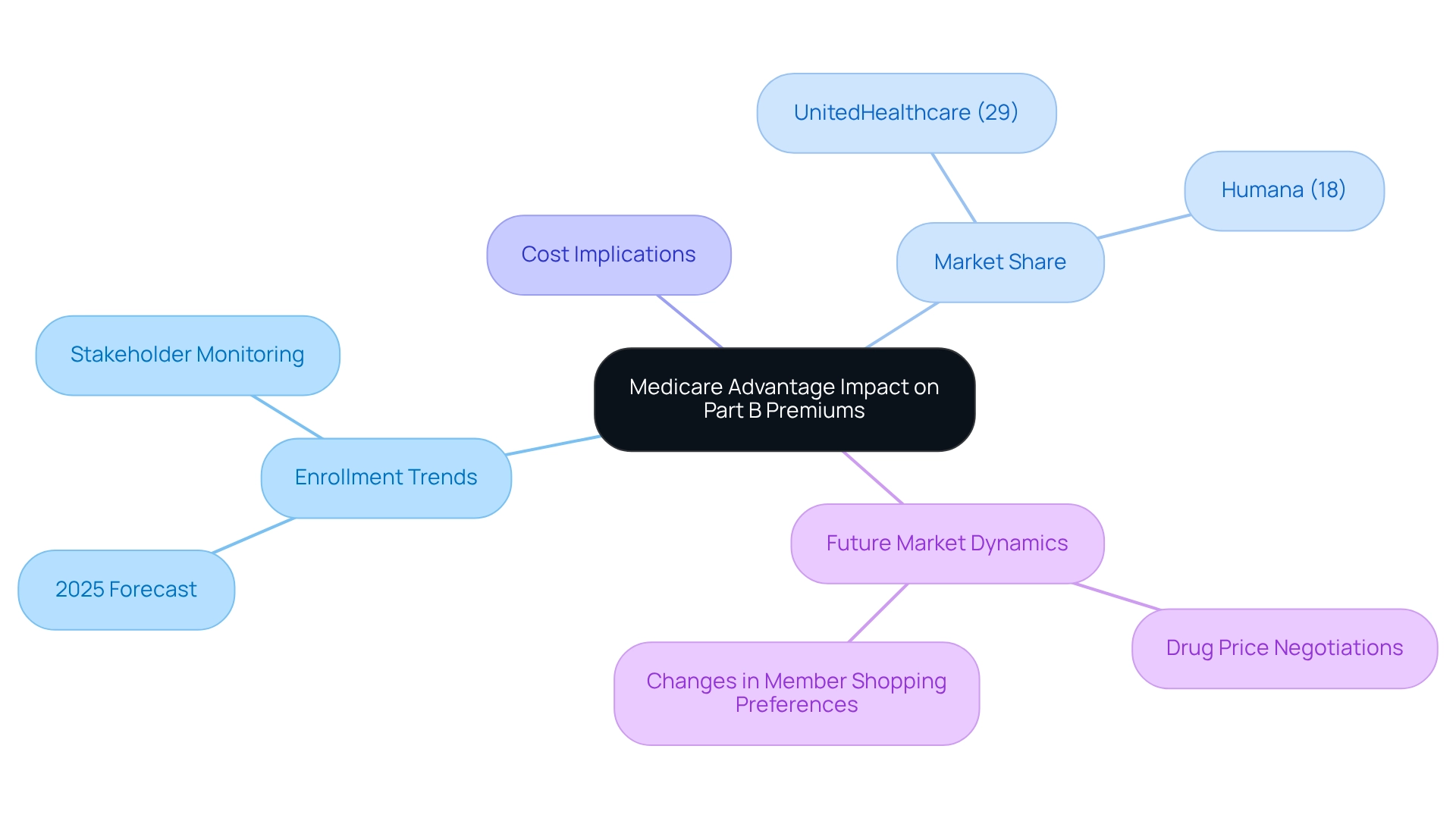

The Kaiser Family Foundation’s analysis reveals that the expansion of Advantage plans is profoundly influencing Part B premiums. Forecasts suggest that almost 50% of participants will sign up for these plans by 2025, indicating a significant shift in the 2025 Part B premium pricing landscape. Notably, UnitedHealthcare accounted for 29% of all Advantage plan enrollment in 2023, while Humana held an 18% market share, underscoring the competitive dynamics at play.

Advantage plans frequently offer additional benefits that can help reduce some costs associated with the 2025 Part B premium, making these options increasingly attractive to beneficiaries. This evolution emphasizes the necessity for stakeholders to closely monitor enrollment trends and their potential impacts on overall medical expenses. As the market adapts, grasping these dynamics will be essential for effective market access and patient engagement strategies.

Furthermore, as the Centers for Medicare & Medicaid Services points out, ‘The Part D risk adjustment model is not intended to predict costs for specific drugs,’ highlighting the complexities inherent in healthcare pricing. Insights derived from CareSet’s extensive healthcare data can empower stakeholders by providing a clearer understanding of these trends, facilitating informed decision-making in navigating the evolving landscape.

Additionally, findings from the case study titled ‘Future Implications for Advantage Plans’ indicate that anticipated changes in the Advantage market, including drug price negotiations, will further shape benefit designs and market strategies. This comprehensive understanding will be vital for participants as they navigate the evolving landscape.

Humana: Resources for Understanding 2025 Medicare Part B Costs

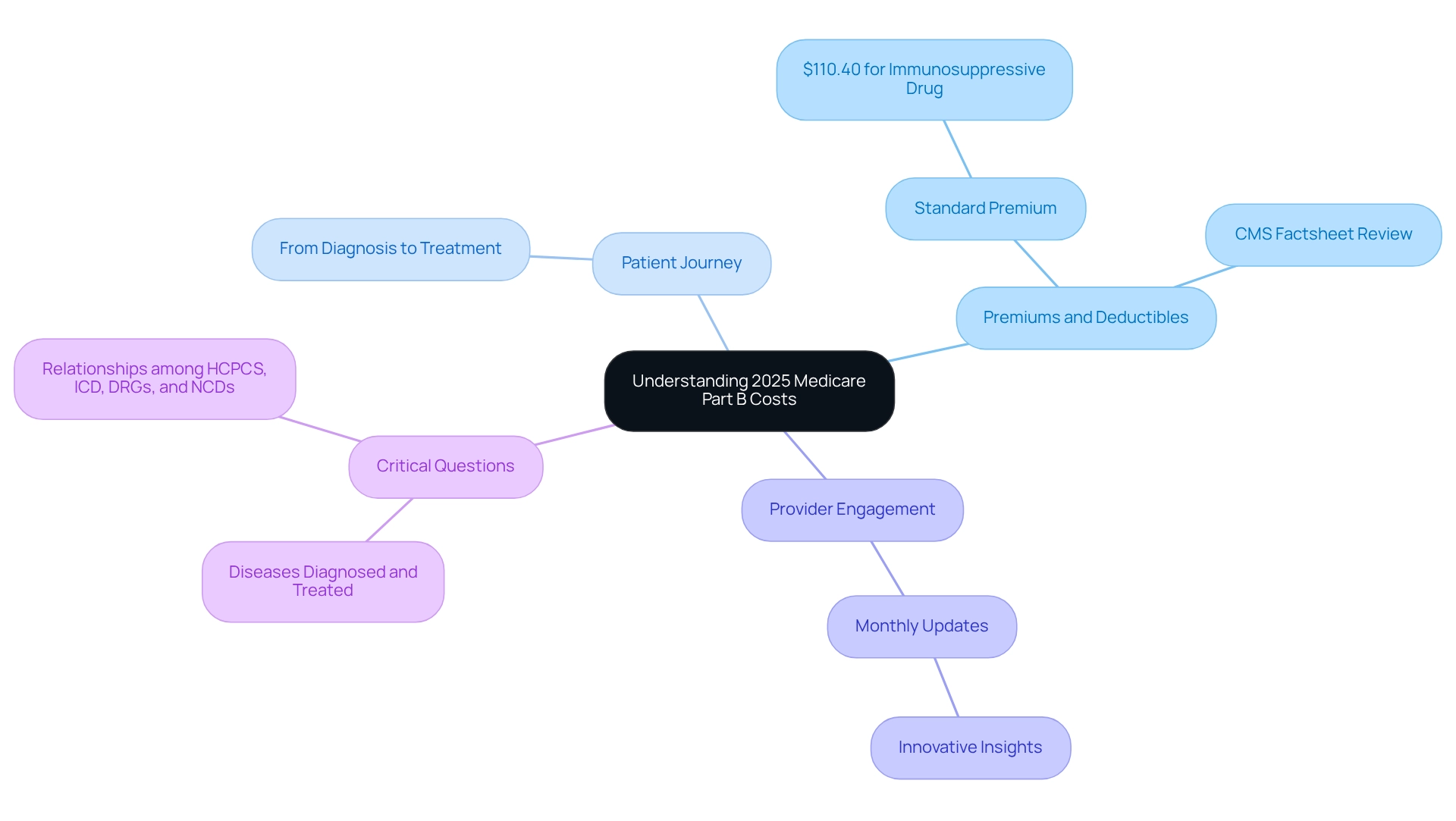

CareSet has developed a comprehensive array of resources designed to assist stakeholders in understanding the financial implications of the 2025 part b premium expenses. These materials offer in-depth insights into premiums, deductibles, and potential out-of-pocket costs, including the 2025 part b premium, which is established at $110.40 for the standard immunosuppressive drug.

Furthermore, CareSet fosters provider engagement through monthly updates, delivering innovative insights into drug utilization and treatment pathways. This proactive strategy is essential as beneficiaries confront new financial realities, enabling them to make informed decisions about their healthcare coverage.

Stakeholders can investigate critical questions, such as:

- The diseases providers diagnose and treat

- The patient journey from diagnosis to treatment

- The relationships among HCPCS, ICD, DRGs, and NCDs within a therapeutic context

Additionally, participants are encouraged to review the CMS factsheet to assess the 2025 part b premium and deductibles, thereby enhancing their understanding of the impending changes. We urge stakeholders to engage with CareSet’s resources for deeper insights into these vital areas.

AHCA: Implications of 2025 Medicare Part B Changes for Healthcare Providers

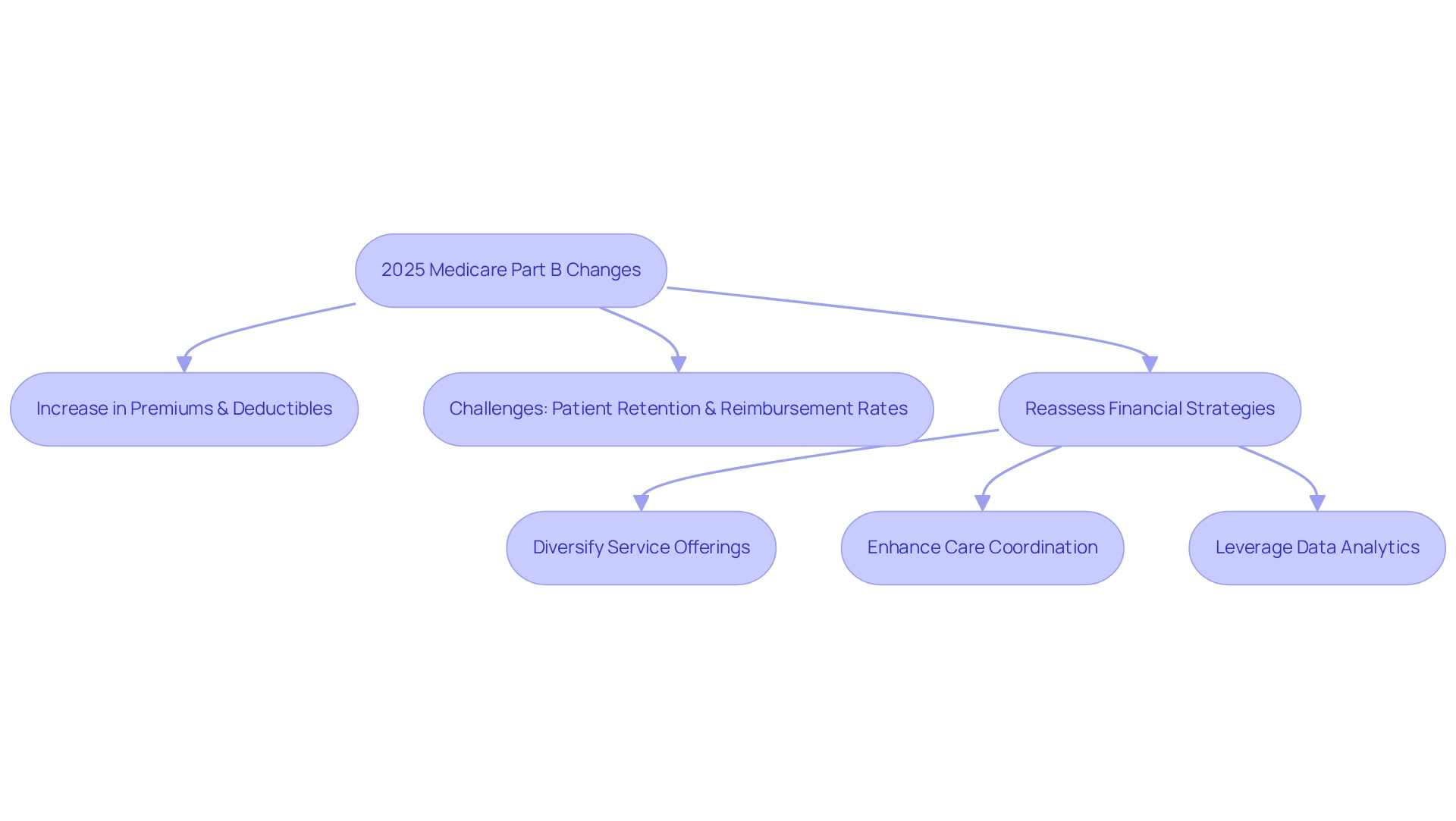

The American Health Care Association (AHCA) has identified significant implications stemming from the 2025 Part B premium changes for medical providers. With an expected rise in the 2025 Part B premium and deductibles, providers may face challenges regarding patient retention and reimbursement rates. To navigate these changes effectively, it is essential for providers to reassess their financial strategies and patient engagement initiatives.

In light of these adjustments, medical service providers are encouraged to adopt proactive financial strategies. For instance, some have begun diversifying their service offerings and enhancing care coordination to improve patient satisfaction and retention. Additionally, leveraging data analytics, such as those provided by CareSet, which integrates insights from over 62 million beneficiaries and 6 million providers, can assist providers in identifying trends in patient behavior and adjusting their services accordingly. This comprehensive approach empowers healthcare stakeholders to make informed decisions that enhance patient care and business success.

Understanding the evolving healthcare landscape is crucial for aligning services with patient needs and preferences. As noted in Jimmo v. Sebelius, “Drawing inspiration from real-life experiences and narratives of recipients and caregivers, we hope to share meaningful discussions with you.” By staying informed about these changes, providers can better position themselves to meet the demands of their patient populations while optimizing reimbursement opportunities. The commitment to data-driven insights, exemplified by CareSet’s approach, underscores the importance of high-quality data without reliance on flawed projections, further empowering providers to enhance patient outcomes and support sustainable growth in a challenging environment. Furthermore, the Inflation Reduction Act (IRA), passed in August 2022, aims to assist enrollees of the health insurance program with the cost of their medications, providing a timely backdrop for the financial strategies being discussed.

Medicare.gov: Essential Information on 2025 Part B Premiums and Coverage

Medicare.gov serves as a vital resource for beneficiaries seeking information on the 2025 part b premium and coverage options. This website offers comprehensive details about the new premium rates, including the 2025 part b premium, deductible amounts, and coverage specifics, ensuring that users have access to essential information. To enhance provider involvement and patient navigation, participants are encouraged to utilize CareSet’s monthly updates on healthcare. These updates address critical business inquiries, such as the diseases providers identify and manage, and how patients transition from diagnosis to treatment within their benefits. By leveraging both Medicare.gov and CareSet’s analytics, stakeholders can remain informed about their options and assist patients in understanding their benefits more effectively.

CareSet identifies 15% more targets and 250% more patients than leading claims vendors, showcasing the effectiveness of its insights. This capability highlights the importance of data in improving patient outcomes and streamlining healthcare processes. The clarity and accessibility of information on Medicare.gov, combined with CareSet’s comprehensive data solutions, are essential for effective patient education and engagement. For those looking to empower their business with data-driven strategies, engaging with CareSet’s services can provide valuable insights and enhance operational efficiency. Consider leveraging these resources to stay ahead in the ever-evolving healthcare landscape.

Kiplinger: Financial Planning for Increased 2025 Medicare Part B Premiums

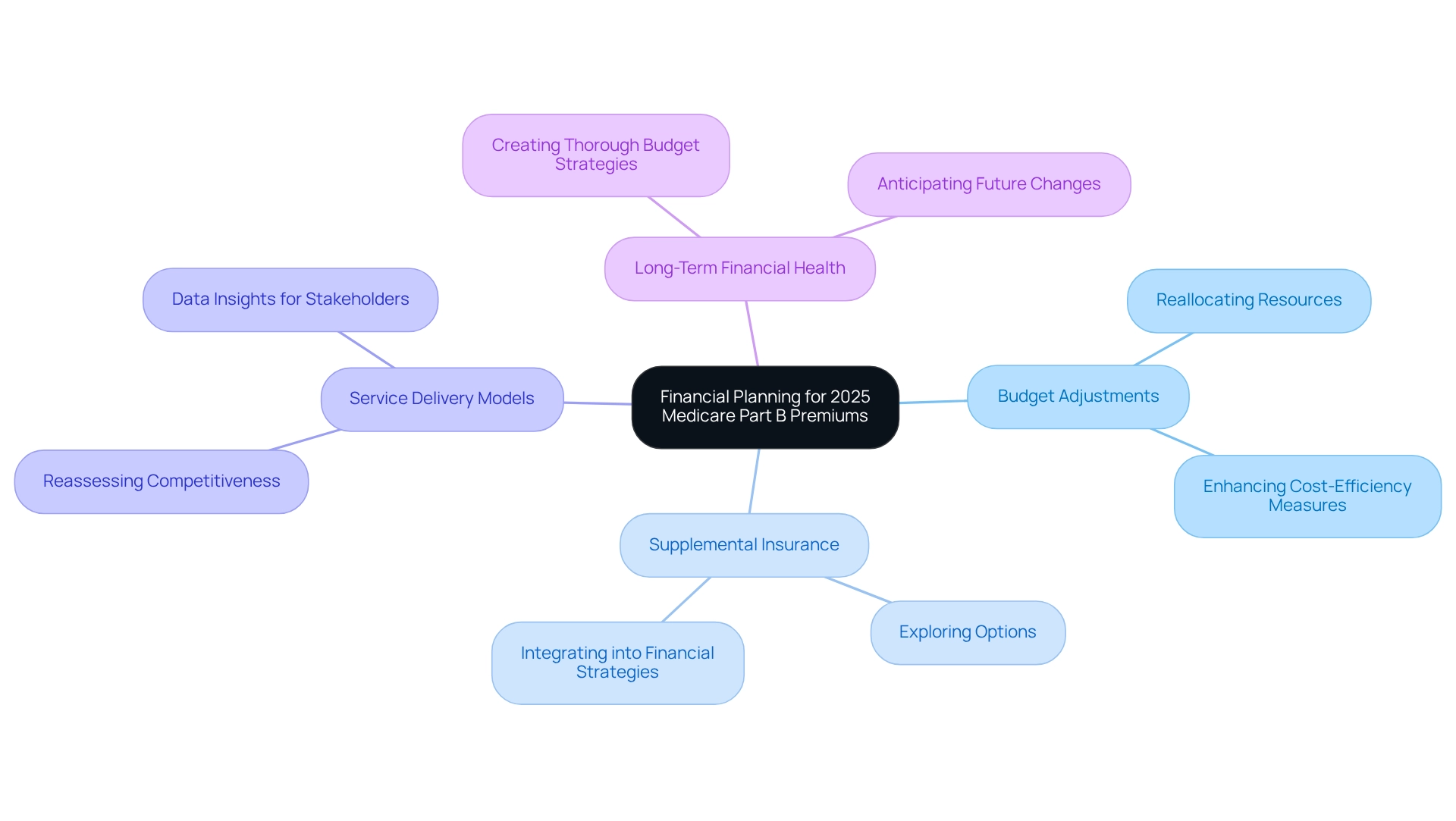

Kiplinger emphasizes the critical importance of proactive financial planning due to the increased 2025 part B premium. Stakeholders must adjust their budgets to accommodate the 2025 part B premium, which is set at $185.00, along with the heightened deductible of $257. This adjustment may necessitate exploring supplemental insurance options or modifying service offerings to sustain profitability. Notably, Part B payment rates have remained unchanged since 2020 and are not expected to rise until 2026, making these adjustments even more vital. By anticipating these changes, organizations can strategically position themselves to navigate the financial implications effectively.

In response to these premium increases, many organizations are implementing financial planning strategies that include reallocating resources and enhancing cost-efficiency measures. For instance, medical providers are reassessing their service delivery models to ensure competitiveness while managing rising costs. Additionally, interested parties are encouraged to leverage CareSet’s comprehensive Medicare data insights, which encompass information from over 62 million beneficiaries and 6 million providers, to inform their strategies and enhance patient care. This data-driven approach empowers pharmaceutical and biotech companies to engage more effectively with medical providers, as illustrated in a recent case study on oncology treatment options that highlights the importance of timely engagement with physicians regarding treatment alternatives.

Kiplinger also recommends that interested parties consider the long-term effects of these changes on their financial health. By creating thorough budget strategies that account for possible changes in medical expenses, organizations can enhance their readiness for the evolving financial support landscape in health services. This proactive approach not only safeguards their financial stability but also bolsters their ability to deliver quality care amidst changing economic conditions. Moreover, with the implementation of a $2,000 out-of-pocket limit on prescription medications for Part D in 2025, stakeholders should consider the 2025 part B premium as they integrate this substantial adjustment into their financial planning, as it will influence overall healthcare expenses. As CMS states, “The proposed policy would be an exception to the physician signature requirement for purposes of an initial certification only and only in cases where a signed and dated order/referral is on file,” underscoring the regulatory landscape that stakeholders must navigate.

NCOA: Guidance on Out-of-Pocket Costs Related to 2025 Medicare Part B Changes

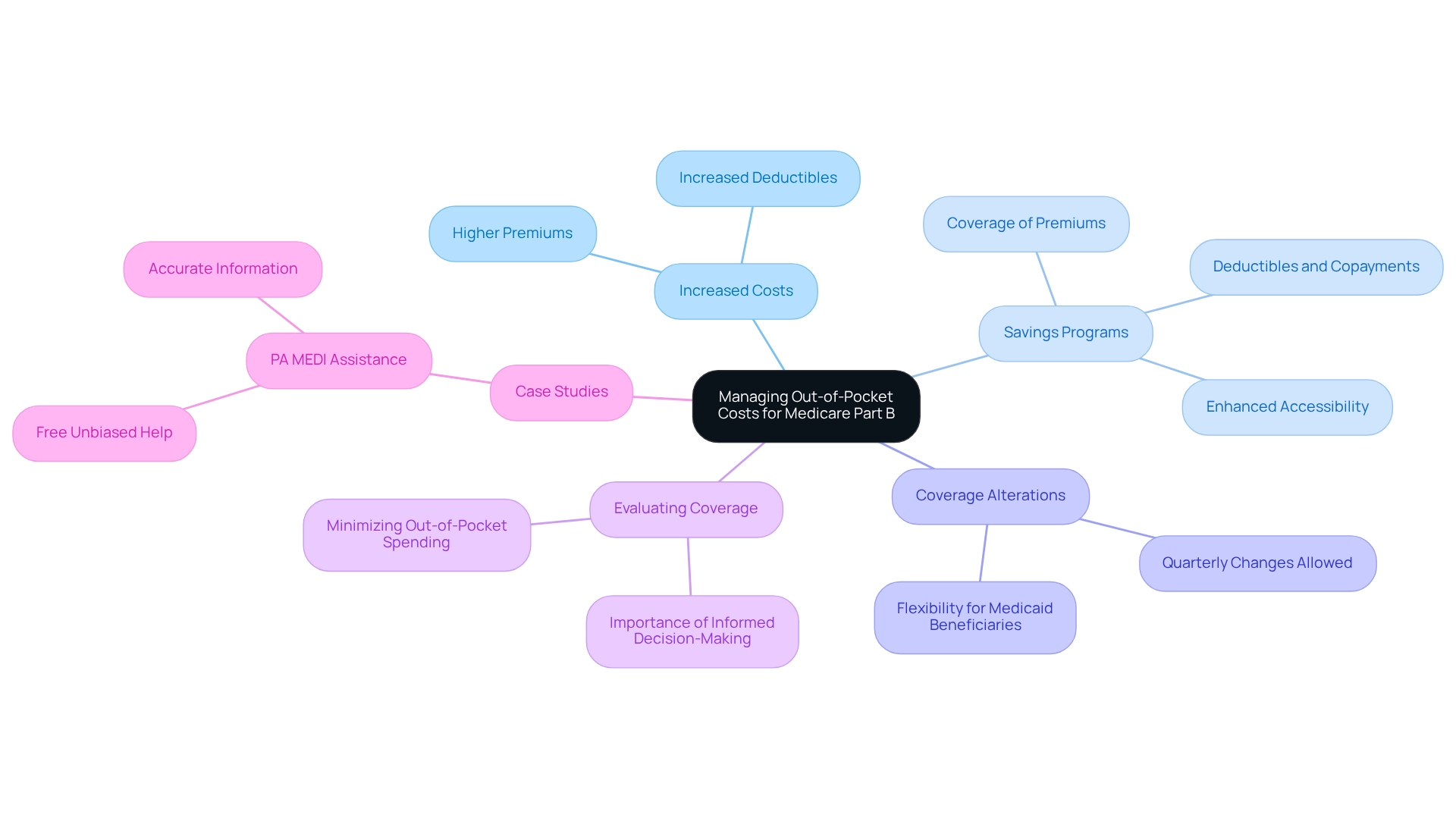

The National Council on Aging (NCOA) provides essential guidance for managing out-of-pocket expenses associated with the 2025 part b premium changes. Beneficiaries face increased premiums and deductibles, significantly impacting their medical costs. To mitigate these financial challenges, the NCOA recommends exploring Savings Programs, which have proven effective in reducing expenses for many recipients. Notably, these programs can cover premiums, deductibles, and copayments, enhancing healthcare accessibility.

Additionally, Medicare recipients qualifying for full Medicaid benefits have the flexibility to alter their Medicare coverage outside of the open enrollment period, allowing changes up to once per quarter. This option is critical for recipients aiming to effectively manage their out-of-pocket costs.

Beneficiaries are also urged to evaluate all available coverage options to minimize out-of-pocket spending. This proactive strategy is vital for ensuring individuals can obtain necessary medical services without financial strain. Statistics reveal that participants utilizing these programs often report increased satisfaction with their coverage, underscoring the importance of informed decision-making in navigating the complexities of the system.

Case studies, such as the PA MEDI Assistance for Medicare Beneficiaries, illustrate the value of impartial support in understanding coverage options. By connecting with PA MEDI, recipients gain accurate information and assistance without sales pressure, empowering them to make informed healthcare decisions. The impact of this support is substantial, as it aids recipients in effectively navigating their options.

In conclusion, leveraging NCOA’s guidance and available resources can significantly enhance the financial well-being of individuals enrolled in the program concerning the 2025 part b premium. As Lindsey Copeland emphasized, “Together, these changes would start to strengthen healthcare coverage and update the program for present and upcoming generations.” Furthermore, recipients should recognize that insurance agents and brokers are compensated by private insurers, which may shape their recommendations. This highlights the necessity of seeking unbiased assistance when making coverage decisions.

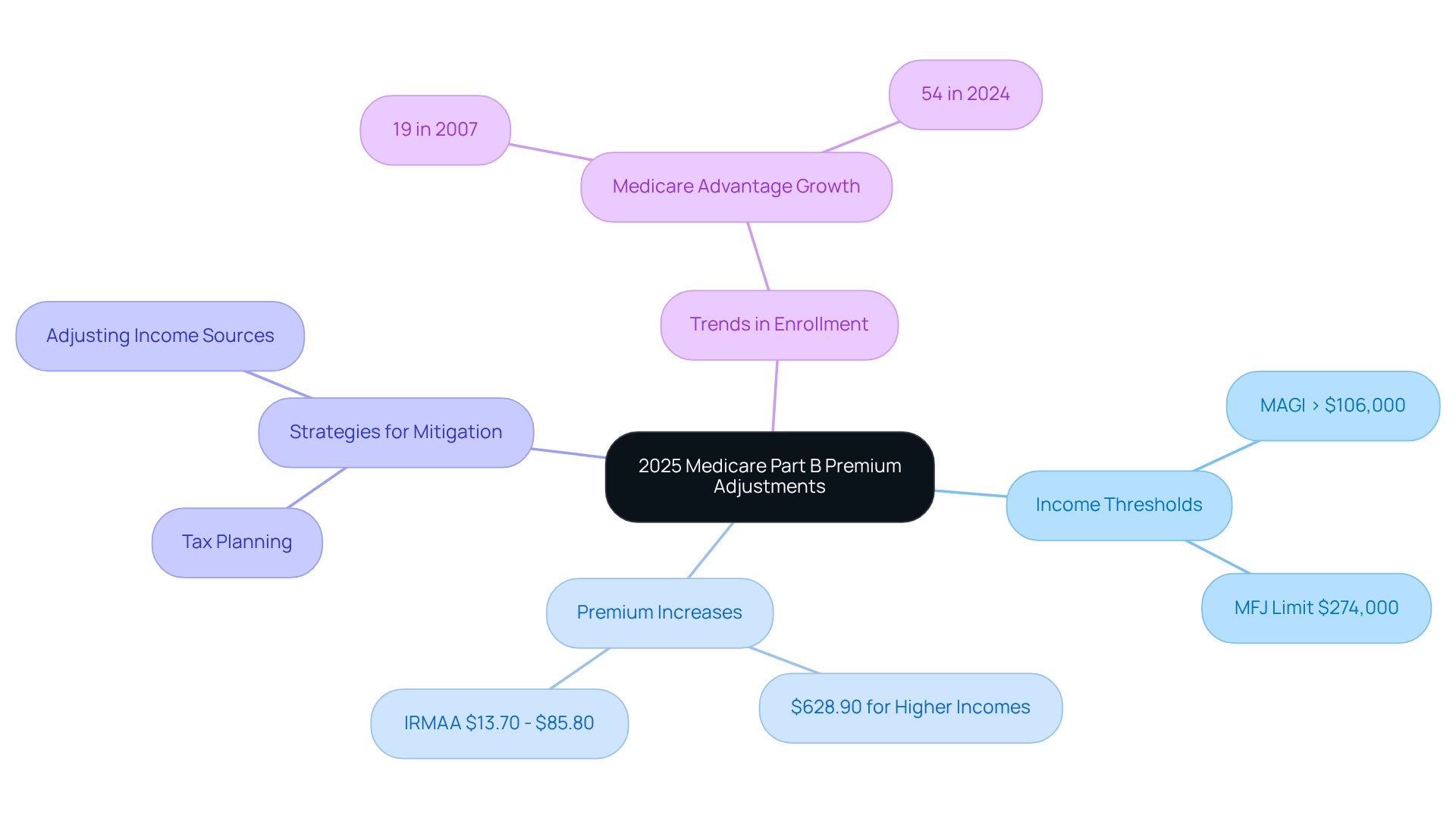

SSA: Understanding Income-Related Adjustments to 2025 Medicare Part B Premiums

The Social Security Administration (SSA) has outlined the income-related adjustments affecting the 2025 part b premium for Medicare. Beneficiaries with modified adjusted gross incomes (MAGI) exceeding $106,000 will face additional surcharges, potentially raising their monthly premiums to as high as $628.90. This increase underscores the importance of understanding the 2025 part b premium adjustments, as they can significantly influence medical expenses for higher-income beneficiaries. CareSet’s robust medical data insights empower stakeholders to navigate these complexities, ensuring they remain well-informed about the financial implications of these changes.

In 2025, the income-related monthly adjustment amounts (IRMAA) for Medicare Part D will range from $13.70 to $85.80, further complicating financial planning for those affected. Stakeholders must ensure that clients are aware of these potential increases, enabling informed decisions regarding their healthcare expenses. By leveraging insights from CareSet, parties can gain a deeper understanding of patient needs and provider networks, thereby enhancing their strategic decision-making.

The methodology for calculating IRMAA brackets is based on the average of 12 monthly Consumer Price Index (CPI) figures, which can result in higher brackets even if prices remain stable. Furthermore, the 2026 Modified Federal Joint (MFJ) income limit is set at $274,000, providing context for future adjustments and aiding stakeholders in grasping the broader implications of income thresholds.

Recent trends indicate a growing preference for Medicare Advantage plans, with enrollment increasing from 19% in 2007 to 54% in 2024. This shift reflects recipients’ responses to the evolving healthcare landscape and the financial implications of premium adjustments. Understanding these trends is crucial for successful market access strategies, as they highlight the necessity for involved parties to adapt to changing consumer preferences. CareSet’s insights into pharmaceutical utilization can further inform these strategies.

Experts stress that recipients should proactively evaluate their financial situations in light of these changes. For example, those anticipating higher premiums should consider strategies such as tax planning or adjusting their income sources to mitigate the impact of IRMAA. As David Fei, CFP®, ChFEBC℠, AIF®, observes, “If your income exceeded $106,000 (MAGI) on your 2023 taxes, then you can expect some to pay IRMAA on top of your original full Part B premium.” By remaining informed and prepared, participants can better assist their clients in navigating these adjustments and optimizing their healthcare expenses, utilizing CareSet’s extensive data solutions.

AARP: Advocacy and Resources for Navigating 2025 Medicare Part B Changes

AARP plays a crucial role in supporting individuals enrolled in the program, particularly regarding the anticipated adjustments to the 2025 part b premium. The organization offers a comprehensive array of resources designed to assist individuals in navigating these modifications, including educational materials and advocacy initiatives. By utilizing AARP’s resources, stakeholders can empower their clients to understand their options and rights within the changing healthcare landscape. This proactive involvement is essential, as it enables recipients to effectively advocate for their medical needs and financial security.

Furthermore, AARP’s dedication to improving patient care and assisting caregivers aligns with the broader objectives of Medicare reforms, ensuring that recipients are well-informed and prepared to make choices that impact their health and well-being. For instance, recipients can now access popular medications like Ozempic and Mounjaro for the treatment of type 2 diabetes, as highlighted by AARP. Additionally, CareSet’s method, which combines over 100 external data sources and examines more than $1.1 trillion in yearly claims, meets urgent data requirements while promoting long-term strategic growth for collaborators in the medical field. This depth of resources is vital for stakeholders aiming to navigate the complexities of Medicare changes effectively, as it empowers them with insights from over 62 million individuals and 6 million providers.

To further assist individuals, resources for navigating Medicare options during open enrollment include:

- Calling 800-MEDICARE

- Reaching out to the State Health Insurance Assistance Program (SHIP)

These actionable tips ensure that beneficiaries are not only informed but also equipped to make the best decisions regarding their healthcare.

Conclusion

The anticipated changes to Medicare Part B premiums and deductibles in 2025 require a thorough understanding from all stakeholders within the healthcare ecosystem. With the standard monthly premium projected to rise to $185.00 and the deductible increasing to $257, beneficiaries and healthcare providers must brace for the financial implications of these adjustments. Organizations such as CareSet and AARP offer vital resources and insights that can assist in navigating this evolving landscape, ensuring that both patients and providers are well-informed about their options and rights.

Furthermore, the shift towards Medicare Advantage plans and the introduction of income-related adjustments underscore the necessity for proactive financial planning. As nearly 50% of beneficiaries are anticipated to enroll in these plans, comprehending the dynamics of premium pricing and additional benefits will be essential for effective budgeting and patient engagement strategies. Stakeholders are urged to leverage data-driven insights to optimize their decision-making processes, ultimately enhancing patient care and financial stability.

In conclusion, the changes to Medicare Part B in 2025 present both challenges and opportunities for stakeholders across the healthcare spectrum. By harnessing available resources and remaining informed about the evolving regulations and market dynamics, healthcare providers and beneficiaries can adeptly navigate these adjustments. A commitment to understanding these changes is crucial for maintaining quality care and ensuring that financial pressures do not obstruct access to necessary services.