Overview

The article presents crucial insights regarding the upcoming 2025 Medicare Part B premiums. Notably, the standard monthly premium is set to rise to $185.00, a change propelled by increasing medical expenses and adjustments in federal funding. This significant increase, coupled with additional income-related modifications for higher earners, underscores the necessity for beneficiaries to grasp their financial obligations. It is imperative for them to prepare for the potential impact on their healthcare budgets, ensuring they remain informed and proactive in managing their healthcare costs.

Introduction

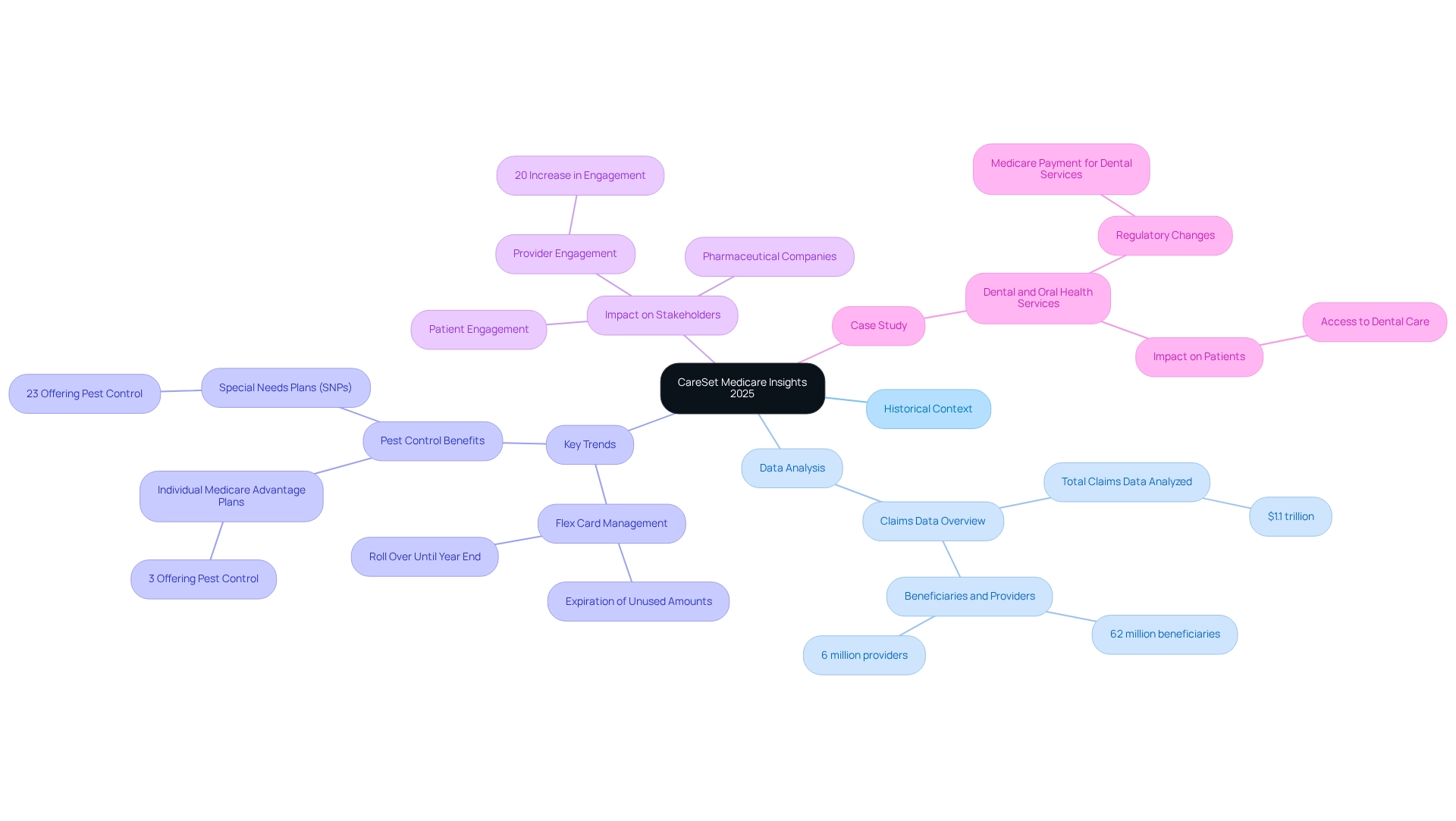

As the landscape of healthcare continues to evolve, understanding the intricacies of Medicare costs becomes increasingly vital for beneficiaries. The year 2025 brings significant changes, including rising premiums and new income-related adjustments that could substantially impact healthcare budgets. CareSet, a leader in Medicare data analysis, offers comprehensive insights drawn from an extensive analysis of over $1.1 trillion in claims data, empowering stakeholders to navigate these complexities. This article delves into critical trends and changes that will shape the Medicare experience in 2025—from the introduction of pest control benefits in certain Medicare Advantage plans to the implications of increased premiums—ensuring beneficiaries are well-equipped to manage their healthcare finances effectively.

CareSet: Comprehensive Medicare Data Insights for 2025 Premiums

Since its inception in 2011, CareSet has firmly established itself as a leader in healthcare data analysis, concentrating on the extraction and interpretation of complex claims data. For 2025, CareSet’s insights into 2025 Medicare premiums Part B are based on an extensive analysis of over $1.1 trillion in annual claims data, empowering healthcare stakeholders with comprehensive insights derived from over 62 million beneficiaries and 6 million providers. This thorough methodology allows stakeholders to acquire a nuanced understanding of treatment patterns and patient demographics, which is essential for navigating the evolving landscape of healthcare costs.

In 2025, the analysis reveals significant trends, notably that 3% of individual Advantage plans and 23% of Special Needs Plans (SNPs) now provide pest control benefits, reflecting a growing acknowledgment of diverse patient needs. This trend may influence overall expenses and patient involvement, as it underscores the increasing personalization of healthcare plans to meet specific recipient needs. Additionally, unused amounts on flex cards may either expire at the end of each month or roll over until the year’s end, impacting how beneficiaries manage their healthcare expenses.

As Tricia Neuman observes, “This analysis concentrates on the Advantage marketplace in 2025 and trends over time,” emphasizing the importance of understanding these dynamics. CareSet’s expertise facilitates the identification of trends and gaps in data, ensuring clients obtain actionable intelligence regarding healthcare expenses and 2025 Medicare premiums Part B. This commitment to delivering high-quality insights positions CareSet as an invaluable ally for pharmaceutical companies and medical organizations aiming to optimize their market access strategies and enhance patient engagement. Furthermore, recent regulatory changes permitting payment for dental services associated with covered medical services illustrate the evolving landscape of these services and their implications for patient care.

For instance, a recent case study involving an oncology treatment manufacturer demonstrated how CareSet’s data insights led to a 20% increase in physician engagement regarding late-stage treatment options. Client feedback highlighted the value of these insights in effectively tailoring their market strategies. This illustrates CareSet’s impact on enhancing provider engagement and optimizing patient care.

2025 Medicare Part B Premium Increase: What to Expect

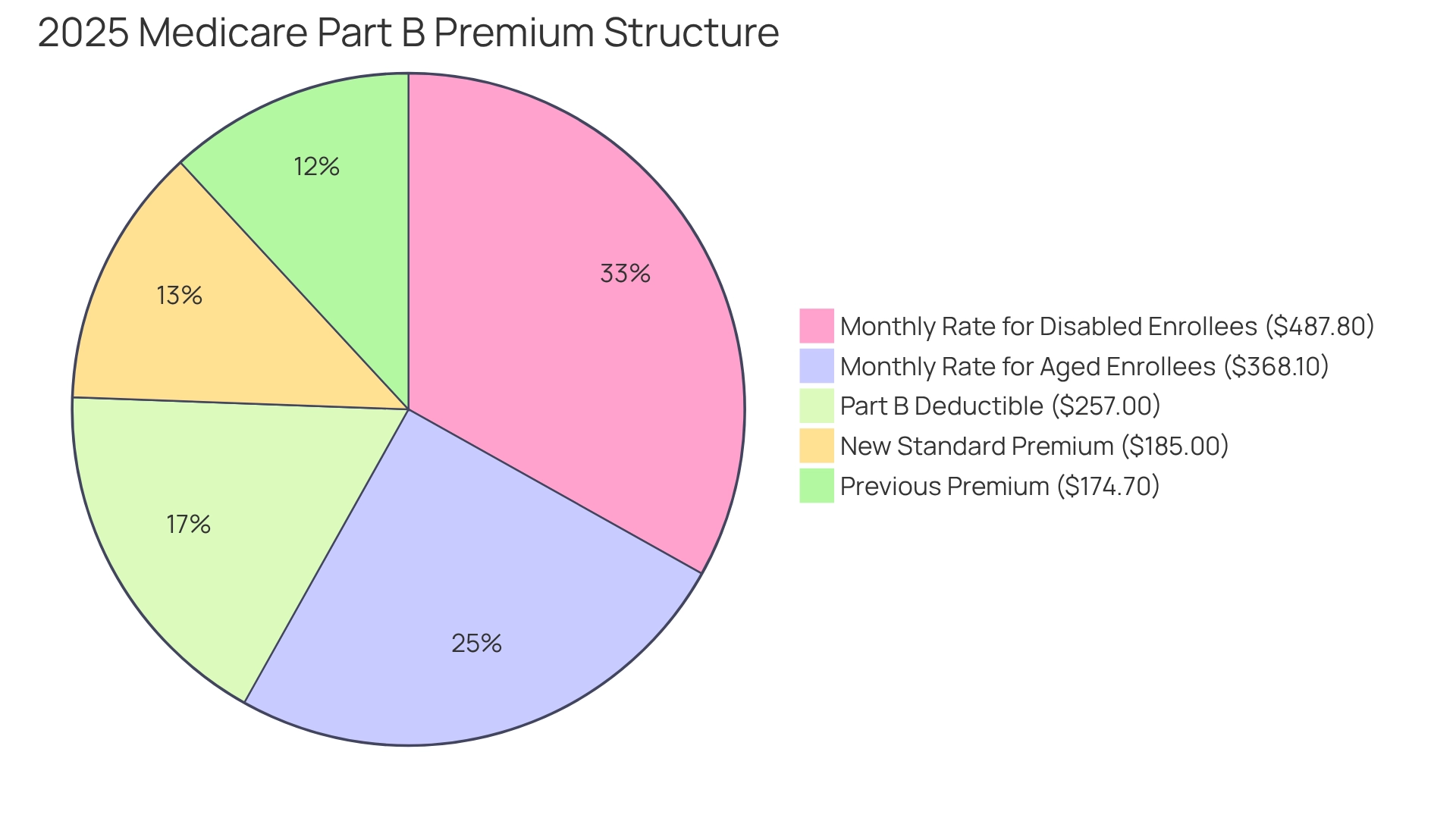

In 2025, the Medicare premiums Part B will increase to a standard monthly fee of $185.00, which is an increase of $10.30 from the previous year’s charge of $174.70. This adjustment is primarily driven by escalating medical expenses and necessary changes in federal funding. Economists in the medical field have noted that this increase is part of a broader trend, with forecasts indicating that the overall cost increase for approximately 64 million Part B participants will total $7.9 billion.

Beneficiaries must acknowledge that this change will significantly impact their monthly medical budgeting. The monthly actuarial rates for aged enrollees will be set at $368.10, while disabled enrollees will face rates of $487.80. Furthermore, the Part B deductible will be $257.00, with income-related adjustments applicable to those with modified adjusted gross income exceeding specific thresholds. Notably, the IRMAA limit for married couples filing jointly will increase from $206,000 in 2024 to $212,000 in 2025, which is crucial for financial planning.

The effective date of the notice regarding these modifications is intended to be prompt to serve the public interest, underscoring the urgency of this information for recipients. Factors contributing to the rise in costs include heightened demand for medical services, advancements in medical technology, and general inflationary pressures affecting the medical sector. As these expenses continue to rise, recipients must prepare for the financial implications of these changes in their healthcare coverage. Moreover, the increase in costs may affect treatment authorizations under Part D, as greater expenses could influence the overall budget for medical services. Understanding how these costs relate to provider interventions and patient treatment pathways is essential for individuals exploring their healthcare options. The case study titled ‘2025 Medicare premiums part b Rates Announcement‘ illustrates the real-world effects of these changes, emphasizing the importance of understanding the factors driving the increase in 2025 Medicare premiums part b.

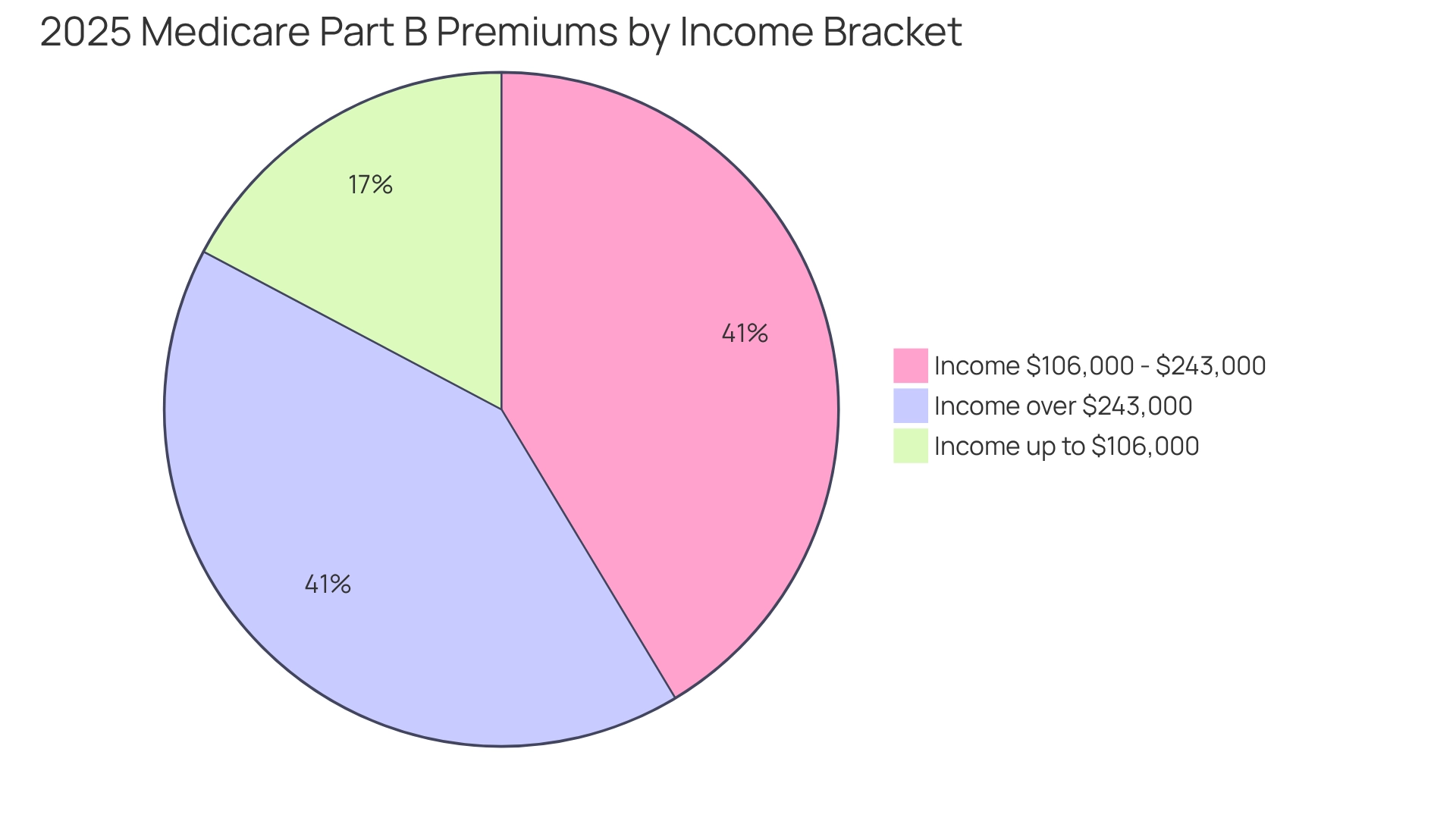

Income-Related Adjustments: How They Affect Your 2025 Medicare Premiums

In 2025, beneficiaries with higher incomes will incur additional charges affecting their 2025 Medicare premiums Part B through the Income-Related Monthly Adjustment Amount (IRMAA). The 2025 Medicare premiums Part B will vary based on modified adjusted gross income (MAGI) from two years prior, with amounts ranging from $259.00 to $628.90. This tiered structure imposes higher costs on individuals earning over $106,000 and couples exceeding $212,000, significantly influencing their overall healthcare expenses.

Understanding these income-related adjustments is essential for effective financial planning, as they can significantly impact the 2025 Medicare premiums Part B and lead to substantial changes in healthcare costs. For instance, individuals with incomes surpassing $243,000 will encounter a fee of $621.40, underscoring the importance of implementing income management strategies to mitigate these charges.

By effectively managing their earnings, recipients can potentially decrease their IRMAA surcharge and lower future healthcare costs. As beneficiaries navigate their medical budgets, a comprehensive understanding of IRMAA and its implications will be crucial for enhancing their experience with the program.

Additionally, several factors affect the cost of Part B premiums, including late enrollment penalties and eligibility for Savings Programs, which should also be considered when planning for medical expenses.

Overview of 2025 Medicare Costs: Premiums, Deductibles, and More

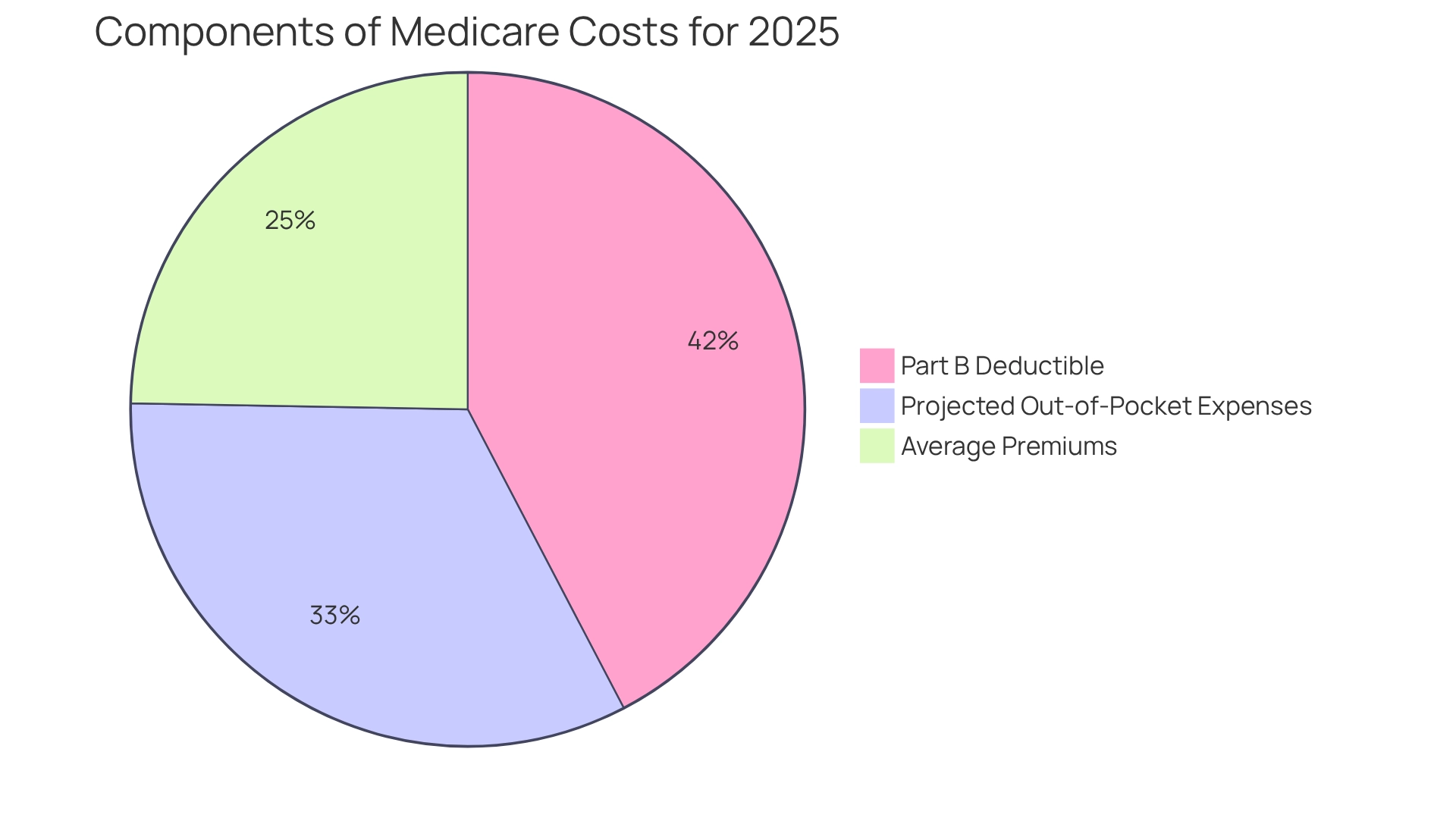

In 2025, the deductible for Part B of the program will rise to $257, which is part of the 2025 Medicare premiums Part B, reflecting a broader trend in increasing healthcare expenses. This change underscores the importance of understanding the evolving financial landscape for Medicare beneficiaries.

As noted in Jimmo v. Sebelius, ‘now is the time to unite as partners and explore methods to advocate for comprehensive health coverage, health equity, and quality health care.’ Beneficiaries must consider potential out-of-pocket expenses for services not covered by the government health program, which can significantly impact their financial planning.

These expenses can fluctuate based on individual healthcare needs and usage trends, making it crucial for recipients to have a clear understanding of their financial responsibilities. CareSet’s innovative healthcare data solutions analyze insights from over 62 million individuals and 6 million providers, empowering clients to navigate these complexities effectively.

By enhancing provider engagement through monthly updates, CareSet provides critical insights into drug utilization, treatment pathways, and patient navigation. The interplay of the 2025 Medicare premiums Part B, deductibles, and out-of-pocket expenses will fundamentally shape the financial landscape for Medicare beneficiaries, necessitating careful consideration and strategic planning.

How will you prepare for these changes?

Conclusion

Navigating the complexities of Medicare costs in 2025 is essential for beneficiaries facing rising premiums and new income-related adjustments. The increase in the standard monthly premium for Medicare Part B to $185.00, coupled with the deductible rising to $257.00, signifies a broader trend driven by escalating healthcare demands and inflationary pressures. Understanding these changes is crucial for effective budgeting and financial planning, especially as the total premium increase is projected to significantly impact approximately 64 million enrollees.

Moreover, the introduction of income-related adjustments through the IRMAA complicates the financial landscape for higher-income beneficiaries, with premiums ranging from $259.00 to $628.90 based on modified adjusted gross income. This tiered structure underscores the importance of income management strategies to mitigate additional costs. Beneficiaries must remain vigilant about these adjustments and their potential implications on overall healthcare expenses.

CareSet’s extensive analysis of Medicare data provides valuable insights that empower stakeholders to navigate these complexities effectively. With innovative solutions that enhance provider engagement and patient navigation, CareSet positions itself as a critical partner in optimizing Medicare experiences. As the healthcare landscape continues to evolve, beneficiaries must stay informed and proactive in managing their healthcare finances to adapt to these changes successfully. The ability to anticipate and plan for these adjustments will be vital in ensuring that beneficiaries can maintain access to the care they need while managing their budgets effectively.