Overview

This article delves into the crucial insights surrounding the 2023 Medicare Part B premiums, underscoring their significant implications for stakeholders within the healthcare sector. Notably, the reduction in premiums to $164.90, coupled with adjustments in deductibles and income-related factors, is poised to enhance patient access to care. Such changes are expected to influence market strategies, as supported by comprehensive data analysis from CareSet, which reveals trends and spending patterns that impact these costs. By understanding these dynamics, stakeholders can better navigate the evolving landscape of healthcare financing.

Introduction

In the evolving landscape of Medicare, grasping the intricacies of Part B premiums is essential for stakeholders in the healthcare and pharmaceutical sectors. Recent adjustments in premium rates, coupled with the complexities introduced by income-related surcharges, create a dynamic financial environment that significantly affects beneficiaries’ access to care. CareSet’s in-depth data analysis unveils important trends shaping these premiums, providing valuable insights that empower stakeholders to make informed decisions.

This article examines the latest changes in Medicare Part B premiums, the factors influencing these shifts, and the implications for patient access. Ultimately, it offers a roadmap for navigating the complexities of Medicare in 2023 and beyond.

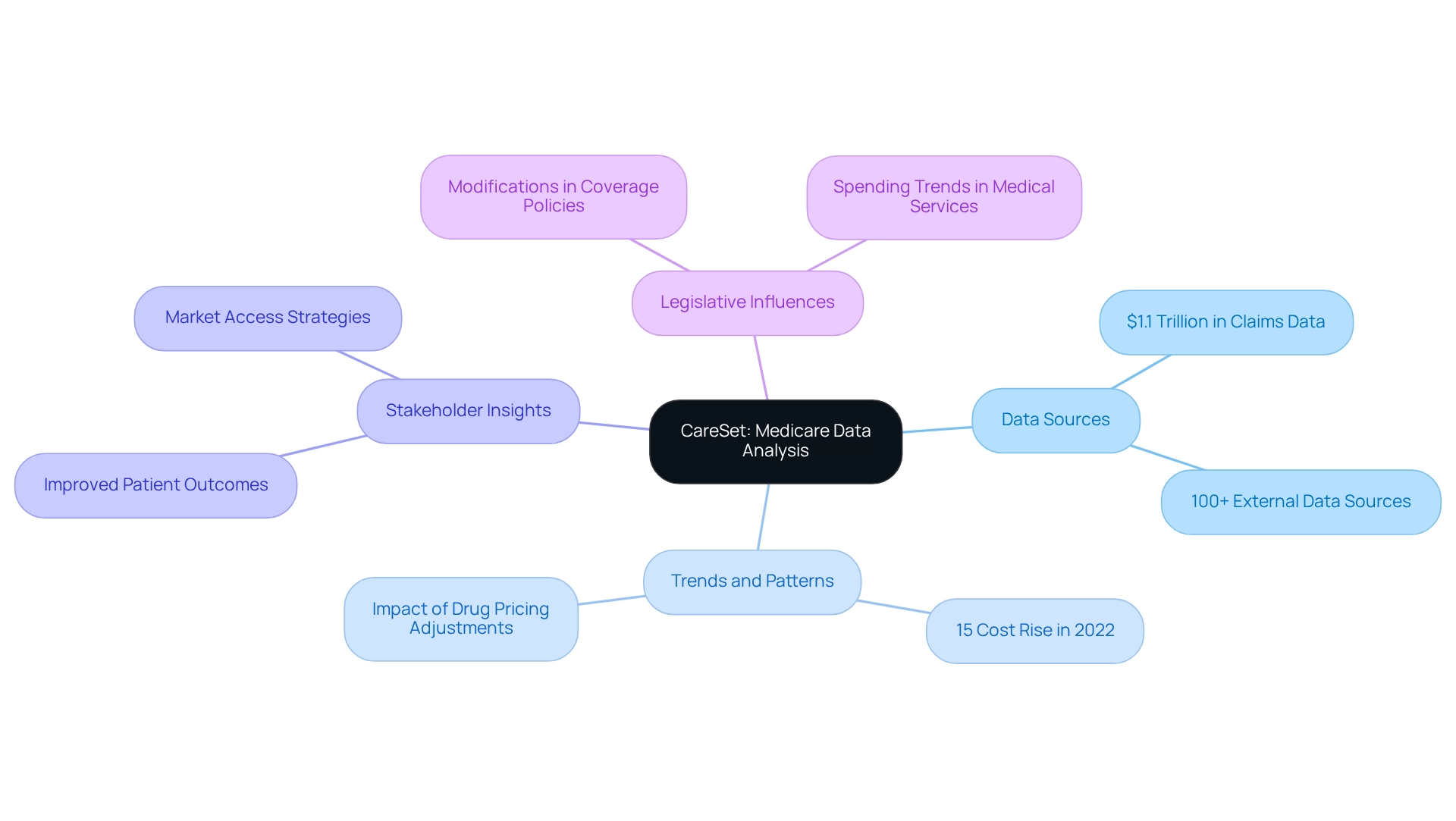

CareSet: Comprehensive Medicare Data Analysis for Part B Premium Insights

CareSet excels in extracting and interpreting complex Medicare claims data, offering stakeholders vital insights into Medicare Part B premiums. By examining over $1.1 trillion in yearly claims data and incorporating more than 100 external data sources, CareSet reveals significant trends and patterns essential for stakeholders in the pharmaceutical and medical sectors. This data-driven approach empowers clients to make informed decisions regarding patient care and market access strategies, particularly in light of the significant variations in 2023 Medicare Part B premiums influenced by several factors including legislative changes, such as modifications in coverage policies, and spending trends in medical services.

For instance, costs rose by nearly 15% in 2022 due to expected spending spikes connected to new drug therapies; however, later price adjustments by manufacturers, such as Biogen’s decrease of Aduhelm’s price, have altered projections. These dynamics underscore the importance of precise data analysis in comprehending premium trends and their effects on providers and individuals alike.

CareSet’s commitment to providing timely insights not only enhances health outcomes but also streamlines the lifecycle management of pharmaceutical products. The case study titled ‘Enhancing Patient Outcomes through Data Leadership’ illustrates how CareSet’s data analysis has led to improved patient results, demonstrating the significant impact of comprehensive data analysis on medical decisions. By unlocking insights from over 62 million beneficiaries and 6 million providers, CareSet empowers healthcare stakeholders to refine their market access strategies, ensuring they remain competitive in a rapidly changing healthcare landscape. As the industry continues to evolve, the insights derived from healthcare claims data will remain essential for strategic planning and market access initiatives.

2023 Standard Medicare Part B Premium Rates: What Beneficiaries Should Know

In 2023, the 2023 Medicare Part B premiums are established at a standard monthly fee of $164.90, reflecting a notable reduction of $5.20 from the previous year. This reduction signifies more than just a numerical change; it embodies broader trends in medical expenses and holds the potential to significantly influence beneficiaries’ medical choices. For instance, lower costs can enhance patient access to essential services, allowing beneficiaries to allocate resources more effectively toward their medical needs.

Economists within the medical field emphasize that such cost adjustments can lead to improved patient engagement and satisfaction, as beneficiaries may feel more empowered to seek necessary treatments without the burden of high expenses. The impact of this $164.90 fee on beneficiaries is substantial, particularly for those on fixed incomes, as it alleviates some financial pressure and encourages proactive healthcare management.

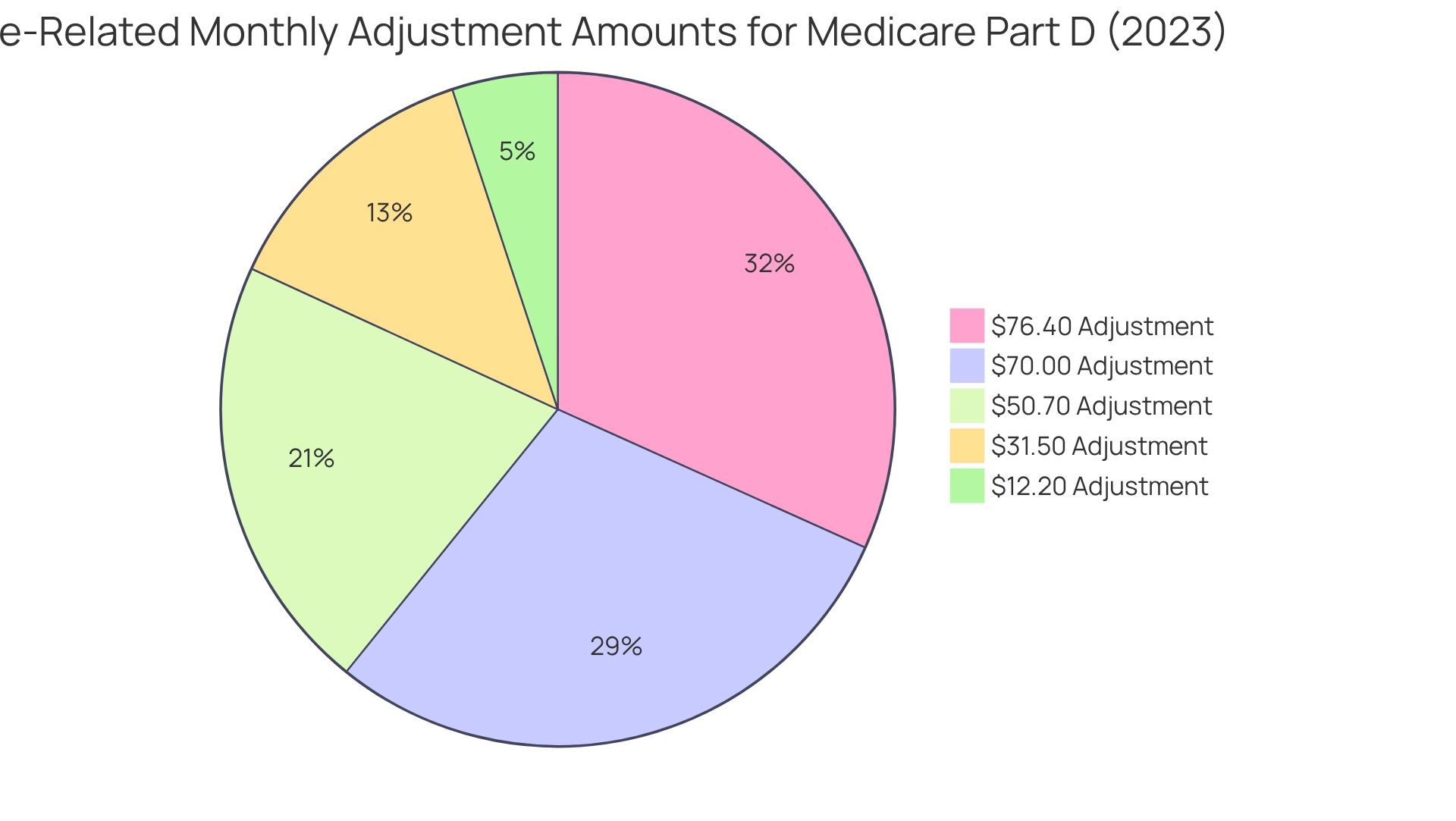

Historically, Part B charges have fluctuated, with changes reflecting shifts in healthcare spending and policy decisions. The recent decline continues this trend, which has seen costs rise and fall in response to various economic factors. For example, since 2011, fee modifications have been instituted to ensure that higher-income recipients contribute appropriately, similar to the income-related monthly adjustment figures for Part D, which affect approximately 8% of participants. The 2023 Part D income-related monthly adjustment figures for high-income recipients include amounts of $12.20, $31.50, $50.70, $70.00, and $76.40.

As stakeholders in the medical field analyze these changes, it is crucial to consider how reductions in health insurance costs can shape consumer behavior and access to services. The adjustments in the 2023 Medicare Part B premiums not only provide immediate financial relief but also create long-term strategic growth opportunities for medical providers and organizations. CareSet’s comprehensive healthcare data insights can empower stakeholders to better understand these dynamics, enabling informed decisions that enhance patient care and organizational success.

Moreover, the monthly actuarial rates effective January 1, 2024, will continue to influence the landscape of healthcare costs, underscoring the importance of staying informed about these developments. The analysis of income-related monthly adjustment amounts for Part D illustrates how similar changes have historically impacted beneficiaries, highlighting the critical role of adjustments within the broader context of the program.

Understanding IRMAA: How Income Affects Your Medicare Part B Premiums in 2023

Understanding IRMAA: How Income Affects Your Medicare Part B Premiums in 2023

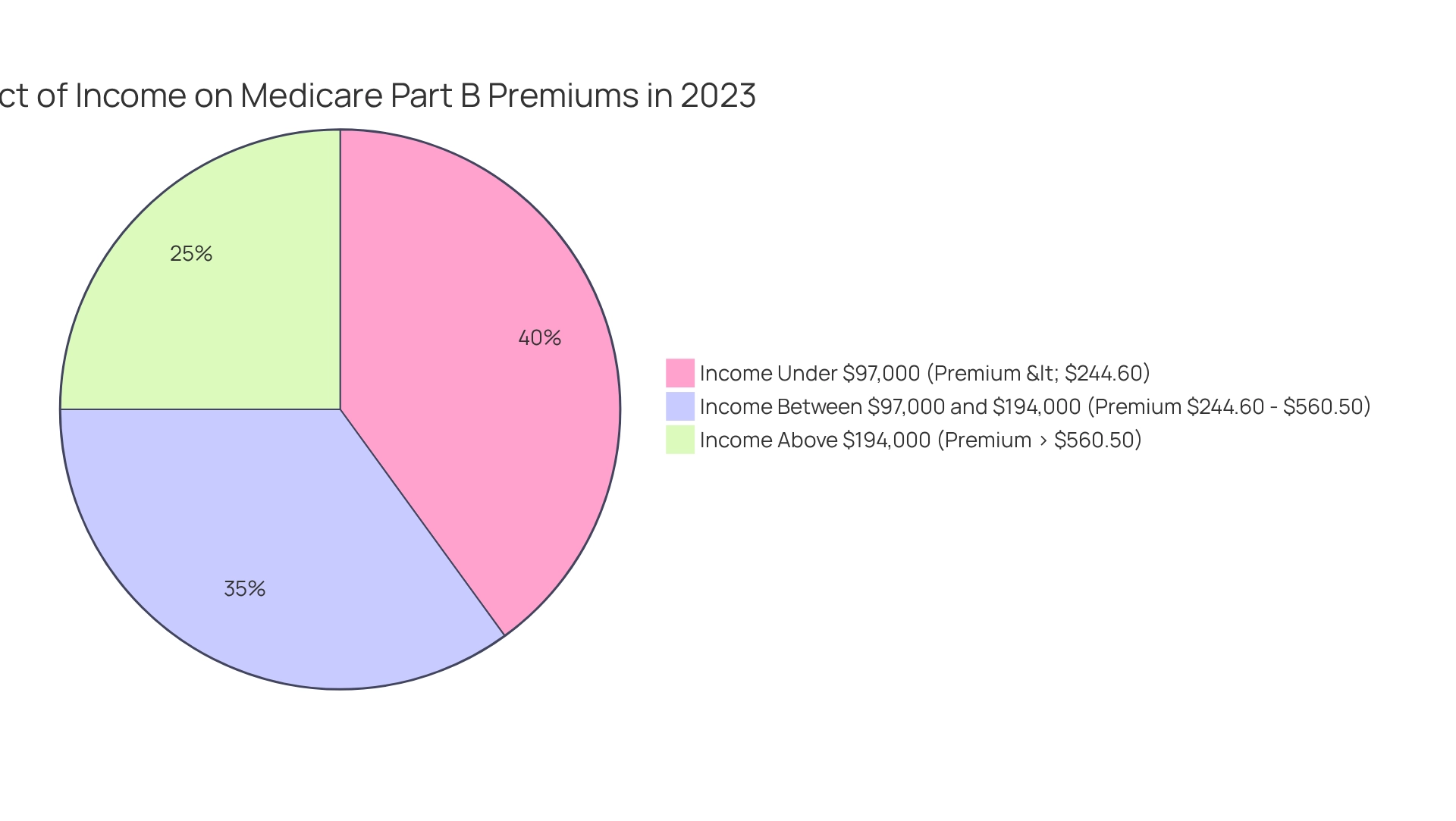

The Income-Related Monthly Adjustment Amount (IRMAA) significantly impacts beneficiaries with higher incomes. In 2023, individuals with a modified adjusted gross income (MAGI) surpassing $97,000 (or $194,000 for married couples) will face increased costs for the 2023 Medicare Part B premiums, which range from $244.60 to $560.50. These income brackets are essential for stakeholders aiming to refine their market access strategies, as they directly influence the financial landscape for Medicare beneficiaries. CareSet’s extensive data insights in the medical field empower stakeholders to better understand these income thresholds and their effects on costs.

As noted by the Social Security Administration, “If you’re on the cusp of an IRMAA bracket, a large taxable event, such as taking required minimum distributions from a retirement account, could raise your income and, consequently, the premium surcharge you’ll need to pay.” By leveraging CareSet’s data, stakeholders can develop strategies to assist clients in navigating these complexities and optimizing their overall healthcare costs. For instance, the case study titled ‘The Importance of Financial Advisors in Managing IRMAA’ illustrates how employing financial advisors who focus on healthcare planning can aid beneficiaries in managing their taxable income and reducing IRMAA charges.

Beneficiaries are encouraged to visit www.Medicare.gov for comprehensive details on premiums, deductibles, and to compare plans tailored to their income situation. This proactive approach not only enhances understanding but also empowers beneficiaries to make informed decisions about their healthcare expenses.

2023 Medicare Part B Annual Deductible: Key Figures and Implications

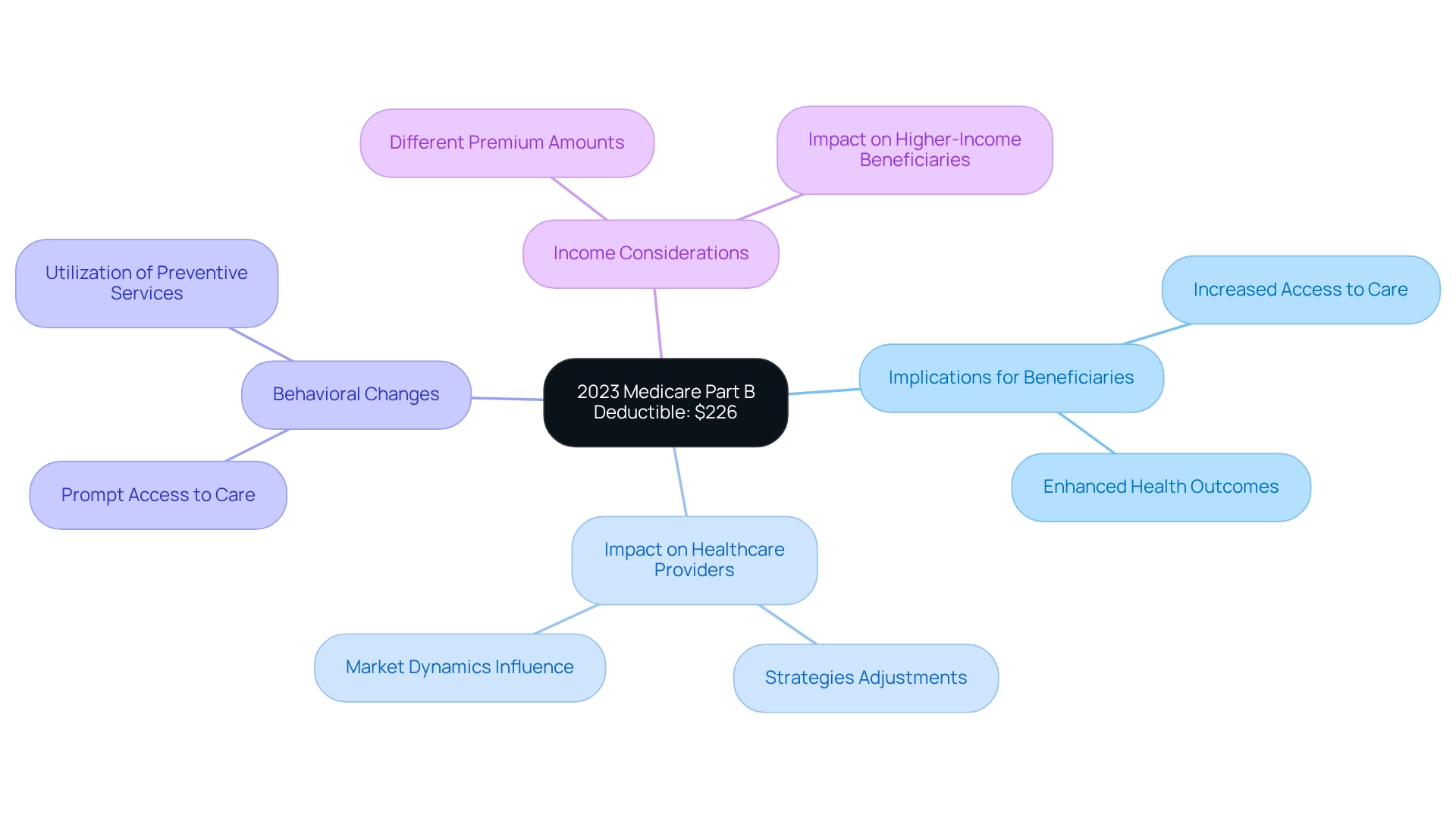

In 2023, the yearly deductible for Part B, part of the 2023 Medicare Part B premiums, is established at $226, a reduction from $233 in 2022. This adjustment aligns with the CMS recommendation in a May 2022 report that excess SMI reserves be passed along to individuals with Medicare Part B coverage, as noted by Jonathan C. Harrington, CFP®, MSFP, MST. Such a change is anticipated to motivate beneficiaries to pursue essential medical services, potentially boosting overall medical utilization.

Experts suggest that reduced deductibles can significantly influence individual behavior, leading to more prompt access to care and enhanced health outcomes. Medical economists have observed that when deductibles are lowered, individuals are more inclined to utilize preventive services and follow-up care, ultimately improving their quality of life.

Furthermore, insights from CareSet’s extensive Medicare data solutions emphasize the importance of understanding treatment pathways for stakeholders in the medical field, particularly in examining how these deductible changes influence access and treatment choices. Beneficiaries filing separate tax returns may experience different premium amounts based on their income, a crucial consideration for understanding the impact of these changes on various beneficiary groups.

Stakeholders must carefully consider how these deductible changes affect patient access and treatment choices, as they play a vital role in shaping medical delivery and outcomes. Moreover, the implications of this deductible adjustment extend beyond individual beneficiaries, influencing healthcare providers’ strategies and market dynamics within the healthcare landscape.

Notably, since 2011, higher-income recipients’ Part D monthly charges are determined by income, impacting approximately 8 percent of individuals enrolled in Part D. This introduces another dimension to the financial consequences of changes in the program.

Impact of 2023 Medicare Part B Premium Changes on Patient Access to Care

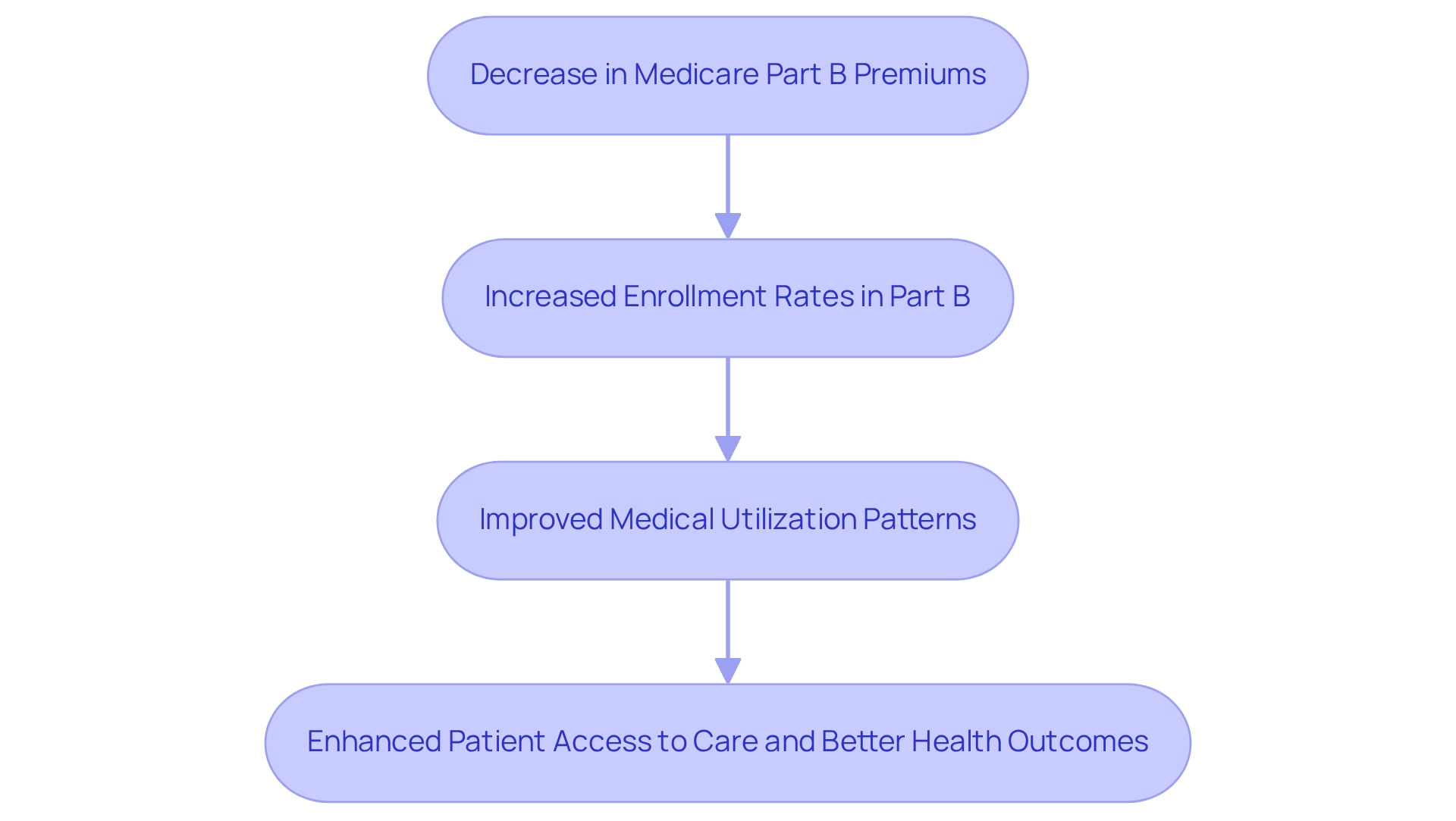

The decrease in the 2023 Medicare Part B premiums is poised to significantly enhance individual access to care by alleviating financial burdens. This reduction is particularly crucial, as it may stimulate increased enrollment rates in Part B, which has historically correlated with improved medical utilization patterns. A notable case study on Medicare’s enrollment trends illustrates that cost adjustments directly influence beneficiary participation; lower expenses frequently lead to higher enrollment and subsequent medical engagement.

In 2023, individuals face a more complex financial landscape, exacerbated by rising costs in other sectors, including a 12.5 percent increase in the net cost of private health coverage, which now accounts for 10.3 percent of total private health insurance expenditure. This context underscores the importance of the cost reduction, providing essential relief for beneficiaries grappling with these financial challenges. Moreover, expenditures for physician and clinical services reached $978.0 billion in 2023, highlighting the broader medical spending environment and its implications for access to treatment. Analysts emphasize that financial obstacles remain a significant barrier to accessing care. As one expert pointed out, the resulting weighted sample from recent studies encompasses approximately 53.6 million U.S. adults, illustrating the extensive population impacted by these changes. By reducing costs, Medicare not only enhances access but also fosters better health outcomes, as individuals are more likely to seek necessary medical services without the burden of excessive expenses.

Furthermore, insights from CareSet’s comprehensive Medicare data solutions reveal how understanding individual treatment pathways and provider interventions can bolster healthcare strategies. Real-world examples from oncology treatment case studies highlight the positive impact of reduced costs on individual outcomes, particularly in navigating complex treatment decisions. Stakeholders should closely monitor these developments, as improved access to care can lead to enhanced health outcomes and a more engaged population. Overall, the 2023 Medicare Part B premiums and cost adjustments are a vital factor in shaping patient access and medical utilization, warranting attention from all stakeholders within the healthcare system.

Factors Influencing Medicare Part B Premiums: A 2023 Overview

Part B fees are influenced by various factors, including medical expenditure patterns, demographic changes, and legislative modifications. In 2023, a notable decrease in costs can be linked to lower-than-expected spending on certain medications and services, which may also impact the 2023 Medicare Part B premiums, illustrating a broader trend in healthcare expenditure. For instance, although the growing elderly demographic continues to exert pressure on healthcare expenses, recent data indicates a slowdown in spending growth, which has positively impacted rate charges.

Healthcare economists emphasize the importance of monitoring these expenditure trends, as they directly affect cost adjustments. CareSet’s integration of over 100 external data sources enriches the understanding of these dynamics, enabling stakeholders to pinpoint specific areas where spending has declined, thereby informing their strategic decisions. By leveraging CareSet’s extensive medical data insights, stakeholders can attain a clearer perspective on the factors influencing health insurance costs and make more informed choices.

Moreover, specialists advise that recipients should proactively anticipate income-related monthly adjustment amounts (IRMAA) surcharges, as fluctuations in income can significantly affect overall medical expenses. Sylvia Gordon notes, “People with high incomes who join Medicare Advantage Plans with prescription coverage must include IRMAA surcharges when they calculate their total healthcare costs.”

Case studies demonstrate that beneficiaries who adjust their financial strategies in anticipation of IRMAA changes can avoid considerable cost increases. For example, the case study titled ‘Expert Insights on Navigating IRMAA Changes’ illustrates that proactive financial adjustments can help beneficiaries mitigate substantial cost increases, underscoring the necessity of regularly monitoring IRMAA trends to maintain consistent costs.

Furthermore, the absence of projected 2023 Medicare Part B premiums from HHS and CMS creates uncertainty for stakeholders, making it crucial for them to stay informed about potential changes that could impact their strategies. As stakeholders navigate these complexities, understanding the relationship between healthcare spending trends and insurance costs will be vital for effective market access and patient engagement strategies. To remain competitive, stakeholders should consistently monitor healthcare spending trends and IRMAA adjustments, reinforcing the importance of proactive financial strategies. Utilizing CareSet’s data insights can further empower stakeholders to navigate these challenges effectively.

Comparative Analysis: 2023 Medicare Part B Premiums vs. Previous Years

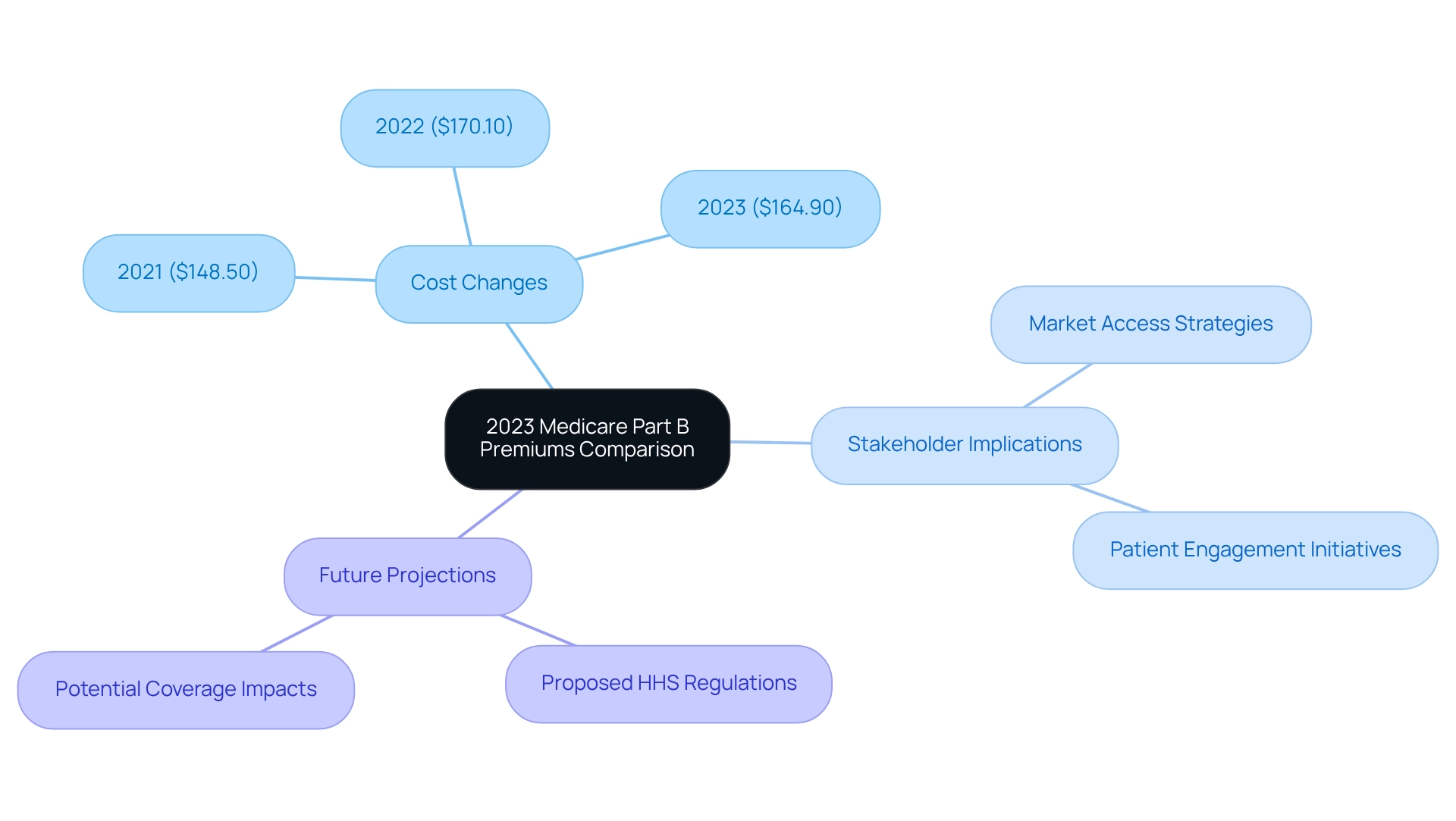

The 2023 Medicare Part B premiums charge stands at $164.90, showing a significant reduction from $170.10 in 2022 and $148.50 in 2021. This downward trend in costs indicates a strategic shift in Medicare expenditure management, which could have far-reaching implications for future policy decisions. Analyzing these fluctuations is crucial for stakeholders, particularly within the pharmaceutical industry, as they may influence market access strategies and patient engagement initiatives.

Historical comparisons reveal that changes in costs extend beyond mere numbers; they signify broader trends in healthcare funding and policy. For instance, the income-related monthly adjustment amounts for the health insurance program Part D, affecting approximately 8% of beneficiaries, illustrate how income-based adjustments can align financial contributions with beneficiaries’ capacity to pay. This approach not only ensures the program’s sustainability but also addresses the diverse needs of its enrollees.

Healthcare analysts suggest that these cost reductions may reflect a more proactive strategy for managing healthcare expenses, potentially leading to enhanced patient care and improved health outcomes. Additionally, the proposed physician payment regulation by HHS on July 10, 2024, aims to promote whole-person care and elevate health quality for all individuals enrolled in the program, adding another layer of context to the ongoing changes in cost management strategies.

As stakeholders navigate these changes, understanding the historical context and future projections of the 2023 Medicare Part B premiums will be essential for devising effective market strategies. CareSet’s extensive healthcare data solutions, which encompass insights from over 62 million beneficiaries and 6 million providers, empower healthcare stakeholders to make informed decisions. Furthermore, as CMS noted, “we must prepare for the potential of coverage for this expensive Alzheimer’s medication which could, if covered, lead to considerably higher costs for the program.” This statement underscores the potential financial repercussions of healthcare coverage choices, further emphasizing the importance of monitoring cost modifications. Overall, integrating these insights will yield a more comprehensive analysis for stakeholders in the pharmaceutical industry.

Looking Ahead: Anticipated Changes in Medicare Part B Premiums for 2024

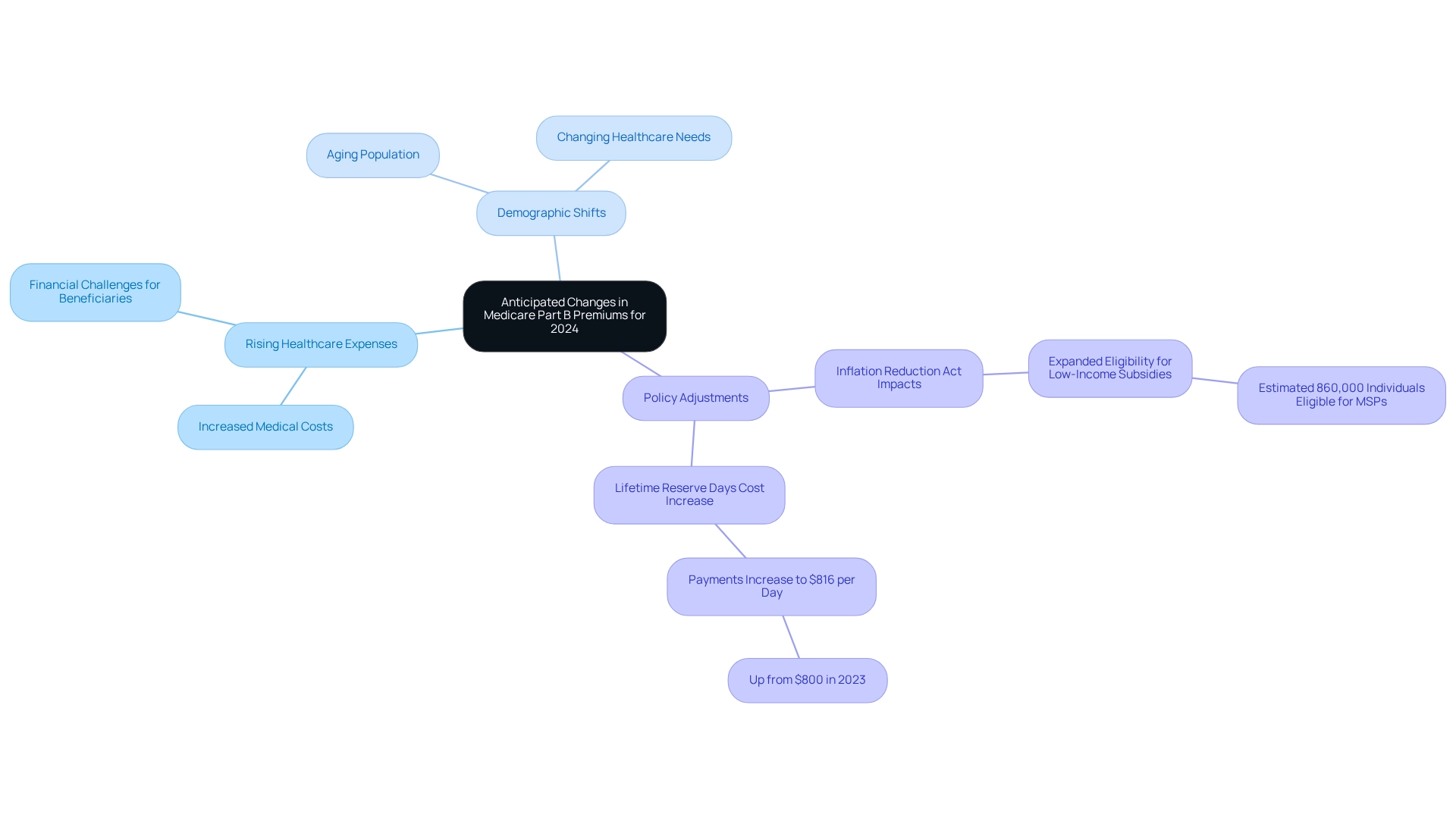

As we approach 2024, the anticipated Medicare Part B premium is set to rise to $174.70, mirroring ongoing trends in medical expenses and spending. This significant increase underscores the persistent financial challenges faced by beneficiaries and the healthcare system as a whole. Stakeholders, particularly those involved in pharmaceutical market access, must proactively adjust their financial models and market access strategies to navigate these changes effectively. Discover how CareSet’s analytics can assist you in identifying more doctors and accounts, thereby enhancing patient targeting and provider engagement.

Several elements are poised to influence future Part B costs, including:

- Rising healthcare expenses

- Demographic shifts

- Policy adjustments

Notably, the Inflation Reduction Act has expanded eligibility for low-income subsidies, which is expected to alleviate some financial burdens for recipients and, consequently, impact overall cost structures. An estimated 860,000 individuals may qualify for Savings Programs (MSPs), further shaping the dynamics of premium adjustments.

In 2024, beneficiaries will also experience an uptick in costs related to lifetime reserve days, with payments increasing to $816 per day, up from $800 in 2023. This trend highlights the importance of strategic planning for stakeholders as they navigate the complexities of healthcare expenses. By leveraging CareSet’s advanced Medicare data analytics, organizations can obtain actionable insights that empower them to adapt their strategies effectively. CareSet has identified 15% more targets, resulting in a remarkable 250% increase in patients indicated for treatment, demonstrating the profound impact of our analytics capabilities.

Healthcare economists anticipate that these adjustments will require a reevaluation of market access strategies, particularly in light of the projected premium increases. M. Kent Clemens emphasized, “The Part B rates and amounts announced in this document are effective January 1, 2025,” underscoring the urgency for stakeholders to prepare for these changes. Stakeholders are encouraged to assess their current approaches and consider how fluctuations in healthcare costs may influence patient engagement and product launch strategies. By remaining informed and adaptable, organizations can better position themselves to meet the evolving needs of the healthcare population. Furthermore, the implications of the Inflation Reduction Act’s extension of low-income subsidies must be considered, as it plays a crucial role in shaping the financial landscape for beneficiaries and impacting cost structures.

Market Access Strategies: Navigating Medicare Part B Premiums for Pharmaceutical Stakeholders

Pharmaceutical stakeholders must devise market access strategies that effectively account for the implications of Part B costs. Understanding the nuances of substantial changes is crucial, as these alterations can significantly impact medication access for individuals. For instance, the projected costs for 2025 indicate a range of $285 to $518 for the 1% of beneficiaries contributing to Part A, which can influence overall healthcare expenses and individual affordability.

Aligning pricing strategies with beneficiary needs is imperative. With average healthcare plan costs expected to decrease slightly from $18.23 in 2024 to $17 in 2025, pharmaceutical companies must assess how these shifts affect their pricing frameworks. This necessitates a comprehensive analysis of demographics and treatment patterns, utilizing CareSet’s extensive Medicare data insights from over 62 million beneficiaries and 6 million providers to identify trends and refine engagement strategies, ultimately driving data-informed success.

Furthermore, modifications to Medicare Advantage benefits, including increased deductibles and potential reductions in supplemental benefits, demand a reassessment of market access strategies. Companies should not underestimate the pivotal role of pricing in communicating the value of their products, as emphasized by industry experts. Patrick, founder of Price Intelligently, asserts that pricing is the sole method to convey product value following substantial investment in development. Real-world examples, such as the case study on oncology treatment options, illustrate that adapting to pricing changes can expand market reach and enhance treatment analytics. This case study revealed that timely engagement with healthcare providers regarding treatment options can yield improved patient outcomes. By prioritizing data-driven insights from CareSet, pharmaceutical stakeholders can adeptly navigate the intricacies of Part B costs and align their strategies for optimal impact.

Staying Informed: Resources for Tracking Medicare Part B Premium Updates in 2023

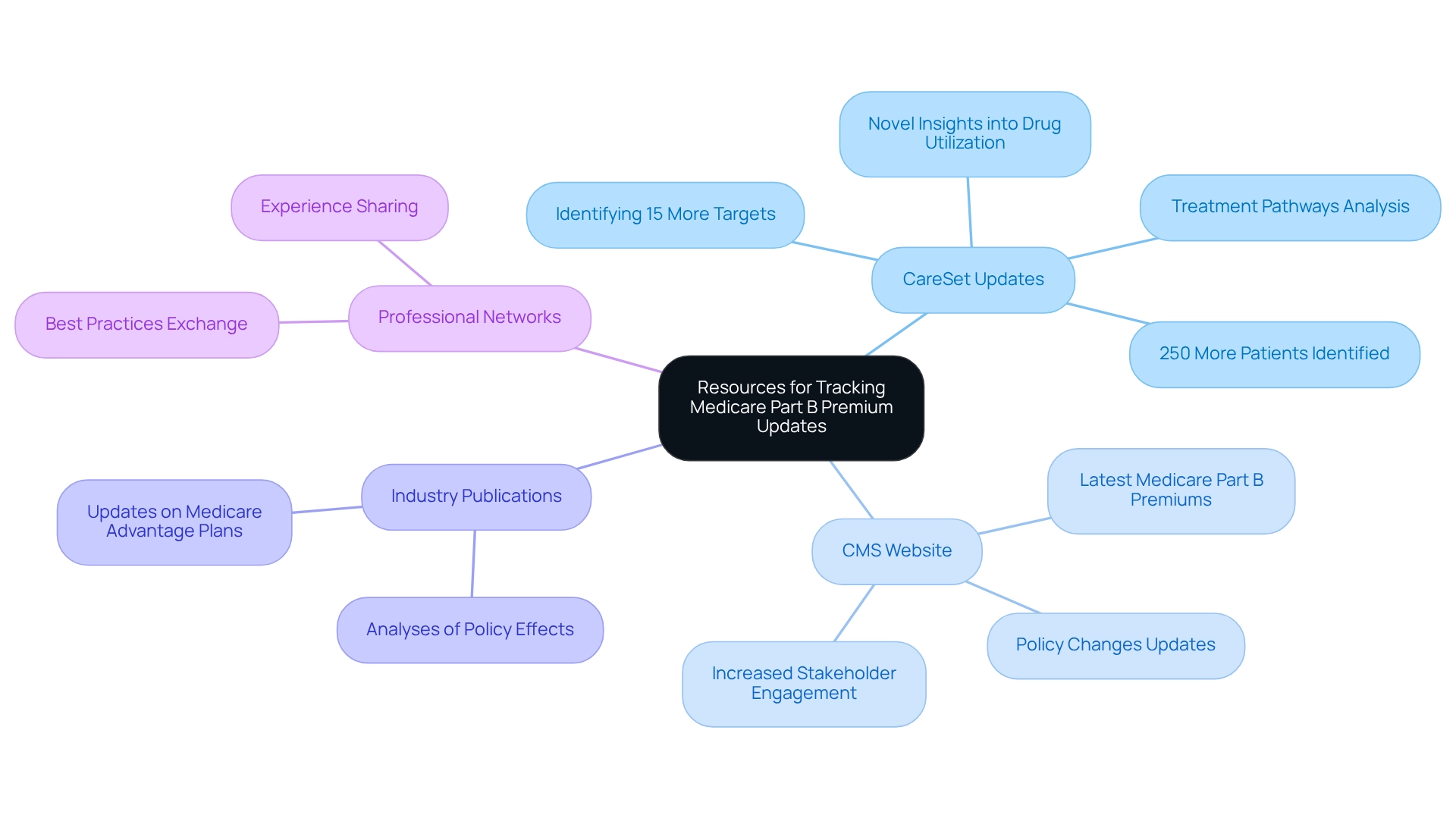

Stakeholders can effectively track Part B fee updates by leveraging a variety of resources, including CareSet’s monthly updates, which provide novel insights into drug utilization and treatment pathways. These updates address essential inquiries such as:

- Which diseases providers identify and manage

- How patients transition from diagnosis to treatment

- What therapies Part D Plans are approving

The Centers for Medicaid Services (CMS) website serves as a primary source for the latest information, including updates on the 2023 Medicare Part B premiums and other policy changes. Furthermore, industry publications and newsletters offer important analyses that can assist stakeholders in comprehending the effects of these updates on their strategies.

Participating in professional networks and forums enables stakeholders to exchange experiences and best practices, promoting a collaborative approach to navigating healthcare policies. Consistently assessing these resources not only keeps stakeholders updated but also allows them to proactively adjust their strategies in response to changing healthcare regulations.

Statistics indicate that a significant percentage of stakeholders actively engage with updates, underscoring the necessity of remaining informed. For instance, the CMS reported a notable increase in the number of stakeholders utilizing their online resources to track the 2023 Medicare Part B premiums changes. Additionally, information from 2009 to 2021 indicates that inpatient actual expenses have consistently accounted for a substantial portion of total costs, highlighting the significance of understanding these financial dynamics.

Moreover, CareSet’s extensive healthcare data insights empower stakeholders by identifying crucial trends in treatment approvals and beneficiary navigation across healthcare advantages. CareSet identifies 15% more targets and 250% more patients than leading claims vendors, providing a significant advantage in understanding the market landscape. A recent case study involving the Department of Justice’s investigation into health insurance firms highlights the potential unethical practices within the Advantage enrollment process. This serves as a cautionary example for stakeholders about the importance of staying informed on Medicare policies, especially regarding the 2023 Medicare Part B premiums, to avoid pitfalls. By employing these strategies and utilizing available resources, including CareSet’s insights from over 62 million beneficiaries and 6 million providers, stakeholders can ensure they remain at the forefront of Medicare Part B premium developments. This ultimately leads to more informed decision-making and improved outcomes. As Chip Somodevilla noted, the turbulence in government healthcare programs during Trump’s presidency underscores the need for vigilance and adaptability in this ever-changing landscape.

Conclusion

The evolving landscape of Medicare Part B premiums in 2023 underscores the critical interplay between financial adjustments and patient access to care. Key changes, including the reduction in the standard monthly premium to $164.90 and the decreased annual deductible of $226, mirror broader trends in healthcare costs and aim to alleviate financial burdens on beneficiaries. These adjustments not only enhance access to essential services but also empower beneficiaries to engage more proactively with their healthcare, ultimately leading to improved health outcomes.

Understanding the complexities surrounding Income-Related Monthly Adjustment Amounts (IRMAA) is essential for stakeholders, as these surcharges can significantly impact costs for higher-income beneficiaries. The insights provided by CareSet’s comprehensive data analysis equip stakeholders with the necessary tools to navigate these dynamics effectively. By staying informed about the factors influencing premium changes and their implications, stakeholders can refine their strategies to better meet the needs of beneficiaries.

As the Medicare landscape continues to evolve, the impact of these premium adjustments on patient behavior and healthcare utilization cannot be overstated. With anticipated changes for 2024 already on the horizon, it is vital for stakeholders to remain vigilant and adaptable. By leveraging data-driven insights and monitoring ongoing trends, stakeholders can position themselves to enhance market access and improve patient care, ensuring they are prepared for the challenges and opportunities that lie ahead in the Medicare ecosystem.