Overview

The article delineates four essential practices for achieving success in health insurance claims. These practices encompass:

- A thorough understanding of the claims process

- Adherence to a structured filing methodology

- Verification of insurance eligibility

- The application of accurate medical coding

Such practices are crucial for minimizing claim denials and facilitating timely reimbursements. The article underscores that meticulous documentation, proactive eligibility checks, and precise coding significantly bolster the likelihood of successful claims processing.

Introduction

Navigating the complex world of health insurance claims presents a significant challenge for healthcare providers and patients alike. The intricacies of claim submissions—ranging from essential components such as patient demographics and service codes to the critical role of accurate medical coding—play a vital role in determining the success of reimbursements. Alarmingly, a substantial percentage of claims are denied due to incomplete information or coding errors, underscoring the high stakes involved.

This article explores the fundamental steps for filing claims, highlights the importance of verifying insurance eligibility, and outlines strategies for effective denial management. By equipping healthcare professionals with the necessary knowledge and tools to streamline the claims process, we can enhance the potential for improved financial outcomes and increased patient satisfaction.

Understand the Basics of Health Insurance Claims

Claims in health insurance represent formal petitions from healthcare professionals to insurance companies for reimbursement of medical services rendered to patients. A thorough understanding of the request components—such as patient demographics, provider information, and service codes—is essential for effective processing. Each claim typically includes a detailed invoice outlining the services provided, accompanied by specific medical codes, including ICD, NDC, and HCPCS codes, which delineate the diagnosis and treatment administered. Claims are frequently submitted in ANSI837 format, enhancing efficiency in identifying and resolving issues.

Familiarity with the reimbursement process not only aids healthcare professionals in avoiding common pitfalls but also increases the chances of successful claims in health insurance. For example, distinguishing between pre-authorization and post-service submissions can significantly influence the outcome of a request. Recent statistics indicate that a considerable percentage of claims in health insurance face rejection due to inadequate information, underscoring the necessity for meticulous documentation.

Effective management of claims in health insurance is vital for medical organizations, particularly when assessing patient treatment pathways and practitioner interventions. Insights from CareSet’s extensive Medicare data solutions, covering information from over 62 million beneficiaries and 6 million providers, can empower healthcare strategies and deepen understanding of treatment approvals. Case studies highlight the importance of strategic denial management, noting that while it may not be possible to eliminate disputes entirely, a tactical approach can mitigate their financial impact. Organizations that establish a robust claims management process have reported substantial reductions in write-offs, thereby stabilizing their financial health and protecting revenues.

Expert insights emphasize that understanding the intricacies of claims in health insurance requests is crucial for providers. Leigh Poland, Vice President of Coding Education, notes, “Creating an effective denial management process takes time and requires continuous monitoring to ensure success.” Ongoing monitoring and refinement of the process are imperative for sustained success. As the healthcare landscape evolves, staying informed about the latest trends and statistics in request processing, such as those presented in Experian Health’s 2024 State of Requests report, will enable providers to address challenges effectively and enhance their reimbursement strategies.

Follow a Step-by-Step Process for Filing Claims

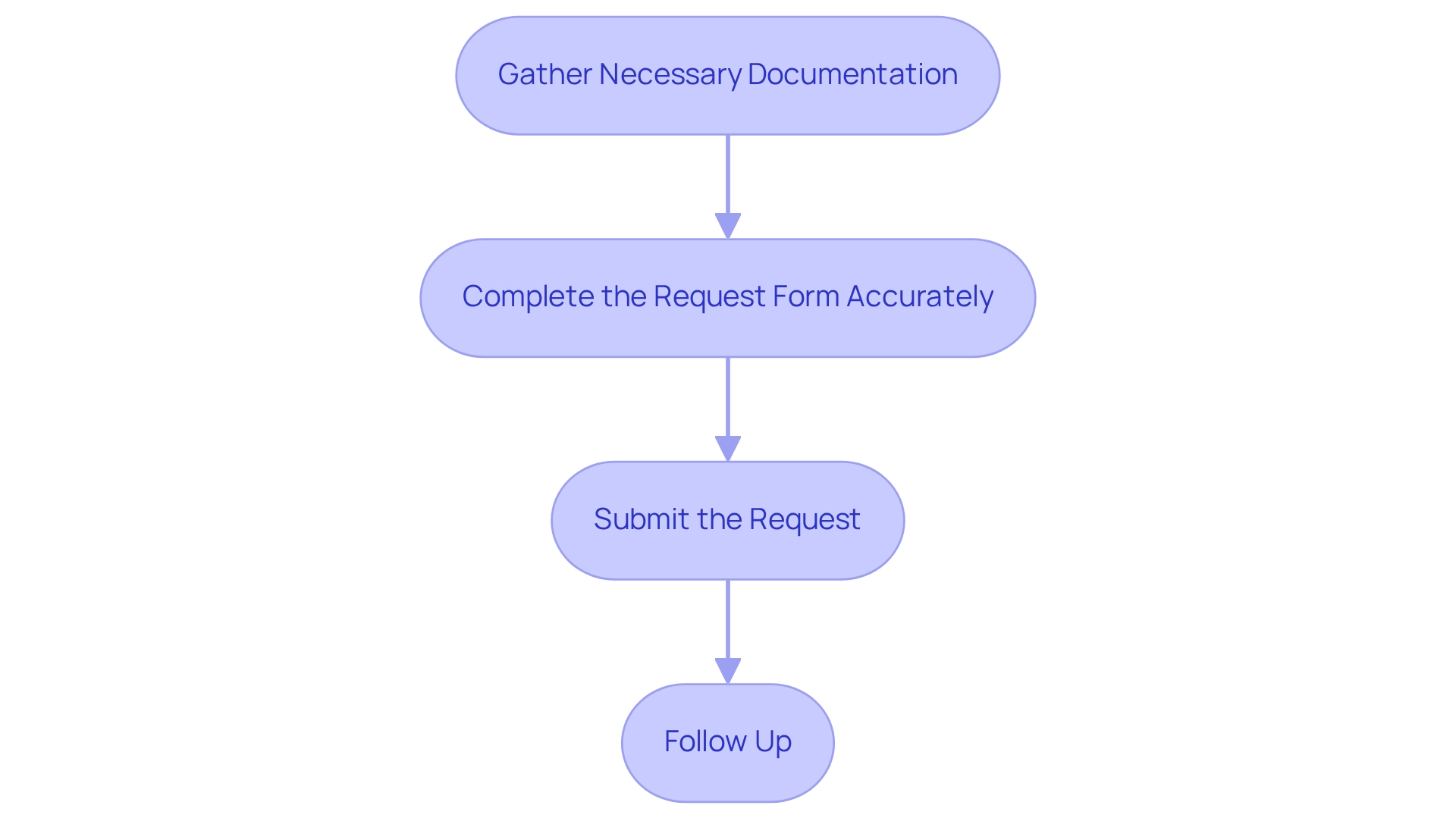

To successfully submit a health insurance request, it is essential to adhere to a structured approach:

-

Gather necessary documentation.

Collect all pertinent documents, including the patient’s insurance details, itemized bills, and any required pre-authorization forms. This step is vital, as insufficient documentation frequently leads to rejections. -

Complete the request form accurately.

Ensure that all fields are filled to prevent delays. Attention to detail can significantly reduce the likelihood of errors that lead to denials. -

Submit the request.

Depending on the insurer’s requirements, requests can be submitted electronically or via mail. Electronic submissions often expedite the process, making this option preferable when available. -

Follow up.

After submission, actively monitor the status of the request and be prepared to provide additional information if requested, as timely responses can facilitate quicker resolutions.

This systematic approach streamlines the claims in health insurance process and helps in the early identification and rectification of potential issues.

In light of recent findings, where over three-quarters of providers report that payer policy changes are occurring more frequently, understanding these steps is more critical than ever. Furthermore, a Gallup poll indicates that only 28% of Americans assess their health insurance coverage as excellent or good, reflecting widespread discontent with the medical system. This sentiment underscores the systemic problems within the medical reimbursement process, particularly considering the high rates of rejection. By applying these best practices, healthcare providers can enhance their success rates in managing claims in health insurance and improve overall patient satisfaction. Moreover, it is crucial to recognize common pitfalls in the claims in health insurance assertion process, such as failing to supply thorough documentation or misinterpreting insurer prerequisites, which can lead to avoidable delays or refusals. Additionally, initiatives to address health insurance reimbursement refusals will remain limited without more consistent and comprehensive national data, highlighting the importance of effectively managing the current processing environment.

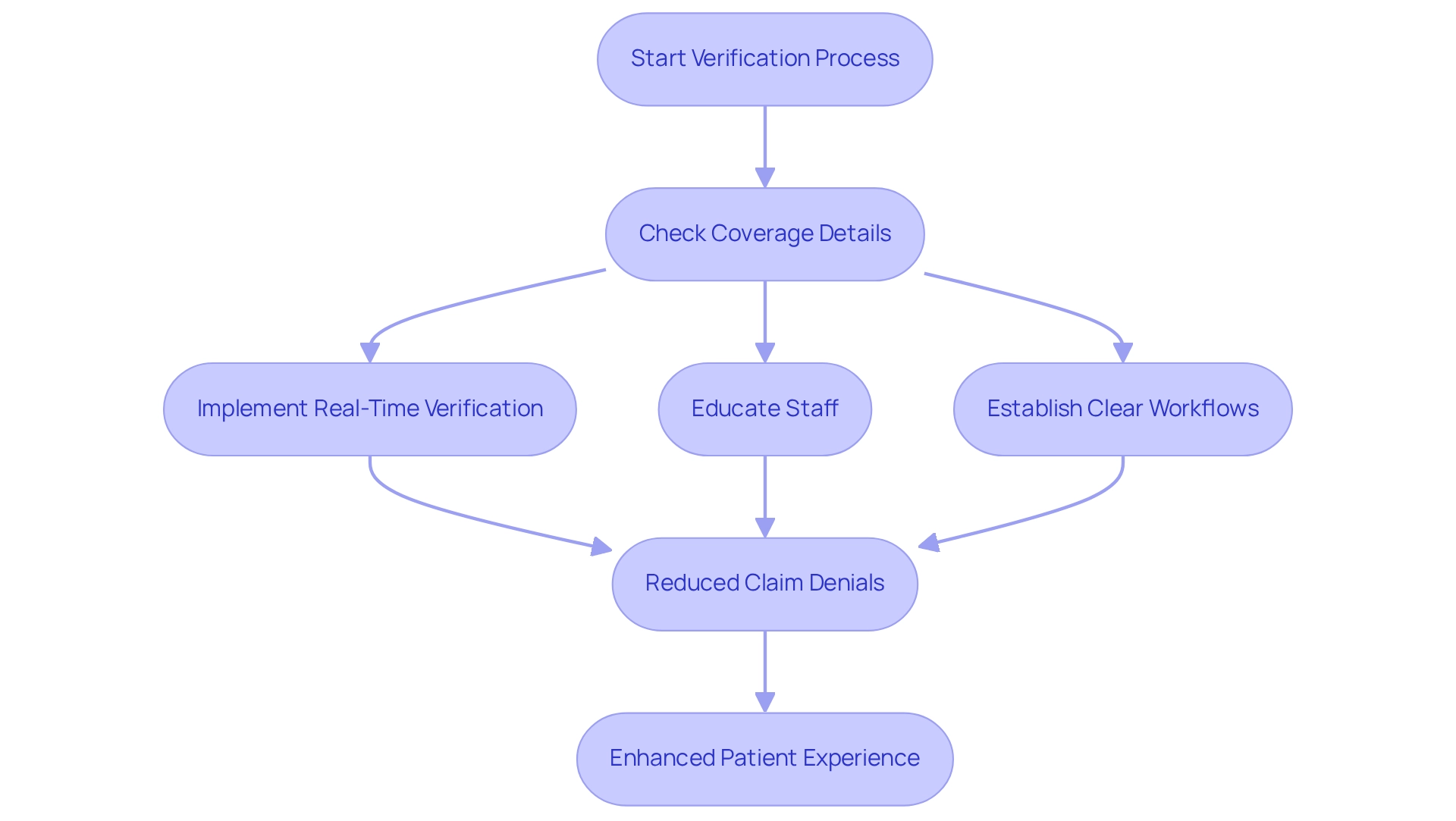

Verify Insurance Eligibility to Avoid Claim Denials

Verifying a patient’s insurance eligibility before providing services is crucial for healthcare providers. This process entails checking coverage details such as co-pays, deductibles, and any clauses related to pre-existing conditions. Implementing real-time eligibility verification systems can significantly streamline this task. For instance, using online portals or directly contacting insurance companies allows for immediate confirmation of coverage, thereby reducing the administrative burden on staff.

Statistics indicate that 19% of rejections arise from services not being covered, underscoring the importance of comprehensive eligibility checks. Furthermore, a recent survey highlights the urgent necessity for effective solutions to address rejected requests, emphasizing that proactive verification can alleviate these issues. The ‘No Surprises’ Act, enforced in 2022, further reinforces the critical need for verifying insurance eligibility to protect patients from unexpected medical bills.

Healthcare providers that have implemented eligibility verification systems report significant enhancements in approval rates. Best practices include:

- Establishing clear workflows

- Educating staff on insurance policies

- Leveraging technology to enhance efficiency

It is essential to strike a balance between application functionality and staff efficiency to maximize the effectiveness of these systems. As Joshua Gayman, Revenue Cycle Manager at UT Medical Center, observes, “Minimizing refusals upfront would enhance our revenue, which could be directed towards ongoing and upcoming investments that support our mission.”

The importance of verifying insurance eligibility cannot be overstated; it not only safeguards against claim denials in health insurance but also fosters a smoother patient experience. Currently, an increasing proportion of healthcare professionals are employing real-time eligibility verification tools, with recent statistics showing that this trend is gaining momentum. By prioritizing this practice and being aware of common pitfalls, professionals can ensure that services are covered before they are rendered, ultimately leading to better financial outcomes and enhanced patient care.

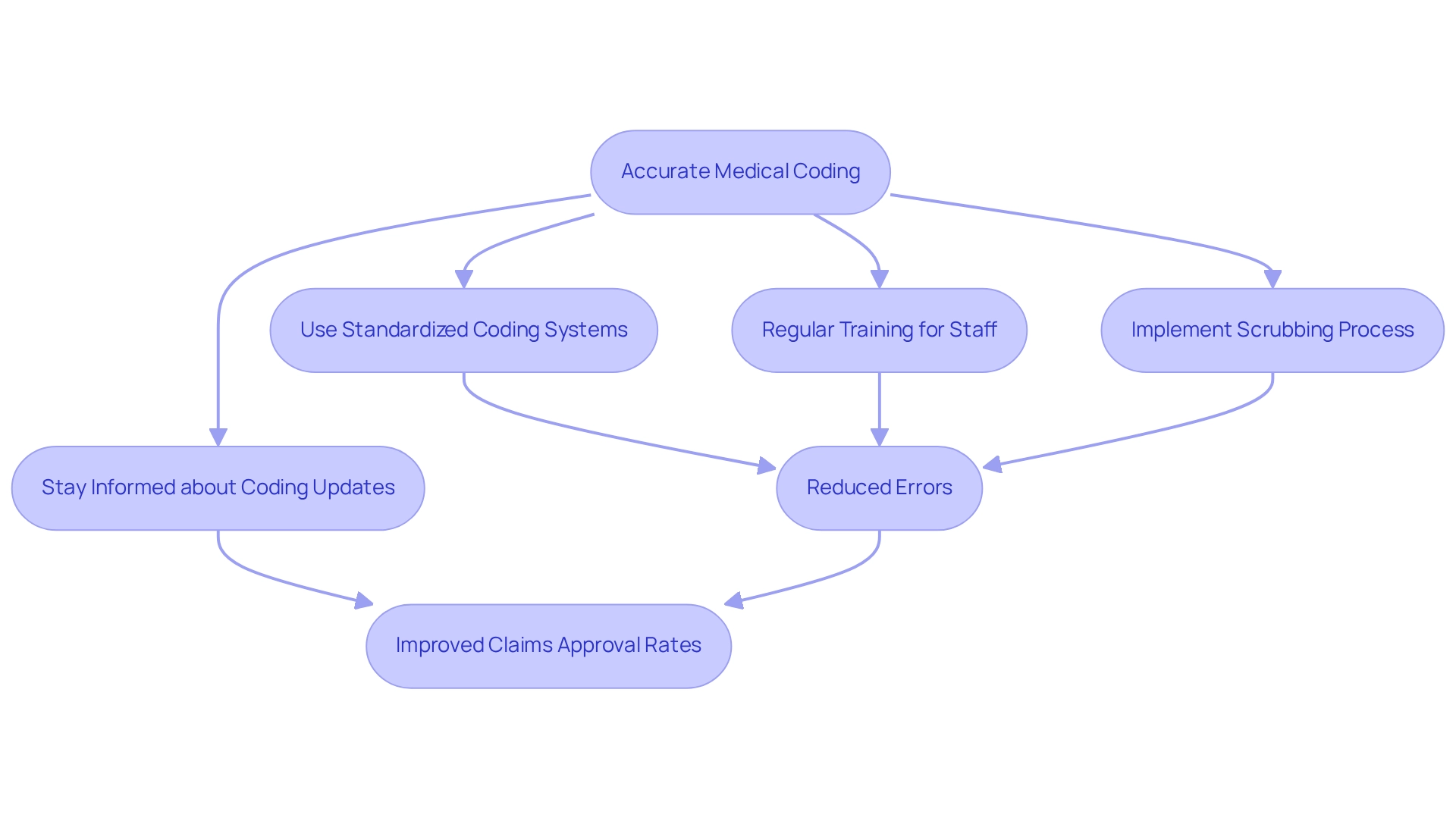

Utilize Accurate Medical Coding for Successful Claims

Precise medical coding is essential for the seamless processing of requests and prompt reimbursement. Healthcare providers must utilize standardized coding systems, such as ICD-10 for diagnoses and CPT for procedures, to ensure consistency and precision. Regular training for coding staff, alongside advanced coding software, can significantly reduce errors. For instance, implementing a scrubbing process—where submissions are meticulously reviewed for accuracy before submission—has been shown to dramatically lower the rate of denied submissions. Notably, 19% of respondents cite services not included as a primary reason for rejections, underscoring the critical need for careful coding practices to mitigate such issues.

Moreover, staying informed about updates to coding standards, including the latest changes to ICD-10 and CPT codes for 2025, as well as payer-specific requirements, is vital for maintaining compliance and optimizing revenue. Case studies focusing on the complexities of medical coding and the impact of workflow bottlenecks on rejections reveal that organizations prioritizing coding accuracy not only enhance their claims in health insurance approval rates but also improve overall patient care by reducing administrative burdens associated with rejected claims in health insurance.

As Will Schmidt notes, “Errors in these codes can occur when selecting the appropriate test or procedure code, using outdated codes, or failing to document medical necessity.” This highlights the importance of a robust coding strategy in the healthcare landscape. Furthermore, AI technologies are increasingly being leveraged to streamline coding processes, thereby alleviating administrative burdens and enhancing accuracy. By incorporating proven denial management strategies, such as those provided by R1, organizations can further bolster financial performance for physician practices, making it imperative for them to adopt comprehensive coding practices.

Conclusion

Navigating the complexities of health insurance claims is essential for both healthcare providers and patients. Understanding the fundamental components of claims—including patient demographics, service codes, and the significance of accurate medical coding—lays the groundwork for successful reimbursement. By adhering to a structured process for filing claims—gathering necessary documentation, completing claim forms accurately, and actively following up—healthcare professionals can significantly reduce the likelihood of denials and enhance their financial outcomes.

Moreover, verifying insurance eligibility before services are rendered is critical in avoiding claim denials. By implementing real-time verification systems and ensuring staff are well-informed about insurance policies, providers can protect themselves and their patients from unexpected costs. This proactive measure not only streamlines operations but also contributes to overall patient satisfaction.

Lastly, the importance of accurate medical coding cannot be overstated. Employing standardized coding systems and regularly training coding staff are vital steps in minimizing errors that lead to denied claims. As the healthcare landscape evolves, adopting advanced coding technologies and comprehensive denial management strategies will be crucial for improving financial health and operational efficiency.

In conclusion, equipping healthcare providers with the tools and knowledge necessary to navigate the claims process effectively increases the potential for improved reimbursement rates and patient satisfaction significantly. A strategic approach to health insurance claims can lead to a more sustainable financial model for healthcare organizations while fostering a better experience for patients.