Overview

The article centers on strategies designed to enhance patient payment processes within healthcare settings. It underscores the critical role of leveraging technology—specifically automated billing systems and patient portals—to improve accuracy and transparency in invoicing. Such advancements not only lead to heightened patient satisfaction but also yield better financial outcomes for healthcare providers. By embracing these technologies, healthcare institutions can streamline their operations and foster a more positive experience for patients, ultimately driving engagement and loyalty.

Introduction

In the intricate landscape of healthcare, effective billing practices are pivotal for ensuring organizational efficiency and enhancing patient satisfaction. As healthcare providers navigate the complexities associated with Medicare data, automation, and transparent communication, the potential for improved financial outcomes becomes increasingly evident.

By leveraging advanced technologies and empowering patients through user-friendly portals, the strategies outlined in this article underscore the critical importance of adaptability and engagement in billing practices. Addressing diverse patient needs while fostering trust through clear financial communication enables healthcare organizations to enhance their operations and create a more positive experience for patients.

This approach not only paves the way for sustainable growth in the industry but also encourages a deeper exploration of CareSet’s insights into effective billing strategies.

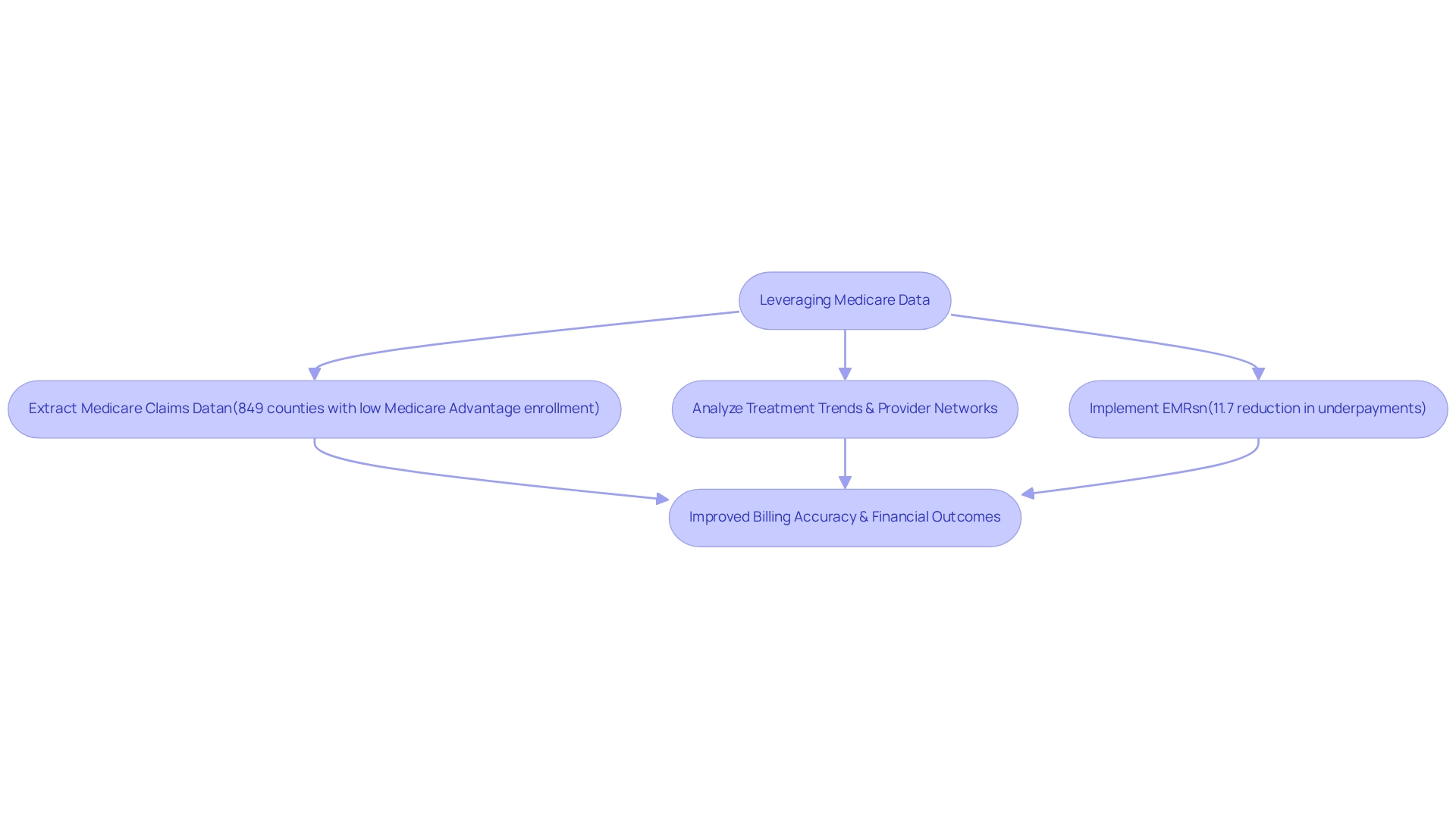

CareSet: Leverage Medicare Data for Efficient Patient Billing

CareSet excels in extracting and interpreting intricate Medicare claims data, which is a crucial resource for simplifying patient payment. Current statistics reveal that 849 counties have less than one-third of their Medicare beneficiaries enrolled in Medicare Advantage plans, indicating a significant opportunity for healthcare organizations to utilize Medicare data for enhanced revenue efficiency.

By examining treatment trends and provider networks, these organizations can identify inefficiencies within their payment systems. This data-focused method not only boosts invoicing precision and reduces mistakes, ultimately enhancing the invoicing process, but also improves patient payment transparency, fostering stronger relationships as patients are better informed about their financial responsibilities.

A case study on the impact of electronic medical records (EMRs) found that these systems improve payment accuracy, reducing Medicare underpayments by an average of 11.7%. For-profit and teaching hospitals experienced even greater reductions, at 49.6% and 36.7%, respectively. Although the initial expenses of implementing EMRs can be significant, the long-term advantages for medical providers are considerable, as noted by specialists in the field.

By utilizing Medicare claims data, organizations can refine their invoicing processes, leading to improved financial results and enhanced client experiences. CareSet’s dedication to providing high-quality Medicare insights enables healthcare providers to manage the intricacies of charges effectively, ensuring that individuals receive the care they require without unnecessary financial burdens.

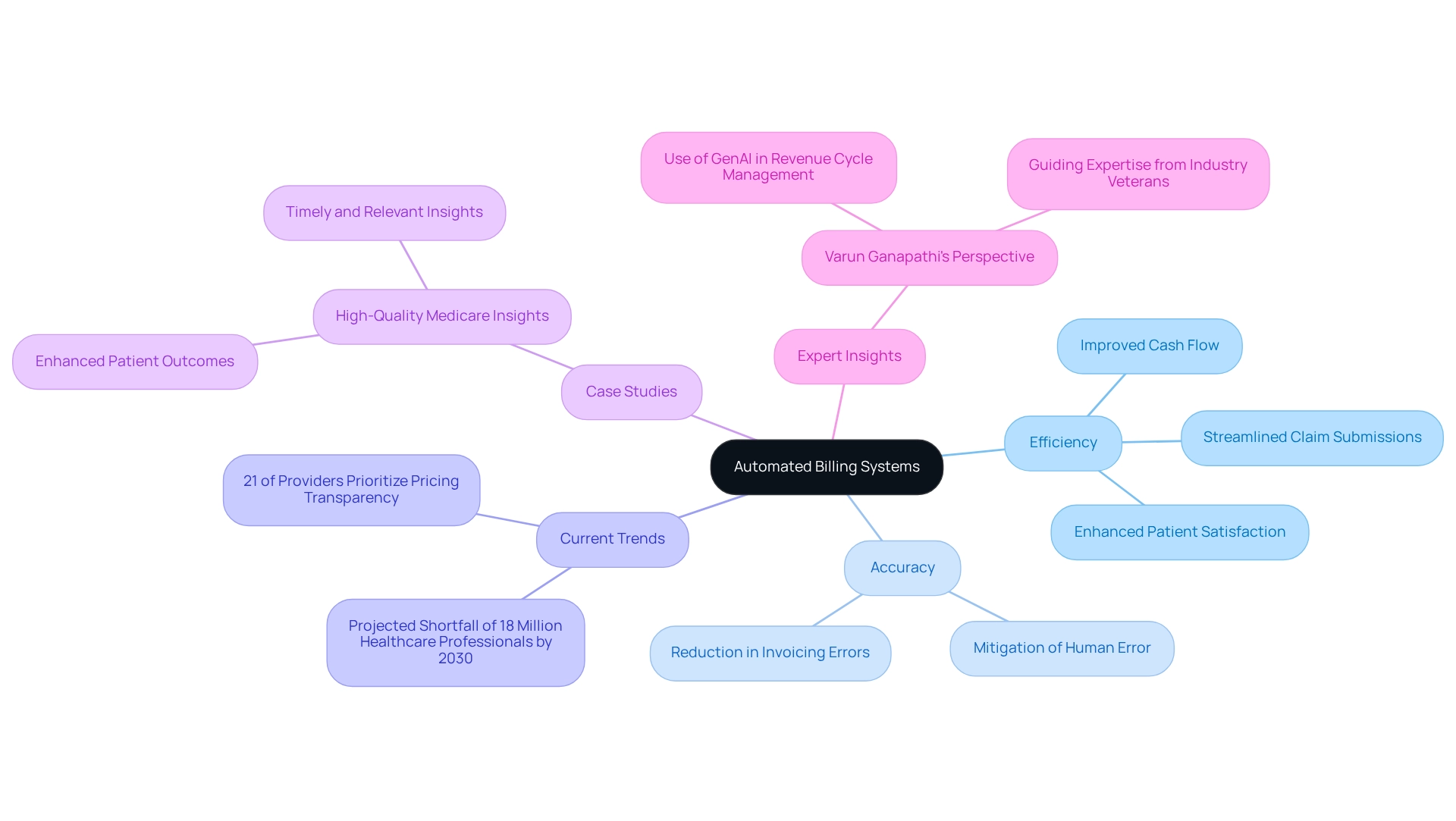

Automate Billing Systems: Enhance Efficiency and Accuracy

Introducing automated invoicing systems is essential for enhancing the efficiency and accuracy of patient payment transaction processes. Automation significantly mitigates human error, streamlines claim submissions, and accelerates payment collections. By leveraging software that seamlessly integrates with existing healthcare systems, providers can ensure timely invoicing and minimize discrepancies. This strategy not only fosters improved cash flow but also elevates patient satisfaction by enhancing patient payment processes.

Current trends indicate that merely 21% of providers prioritize pricing transparency, highlighting a critical area where automation can refine payment practices. As the medical landscape transforms, the demand for automation is projected to rise, especially in light of forecasts predicting a global shortfall of 18 million medical professionals by 2030, including 5 million fewer doctors than necessary.

Case studies reveal that healthcare providers who have adopted automated invoicing systems report notable improvements in patient payment accuracy and operational efficiency. For instance, organizations implementing automation have documented a substantial reduction in invoicing errors, which directly correlates with enhanced client experiences.

Expert insights indicate that the incorporation of advanced technologies, such as GenAI, can further optimize revenue cycle management. Varun Ganapathi, Chief Technology Officer and Co-Founder at AKASA, underscores that solutions employing advanced technology, in conjunction with the expertise of seasoned professionals, are vital for creating effective invoicing systems that diminish human error.

Ultimately, the benefits of automation in healthcare invoicing are clear: heightened accuracy, improved efficiency, and, ultimately, superior outcomes for patients receiving care.

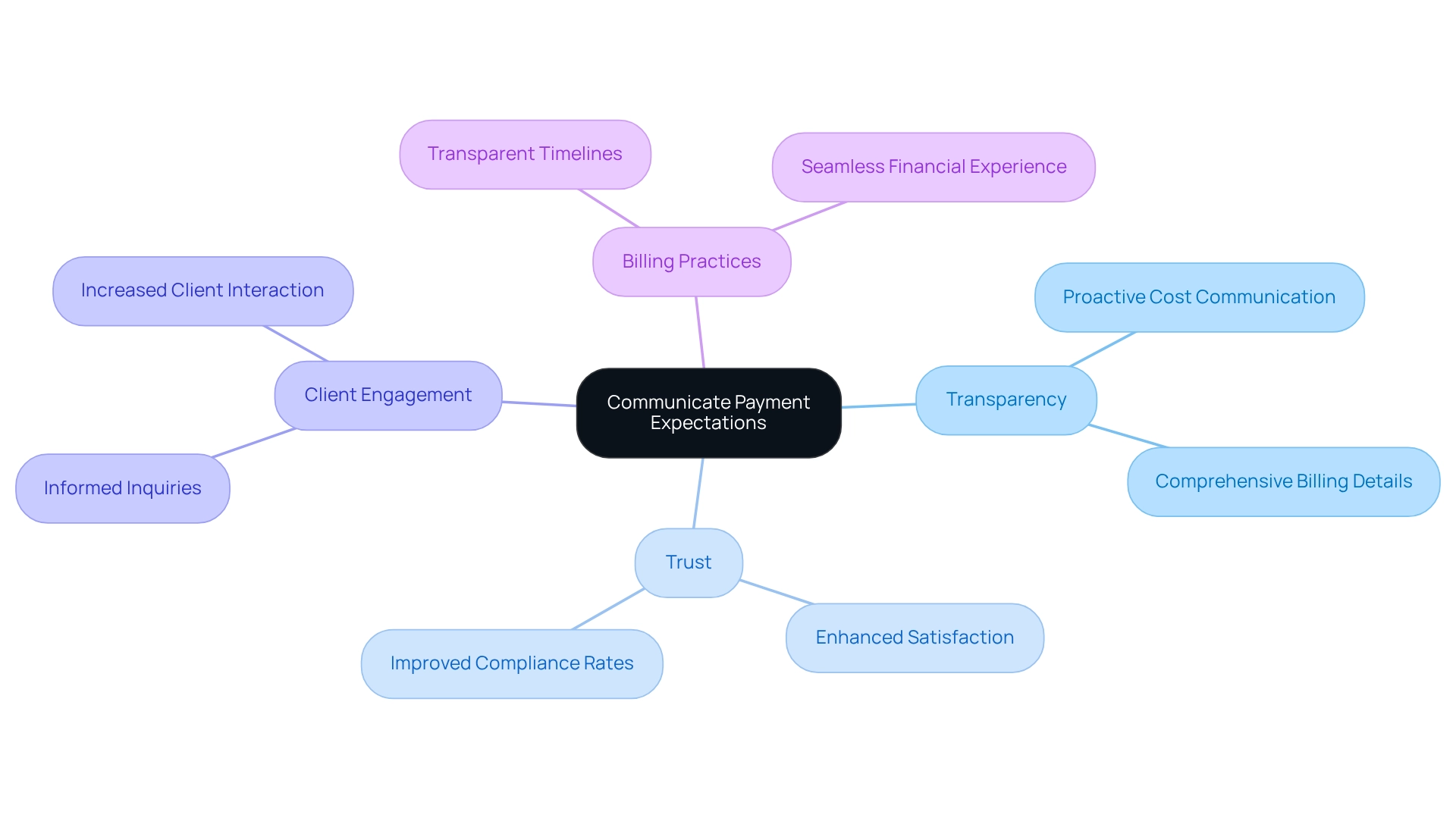

Communicate Payment Expectations: Foster Transparency with Patients

Clear communication regarding patient payment expectations is paramount in fostering transparency with clients. Healthcare providers must proactively delineate the costs associated with services, including potential patient payment and out-of-pocket expenses, before delivery. By offering comprehensive billing details and transparent timelines, providers can significantly reduce confusion and cultivate trust with clients. This openness not only enhances satisfaction among individuals but also leads to improved compliance rates.

Statistics indicate that individuals are increasingly making more informed inquiries concerning healthcare expenses, underscoring the need for providers to adapt their communication strategies accordingly. For instance, case studies illustrate that organizations prioritizing transparent communication of financial expectations witness a substantial increase in client engagement and compliance, as evidenced in the case study titled ‘Long-Term Strategic Growth for Healthcare Partners.’

Ultimately, fostering transparency in billing practices is essential for building trust and ensuring a more seamless financial experience for individuals, especially in relation to patient payment.

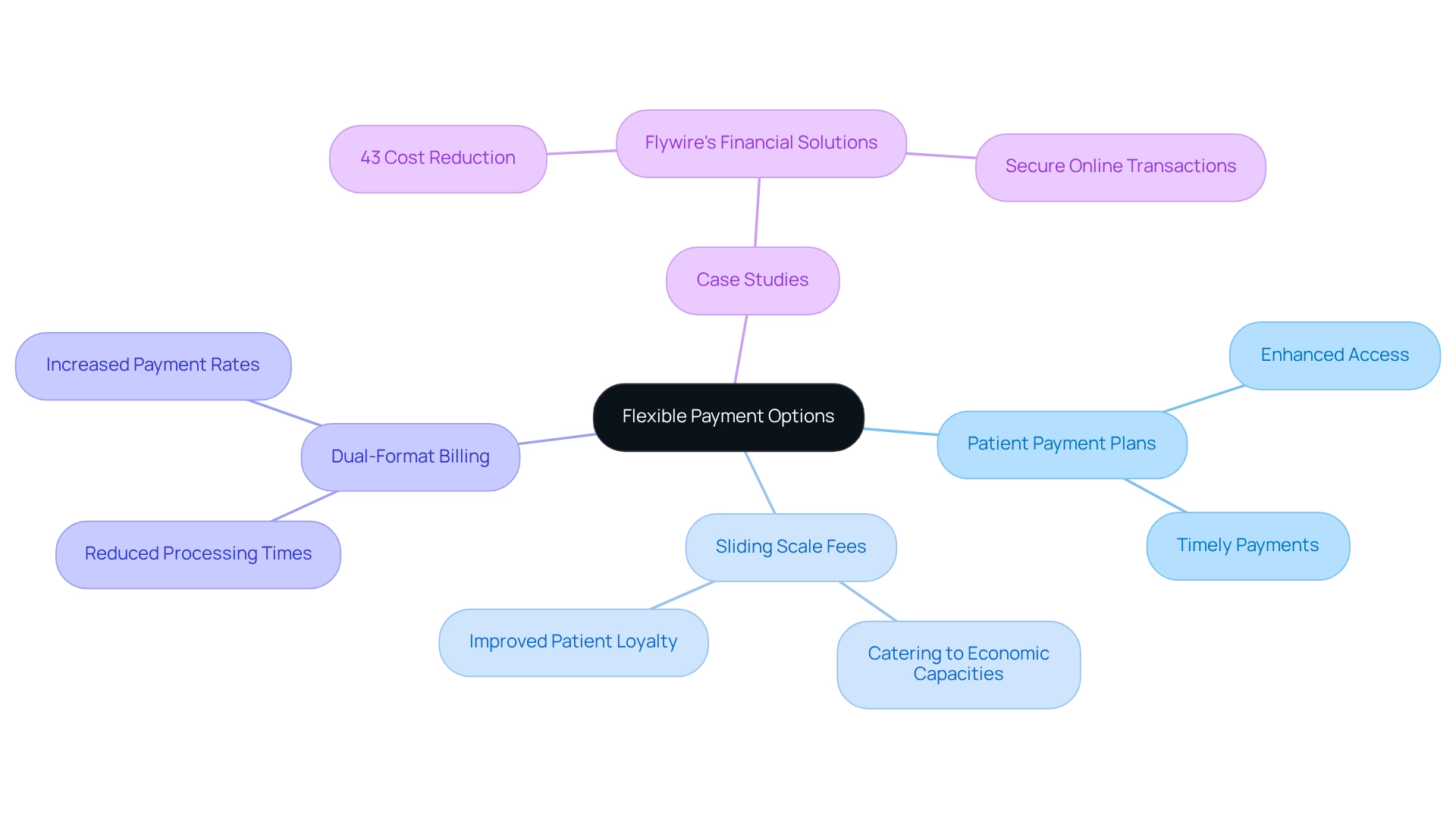

Provide Flexible Payment Options: Cater to Diverse Patient Needs

To effectively address the diverse financial needs of individuals, service providers must implement adaptable financing options, such as patient payment plans and sliding scale fees based on income. These strategies not only enhance access to medical services but also promote timely payments.

By allowing individuals to select patient payment methods that align with their financial circumstances, providers can foster greater loyalty and significantly reduce outstanding balances. This disparity underscores the necessity for flexible financial solutions that cater to varying economic capacities, highlighting the importance of patient payment options.

For instance, a case study on Flywire’s financial solutions illustrates how medical systems can offer customized financing plans, resulting in a 43% reduction in costs per individual transaction for specific clients. This not only bolsters the financial health of medical organizations but also enhances client experiences by providing secure online transaction platforms.

Furthermore, expert insights suggest that dual-format billing, which combines electronic and paper statements, can significantly reduce processing times and elevate complete transaction rates from 77% to 95%. This context reinforces the critical role of such innovations in transaction processing for improving consumer compliance and overall satisfaction.

By embracing adaptable financing options, medical providers can adeptly navigate the complexities of consumer financial experiences, ultimately yielding improved outcomes for both individuals and organizations.

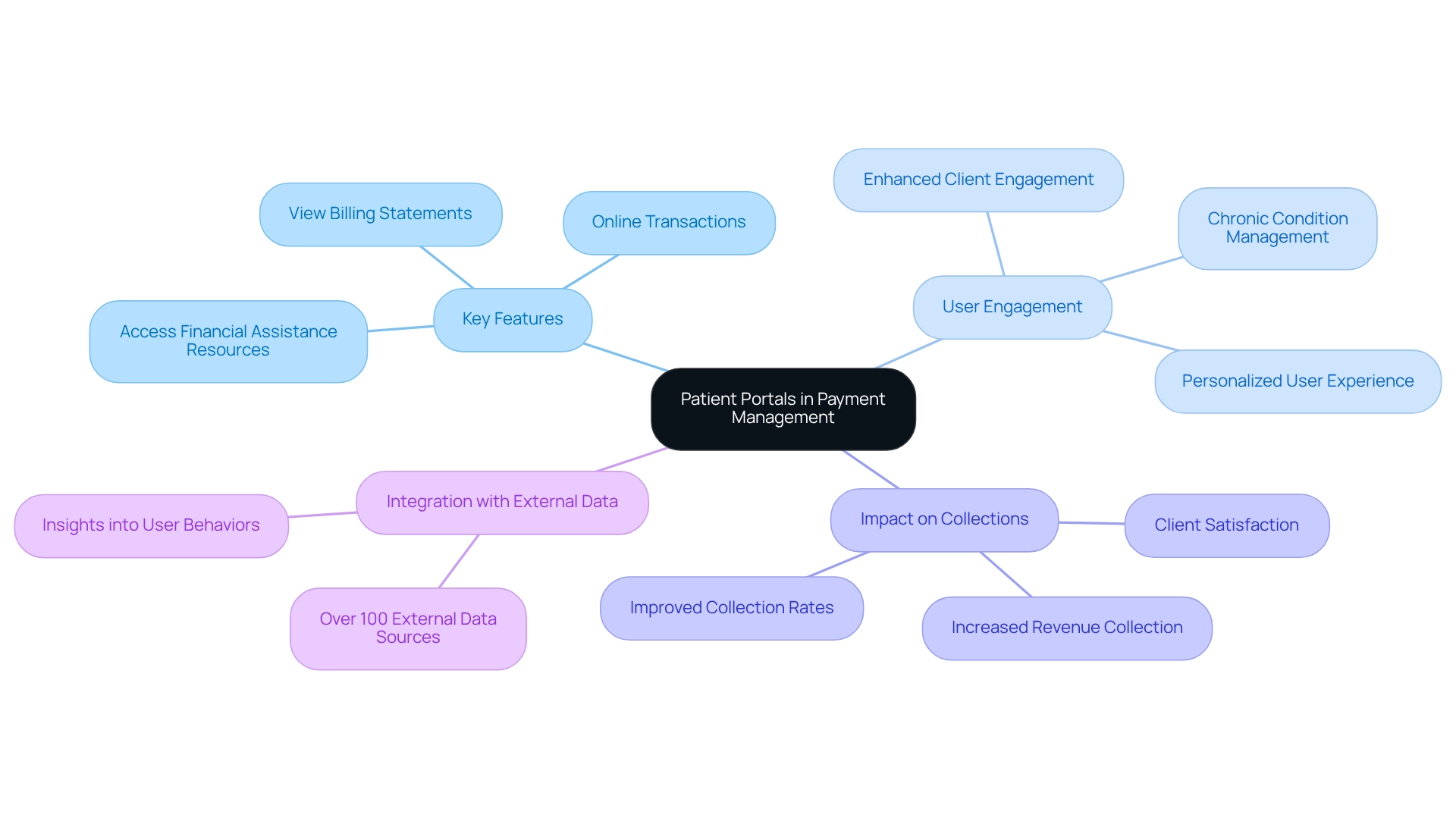

Utilize Patient Portals: Empower Patients in Payment Management

Access portals serve as crucial tools that empower individuals to effectively manage their medical expenses and patient payment. These platforms allow users to view billing statements, conduct online transactions, and access financial assistance resources. By providing an intuitive interface, medical organizations can enhance client engagement and streamline the patient payment process, ultimately leading to improved collection rates.

Research indicates that while media coverage frequently highlights unexpected healthcare incidents and emergency room visits resulting in substantial medical bills, a significant portion of debt arises from treatment for chronic health conditions. This underscores the importance of portals in helping individuals navigate their medical expenses efficiently. Moreover, the integration of over 100 external data sources enables organizations to gain deeper insights into user behaviors and preferences, thereby refining the functionality of these portals. Such integration is vital for personalizing the user experience and ensuring that the information provided meets the specific needs of users, particularly those managing chronic conditions.

A study of MyUFHealth revealed that the user group comprised a higher percentage of individuals with multiple chronic issues compared to nonusers, highlighting the necessity for effective engagement strategies through digital platforms. As medical technology experts note, enhancing consumer engagement via these platforms is essential for improving overall financial experiences in the healthcare sector.

The impact of consumer portals on medical billing collection rates is significant. Organizations that have adopted these systems report increased revenue collection and heightened client satisfaction. By providing transparent invoicing details and straightforward patient payment options, portals not only facilitate timely payments but also foster trust and transparency between individuals and healthcare providers.

In conclusion, these portals transcend mere convenience; they represent a strategic asset in managing medical payments. By increasing engagement and simplifying payment processes, these platforms play a vital role in improving financial outcomes for both individuals and healthcare organizations.

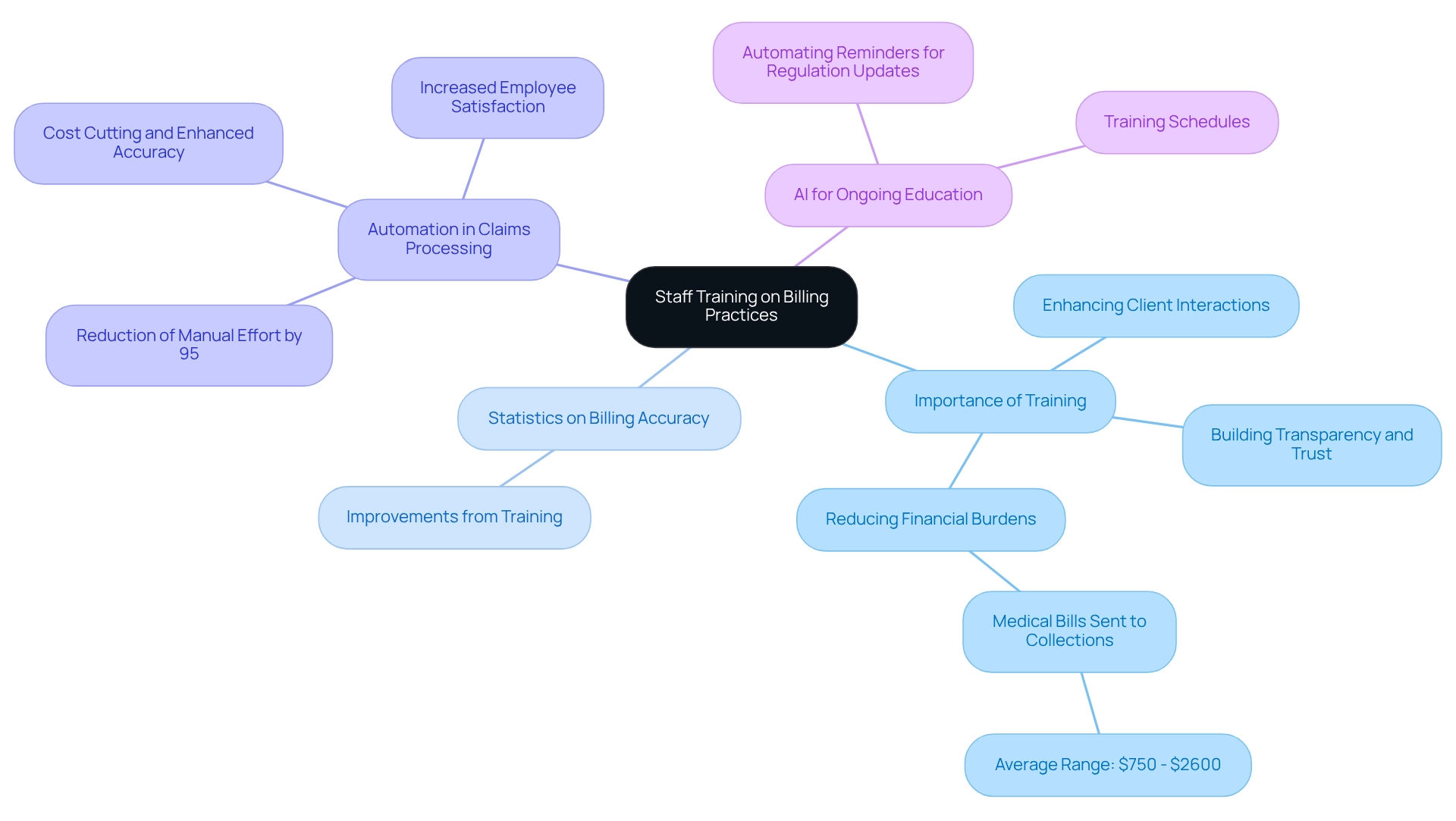

Train Staff on Billing Practices: Improve Patient Interaction

Educating personnel on invoicing methods is essential for enhancing client interactions and ensuring precise charges. Employees must be adept at clearly explaining patient payment procedures while addressing patient inquiries with empathy. Regular training sessions not only keep staff informed about evolving financial regulations and best practices but also cultivate a culture of transparency and trust within the organization.

Statistics reveal that organizations investing in comprehensive staff training experience significant improvements in billing accuracy, which can substantially reduce the likelihood of medical bills being sent to collections—often ranging from $750 to $2,600 per person. This connection underscores the importance of training in alleviating financial burdens on individuals.

Furthermore, case studies demonstrate that automation in claims processing can diminish manual effort by up to 95%, allowing trained personnel to focus on client engagement rather than repetitive tasks. By prioritizing employee training on invoicing methods, medical organizations can markedly enhance patient payment processes and foster long-term loyalty.

Additionally, leveraging AI to automate reminders for regulation updates and training schedules can further bolster ongoing education efforts, ensuring that staff remain informed and capable of delivering the highest quality service.

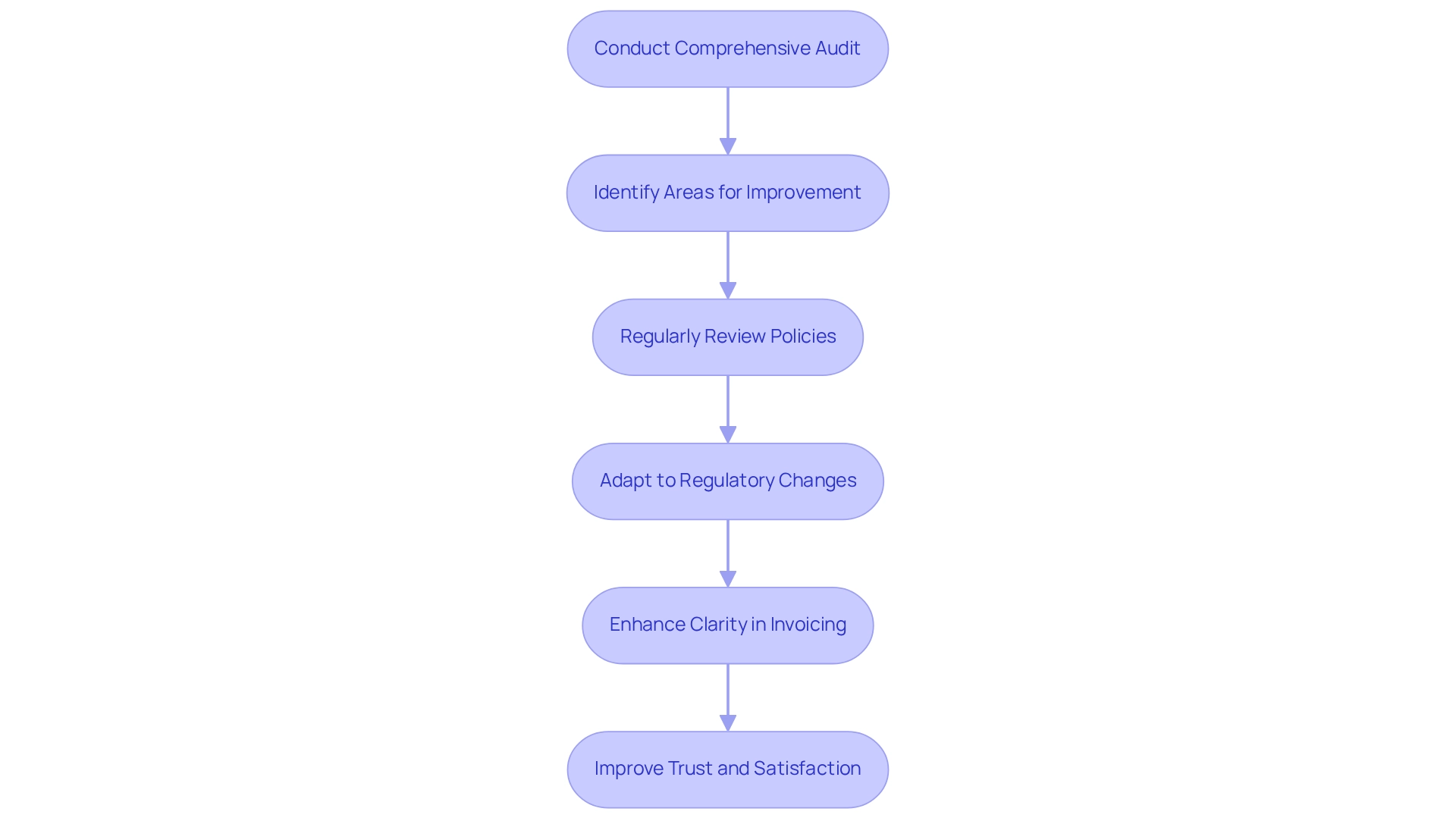

Review Billing Policies: Ensure Compliance and Adaptability

Healthcare organizations must prioritize the regular review of their patient payment policies to ensure compliance with evolving regulations and adapt to the dynamic healthcare landscape. This proactive approach not only assists in recognizing potential problems before they worsen but also guarantees that patient payment practices conform to industry standards. For instance, during the COVID-19 pandemic, Gibson Diagnostic Labs faced considerable invoicing errors due to heightened demand and dependence on third-party systems, underscoring the essential requirement for precise invoicing practices.

Statistics reveal that merely one-third of individuals express confidence in the precision of their medical bills, emphasizing a widespread lack of trust in patient payment. This situation necessitates improved clarity in invoicing procedures, as highlighted by specialists in the area, including the Journal of the American Medical Association, which asserts, “Transparency in medical services continues to increase in significance.” By maintaining up-to-date policies, organizations can enhance operational efficiency and mitigate the risk of costly errors, ultimately fostering a more trustworthy experience regarding patient payment.

Moreover, adjusting invoicing practices to adhere to regulatory changes is essential for healthcare organizations to facilitate accurate patient payment. Compliance officers emphasize the importance of regularly reviewing invoicing policies, particularly those related to patient payment, to align with industry standards, ensuring that organizations remain resilient in the face of regulatory shifts. As one compliance officer observed, ‘Regular assessments of patient payment policies are essential to prevent penalties and improve trust among individuals receiving care.’ This flexibility not only shields organizations from possible fines but also enhances patient satisfaction and trust in the medical system. To initiate this process, organizations should conduct a comprehensive audit of their current billing policies and identify areas for improvement.

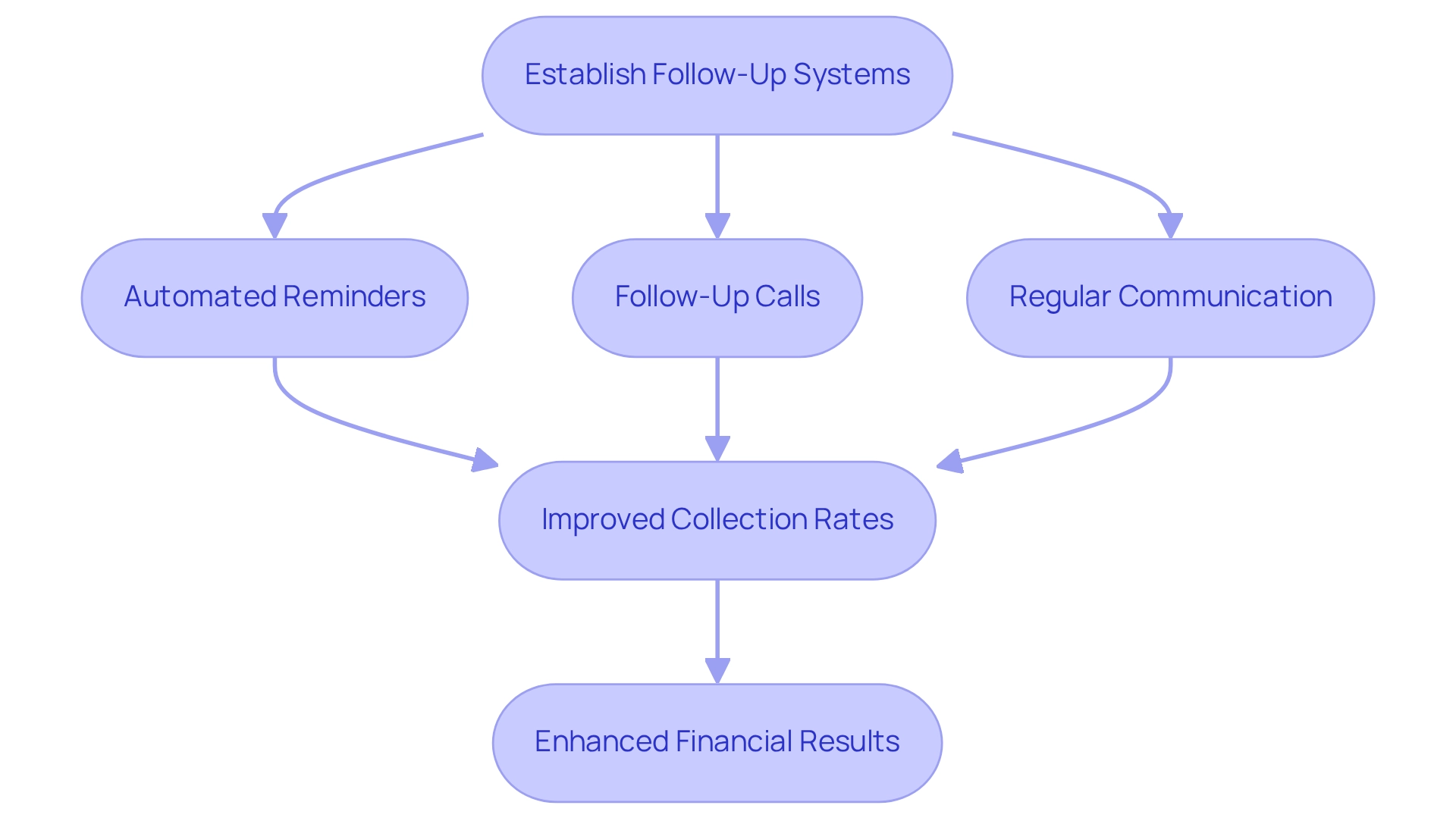

Establish Follow-Up Systems: Reduce Outstanding Payments

Establishing efficient follow-up systems is crucial for reducing unpaid bills and ensuring timely patient payment in healthcare. Automated reminders for upcoming dues, along with follow-up calls for overdue accounts, can significantly improve collection rates. Research indicates that digital transaction reminders can reduce billing bottlenecks, accelerating revenue growth and improving cash flow. Medical professionals that have implemented automated client billing solutions report enhanced collection rates and decreased transaction delays, thanks to real-time alerts via text or email, which facilitate timely patient payment. Regular communication about financial obligations encourages a proactive approach among clients, enabling them to handle their bills more efficiently. Experts in revenue cycle management emphasize that timely follow-ups can lead to substantial improvements in patient payment collection rates. A case study showcases an organization that established an automated reminder system, leading to a 30% reduction in overdue balances and a more efficient revenue cycle.

Current trends indicate that the incorporation of technology in financial processes is becoming increasingly essential. As medical professionals continue to adopt automated reminders, they not only improve client experiences but also guarantee financial stability for their organizations. By prioritizing efficient follow-up systems, medical organizations can manage the intricacies of client transactions, ultimately resulting in enhanced financial results.

Analyze Payment Data: Identify Trends for Continuous Improvement

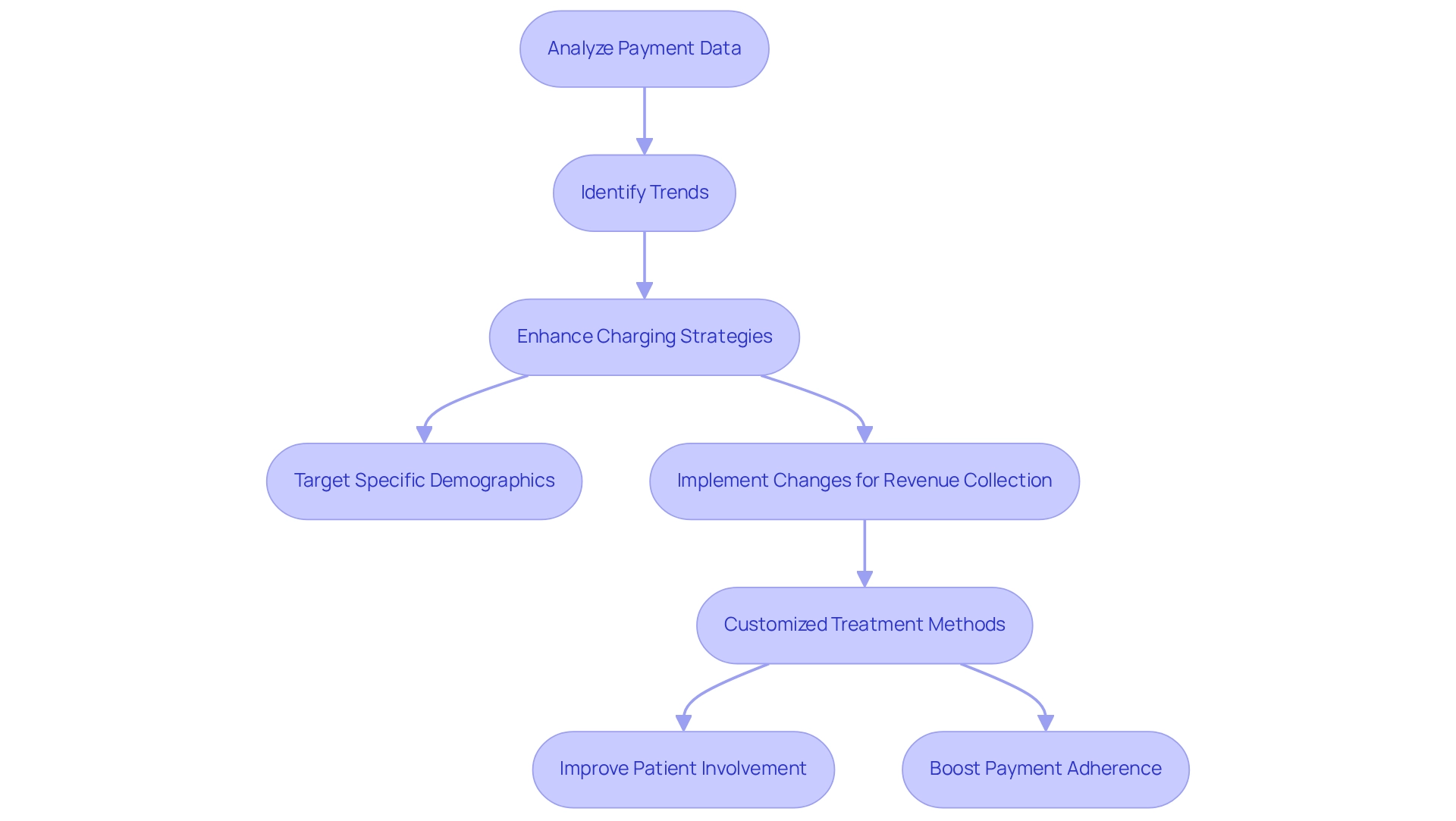

Frequent examination of financial data is essential for medical organizations striving to reveal trends and patterns in patient payment behaviors. By utilizing this data, particularly insights from CareSet’s monthly Medicare updates, providers can enhance their charging strategies, effectively target specific demographics, and implement changes that bolster overall revenue collection.

Organizations that have embraced customized treatment methods, guided by thorough patient journey examinations, have experienced notable improvements in patient involvement and patient payment adherence, as tailored strategies align more closely with individual needs. This enables them to pinpoint areas for growth and identify potential pitfalls.

CareSet’s insights into drug utilization and treatment pathways, including specific ICD codes and the approval processes of Medicare Part D Plans, empower pharmaceutical strategies, allowing organizations to engage meaningfully with healthcare providers regarding treatment options. This proactive approach not only enhances invoicing practices but also contributes to increased patient payment.

Ongoing improvements driven by data insights promote more efficient invoicing methods, ultimately leading to better financial outcomes and enhanced client experiences. As the medical landscape evolves, the capacity to assess billing data, supported by CareSet’s data leadership and specific results from case studies, will remain a crucial element in refining invoicing strategies and ensuring sustainable growth.

Engage Patients on Financial Options: Build Trust and Improve Payments

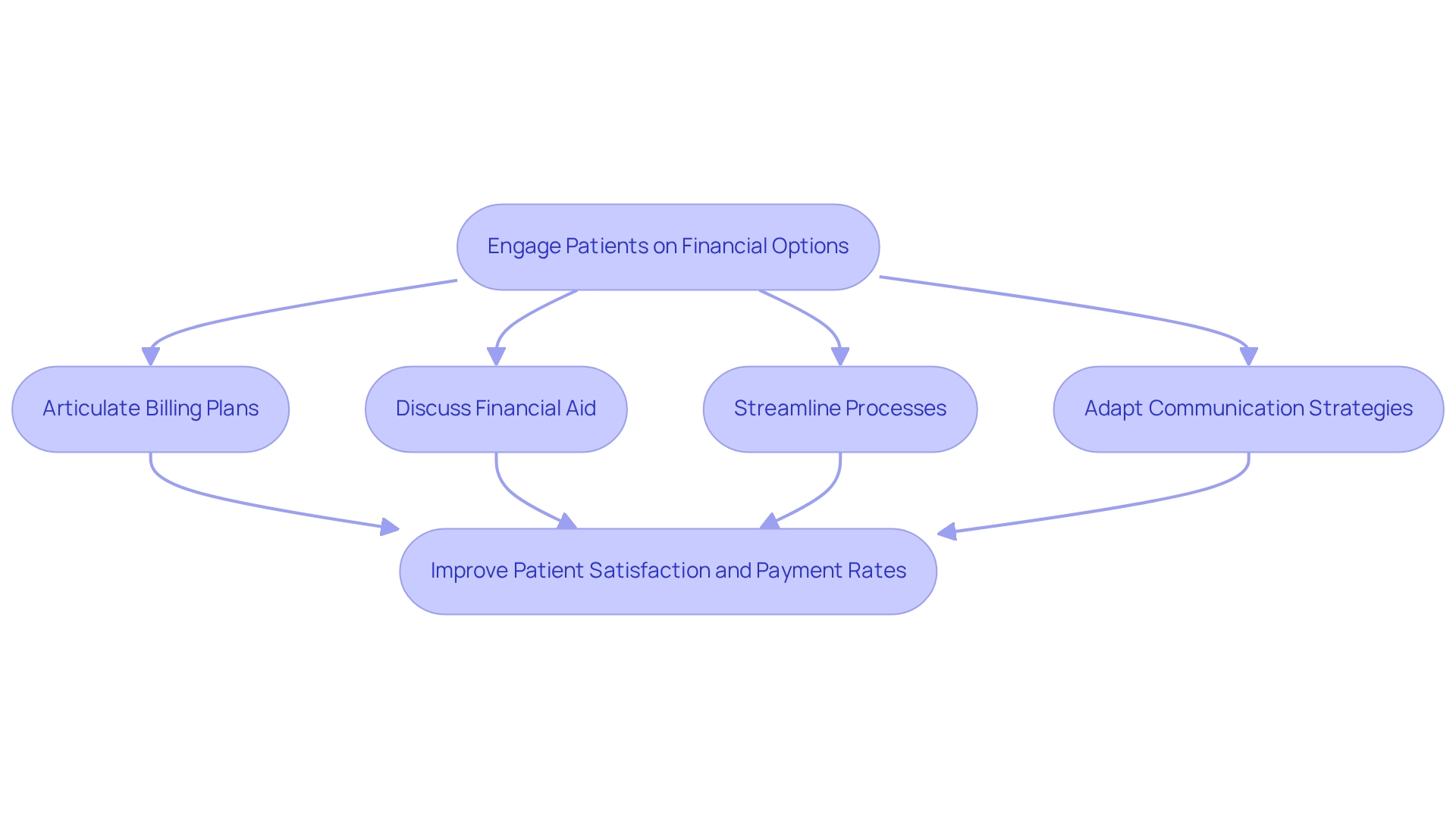

Engaging individuals in discussions about their financial decisions is crucial for fostering trust and enhancing compensation rates. Medical service providers must take the initiative to clearly articulate available billing plans, financial aid programs, and other resources designed to alleviate the financial burden of medical expenses. This proactive approach not only assists individuals in understanding their financial responsibilities but also significantly improves their satisfaction with the overall care experience, particularly regarding patient payment options.

Research has shown that when medical organizations transparently address financial options, patient engagement increases, leading to higher payment rates. A notable case study illustrates that reducing wait times in healthcare facilities not only boosted patient satisfaction but also positively affected their willingness to engage in financial discussions. By streamlining processes and improving communication, providers can cultivate an environment where individuals feel at ease discussing their financial concerns.

Moreover, financial advisors emphasize that preemptively addressing payment options enhances client confidence and diminishes negative feelings associated with unexpected costs. This level of transparency is vital in establishing a trusting relationship between clients and providers, ultimately resulting in better financial outcomes.

As the medical landscape transitions from traditional mailed bills to automated calls and text messages, it becomes increasingly essential for providers to adapt their communication strategies. By integrating these modern techniques, medical organizations can effectively engage individuals in financial discussions about patient payment, ensuring they are well-informed and empowered to make decisions regarding their medical expenses. This not only improves patient satisfaction but also streamlines payment processes, contributing to the overall success of healthcare providers.

Conclusion

The exploration of effective billing practices in healthcare unveils a multifaceted approach that is crucial for enhancing both operational efficiency and patient satisfaction. Leveraging Medicare data allows healthcare organizations to streamline their billing processes, improve accuracy, and minimize errors, ultimately leading to better financial outcomes. The integration of automated billing systems represents a significant advancement, reducing human error and accelerating payment collections—an essential factor in an industry grappling with a looming shortage of healthcare professionals.

Transparent communication regarding payment expectations serves as a cornerstone for fostering trust between patients and providers. By outlining costs upfront and offering flexible payment options, organizations can address diverse patient needs, promoting timely payments and reducing outstanding balances. The implementation of patient portals empowers patients, enabling them to manage their healthcare payments effectively and enhancing overall engagement.

Training staff on billing practices is vital to ensuring they can provide clear and empathetic communication to patients, which is essential for building trust. Regular reviews of billing policies help organizations maintain compliance with regulations and adapt to changes, thereby preserving operational integrity. Furthermore, establishing robust follow-up systems and analyzing payment data enables healthcare providers to identify trends and continuously refine their billing strategies.

In summary, the integration of advanced technologies, transparent practices, and patient engagement strategies is fundamental to transforming the healthcare billing landscape. By prioritizing these elements, healthcare organizations can enhance their financial health while creating a more positive and trustworthy experience for patients, paving the way for sustainable growth in the industry.